The global crude oil landscape entering 2025 reveals a market carefully calibrated by OPEC+ production strategy, tempered by macroeconomic headwinds, and shaped by the enduring tension between supply discipline and demand uncertainty. As the cartel delays production increases and extends output targets through 2026, the trajectory of crude prices hinges on the delicate interplay between inventory dynamics, geopolitical volatility, and the health of major consuming economies particularly China.

The Production Pivot

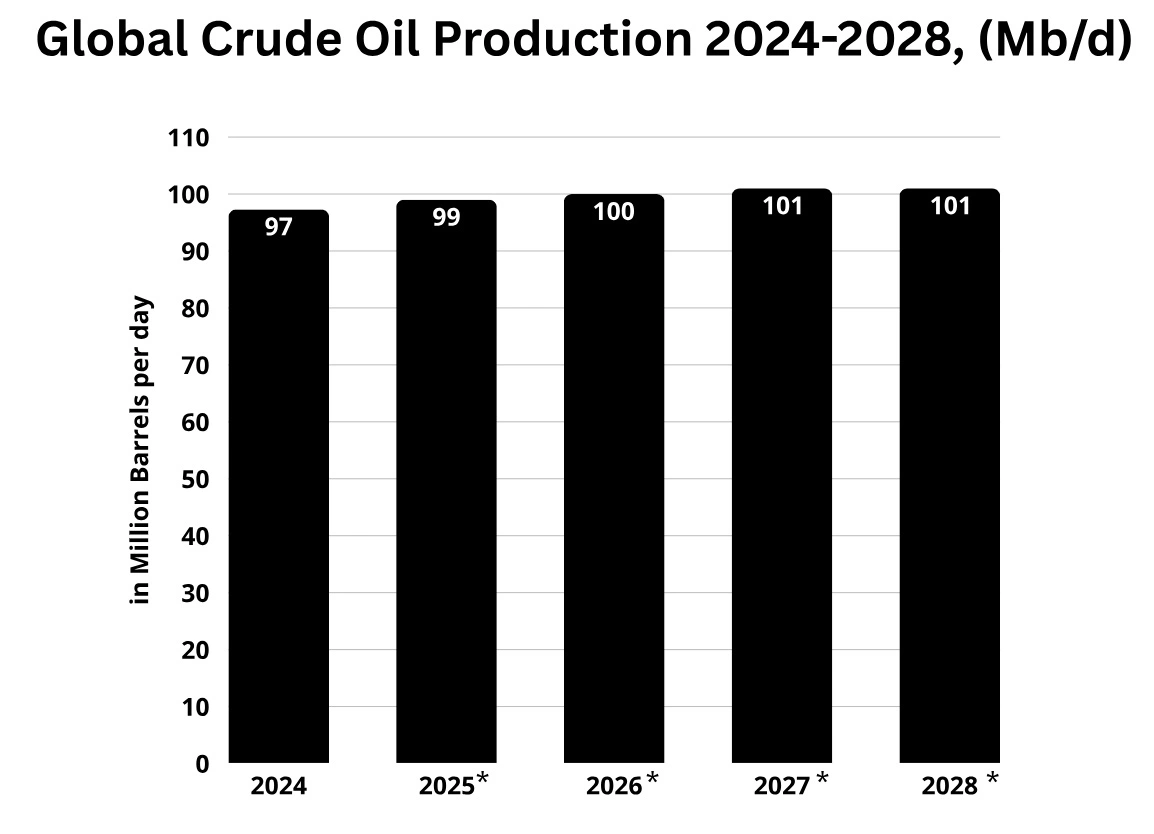

OPEC+’s December 2024 decision to postpone production increases from January to April 2025 underscores the group’s cautious approach to market management. The move signals recognition that premature supply additions could destabilize a market still absorbing the impacts of earlier cuts. Throughout 2024, OPEC+ production restraint resulted in a global inventory drawdown averaging 0.4 million barrels per day (b/d), tightening available supplies and providing modest price support despite broader bearish pressures.

