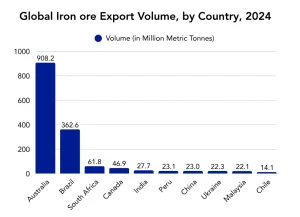

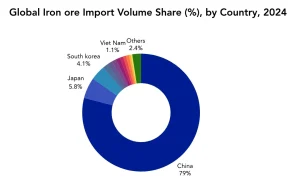

Australia, the world’s largest iron ore producer, has shipped nearly 889 million tonnes of iron ore in 2024, yet its earnings have been struggling due to weak prices in the international market. Several estimates forecast that benchmark iron ore spot prices will fall further to USD 83/MT in 2025, down from USD 93/MT last year, threatening to shrink export revenues by almost USD 20 billion over the next two years. China’s slowing steel demand, tighter environmental regulations, and the global shift toward higher-grade ores are reshaping the market, while India’s new 30% export duty on low-grade ore adds another twist. With fresh supply from Guinea’s Simandou mine looming and policy shifts accelerating, producers face a future where volumes remain strong, but profits are harder to secure.

Global iron ore supply has recovered after disruptions in Australia. Fortescue Metals Group, for instance, shipped over 44.75 million tonnes in Q1, a more than 5% increase compared to last year, recovering from logistical setbacks and aiming to reach up to 200 million tonnes for the year. With stable exports from Australia and Brazil and upcoming new supply from Guinea’s Simandou mine, analysts expect global availability to soon outpace demand. Meanwhile, steel consumption in China is forecast to drop by 5–7 million tonnes a year over the next decade as the country faces slowing economic growth and tightening environmental regulations.

Pricing Dynamics

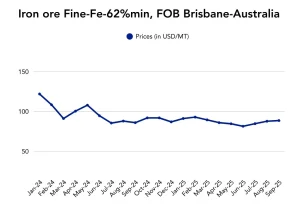

The iron ore market entered September 2025 with moderate gains, recovering from the instability seen at the end of August. Although the first week of the month was marked by sharp price swings, the overall trend was upward.

At the beginning of September 2025, the main factor weighing on prices was the temporary reduction in steel production in China ahead of the Military Parade on September 3. In several regions, especially Hebei and Henan provinces, mills cut pig iron output by 30–50%, and some blast furnaces were idled. This sudden decline in ore demand led to a price drop on September 1, with futures falling to USD 107/MT in Dalian and USD 101.3/MT in Singapore.

Once the parade concluded, the market began to recover. Blast furnace operations were gradually restarted, pig iron production rose, and ore demand picked up. As a result, quotations rose steadily between September 2-4, 2025. Even though rolled steel consumption remained subdued, and inventories continued to rise, expectations of stronger demand after the end of restrictions helped support the rally.

Australia: Record Volume Sales, Declining Revenue

Australia continues to hold its position as the world’s largest iron ore exporter, with Western Australia shipping more than 900 million tonnes of iron ore in 2024. These shipments generated export earnings worth AUD 117.7 billion (approximately. USD 77 billion), though revenues fell by more than 13% compared with the previous year due to softer global prices.

In July 2025, Iron ore exports rose to 75 million tonnes, up 5% year-on-year, demonstrating the resilience of Australia’s supply. However, this increase in volume has been overshadowed by weaker prices. Benchmark 62% Fe fines spot prices have softened and are forecast to average USD 83/MT in 2025, down from USD 93/MT in 2024, with further declines expected in the subsequent year.

Reflecting this downward price trajectory, Australia’s iron ore export earnings are projected to shrink from AUD 116 billion in 2024–25 to AUD 105 billion in 2025–26, and further to AUD 97 billion in 2026–27. This decline highlights the challenge of maintaining revenues in a market characterized by stable volumes but weakening prices.

On the production side, major producer Rio Tinto shipped nearly 80 million tonnes in the second quarter of 2025, underscoring steady output. Meanwhile, Mineral Resources is targeting 9–10 million tonnes annually from its Onslow project, pointing to incremental growth but not significant expansion.

The key challenge lies in China’s slowing demand and the global shift toward higher-grade ores that support low-emission steelmaking. Many Australian mines produce mid-grade ore, leaving them vulnerable to evolving market preferences.

To address these shifts, the Australian government and industry players are investing in infrastructure and sustainability initiatives. A notable measure is the establishment of a AUD 636 million “green iron” fund, designed to support cleaner steel production and position Australia as a long-term supplier in a decarbonizing global economy.

China: Changing Tariffs and Policy Landscape

China’s strict steel output controls to combat air pollution ahead of national celebrations drove iron ore prices higher, while Australian supply rebounded following weather disruptions. Global mining competition is intensifying, with companies investing in technology and logistics to enhance export reliability. Renewed optimism stems from strong Dalian futures contracts and continued steel mill restocking, but overall market sentiment remains closely tied to China’s economic and policy decisions.

Iron ore prices in China are expected to remain above USD 100 per ton for the next six months, supported by the country’s autumn construction boom. Nonetheless, most forecasts call for a gradual decline as new supply comes online and demand growth slows. Key risk factors include evolving environmental regulations, changing trade policies, weather disruptions, and potential economic stimulus from China. Producers must stay agile by monitoring inventories, watching for Chinese steel restrictions, and preparing for policy changes. Important market signals include steel mill inventory levels, Chinese manufacturing data, and export volumes.

India Imposes New Export Duty

India frequently adjusts its iron ore export and imports policies to balance its domestic market. High-grade iron ore exports face tariffs of up to 50%, while import duties have generally been low but may increase if supply dynamics change. Exports tend to rise when domestic demand weakens or when international prices gain traction, with China being the primary buyer. These frequent policy changes require exporters and miners to stay vigilant to avoid sudden financial losses. Export volumes fluctuate and spike when domestic supply exceeds local needs, primarily serving steelmakers in Asia and the Middle East.

From October 2025, India will introduce a 30% export duty on low-grade iron ore (below 58% Fe) to ensure sufficient supply for its rapidly expanding steel sector and stabilize domestic prices. This marks a significant shift from previous exemptions and primarily affects exports to China, which is the largest customer for India’s low-grade ore. In 2024, India’s iron ore exports dropped from 48 million tonnes to about 30 million tonnes as the country prioritized domestic steel production.

The majority (80–90%) of India’s iron ore exports are low-grade, while higher-quality ore is reserved for local steelmakers and subject to higher taxes. The new export duty aims to encourage more value-added processing and innovation in India, shield local steelmakers from price spikes, and keep Indian steel internationally competitive. While steel manufacturers welcome these changes, miners worry about unsold low-grade ore accumulating at mines, especially in export-dependent regions such as Goa.

This policy is part of India’s larger strategy to meet an expected iron ore demand of 430 million tonnes by 2030, up from roughly 290 million tonnes today. The government hopes these actions will help transform India into a major global steel exporter over the coming decade.

The Road Ahead

As the iron ore market pivots from a volume-driven era to one defined by strategic resilience, the road ahead demands bold adaptation and foresight. Australia’s iron ore dominance now faces mounting pressures from shifting Chinese demand, emerging global supplies like Guinea’s Simandou, and growing protectionism from India. Yet, this evolving landscape opens a gateway to innovation where embracing greener steel technologies and navigating policy volatility will separate the leaders from the laggards.

In this transformative moment, the true value lies not in extracting more ore, but in reshaping business models, forging sustainability, and mastering agility. The companies that thrive will be those that recognize that success in the iron ore market of tomorrow hinges on resilience built through change, not volume alone.