A silent revolution is taking place in boardrooms across the world. While executives spend ample time thinking about digital transformation and strategies around AI, there is a more fundamental evolution taking place that is disrupting entire industries: the Aluminum Circular Economy (ACE). This is not just a sustainability movement, this is an economic phenomenon that is rewriting the rules of how we think about manufacturing, how we think about cost control, and how we think of competitive advantage.

Aluminum has a unique superpower in the materials world: it is infinitely recyclable without any loss of quality. Paper gets weaker with each cycle, plastics break down, aluminum maintains its molecular integrity forever. This means that soda cans you recycle today, could be a component in a Boeing 787 aircraft tomorrow, then become a body in an electric vehicle, and truly can be infinitely reused.

The strategic implications are significant. There are companies that are getting highly proficient at aluminum recycling. They are not just minimizing their impact on the environment but are building permanent competitive moats in a world where resources are becoming more limited.

The Economics of Forever

The figures represent a powerful story, yet the strategic implications are even greater than many understand. Recycling aluminum takes just 5% of the energy needed for primary production to recycle aluminum which represents a 95% energy savings, directly relates to cost savings, and an overall reduction in carbon output. Nearly 10 tons of CO₂ emissions are avoided for every ton of aluminum recycled.

However, the majority miss this point: it is not about being green, it is about becoming economically invincible. In the midst of rising energy prices and carbon taxes, the advantage of using 95% less energy equals a 95% cost advantage in the marketplace. When energy costs increase, the recycling companies stick to their price while their competitors that rely on primary aluminum see their margins erode.

This leads to a “ratchet effect,” which means that these companies will have developed recycling capabilities that are cost-advantageous and are likely to become greater cost-advantages over time. The recycled aluminum market is projected to grow by more than 8% from 2025-2032. This is not just growth; it’s a shift in wealth from the high-energy primary producers to more efficient recyclers.

Regional Strategies and Competitive Positioning

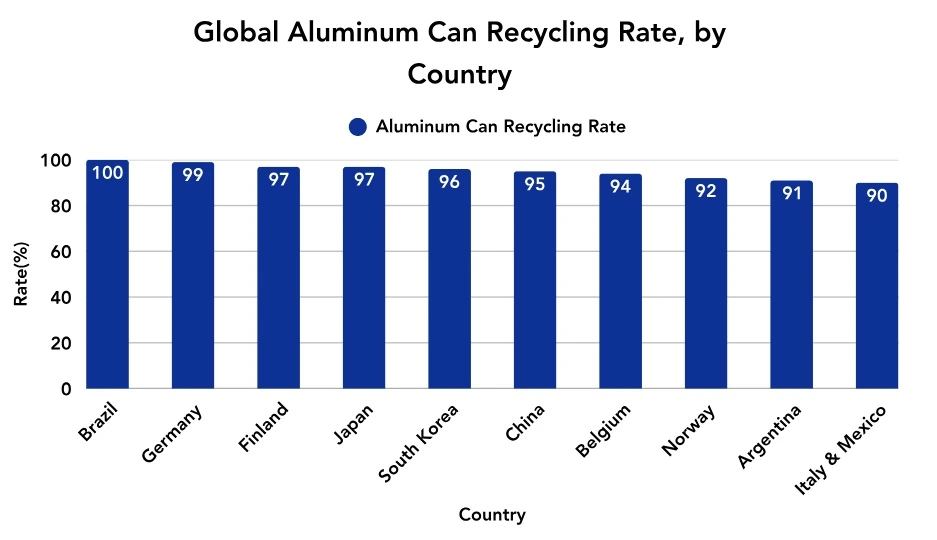

The landscape of recycling aluminum presents interesting regional adaptations that might provide indicators of future competition. Brazil’s 100% aluminum can recycle rate (separated for recycling) is not only remarkable, but also strategic. Brazil has achieved almost complete collection efficiency in aluminum can recycling, creating a domestic supply of aluminum which is virtually isolated from fluctuations in the global price for bauxite.

Germany’s 99% recycling rate represents a different strategy: systematic infrastructure investment that creates both domestic supply security and export opportunities. German companies can now offer “verified recycled content” at premium prices to global markets increasingly which are demanding circular materials.

