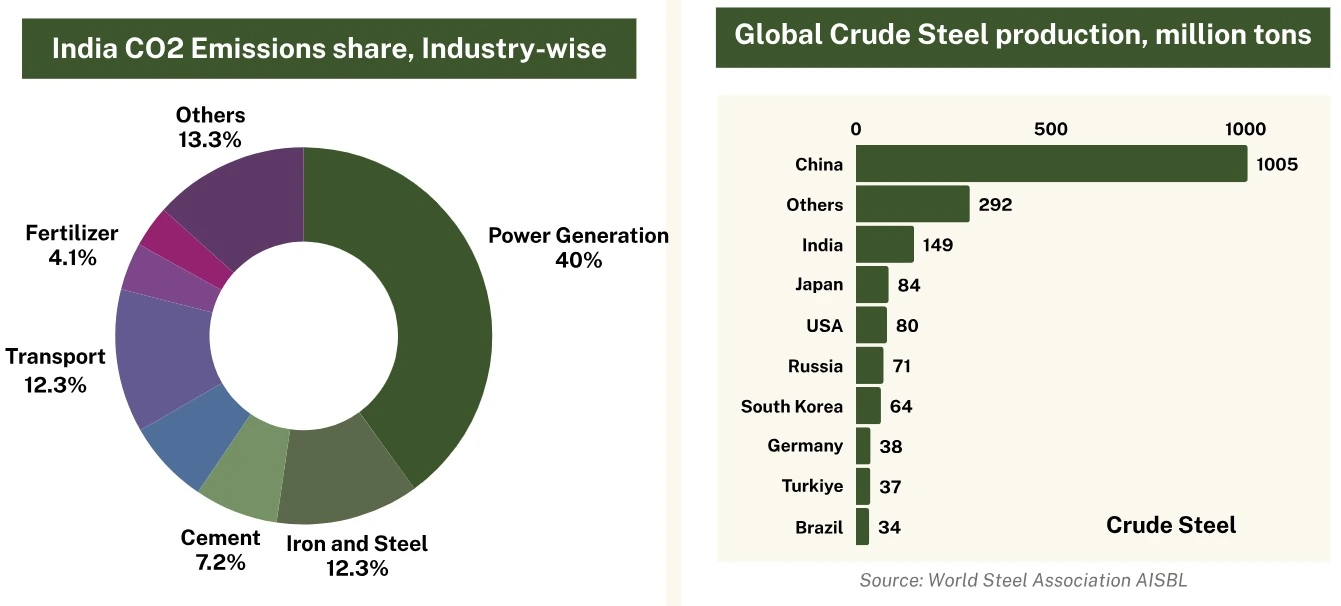

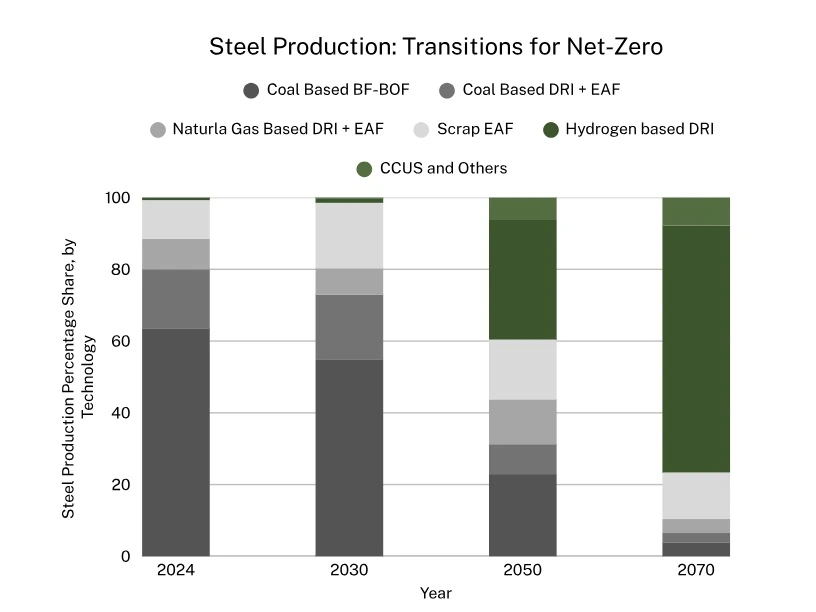

India’s iron and steel industry stands at a critical juncture. As the world’s second-largest steel producer, India faces the dual challenge of meeting soaring domestic demand while slashing carbon emissions in line with its net-zero 2070 commitment. The sector currently contributes nearly 12% of the country’s CO₂ emissions, largely due to its reliance on coal-based blast furnace-basic oxygen furnace (BF-BOF) and gas-based direct reduced iron (DRI) routes. The answer to this problem lies in hydrogen-based DRI, a transformative technology that promises to reshape the market.

