The petrochemical segment in 2025 stands at a pivotal moment, marking a significant departure from its earlier trajectory of rapid growth and predictable trade flows. Historically driven by surging demand in Asia and other regions, the sector is now being reshaped by several disruptive forces. A massive increase in Chinese production capacity has altered the global supply-demand balance, while the United States continues to maintain a competitive edge with its cost-efficient feedstock advantage. At the same time, fragile global logistics networks have introduced new complexities and risks to trade flows.

According to the International Energy Agency (IEA), petrochemicals are projected to account for roughly one-third of oil demand growth by 2030, a figure that could rise to nearly 50% by 2050 clear evidence of the growing significance of petrochemicals within the global energy system. In this rapidly evolving environment, understanding the new dynamics of production, consumption, and transportation is no longer optional; it is essential for producers, traders, and consumers who seek to navigate an increasingly volatile market.

Global Production Realignment: China Flipping the Script

Production dynamics are being remodeled at a foundational level. On one part of the world, the United States continues to deepen its ethane-fueled petrochemical hegemony. Ethane production is 2.83 million barrels per day (Mb/d) in 2024, a record, and is forecast to increase marginally higher to 2.9 Mb/d in 2025. Almost all of this production goes domestically to feed Gulf Coast crackers and offers a strong cost benefit over European and certain Asian naphtha-based producers. The shale revolution has guaranteed that American ethane is abundant and cheap, keeping American petrochemical exporters strong contenders in the international market.

On the other hand, China has embraced the “self-sufficiency by scale,” strategy, rushing to new steam crackers and derivative plants. Ethylene capacity above local demand leaped by 2025 to 11.5 million tonnes, a boost from 2024’s just over 5 million tonnes. Propylene excess capacity increased even more, rising to 20.3 million tonnes, almost doubling year-on-year. These surpluses are the result of years and years of aggressive investment in integrated refining-petrochemical complexes that are underpinned by state-controlled majors and regional governments seeking to attain industrial autonomy.

The outcome is a global production barbell: U.S. and Middle Eastern producers enjoy advantaged feedstocks, while China has enormous scale dominance, even if utilization levels are marginal. For producers outside, particularly in Europe, South Korea, and Japan, the squeeze is huge as they are subjected to trimmed margins and the threat of being structurally priced out of export markets.

Trade in Transition: Navigating Demand Shifts

It is perhaps the most significant shift in 2025 not in manufacturing but in demand and trade patterns. China, for decades, had served as the “sink” for the world’s petrochemicals, taking up surplus polyethylene and polypropylene volumes from Middle Eastern, South Korean, and U.S. exporters. That era is fast closing down.

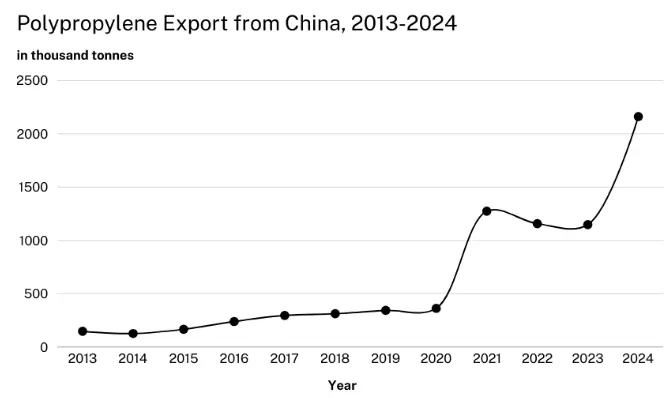

Polypropylene (PP) is a great example of that where China shipped only 0.4 million tonnes in 2020. In 2024, exports reached 2.2 million tonnes, and at the rate of the first half of 2025, full-year exports may reach almost 3.0 million tonnes. China was a net exporter of PP for several consecutive months in early 2025 which is a symbolic boundary point representing its transformation from importer to exporter.

The current situation is largely driven by excess local capacity coupled with slower-than-anticipated domestic consumption growth. The post-COVID recovery has been muted, falling short of earlier projections, and has been less reliant on commodity-driven demand than predicted. Simultaneously, Beijing’s strategic pivot toward services and eco-friendly technologies has reduced the intensity of plastics-heavy construction and manufacturing activities, further dampening demand in key industrial segments. Chinese manufacturers are therefore looking to export markets. Southeast Asia, Turkey, Africa, and Latin America have all witnessed increased Chinese bids, frequently on discounted terms.

For international suppliers, this is a shake-up. Exporters from South Korea and the Middle East, which had previously banked on China to provide stable demand, now must diversify or be priced into oblivion. Meanwhile, fresh arbitrage patterns are starting to form, with Chinese material going toe-to-toe with U.S. resins in Latin America and some parts of Europe.

