The petrochemical industry has been in the headlines, the decisions being made today in Seoul, Beijing, and Tokyo will reverberate through global supply chains for decades to come. East Asia is embarking on the most dramatic restructuring of Ethylene production capacity in modern history a bold gamble that could either restore market equilibrium or trigger a new wave of competitive chaos.

The Anatomy of Overcapacity

To understand why this restructuring matters, we need to grasp how profoundly deep the Ethylene market has become. For years, the industry operated under a simple but ultimately destructive logic: build more capacity, capture more market share, and economies of scale will deliver profits. China, in particular, embraced this philosophy with characteristic zeal, constructing crackers at a pace that far outstripped demand growth.

The result was predictable yet impactful. Ethylene prices collapsed as supply overwhelmed demand. Profit margins evaporated. Ethylene plants that were once cash-generating assets became financial liabilities, haemorrhaging money with each production cycle. The relationship between Ethylene and its primary feedstock, Naphtha, became so compressed that even efficient operations struggled to break even.

What made this situation particularly intractable was the simultaneous slowdown in demand. The sectors that consume Ethylene derivatives automotive manufacturing, construction, consumer packaging all experienced strong headwinds. Electric vehicles require less petrochemical content than traditional cars. Construction markets in China cooled. Sustainability initiatives pushed consumers toward alternatives to single-use plastics. The demand side of the equation hasn’t meeting with industry expectations.

The Capacity Purge Begins

Now comes the reckoning. By 2027, South Korea, China, and Japan plan to eliminate over 13 million tons of Ethylene production capacity nearly 8% of global supply. To put this in perspective, this is not incremental optimization. South Korea alone is targeting a 25% reduction in annual output, one of the most aggressive capacities cuts any major producing nation has ever attempted.

The strategy makes economic sense, even if the execution will be less favourable. China is retiring its oldest, least efficient crackers facilities that were marginal even in good times and catastrophic in bad ones. South Korea and Japan are streamlining their Naphtha-based operations, recognizing that these higher-cost production methods cannot compete in a supply-dominant market.

Early indicators suggest this manoeuvre has started to work. The spread between Ethylene and Naphtha prices has begun to widen, a technical signal that plant margins are improving. We’re not talking about robust profitability, yet the industry remains far from healthy, but the trajectory has shifted from deterioration to cautious recovery.

The S-Oil Wild Card

Amid this industry-wide retrenchment, one project stands out for its audacity and timing: S-Oil Corporation’s Shaheen Project. S-Oil Corporation, a South Korea based petroleum and refinery company, is investing South Korea Won 9.258 trillion (approximately USD 7 billion) in what could be the most competitive Ethylene facility in the world, meanwhile other companies are shutting down their capacities.

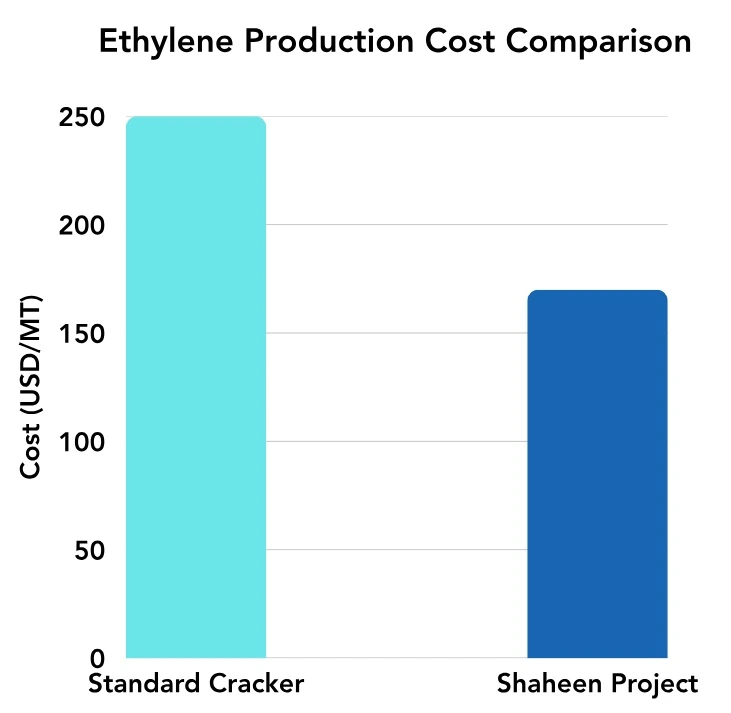

The economics are striking. Shaheen Project aims to produce Ethylene at a break-even cost of USD 171 per ton, compared to USD 250 per ton for typical Naphtha Cracking Centres. That’s a 30% cost advantage the kind of differential that doesn’t just improve margins but fundamentally alters competitive dynamics.

How is S-Oil achieving this? Three factors create the advantage.

- Feedstock flexibility: by utilizing alternatives to expensive Naphtha, the project reduces its single largest cost input.

- Power efficiency: LNG-based facilities deliver cheaper energy than conventional options.

- Scale and labour productivity: larger, more automated operations spread fixed costs across greater output.

The technological innovation here shouldn’t be overlooked. Shaheen pioneers TC2C (crude-to-chemicals) technology, a world-first approach that processes crude oil directly into petrochemical products, bypassing traditional refining steps. When completed by mid-2026, the facility will produce not just 1.8 million tons of Ethylene annually, but also substantial volumes of Propylene, Benzene, Butadiene, and Polyethylene derivatives.

The strategic timing is either brilliant or risky, depending on your perspective. S-Oil is bringing massive new capacity online just as competitors are cutting back. If the capacity reductions successfully tighten the market, Shaheen will enter improving conditions with a structural cost advantage. But if overcapacity persists, even low-cost producers may struggle.

The China Question

China is retiring old capacity, it’s simultaneously building new, highly efficient facilities. This isn’t a net reduction in Chinese supply it’s an upgrade to more competitive production. Those modern Chinese plants can produce Ethylene at costs comparable to or even lower than traditional producers in the US and Europe.

This creates a troubling scenario for the global market. If Chinese domestic demand remains weak, a real possibility given the country’s economic challenges all that efficient new capacity will seek export markets. The US, Europe, and other regions with higher-cost production could face waves of competitively priced Chinese Ethylene and derivatives, putting additional pressure on already struggling Western facilities.

The same been done before in steel, solar panels, and other industries. Overcapacity in China doesn’t just affect Chinese producers; it exports deflation and competitive pressure worldwide. For Western petrochemical companies, many of which operate older plants with higher energy and labour costs, this represents an existential threat.

What’s Next

The next 18 months will be absolutely pivotal for the petrochemical industry. Reduced ethylene capacity in South Korea, China, and a few other countries will begin to take effect, margins should improve, and ethylene prices should recover gradually as supply tightens. Ethylene producers who emerge this transition, whether through better operations or simply by strategic positioning, must navigate a changed competitive landscape. But, maintaining a stable ethylene market requires not only supply discipline, but also incremental demand growth driven by economic, environmental, and geopolitical pressures.

The petrochemical industry’s collective initiative to address excess capacity indicates an important inflection point to determine if this is a sustained recovery or simply a brief pause in persistent volatility. For all stakeholders across the value chain, the actions taken at this juncture will define competitive advantages and influence the future of petrochemical manufacturing.