Why Hydrogen-Based DRI?

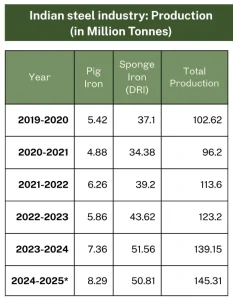

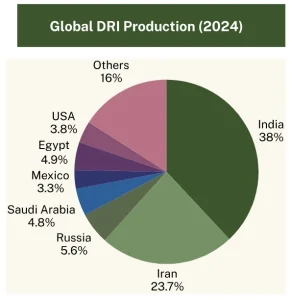

Direct Reduced Iron (DRI), or sponge iron, is a key input in steelmaking. In India, DRI has traditionally relied on natural gas or coal as reducing agents, resulting in high carbon emissions. India is the world’s largest sponge iron producer, with an installed capacity of 60.52 MTPA in FY 2023-24. Notably, India’s DRI industry is predominantly coal-based. Its leadership in DRI and growing renewable/hydrogen infrastructure makes the transition to hydrogen-based DRI highly feasible, supporting national and global decarbonization goals.

- Global DRI Leader: India, the largest DRI producer, can lead in hydrogen-based steel.

- Carbon-Free Ironmaking: Hydrogen replaces coal, producing water vapor instead of CO₂ in the reduction process.

- Massive Emission Cuts: Hydrogen-based DRI slashes CO₂ emissions by 90–95% vs traditional Blast Furnace-BOF routes.

- India’s Edge: Abundant renewables enable cost-effective green hydrogen for steelmaking.

India’s Strategic Push for Green Hydrogen

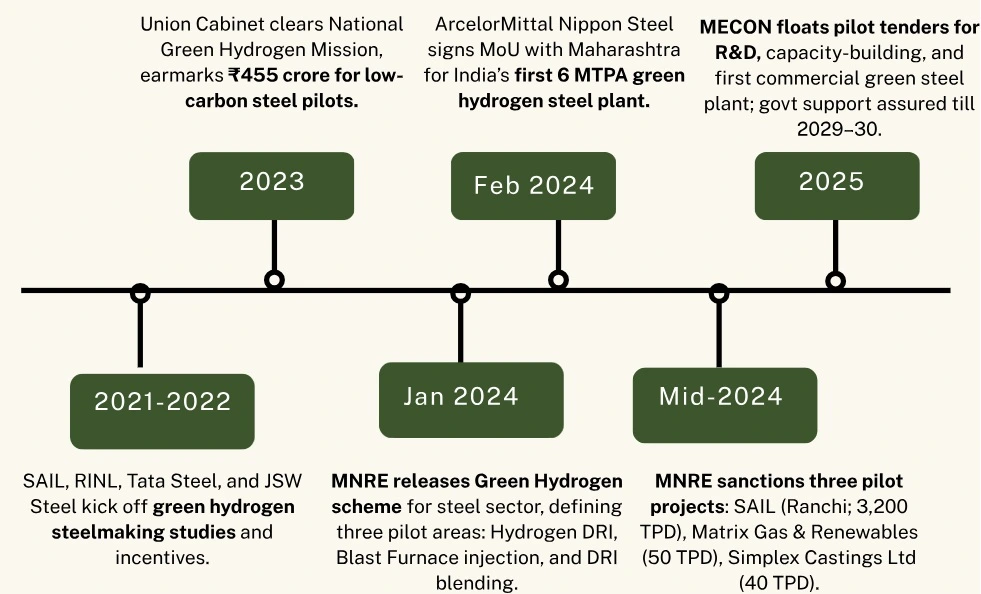

The Government of India, under the National Green Hydrogen Mission, aims to make the country a global hub for green hydrogen by 2030. Steel is identified as one of the priority sectors for hydrogen adoption. Several initiatives and pilots are already underway:

- Steel Authority of India Limited (SAIL) and RINL have initiated feasibility studies on hydrogen-based steelmaking.

- Tata Steel and JSW Steel are exploring green hydrogen integration into their DRI units.

- The government plans to introduce green hydrogen purchase obligations, incentivizing early adoption.

