Vitamin B5 (Pantothenic Acid) Price Trend Q3 2025

According to Price-Watch, In 2025 Q3, the global Vitamin B5 (Pantothenic Acid) D-Calcium Pantothenate market held a mostly weak market sentiment as consistent supply conditions have been met with weakened downstream demand in important regions globally.

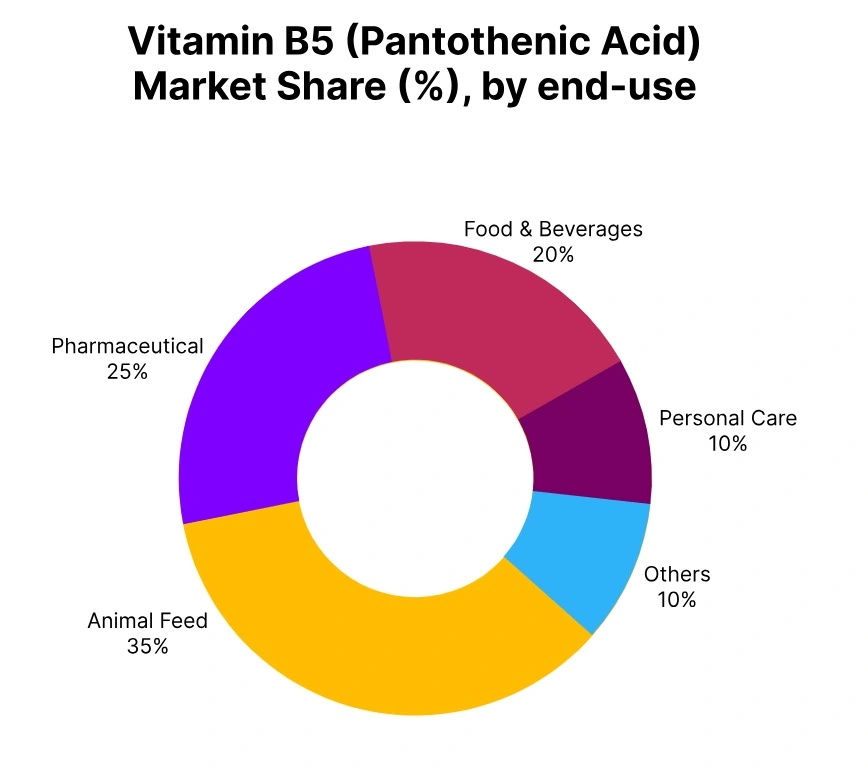

D-Calcium Pantothenate prices had pricing pressure driven by a cautious purchasing made by downstream buyers in the feed, food-fortification, and pharmaceutical market segments, along with competing domestic offerings from China and weighing production rates that contributed to a moderately narrow pricing range during the quarter 6-8%.

Adequate stocks, raw input materials trending flat, and predictability in output supported general market stability as weakened consumption trends limited upward momentum. Demand from nutrition and fortified food applications remained muted, as the base industrial usage did help limit sharper declines.

Going forward, restocking changes, global demand for supplements, and competitive pricing from large-revenue producers in China are expected to have significant factors in increasing pricing dynamics for Vitamin B5 (Pantothenic Acid) price trend into 2025 Q4.

China: Vitamin B5 (Pantothenic Acid) Export Prices FOB Shanghai.

During Q3 2025, Vitamin B5 (Pantothenic Acid) D-Calcium Pantothenate (>98%, Powder) price trend in China declined amid soft demand and steady domestic supply. Consistent operating rates among major producers and competitive domestic offers kept prices within USD 5,500–5,750 per metric ton.

Demand from the feed, food-fortification, and pharmaceutical sectors stayed weak, while export momentum slowed due to muted overseas buying. Market sentiment remained bearish as inventories stayed comfortable and no major supply disruptions emerged.

In September 2025, Vitamin B5 (Pantothenic Acid) price trend in China dropped by roughly 7.4%, reflecting cautious purchasing behavior and persistent supply-side pressure. Heading into Q4, limited restocking and stable production levels may continue to suppress upward price potential unless global supplement demand improves noticeably.