Price-Watch’s most active coverage of Zinc Oxide (ZnO) price assessment:

- Zinc Oxide 99.5%, Ex-Kolkata, India

- Zinc Oxide 99.5%, Ex-Vadodara, India

- Zinc Oxide 99.5%, Ex-Delhi, India

- Zinc Oxide 99.5%, Ex-East India, India

- Zinc Oxide 99.5%, Ex-West India, India

- Zinc Oxide 99.5%, Ex-North India, India

- Zinc Oxide 99.5%, FOB Kolkata Sea, India

- Zinc Oxide 99.5%, FOB Hazira, India

- Zinc Oxide 99.5%, CIF Cat Lai (India), Vietnam

- Zinc Oxide 99.5%, CIF Jebel Ali (India), UAE

- Zinc Oxide 99.7%, Ex Shanghai, China

Zinc Oxide (ZnO) Price Trend Q3 2025

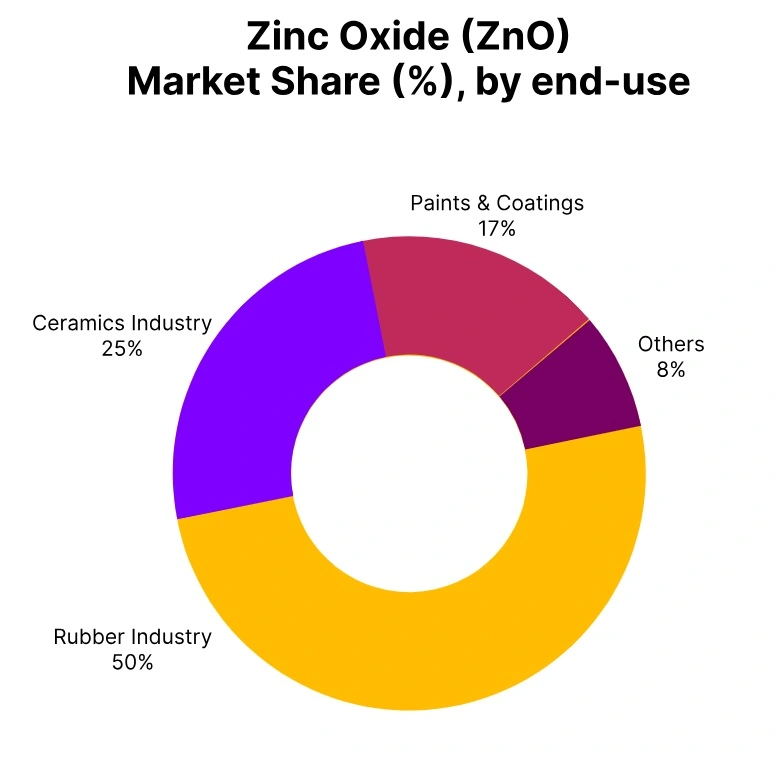

In Q3 2025, the global Zinc Oxide market exhibited a steady-to-firm trend, supported by consistent industrial demand across rubber, ceramics, coatings, and chemical sectors. Domestic production in India remained stable, while Chinese supply of higher-purity Zinc Oxide (99.7%) maintained moderate growth. Export markets such as Vietnam and the UAE contributed to sustained trade flows, with Zinc Oxide (ZnO) price trend movements ranging from 0.19% to 0.92%, reflecting balanced supply and resilient downstream consumption.

Raw material zinc costs remained relatively steady, helping moderate volatility. Overall, market fundamentals indicate a stable-to-slightly bullish trajectory heading into Q4 2025, driven by consistent procurement, controlled inventories, and seasonal demand recovery in key regions.

UAE: Zinc Oxide (ZnO) (99.5%) | CIF Jebel Ali (India).

In Q3 2025, Zinc Oxide prices in UAE recorded a notable upward movement, driven by strong demand from construction, coatings, and chemical sectors. Indian exporters supplied consistently under favourable freight conditions, while domestic distributors maintained measured procurement strategies to optimize inventory levels. The Zinc Oxide (ZnO) price trend in UAE reflected firm buying interest and stable feedstock zinc costs, supporting a sustained market tone.

In September 2025, Zinc Oxide (ZnO) prices under CIF Jebel Ali increased by 0.92%, marking one of the strongest regional gains of the quarter. Overall, fundamentals remained robust, and the market is expected to remain firm-to-bullish into Q4 2025 with continued balanced supply-demand dynamics.

India: Zinc Oxide (ZnO) (99.5%) | Ex-Kolkata.

According to Price-Watch, in the third quarter of 2025, prices for Zinc Oxide in India experienced a small increase, largely due to steady industrial demand from rubber and ceramics as well as chemical applications. Local production by manufacturers remained moderate in line with a balanced inventory, while offtake remained consistent to downstream customers. The Zinc Oxide (ZnO) price trend in India largely reflected stable costs of the feedstock zinc supply, moderated logistics, and an absence of extreme low pricing activity, despite a few cautious purchasers.

In September 2025, Zinc Oxide prices under the Ex-Kolkata terms increased by 0.44%, consistent with a stable-to-slightly firm pricing tone. Overall, the inventory supply and demand fundamentals for the market remained balanced, given steady industrial demand, measured supply, and stable trading sentiment. Zinc oxide prices in India are projected to remain stable into the fourth quarter of 2025.

Vietnam: Zinc Oxide (ZnO) (99.5%) | CIF Cat Lai (India).

In the third quarter of 2025, Vietnam’s Zinc Oxide prices experienced a slight increase, aided by consistent demand from the rubber, tire, and chemical industries. Importers, in search of the most reliable feedstock supply with the most favourable freight rate conditions, have primarily sourcing Zinc Oxide from India.

The Zinc Oxide (ZnO) price trend observed in Vietnam has been indicative of the measured replenishment of inventories and balanced trade flows, with downstream consumers staying cautious and refraining from exacerbating price volatility with higher consumption rates. The price for Zinc Oxide under CIF Cat Lai terms increased by 0.37% in September 2025, contributing to a stable-to-firm price tone.

China: Zinc Oxide (ZnO) Domestically trades prices in Ex-Shanghai, China, Grade: (99.7%).

According to Price-Watch, in Q3 2025, Zinc Oxide prices in China exhibited slight upward movement, influenced by cautious buying from electronics, rubber, and chemical industries. Domestic producers maintained stable production and inventories, while feedstock zinc costs held steady, limiting aggressive pricing.

The Zinc Oxide price trend in China reflected moderate trade activity, balanced supply-demand dynamics, and controlled logistical conditions, preventing sharp price swings. In September 2025, Zinc Oxide prices under Ex-Shanghai increased by 0.19%, indicating a steady-to-firm market tone in ceramics industry as well the rubber industry.