Economic and Policy Drivers

- Hydrogen-based DRI is not just an environmental imperative but also an economic opportunity:

- Carbon Border Adjustment Mechanism (CBAM) in the EU will impose tariffs on carbon-intensive steel imports starting 2026. Indian steelmakers must decarbonize to stay competitive in export markets.

- Domestic demand is projected to grow from 130 MT in 2023 to 300 MT by 2030, making green steel a differentiator for automotive, construction, and renewable sectors.

- Financial institutions are increasingly linking capital access to ESG compliance, favouring low-carbon steel investments.

Milestones in India’s Green Steel Transition

India’s steel sector is fast-tracking its green transition with the National Green Steel Mission. Backed by bold policies, green hydrogen, renewable energy, and the first Green Steel Taxonomy, India is setting the pace for global steel decarbonization. The roadmap targets net-zero by 2070, powering innovation, jobs, and a cleaner, competitive future.

Inside the Challenges of India’s Green Steel Transition

Moving from coal-based steelmaking to hydrogen-powered green steel sounds promising, but the reality is complex. High production costs, weak carbon pricing, limited renewable capacity, and storage challenges make large-scale adoption difficult. Without bold policies, heavy investments, and market incentives, the green steel dream will remain out of reach. Below are the detailed challenges faced by India’s green steel transition.

1. Technical Barriers

Renewable Energy Demand: Producing 1 ton of green hydrogen requires ~50 kWh of renewable energy. India’s current renewable energy capacity cannot meet this demand, highlighting a critical bottleneck. Scaling green hydrogen without expanding renewable infrastructure could stall decarbonization efforts.

Limited Hydrogen-Ready Steel Plants: Only 10% of India’s steel plants have infrastructure for renewable energy or hydrogen integration. Adoption of green steel is heavily dependent on upgrading plants. Without modernization, most of India’s steel industry cannot shift to hydrogen-based DRI, slowing the green transition.

Storage Challenges: Storing green hydrogen is complex and expensive, exceeding ₹12,000 per ton. Hydrogen is highly volatile and requires advanced containment (like high-pressure tanks or cryogenic systems). This adds both capital and operational costs, which can discourage smaller producers from adopting green hydrogen.

2. Economic Constraints

High Production Costs of Green Steel: The cost premium makes green steel less competitive domestically and globally. Green steel costs ₹55,000–₹65,000 per ton, compared to ₹45,000–₹50,000 per ton for conventional steel. Without subsidies, carbon pricing, or incentives, demand may lag despite environmental benefits.

Investment Deficit: India needs USD 10 billion annually for steel sector decarbonization but attracts only USD 3 billion. There is a funding gap that could delay infrastructure upgrades, renewable energy deployment, and R&D in green steel technologies. Attracting global investors and promoting public-private partnerships is crucial.

Expensive Green Hydrogen: Green hydrogen costs USD 4–7/kg, compared to USD 1.8/kg for grey hydrogen. Despite environmental benefits, the high price makes green hydrogen economically impractical for large-scale adoption. Price reductions via technology improvements, scale, and renewable energy expansion are necessary.

3. Governance and Policy Issues

Low R&D Spending: Only 0.7% of GDP goes to R&D, with little focus on green steel. Innovation in hydrogen DRI, storage solutions, and advanced steelmaking is stifled, limiting domestic technology leadership and cost reduction potential.

Weak Carbon Regulations: India’s carbon tax is INR 400/ton CO₂, versus USD 60-100/ton in Europe. Minimal economic pressure exists to reduce emissions. Companies have little incentive to shift to cleaner technologies, slowing decarbonization.

4. Supply Chain Constraints

Low Scrap Recycling Rates: Steel scrap recycling is 20% in India, vs global average 35%. Limited scrap constrains Electric Arc Furnace (EAF) adoption, which is a key pathway for lower emissions.

Underdeveloped Scrap Market: Lack of efficient collection and supply of scrap. Even if EAFs are deployed, scrap shortages could throttle green steel production, requiring import reliance or new collection systems.

Inadequate Carbon Capture: Carbon Capture Utilization and Storage technology is expensive, energy-intensive, and lacks storage infrastructure. Carbon capture, a potential decarbonization tool, is currently non-scalable, limiting its impact on large steel plants.

5. Price-Sensitive Market & Demand Challenges

Consumer Reluctance: The Indian market is unwilling to pay the premium for green steel. Even environmentally conscious buyers are price-driven, so green steel adoption hinges on making it cost-competitive or offering financial incentives.

Need for Legislative Support: Without subsidies or policy backing, demand remains subdued. Government intervention like tax rebates, procurement mandates, or carbon pricing is essential to stimulate market pull for green steel.