This disciplined approach is expected to intensify in early 2025, with first-quarter inventory withdrawals projected at 0.7 million b/d nearly double the 2024 rate. Such aggressive drawdowns reflect OPEC+’s intent to defend price floors during a period when demand traditionally softens post-winter heating season peaks. However, the calculus shifts dramatically from the second quarter onward. As OPEC+ gradually restores output and non-OPEC supply growth accelerates particularly from US shale, Guyana, and Brazil the market pivots toward modest inventory builds averaging 0.1 million b/d through year-end.

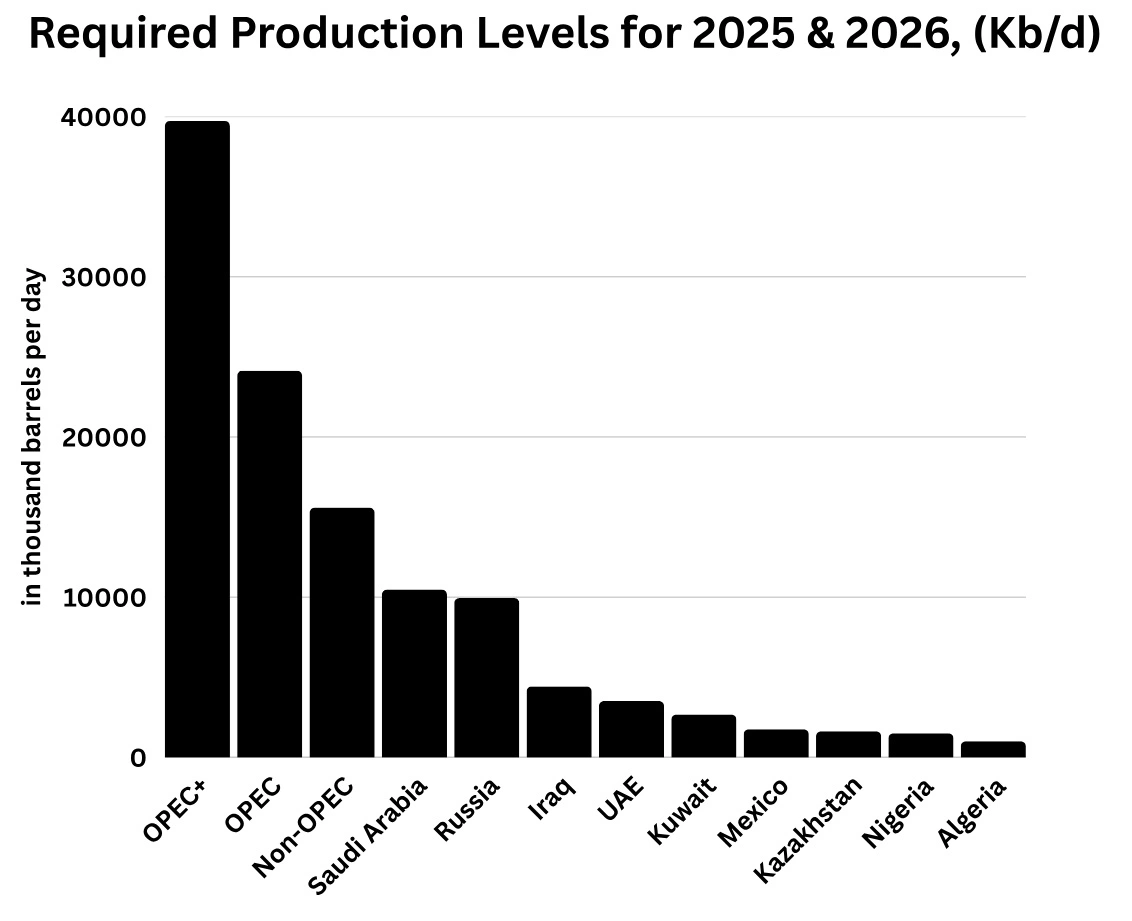

This transition from drawdown to build represents the central challenge facing OPEC+ in 2025: maintaining cohesion and compliance while managing expectations of rising supply against uncertain demand growth. The production targets extending through 2026, totaling 39.725 million b/d across OPEC+ members, establish a framework intended to balance market share preservation with revenue needs. Saudi Arabia’s allocation of 10.478 million b/d and Russia’s 9.949 million b/d position these swing producers as critical stabilizers, capable of adjusting output to offset compliance lapses by smaller members or unexpected demand shifts.

