Price-Watch’s most active coverage of Acrylonitrile Butadiene Styrene (ABS) price assessment:

- General Purpose (MFI: 20-23) Ex-Ningbo

- Heat Resistant Injection Moulding (MFI:23) FOB Busan

- Heat Resistant Injection Moulding (MFI: 16-23) Ex-Mumbai

- Heat Resistant Injection Moulding (MFI:23) CIF Nhava Shava (South Korea)

- General Purpose (MFI:43) Ex-Abu Road

- General Purpose (MFI:43) Ex-North India

- General Purpose (MFI >25) Ex-South India

- General Purpose (MFI >25) Ex-West India

- Heat Resistant Injection Moulding (MFI: 16-23) Ex-South India

- Heat Resistant Injection Moulding (MFI: 16-23) Ex-West India

- General Purpose (MFI: 20-22) CIF Santos (South Korea)

- General Purpose (MFI: 20-22) FOB Busan

- General Purpose (MFI: 19-23) FOB Kaohsiung

- General Purpose (MFI: 20-22) CIF Mersin (South Korea)

- General Purpose (MFI: 20-22) CIF Laem Chabang (South Korea)

- General Purpose (MFI: 20-22) CIF Shanghai (South Korea)

- General Purpose (MFI: 20-22) CIF Houston (South Korea)

- General Purpose (MFI: 19-23) CIF Houston (Taiwan)

- General Purpose (MFI: 20-22) CIF Nhava Shava (South Korea)

- General Purpose (MFI:>25) Ex-Mumbai

- General Purpose (MVR: 19-34) FD Rotterdam

- General Purpose (MVR: 19-34) FD Antwerp

- General Purpose (MVR: 19-34) FD Hamburg

- Flame Retardant Injection Moulding (MFI:50) FOB Busan

- Flame Retardant Injection Moulding (MFI:50) CIF Nhava Sheva (South Korea)

- Flame Retardant Injection Moulding (MFI: 35) Ex-Mumbai

- Flame Retardant Injection Moulding (MFI:50) CIF Houston (South Korea)

- Flame Retardant Injection Moulding (MFI:50) CIF Jakarta (South Korea)

- Heat Resistant Injection Moulding (MFI:23) CIF Houston (South Korea)

- Heat Resistant Injection Moulding (MFI:23) CIF Jakarta (South Korea)

- General Purpose (MFI: 20-22) CIF Jakarta (South Korea)