Market Implication: If costs stay high without support, producers may hesitate to invest, and India could lag global competitors in decarbonized steel production.

The Road to Green Steel

Hydrogen-based DRI is no longer a distant dream it is becoming a strategic necessity. Early movers in India’s steel sector can secure global leadership in low-carbon steel, attract green financing, and meet stringent trade norms. With the right policy push, technology investments, and partnerships, India can transform its steel industry from a carbon-intensive giant to a sustainability leader.

India’s steel story is at a crossroads. As the backbone of infrastructure and growth, the sector must shed its carbon-heavy past to embrace a green future. Here’s how the journey from coal to clean unfolds in the upcoming deciding decades.

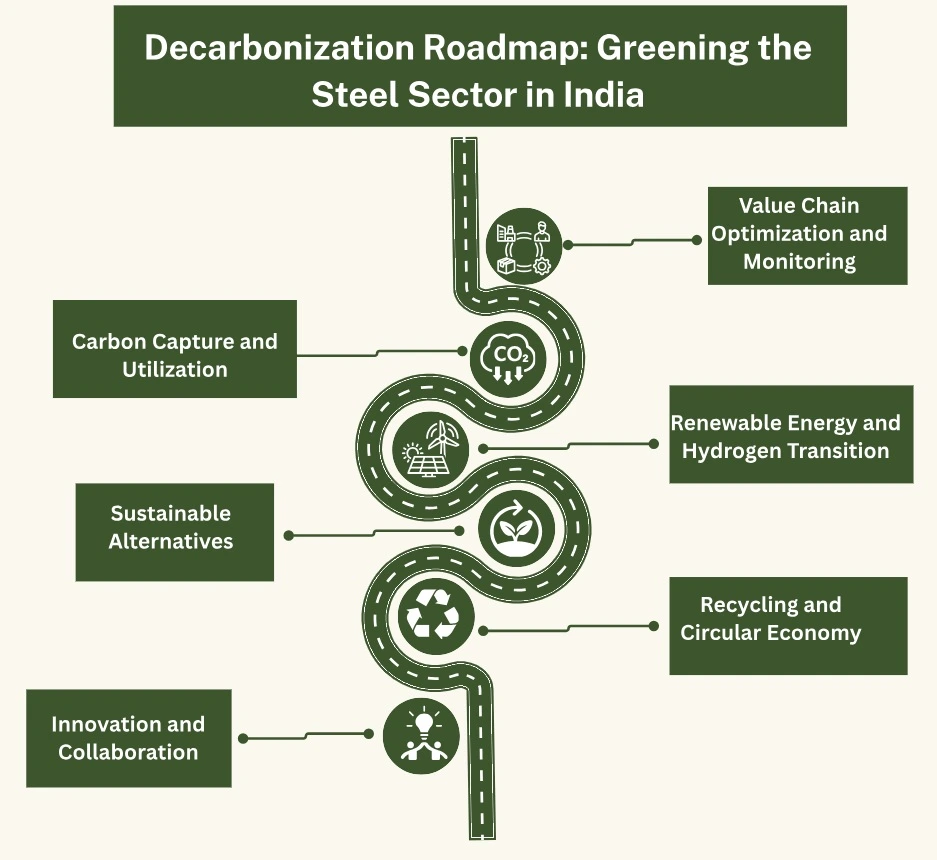

Accelerating green steel production in India requires a holistic and coordinated approach. This includes bold policy reforms, technological innovation, market incentives, and active engagement from consumers and industry stakeholders. Effective carbon pricing and targeted subsidies will be crucial to make sustainable practices economically viable. At the same time, strategic investments in R&D, energy-efficient processes, and carbon capture utilization and storage (CCUS), supported by robust certification systems, will ensure transparency, credibility, and scalability.

Aligning domestic standards with global regulations and fostering strong public-private partnerships will position India as a leader in sustainable steel. Finally, raising awareness and promoting the procurement of certified green steel especially for infrastructure projects will drive market demand. Together, these efforts can transform India’s steel sector, making it environmentally sustainable, globally competitive, and aligned with broader climate objectives.

Sources and further readings:

https://www.switchon.org.in/wp-content/uploads/2025/04/Sustainable-Steel-for-Sustainable-Jharkhand.pdf

https://moef.gov.in/uploads/2017/08/GHG-report.pdf

https://www.ceew.in/publications/state-and-sector-wise-greenhouse-gases-and-carbon-emissions-india

https://iced.niti.gov.in/climate-and-environment/ghg-emissions/economy-wide