Price Trajectory

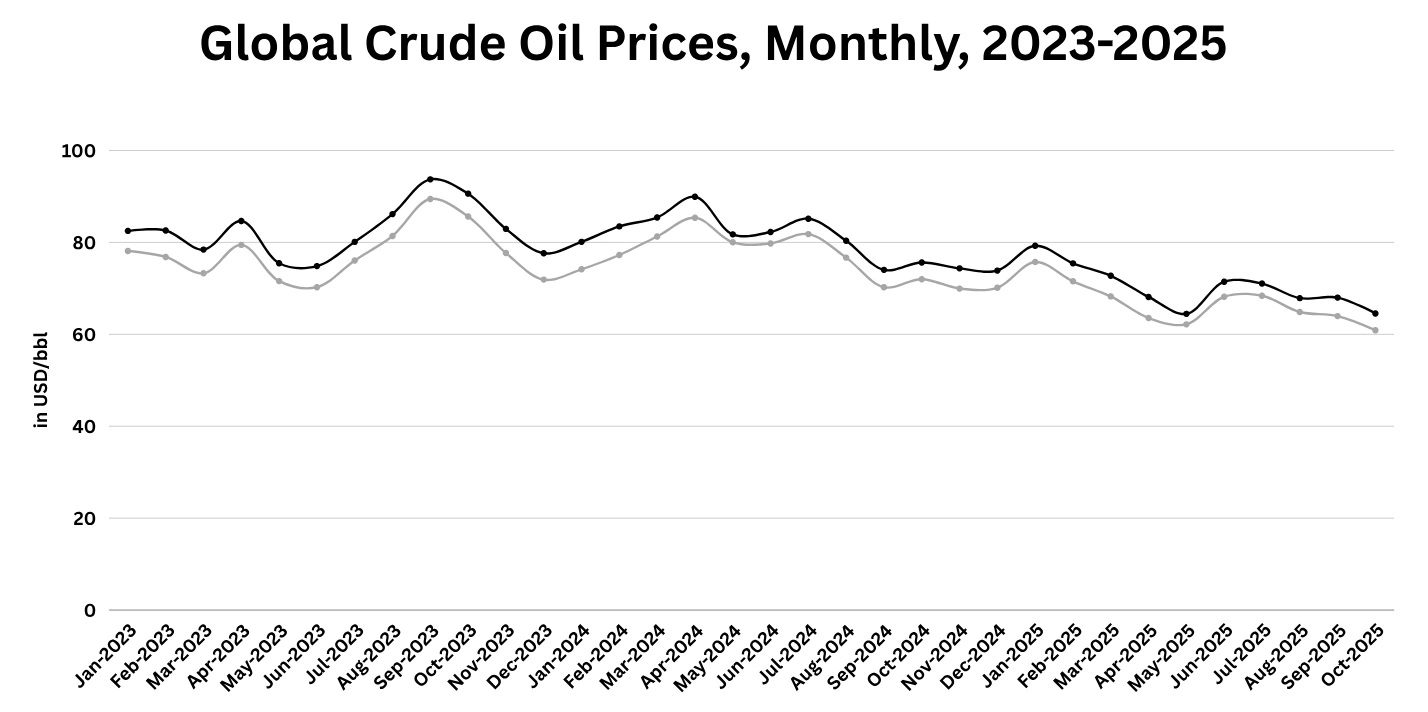

The anticipated inventory dynamics translate directly into price expectations. Brent crude, averaging USD 80 per barrel in 2024, faces a downward trajectory in 2025 with full-year averages forecast at USD 75 per barrel, a 6% decline reflecting the transition from tight to adequately supplied markets. Quarterly progression reveals the mechanics of this shift: Brent averages USD 74 per barrel in Q1 2025, supported by inventory drawdowns and winter demand, before softening to USD 72 per barrel by Q4 as inventory builds accelerate and seasonal demand weakens.

This price compression occurs despite ongoing geopolitical risks the Middle East remains volatile, and Eastern European tensions periodically flare suggesting that fundamental supply-demand balances increasingly outweigh risk premiums in driving prices. The market appears to have internalized geopolitical uncertainty as a persistent feature rather than an acute threat, reducing the sustained premium such risks once commanded.

