Price-Watch’s most active coverage of Zinc Ingot price assessment:

- Purity:99.99% Ex-Shanghai, China

- Purity:99.99%(SHG) FOB Mumbai, India

- Purity:99.995% Del Alabama, USA

- Purity:99.995% FD-Willich, Germany

Zinc Ingot Price Trend Q3 2025

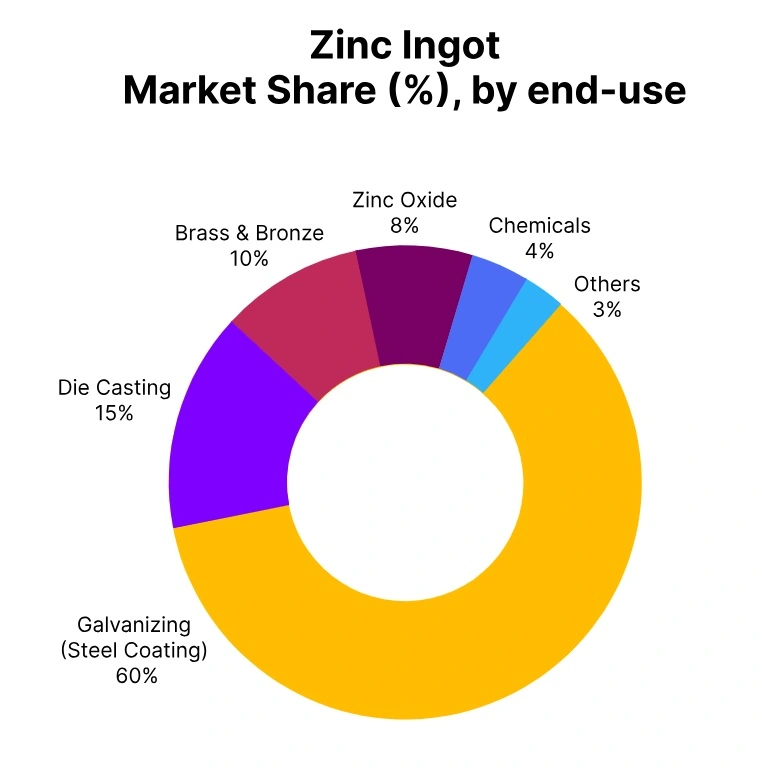

In Q3 2025, the global zinc ingot market experienced a significant price rise of around 3–5% seasonally against Q2 2025 driven chiefly by supply tightening from significant producers during maintenance shutdowns and lower production in China and Europe. Demand remained mostly stable to slightly improved from construction, galvanizing, and automotive sectors, particularly in Asia and North America.

Additional support to market sentiment derived from a modestly higher global manufacturing activity and improvement in investor attitude amid falling inflation. It appeared as if measures to rely on lower inventory levels from large exchanges like the LME were contributing factors in supporting prices in Q3 2025.

Germany: Zinc Ingot Domestically traded prices FD-Willich, Germany, Grade- Purity:99.995%.

The zinc ingot price trend in Germany during Q3 2025 showed a moderate upward movement, marking a 2% increase compared to the previous quarter. This price rise has primarily been driven by steady demand from the construction and automotive sectors, coupled with tighter supply due to maintenance shutdowns at several European smelters.

Energy costs remained elevated, adding to production expenses and supporting higher market prices. In September 2025, the price of zinc ingot in Germany have increased by 0.5%, reflecting sustained demand and limited spot market availability. Traders also noted increased interest from downstream manufacturers looking to secure supply ahead of potential disruptions.

Additionally, global zinc inventory levels continued to decline, reinforcing bullish sentiment. The German market remained influenced by both local consumption patterns and broader European supply chain dynamics.

USA: Zinc Ingot Domestically traded prices Del Alabama, USA, Grade- Purity:99.995%.

According to Price-Watch, The zinc ingot price trend in the USA during Q3 2025 showed a steady upward movement overall, marked by a 3% increase compared to Q2 2025. This price escalation was largely driven by tightening supply chains, increased demand from the galvanizing and construction sectors, and concerns over reduced smelter outputs globally.

Market participants reported a moderate revival in industrial activity during July and August, contributing to the bullish sentiment. However, in September 2025, zinc ingot prices in the US witnessed a slight correction as the price was decreased by 0.5%.

This minor dip has been attributed to improved inventory levels and a temporary slowdown in procurement activities ahead of the year-end. Despite this marginal drop, the overall quarterly outlook remained positive, with consistent buying interest and a stable downstream market supporting the price floor.

China: Zinc Ingot Domestically traded prices EX-Shanghai, China, Grade- Purity:99.99%.

Zinc ingot prices in China experienced a considerable increase in Q3 2025, advancing by nearly 7% from Q2 2025. Increased prices were largely attributed to tighter supply due to smelter maintenance combined with environmental controls in several key production areas, as well as decreased imports.

Ongoing demand from the galvanizing industry and ongoing Chinese government-funded construction activities supported solid demand in Q3 and contributed pressure on prices.

Prices retreated by about 4% in September 2025 as smelters resumed operations and market participants adopted a cautious stance in a market with weak downstream demand and improved inventories. Further, bullish sentiment observed in July and August weakened by quarter end.

India: Zinc Ingot Export prices FOB-Mumbai, India, Grade- Purity: 99.99%(SHG).

According to Price-Watch, In the context of Zinc Ingot price trend in India, Q3 2025 displayed an upward trend of 7% over Q2 2025. This influenced by decreasing domestic supply, increased industrial demand in galvanization and die-casting, and an uptick in infrastructure and construction work at post-monsoon year’s end.

Moreover, escalating input costs of Zinc Ingot, along with a weaker rupee to US dollar exchange rate, resulted in rising price points to support bullish sentiment. During September 2025, Zinc Ingot prices in India increased by 5% month on month, due to heavy procurement by lower levels of industry who expected further price increases to follow.

Additionally, there are contributing factors to the price movement present in the global market as zinc production from major exporting markets was disrupted leading to supply constraints.