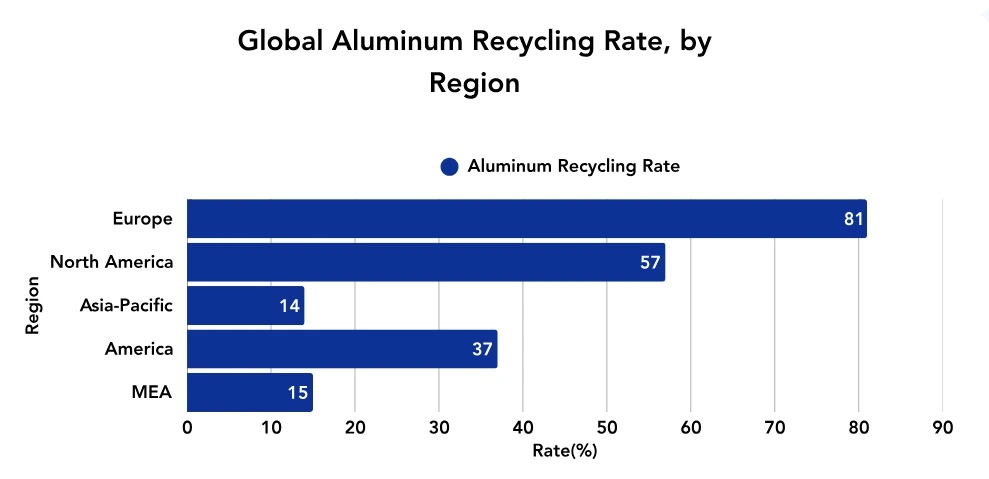

Overall, the story lies in the regional efficiency gaps. Europe leads with an 81% recycling efficiency, while the US manages just 57%. This isn’t just an environmental metric; it’s a competitiveness indicator. European manufacturers have 24% lower material costs and carbon footprints, creating permanent advantages in global markets.

The Technology Arms Race: Beyond Simple Melting

Modern aluminum recycling processes have advanced far beyond basic melting. It is now a meticulous science that uses artificial intelligence, digital twin optimization, and blockchain tracking. These technologies not only increase efficiency but also create entirely new competitive landscapes.

AI-powered sorting systems now achieve 99% accuracy and are a game changer. They allow recyclers to process mixed scrap streams that were unviable, resulting in massively increased feedstock availability. Companies that are early to use these technologies will be able to find materials that competitors cannot process, resulting in supply advantages.

Smart furnaces with AI algorithms-based control reduce energy use by 20% while optimizing alloy chemistry and composition in real-time. This is not just an operations improvement it is an aspect of strategic differentiation. Companies with smart furnaces can produce consistent quality while lowering costs at the same time.

Blockchain tracking enables something we’ve never had before verified provenance for recycled materials. This becomes a premium price opportunity in markets that are demanding transparency. Companies will be able to charge more for recycled aluminum that is labelled “blockchain-verified,” successfully upcycling waste streams into premium products.

The Contamination Conundrum: Where Chemistry Meets Strategy

Contamination is one of the great challenges of aluminum recycling. Mixed metals, coatings, and other irregularities can ruin entire batches of recycling and necessitate the use of more advanced separation technologies. It’s not just a technical issue; it’s a competitive differentiator.

Companies that successfully control contamination can process low-grade scrap long before their competitors, which gives them more feedstock options and lowers their sourcing cost. More importantly, it provides resilience in their supply chain as they don’t have to rely solely on high-grade scrap that is increasingly scarce and expensive.

The contamination challenge also creates an interesting market dynamic. Premiums are paid for high grade scrap, and heavily contaminated products are sold at a discount. Companies that can clean scrap with fewer steps can leverage that price differential, while increased feedstock supply is achieved by being able to buy cheap low-grade scrap loads.

Market Challenges for Recycling Aluminum

The aluminum recycling industry contends with a number of inherent challenges that have consequences for the profitability and efficiency of recycling aluminum. Foremost among these issues is the contamination of scrap, as previously discussed. Adding further complexity, scraps also become fragmented into smaller pieces and mixed into the user’s process and heterogeneous bins. The machines required to sort more precisely the distinguishing characteristics of different grades and alloys of aluminum demand expensive technology development and capital investment and are not always community accessible.

Moreover, the recycling process is more energy efficient than mining aluminum, but factors of contamination and energy use will still contribute to the operational costs of smelting and refining, as well as its carbon footprint.