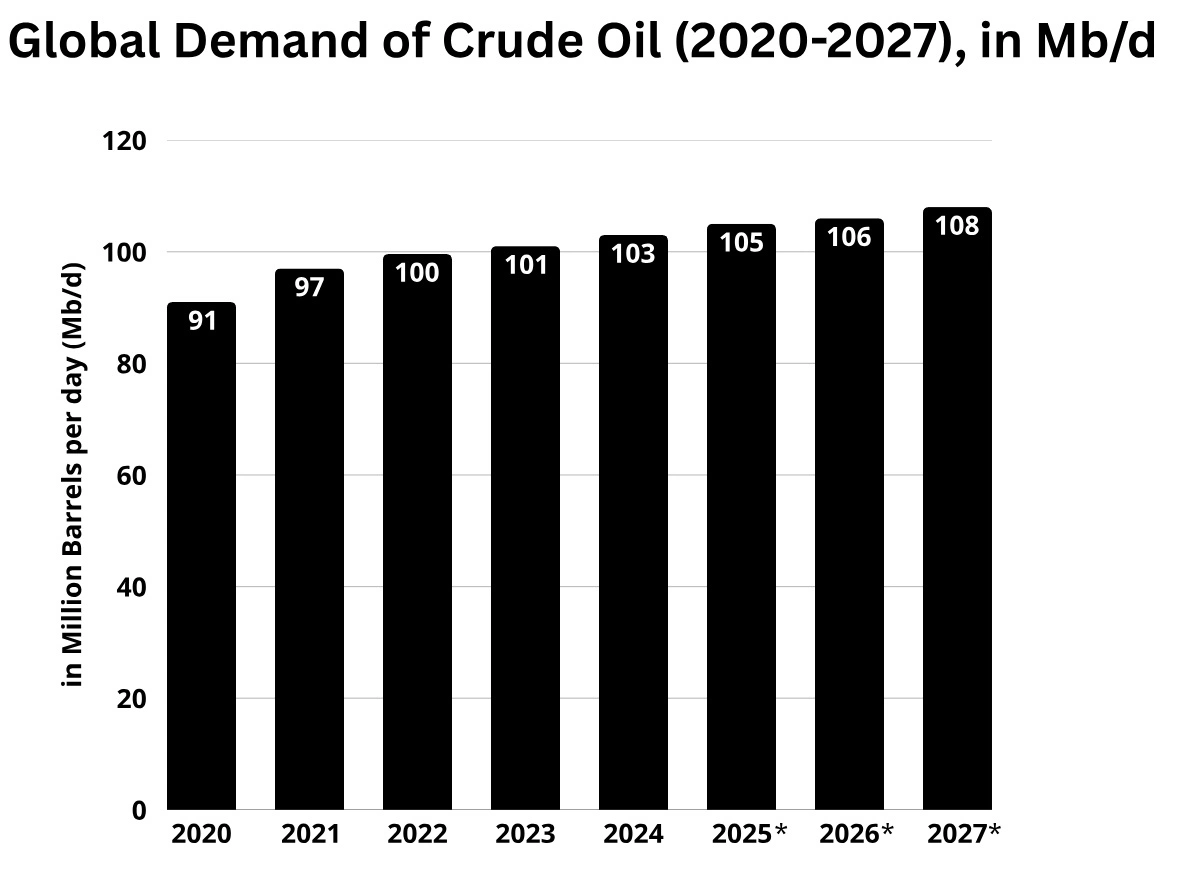

Demand trends in Crude oil

China’s economic trajectory emerges as the paramount demand-side variable. Throughout late 2024, China’s sluggish recovery repeatedly undermined bullish price momentum. November 2024 exemplified this pattern: early-month optimism driven by Beijing’s fiscal stimulus announcements quickly evaporated as weak macroeconomic data surfaced.

Lower crude imports in October, muted consumer inflation, and accelerating producer price deflections exposed structural challenges in China’s economy, dampening expectations for robust oil demand growth.

This dynamic matters enormously because China remains the world’s largest oil importer and marginal demand growth engine. Any sustained underperformance in Chinese consumption directly threatens the demand assumptions underpinning OPEC+’s production plans. If China’s economic malaise persists or deepens particularly in manufacturing and construction sectors that drive industrial fuel consumption global oil demand growth could disappoint, forcing OPEC+ to either accept lower prices or implement additional production cuts that strain member cohesion and cede market share to non-OPEC producers.