Acrylonitrile Butadiene Styrene (ABS) Price Trend Q3 2025

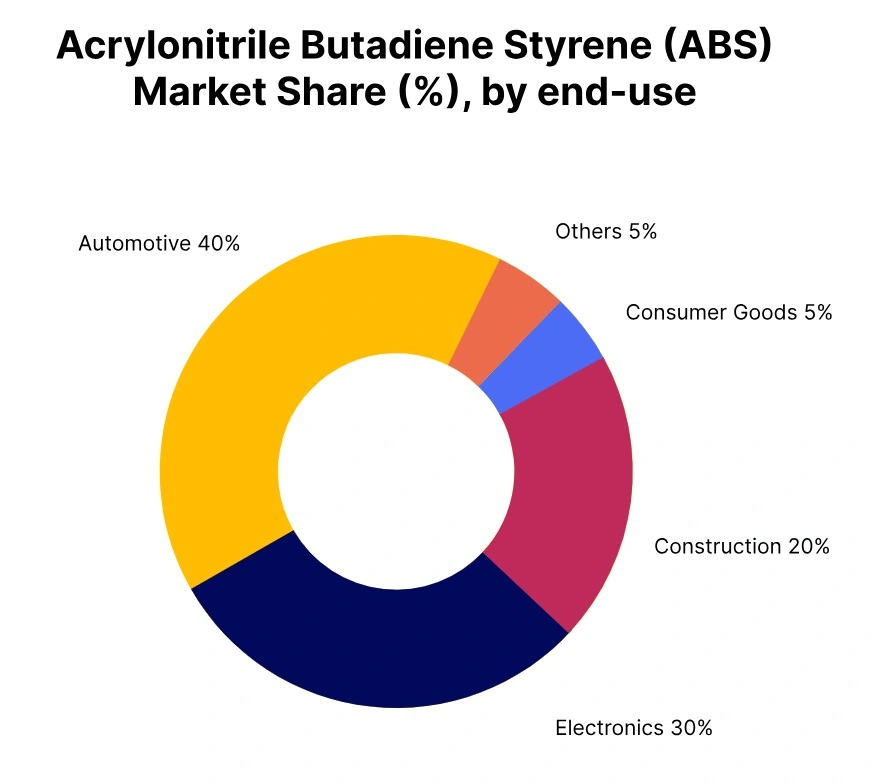

The global Acrylonitrile Butadiene Styrene (ABS) price trend in Q3 2025 has reflected broadly soft-to-weak trends across major regions, with downward movement observed in most key markets. Prices in Asia, including South Korea, Taiwan, and China, have been pressured by weakening upstream feedstocks, including acrylonitrile and styrene, alongside moderate downstream demand from automotive, electronics, and appliance applications.

In North America and Europe, Acrylonitrile Butadiene Styrene (ABS) prices in the USA and the Netherlands also have softened amid subdued industrial consumption and balanced inventory levels. Conversely, Brazil was a notable exception, Acrylonitrile Butadiene Styrene (ABS) prices have shown moderate gains supported by increased freight rates and strong domestic restocking activity. Overall, oversupply, softening feedstock costs, and cautious buying sentiment have kept global ABS prices under pressure, with regional variations reflecting local market dynamics.

South Korea: ABS Export prices FOB Busan, South Korea, Grade- General Purpose (MFI: 20-22).

According to the PriceWatch, the Acrylonitrile Butadiene Styrene (ABS) price trend in South Korea has shown a softening movement during Q3 2025, averaging around USD 1,350-1370/MT, reflecting a 3.8% fall from the previous quarter. The market has been pressured by weaker upstream feedstock costs, including acrylonitrile and styrene, alongside moderate downstream demand from automotive components, electronics, and appliance sectors.

Supply availability has remained adequate, keeping prices from falling further despite cautious buying sentiment. In September 2025, Acrylonitrile Butadiene Styrene (ABS) prices in South Korea recorded a further 1.8% decrease from August levels, influenced by continued moderate demand and limited restocking activity. Overall, balanced supply flows, softening feedstock costs, and subdued industrial consumption have kept the South Korean ABS market under pressure, with limited upside expected in early Q4 2025.

Taiwan: ABS Export prices FOB Kaohsiung, Taiwan, Grade- General Purpose (MFI: 19-23).

The Acrylonitrile Butadiene Styrene (ABS) price trend in Taiwan has shown a softening movement during Q3 2025, averaging around USD 1,300-1320/MT, reflecting a 1.11% fall from the previous quarter. The market has been pressured by weaker upstream feedstock costs, particularly acrylonitrile and styrene, along with moderate downstream demand from automotive, electronics, and appliance sectors.

Supply availability has remained adequate, limiting any sharp price movements despite cautious buying sentiment. In September 2025, Acrylonitrile Butadiene Styrene (ABS) prices in Taiwan recorded a further 0.73% decline from August levels, as subdued industrial activity and restrained restocking continued to weigh on the market. Overall, balanced supply flows, softening feedstock costs, and moderate demand have kept the Taiwanese ABS market under pressure, with limited price upside expected in early Q4 2025.

China: ABS Domestically traded prices Ex-Ningbo, China, Grade- General Purpose (MFI: 20-23).

The Acrylonitrile Butadiene Styrene (ABS) price trend in China’s domestic market has shown a softening movement during Q3 2025, averaging around USD 1,340-1360/MT, reflecting a 4.4% fall from the previous quarter. The market has been pressured by weakening upstream feedstock costs, particularly acrylonitrile and styrene, combined with moderate downstream demand from automotive, electronics, and appliance sectors.

Supply flows have remained balanced, preventing sharper declines despite cautious buying sentiment from converters. In September 2025, Acrylonitrile Butadiene Styrene (ABS) prices in China recorded a further 1.5% decrease from August levels, influenced by subdued restocking activity and steady industrial consumption. Overall, softening feedstock costs, balanced inventories, and moderate downstream demand have kept the Chinese ABS market under pressure, with limited upside expected in early Q4 2025.

