Price-Watch’s most active coverage of Yellow Phosphorous price assessment:

- Phosphorus (P4): >99% FOB Haiphong, Vietnam

- Phosphorus (P4): >99% FOB Aktau, Kazakhstan

- Phosphorus (P4): >99% CIF Tokyo (Vietnam), Japan

- Phosphorus (P4): >99% CIF Busan (Vietnam), South Korea

- Phosphorus (P4): >99% CIF Sharjah (Vietnam), United Arab Emirates

- Phosphorus (P4): >99% CIF Nhava Sheva (Vietnam), India

- Phosphorus (P4): >99% CIF Nhava Sheva (Kazakhstan), India

Yellow Phosphorus Price Trend Q3 2025

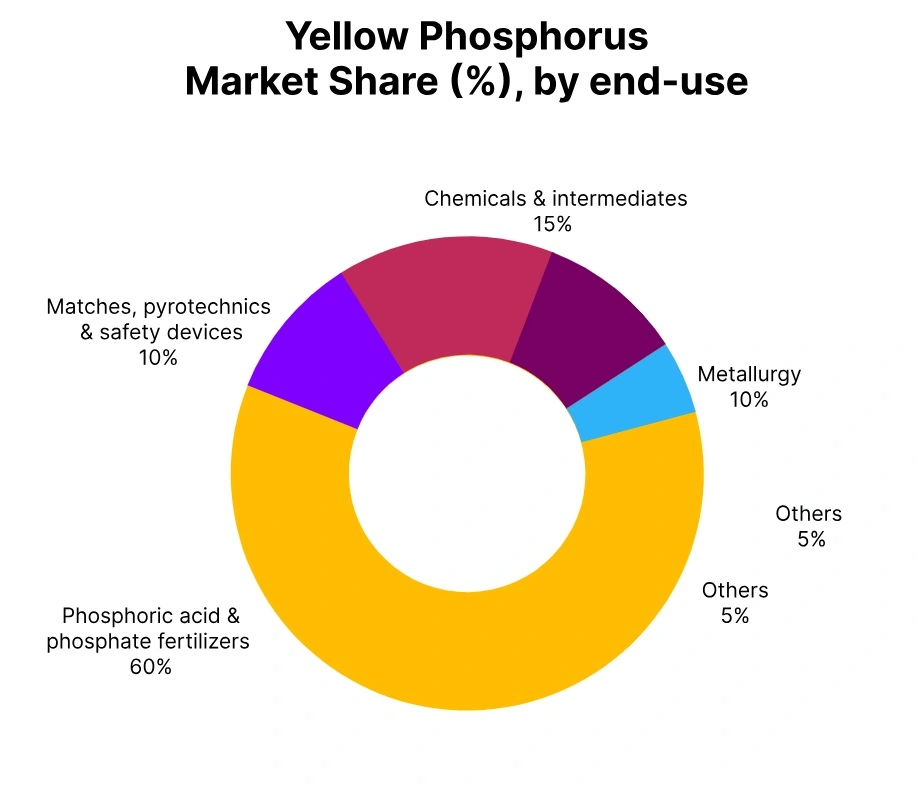

In Q3 2025, the global Yellow Phosphorus market experienced slight softness, driven by cautious demand from fertilizer, chemical intermediate, and flame-retardant sectors. Exports from Southeast Asia and Central Asia saw modest price easing amid steady production and balanced inventories, while regional buyers in East Asia and the Middle East adopted selective procurement to manage stock levels.

In contrast, South Asia recorded a mixed trend, with imports from Southeast Asia firming slightly due to active fertilizer sector demand. Overall, the market remained stable, characterized by balanced supply-demand dynamics, efficient logistics, and cautious downstream consumption across key regions.

Vietnam: Yellow Phosphorous Exported price in Vietnam, Phosphorus (P4) >99%.

In Q3 2025, Yellow Phosphorous prices from Vietnam have softened slightly due to weaker demand from fertilizer and chemical intermediate sectors. Yellow Phosphorous price in Vietnam has declined, with FOB Haiphong prices falling 1.44%, trading between USD 4000–4200 per metric ton. In September 2025, Yellow Phosphorous prices in Vietnam have fallen by 1.83%, compared to the previous month.