Conversely, successful Chinese stimulus efforts or unexpectedly strong US and European economic resilience could tighten markets more than forecast, supporting prices above baseline projections. The range of demand outcomes remains wide, making 2025 a year where macroeconomic data releases from Beijing will be parsed with unusual intensity by oil market participants.

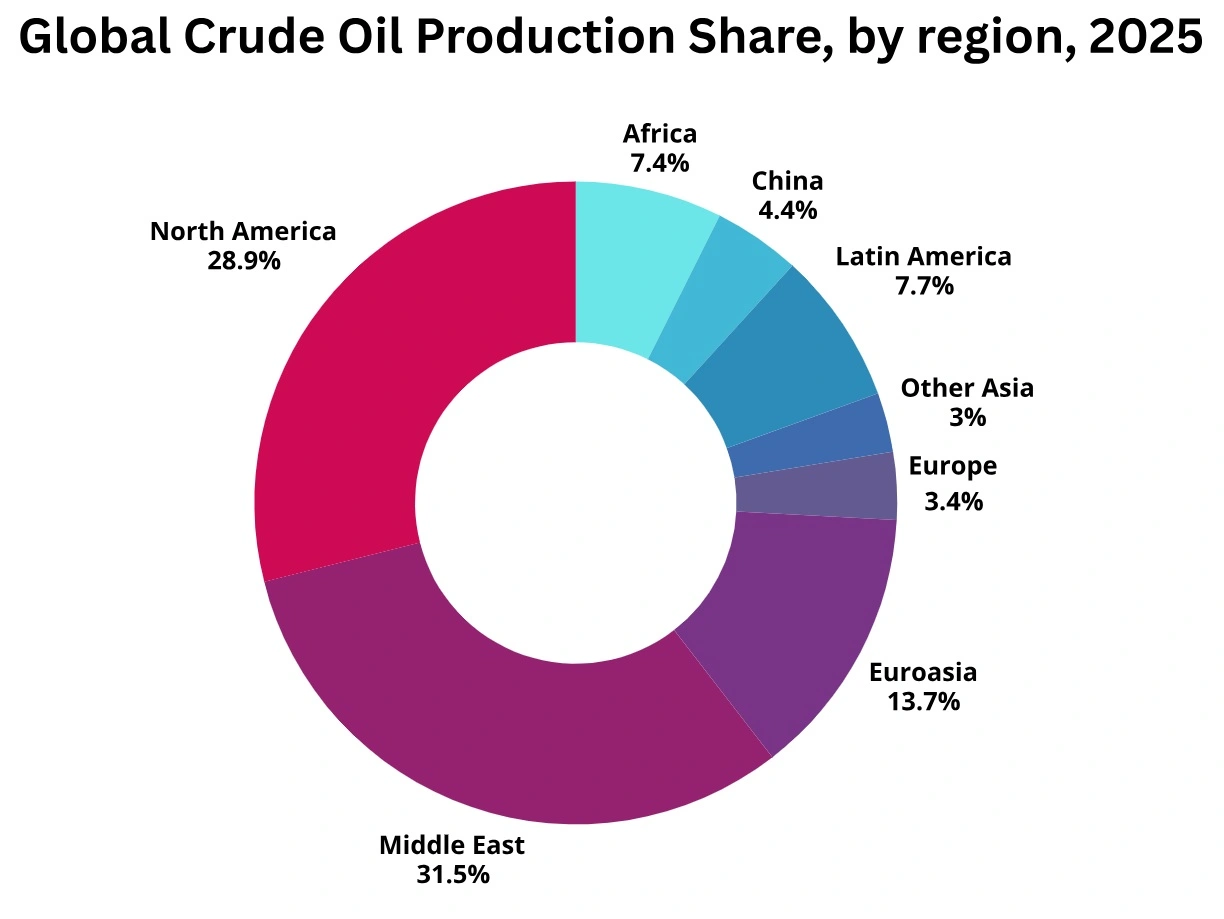

Non-OPEC Supply dynamics

The other side of the market equation involves accelerating non-OPEC supply growth. US shale production, having recovered from pandemic-era disruptions, continues expanding with producers benefiting from efficiency gains and improved capital discipline. Latin American growth, particularly from Guyana’s offshore fields and Brazil’s pre-salt developments, adds substantial new volumes to global supply. Combined, these sources create competitive pressure that limits OPEC+’s pricing power and constrains the cartel’s ability to reduce output without suffering market share erosion.