USA: ABS Import prices CIF Houston (Taiwan), USA, Grade- General Purpose (MFI: 19-23).

According to the PriceWatch, the Acrylonitrile Butadiene Styrene (ABS) price trend in the USA has shown a softening movement during Q3 2025, averaging around USD 1,460-1480/MT, reflecting a 3.6% fall from the previous quarter. The market has been pressured by weakening upstream feedstock costs, including acrylonitrile and styrene, alongside moderate downstream demand from automotive, electronics, and appliance sectors. Supply availability has remained adequate, helping to contain sharper declines despite cautious buying sentiment.

In September 2025, ABS prices in the USA recorded a further 0.4% decrease from August levels, influenced by restrained restocking activity and steady industrial consumption. Overall, softening feedstock costs, balanced supply flows, and moderate downstream demand have kept the U.S. ABS market under pressure, with limited price upside expected in early Q4 2025.

Türkiye: ABS Import prices CIF Mersin (South Korea), Türkiye, Grade- General Purpose (MFI: 20-22).

The Acrylonitrile Butadiene Styrene (ABS) price trend in Türkiye has shown a softening movement during Q3 2025, averaging around USD 1,400-1420/MT, reflecting a 3.6% fall from the previous quarter. The market has been pressured by weaker upstream feedstock costs, particularly acrylonitrile and styrene, along with moderate downstream demand from automotive, electronics, and appliance sectors.

Supply availability has remained adequate, helping to limit sharper price falls despite cautious buying sentiment. In September 2025, ABS prices in Türkiye recorded a further 2.2% decline from August levels, influenced by subdued restocking activity and restrained industrial consumption. Overall, softening feedstock costs, balanced inventories, and moderate downstream demand have kept the Turkish ABS market under pressure, with limited upside expected in early Q4 2025.

Netherlands: ABS Domestically traded prices FD Rotterdam, Netherlands, Grade- General Purpose (MVR: 19-34).

The Acrylonitrile Butadiene Styrene (ABS) price trend in the Netherlands has shown a softening movement during Q3 2025, averaging around USD 1,920-1940/MT, reflecting a 4% fall from the previous quarter. The market has been pressured by weakening upstream feedstock costs, particularly acrylonitrile and styrene, alongside moderate downstream demand from automotive, electronics, and appliance sectors.

Supply availability has remained balanced, limiting sharper declines despite cautious buying sentiment. In September 2025, Acrylonitrile Butadiene Styrene (ABS) prices in the Netherlands recorded a further 3.9% decrease from August levels, driven by restrained restocking and subdued industrial activity. Overall, softening feedstock costs, stable inventories, and moderate downstream demand have kept the Dutch ABS market under pressure, with limited upside expected in early Q4 2025.

Germany: ABS Domestically traded prices FD Hamburg, Germany, Grade- General Purpose (MVR: 19-34).

The Acrylonitrile Butadiene Styrene (ABS) price trend in Germany has shown a softening movement during Q3 2025, averaging around USD 1,950-1970/MT, reflecting a 3.9% decline from the previous quarter. The market has been pressured by weakening upstream feedstock costs, particularly acrylonitrile and styrene, alongside moderate downstream demand from automotive, electronics, and appliance sectors. Supply availability has remained balanced, limiting sharper price declines despite cautious buying sentiment.

In September 2025, acrylonitrile butadiene styrene (ABS) prices in Germany recorded a further 3.8% decrease from August levels, influenced by restrained restocking activity and subdued industrial consumption. Overall, softening feedstock costs, stable inventories, and moderate downstream demand have kept the German ABS market under pressure, with limited upside expected heading into early Q4 2025.

Belgium: ABS Domestically traded prices FD Antwerp, Belgium, Grade- General Purpose (MVR: 19-34).

The Acrylonitrile Butadiene Styrene (ABS) price trend in Belgium has shown a softening movement during Q3 2025, averaging around USD 1,940-1960/MT, reflecting a 3.9% fall from the previous quarter. The market has been pressured by weakening upstream feedstock costs, particularly acrylonitrile and styrene, alongside moderate downstream demand from automotive, electronics, and appliance sectors. Supply availability has remained balanced, limiting sharper price declines despite cautious buying sentiment.