Market dynamics affect the feasibility and viability of aluminum recycling. Aluminum scrap prices can be somewhat volatile due to supply and demand imbalances, geopolitical influences, and shifting trade policies. This creates financial uncertainty for recyclers, which makes it difficult for them to predict profitability. In addition, regions with uneven recycling infrastructures and regulatory variances add complexity to scaling up recycling activities and facilitating cross border flows of aluminum scrap.

Consumer awareness of recycling remains low, leading to higher contamination and lower collection rates in the recycled scrap stream. Moreover, differences again in region (as well as other economic factors) make recycling more expensive than primary production, especially if the scrap quality is low and the collection is inefficient or uneconomical.

The Asian Opportunity

Asia-Pacific is both the greatest opportunity and greatest challenge for industry simultaneously. The region shows the greatest growth opportunity and the largest efficiency gaps. Countries that emerge as recycling leaders in Asia will dominate global supply chains for decades.

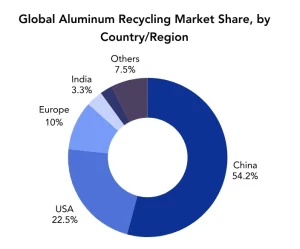

China generates 10 million tons of scrap aluminum each year, which is about 1/3 of the world’s production, demonstrating another strategic move – scale as strategy. As China continues to take charge of scrap collection and processing, it is positioning itself as the global hub for circular aluminum supply chains. China’s immense scale advantage in scrap production offers opportunities for governments and businesses alike, while invariably creating weaknesses. Countries and companies that embrace China’s scale through integration with Chinese recycling and refining facilities will benefit from massive flow of materials. Countries and companies that do not will face significant limitation on supply.

India’s growth in aluminum consumption provides an opportunity for investment in recycling infrastructure. Early movers investing in infrastructure, such as sorting centers, will benefit once the domestic aluminum market matures.

Japan’s technology leadership in recycling efficiency provides opportunities for companies seeking execution improvements through partnerships. Japanese advanced methodologies and specialized technologies will likely drive global standards.

Why Aluminum Recycling Is Inevitable

The transformation to aluminum recycling is foreseeable, it is not a question of if, but when and who will lead the revolution. Many converging factors render this shift unavoidable. Energy prices will continually rise making recycling’s 95%+ advantage more valuable. Carbon pricing will proliferate globally creating further burdens for primary production that is energy intensive. The scarcity of resources will also drive demand for circular supply chains.

Increased consumer and regulatory pressure for sustainability will create opportunities for premium pricing for established recycled content. Corporate commitments to sustainability will increase preference for recycled inputs in procurement. Companies that distinguish these shifts early and build organizational capacity to respond will realize disproportionate value relative to their competitors. Those who wait for certainty will remain at a disadvantage.

The aluminum circular economy is forming new rules for industrial competing that are significantly larger than how materials are processed. Companies must be systematic about flows of material resources, energy use efficiency, and integrated supply chains. Ultimately, the winners are those who realize aluminum recycling is not a cost center but a profitable process. The 95% energy savings, carbon-benefit, and infinite recyclability will create profitable and sustainable value beyond cost accounting.

Circular Economy begins with Aluminum Recyclability

The aluminum revolution unveils a larger truth about the future of industrial competition: a circular economy is not an environmental convenience but an economic imperative. Companies that recognize this early will create sustainable competitive advantages, while those that fail to will be displaced by more circular competitors.

Aluminum is the ideal material for an infinite economy since it is infinitely recyclable. In a world of finite resources and infinite wants, that is not only an advantage but a strategic necessity. The circular economy requires circular thinking, and aluminum enables both.

Companies and countries that harness the circular potential of aluminum will not only gain in materials but will lead sustainable industrial leadership models that will define competitive advantages for decades to come.

Sources and further readings:

https://international-aluminium.org/wp-content/uploads/2024/09/Global_Recycling_League_Table_Phase_1_Report.pdf

https://international-aluminium.org/wp-content/uploads/2024/10/Eunomia-recylcing-league-factsheet.pdf

https://www.alcircle.com/specialreport/2472/global-aluminum-recycling-market?m=true

https://reports.weforum.org/docs/WEF_Net_Zero_Industry_Tracker_2024_Aluminium.pdf

https://www.datamintelligence.com/research-report/aluminum-recycling-market

https://pubs.usgs.gov/periodicals/mcs2025/mcs2025.pdf