This reality explains OPEC+’s cautious approach to production increases: restoring volumes too aggressively risks triggering price collapses that would benefit competitors while damaging member revenues. Yet maintaining cuts indefinitely allows non-OPEC producers to capture incremental demand growth, permanently eroding OPEC+’s market position. Threading this needle requires exceptional coordination among 23 member countries with divergent fiscal needs, production capacities, and geopolitical priorities a perennial challenge that defines OPEC+ dynamics.

Takeaways from Recent Price Volatility

Context from recent years illuminates current challenges. The 2023 oil market saw the OPEC Reference Basket average USD 82.95 per barrel, down 17% year-on-year from 2022’s USD 100 levels, as geopolitical risk premiums faded and supply conditions normalized. Despite OPEC+ cuts, speculative futures activity and robust non-OPEC supply growth kept prices range-bound. Healthy refinery margins and stabilizing OECD inventories provided support, preventing sharper declines, but underscored that production restraint alone couldn’t override fundamental supply abundance when demand disappointed.

November 2024’s price action captured the market’s characteristic volatility. Early-month rallies driven by Middle East tensions and US Gulf of Mexico storm threats quickly reversed when US inventory builds revealed adequate supply. Currency movements particularly US dollar strength amplified downward pressure by raising crude costs for non-dollar buyers. The month’s price swings illustrated how fleeting geopolitical risk premiums have become when fundamental indicators point toward balanced or oversupplied conditions.

Strategic Implications for Market Participants

For oil market stakeholders, several strategic considerations emerge:

Refiners and consumers benefit from the forecast price moderation, with Brent in the USD 70-75 range offering improved margins and planning certainty compared to 2022-2023’s elevated volatility. However, the potential for sharp moves remains, particularly around OPEC+ meeting announcements or geopolitical flare-ups, necessitating hedging strategies that protect against tail risks.

Producers face divergent realities. OPEC+ members must navigate production discipline requirements against fiscal pressures and internal compliance challenges. Non-OPEC producers, particularly US independents, can capitalize on market share opportunities but must remain capital disciplined to avoid repeating the boom-bust cycles that characterized previous shale expansions.

Traders and speculators should focus on the inventory transition timing the shift from Q1 drawdowns to subsequent builds creates inflection points where prices may adjust abruptly as market participants reassess supply-demand balances. Chinese economic data releases will function as critical sentiment drivers, offering tactical opportunities around consensus surprises.

Long-term energy investors must weigh oil market developments against broader energy transition trends. While 2025 appears balanced toward modest oversupply, structural demand questions loom as electrification and efficiency gains gradually erode oil consumption growth rates in developed economies, even as emerging markets sustain demand.

Calibrated Caution Defines 2025

The crude oil outlook for 2025 reflects a market in calibrated equilibrium rather than crisis or boom. OPEC+’s production strategy aims to engineer a soft-landing defending prices through disciplined output while avoiding cuts so severe they permanently sacrifice market share to competitors. Success depends on variables partially beyond the cartel’s control: China’s economic recovery pace, non-OPEC supply growth trajectories, and whether geopolitical risks escalate from chronic tensions into acute supply disruptions.

The forecast path toward USD 75 Brent appears reasonable given current fundamentals, but the confidence intervals around that baseline remain wide. Market participants navigating 2025 would be wise to maintain flexibility, hedge tail risks, and monitor Chinese macroeconomic indicators with particular attention. In an era where geopolitical risk premiums compress and fundamental supply-demand balances reassert primacy, the unglamorous mechanics of inventory statistics and refinery utilization rates may prove more determinative than dramatic headlines.

Oil markets in 2025 will reward those who respect the lesson increasingly evident across recent years: discipline, diversification, and data-driven decision-making matter more than betting on shocks. OPEC+ understands this reality, and their cautious production management reflects it. Market participants should approach the year with similar prudence.