In September 2025, ABS prices in Belgium recorded a further 3.9% decrease from August levels, influenced by subdued restocking activity and restrained industrial consumption. Overall, softening feedstock costs, stable inventories, and moderate downstream demand have kept the Belgian ABS market under pressure, with limited upside expected heading into early Q4 2025.

Brazil: ABS Import prices CIF Santos (South Korea), Brazil, Grade- General Purpose (MFI: 20-22).

The Acrylonitrile Butadiene Styrene (ABS) price trend in Brazil has shown a firming movement during Q3 2025, averaging around USD 1,560-1580/MT, reflecting a 1.9% increase from the previous quarter. The market has been supported by robust domestic demand from automotive, electronics, and appliance sectors, while supply availability has been influenced by higher freight rates, which added upward pressure to prices.

In September 2025, Acrylonitrile Butadiene Styrene (ABS) prices in Brazil recorded a 5.6% decline from August levels, driven by cautious restocking activity and softening downstream demand. Overall, strong underlying domestic consumption, balanced inventories, and freight-driven supply dynamics have kept the Brazilian ABS market moderately supported, although short-term volatility has been observed heading into early Q4 2025.

India: ABS Domestically traded prices Ex-Mumbai, India, Grade- General Purpose (MFI:>25).

According to the PriceWatch, the Acrylonitrile Butadiene Styrene (ABS) price trend in India’s domestic market has shown a notable softening during Q3 2025, averaging around USD 1,520-1540/MT, reflecting a 6.5% fall from the previous quarter. The market has been pressured by weakening upstream feedstock costs, particularly acrylonitrile and styrene, alongside moderate downstream demand from automotive, electronics, and appliance sectors.

Supply flows have remained adequate, preventing sharper declines despite cautious buying sentiment. In September 2025, ABS prices in India recorded a further 3.6% decrease from August levels, influenced by subdued restocking activity and restrained industrial consumption. Overall, softening feedstock costs, balanced inventories, and moderate downstream demand have kept the Indian ABS market under pressure, with limited upside expected in early Q4 2025.

Thailand: Acrylonitrile Butadiene Styrene (ABS) Import prices CIF Laem Chabang (South Korea), Thailand, Grade- General Purpose (MFI: 20-22).

The Acrylonitrile Butadiene Styrene (ABS) price trend in Thailand has shown a softening movement during Q3 2025, averaging around USD 1,400-1420/MT, reflecting a 3.6% decline from the previous quarter. The market has been pressured by weakening upstream feedstock costs, particularly acrylonitrile and styrene, along with moderate downstream demand from automotive, electronics, and appliance sectors. Supply availability has remained balanced, helping to contain sharper price declines despite cautious buying sentiment.

In September 2025, ABS prices in Thailand recorded a further 1.7% decrease from August levels, influenced by restrained restocking activity and subdued industrial consumption. Overall, softening feedstock costs, stable supply flows, and moderate downstream demand have kept the Thai ABS market under pressure, with limited upside expected heading into early Q4 2025.

Indonesia: Acrylonitrile Butadiene Styrene (ABS) Import prices CIF Jakarta (South Korea), Indonesia, Grade- General Purpose (MFI: 20-22).

The Acrylonitrile Butadiene Styrene (ABS) price trend in Indonesia has shown a softening movement during Q3 2025, averaging around USD 1,410-1430/MT, reflecting a 3.3% drop from the previous quarter. The market has been pressured by weakening upstream feedstock costs, particularly acrylonitrile and styrene, alongside moderate downstream demand from automotive, electronics, and appliance sectors. Supply availability has remained balanced, limiting sharper price declines despite cautious buying sentiment.

In September 2025, Acrylonitrile Butadiene Styrene (ABS) prices in Indonesia recorded a further 1.7% decrease from August levels, influenced by subdued restocking activity and restrained industrial consumption. Overall, softening feedstock costs, balanced inventories, and moderate downstream demand have kept the Indonesian Acrylonitrile Butadiene Styrene (ABS) market under pressure, with limited upside expected heading into early Q4 2025.