Logistical Bottlenecks and Detours: The Longer Road for Trade

Even as production and demand redraw the competitive landscape, logistics is the uncertainty that defines 2025. The international supply chain has yet to revert to “normal” since the pandemic disruptions. Petrochemicals with their high volume and freight rate sensitivity are especially vulnerable.

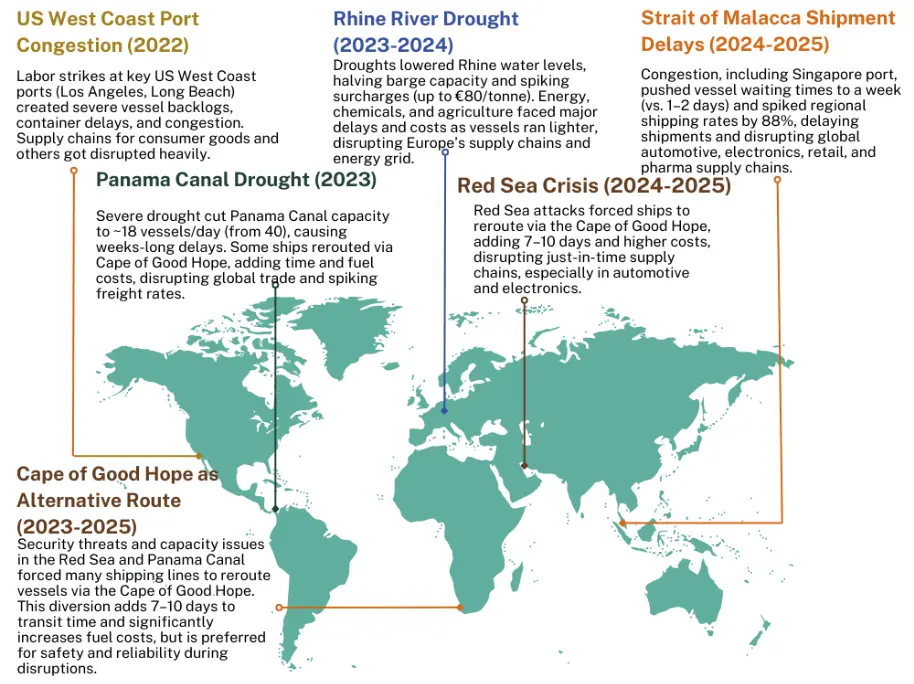

The Red Sea crisis, caused by commercial ship attacks, compelled many carriers to divert their routes via the Cape of Good Hope. The diversion amounted to two weeks of sea time from Asia to Europe and occupied container capacity. During the height of the disruption in 2024, the capacity available for shipping on the Asia–Europe trade was estimated to decline by 15–20%. Even in 2025, diversion is prevalent, and reliability is way behind pre-crisis levels.

At the same time, the Panama Canal transitioned from drought-imposed limitation to partial recovery. The level of lakes picked up in early 2025, with additional booking slots being available, and sometimes even going unscheduled. This has been a relief for American resin exporters to Asia and Latin America but has left the memory of 2023’s bottlenecks as a reminder of climate change danger to global chokepoints.

The picture of freight costs also demonstrates this volatility. The Drewry World Container Index, a global standard for container rates, averaged around USD 1,500 per 40-foot FEU in 2023, spiked to USD 3,000 per 40-foot FEU in 2024 during the crisis rerouting, and has settled back to around USD 2,350 per 40-foot FEU in mid-2025. This is remarkable return to normality, but still higher than pre-pandemic levels, and volatility will continue as long as geopolitical tensions stay unresolved.

Petrochemical Outlook: Balancing Supply, Risk and Opportunity

The year 2025 presents both challenges and opportunities for the petrochemical industry. The IEA’s projection that petrochemicals will account for over a third of global oil-demand growth through 2030 underscores the sector’s resilience. Even amid oversupply and logistical disruptions, fundamental demand for plastics, fertilizers, and other derivatives remains strong, fueled by rising global populations and ongoing industrialization outside of China.

The petrochemical landscape is clearly shifting. U.S. producers continue to enjoy a feedstock advantage, yet policy volatility, such as licensing restrictions on ethane exports, can trigger sudden disruptions. Meanwhile, China’s substantial surpluses persist, keeping global markets competitive and, at times, oversupplied. Although some logistical bottlenecks may ease, geopolitical risks remain, keeping freight costs uncertain.

In essence, the 2025 petrochemical supply chain reflects a dual reality: abundant supply in certain regions alongside persistent distribution challenges. Companies that adapt their strategies to this evolving environment, balancing cost efficiency, operational flexibility, and sustainability will be best positioned to thrive in the coming years.