Exporters have reported steady production and balanced inventories, but subdued buying interest from regional markets has pressured prices. Logistics and shipping have remained stable, facilitating consistent trade flows despite the mild price correction. Overall, Yellow Phosphorous price trend in Vietnam has indicated a mild downward trajectory.

Kazakhstan: Yellow Phosphorous Exported price in Kazakhstan, Phosphorus (P4) >99%.

In Q3 2025, Yellow Phosphorous prices from Kazakhstan have fallen modestly as regional demand has softened, particularly from agricultural and industrial users. Yellow Phosphorous price in Kazakhstan has declined, with FOB Aktau prices moving down by –1.98% to USD 3600–3800 per metric ton.

In September 2025, Yellow Phosphorous prices in Kazakhstan have risen by 0.33%, compared to the previous month. Supply has remained steady with stable plant operations, but sales have slowed amid cautious buyer behaviour and competitive international offers.

Export momentum has remained subdued, with market participants monitoring order flow amid global supply adjustments. Overall, Yellow Phosphorous price trend in Kazakhstan has been slightly downward.

Japan: Yellow Phosphorous Imported price in Japan from Vietnam, Phosphorus (P4) >99%.

In the third quarter of 2025, prices for imports of Yellow Phosphorous in Japan have dropped slightly due to a decrease in demand by the chemical and fertilizer industries. The Price trend of Yellow Phosphorous have slightly decreased in Japan.

The price of Yellow Phosphorous in Japan has lessened as CIF Tokyo prices have been down by 1.42%, yielding a result within USD 4100-4200 per metric ton. Also in September 2025, prices for Yellow Phosphorous in Japan have decreased by 1.65%, waning from the previous month’s price.

Importers have kept steady buying behaviour, despite weaker downstream demand. Supply chains have continued to improve without major disruptions, ensuring consistent cargo arrival, alongside acceptable regional buying demand from the industrial demand side. The market has remained stable and limited in price increases.

South Korea: Yellow Phosphorous Imported price in South Korea from Vietnam, Phosphorus (P4) >99%.

In Q3 2025, Yellow Phosphorous prices in South Korea have softened slightly as demand from flame retardant and chemical manufacturing sectors has moderated. Yellow Phosphorous price in South Korea has declined, with CIF Busan prices falling 1.54%, trading between USD 4000–4200 per metric ton. In September 2025, Yellow Phosphorous prices in South Korea have fallen by 1.66%, compared to the previous month.

Buyers have shown selective purchasing amid sufficient inventory levels, while import volumes have remained steady. Market players have reported balanced supply-demand fundamentals, with traders anticipating stable price trends in the near term. Overall, Yellow Phosphorous price trend in South Korea has been mildly downward.

United Arab Emirates: Yellow Phosphorous Imported price in UAE from Vietnam; Phosphorus (P4) >99%.

In Q3 2025, Yellow Phosphorous CIF Sharjah prices have softened by 1.43% to USD 4000–4300 per metric ton amid muted demand from chemical and fertilizer sectors. Yellow Phosphorous price in United Arab Emirates has declined, as imports from Vietnam have remained regular, although buyers have exercised caution owing to steady stocks and limited consumption growth.

In September 2025, Yellow Phosphorous prices in UAE have fallen by 3.07%, compared to the previous month. The regional market has experienced moderate activity, with pricing pressured by balanced supply and conservative downstream procurement. Overall, Yellow Phosphorous price trend in United Arab Emirates has been downward.

India: Yellow Phosphorous Imported price in India from Vietnam and Kazakhstan, Phosphorus (P4) >99%.

According to Price-Watch, during the third quarter of 2025, the price of Yellow Phosphorous imported to India showed divergent trends. The price of Yellow Phosphorous in India reported an increase for CIF Nhava Sheva imports, from Vietnam, rising from USD 4100-4300 per metric ton, marginally increased by 0.86%, with better purchase levels reported from fertilizer manufacturers.

In comparison, imports from Kazakhstan decreased by 0.49% ranging from USD 3700-3900 per metric ton with buyers being cautious in buying and facing inventories that were relatively flushed. In India, Yellow Phosphorous prices in September 2025 decreased by 1.37% over August 2025.

Indian buyers have balanced sourcing to match the fluctuations in demand from industrial and agricultural diversified end-uses. Overall, the price trends for Yellow Phosphorous in India have been mixed based on origins.