Price-Watch’s most active coverage of Butyl Acrylate price assessment:

- Industrial Grade Purity (≥ 99%) FOB (Shanghai), China

- Industrial Grade Purity (≥ 99%) FOB (Jeddah), Saudi Arabia

- Industrial Grade Purity (≥ 99%) FOB (Klang), Malaysia

- Industrial Grade Purity (≥ 99%) CIF (Santos_China), Brazil

- Industrial Grade Purity (≥ 99%) CIF (Mersin_Saudi Arabia), Turkey

- Industrial Grade Purity (≥ 99%) CIF (Nhava Sheva_China), India

- Industrial Grade Purity (≥ 99%) CIF (Nhava Sheva_Malaysia), India

- Industrial Grade Purity (≥ 99%) Ex-Mumbai, India

Butyl Acrylate Price Trend Q3 2025

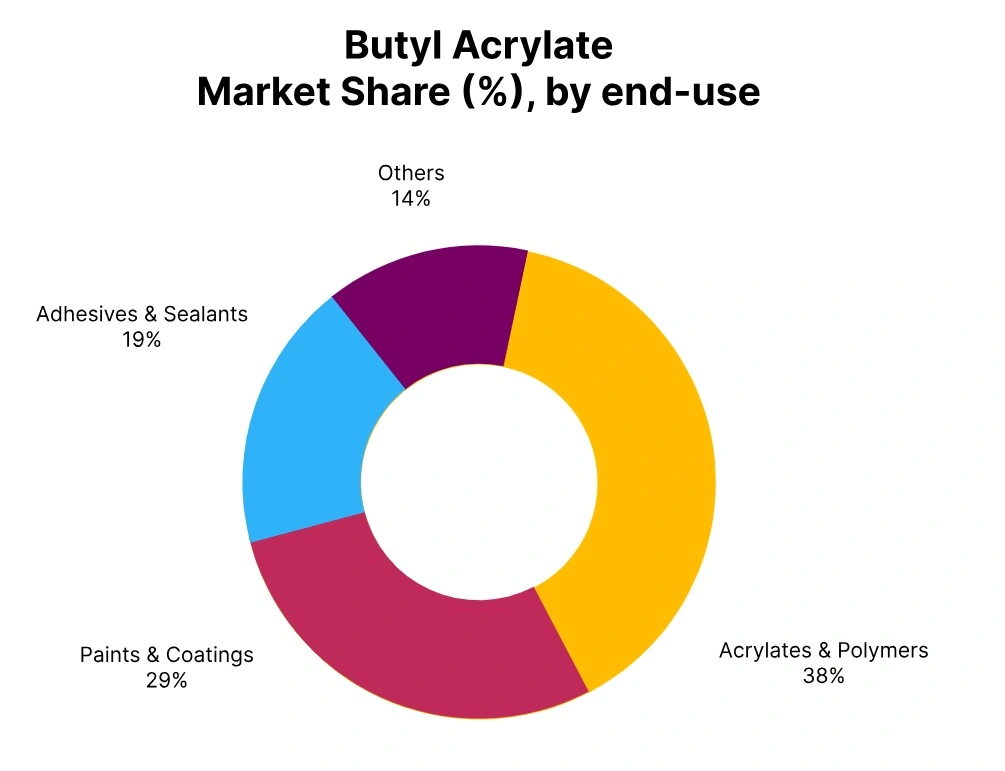

In Q3 2025, the global Butyl Acrylate market exhibited average stability with slight downward corrections in most regions. Prices were influenced by balanced feedstock availability, steady propylene and acrylic acid costs, and consistent demand from coatings, adhesives, and polymer applications. Regional variations arose due to localized consumption patterns, trade flows, and logistical factors.

Despite slight declines, overall production remained stable, with exporters maintaining regular shipments to major markets across Asia, the Middle East, and Latin America. Market fundamentals suggest that pricing remained controlled, reflecting a balance between supply efficiency and measured downstream demand. Limited volatility is expected to continue into early Q4 2025.

China: Butyl Acrylate Export Prices, FOB Shanghai, China, Purity >99%.

In Q3 2025, Butyl Acrylate prices in China displayed a slight downward trend, influenced by softening demand from domestic adhesives, coatings, and superabsorbent polymer sectors. Export inquiries from Southeast Asia and India remained steady but cautious as buyers adjusted to mild cost corrections in upstream acrylic acid and propylene. The Butyl Acrylate price trend in China reflected stable production levels and adequate inventories, supporting balanced market conditions despite conservative buying interest.

Producers maintained consistent operating rates, ensuring smooth supply to key ports. In September 2025, Butyl Acrylate prices in China under FOB Shanghai decreased by 0.23%, indicating a balanced-to-soft market tone with near-term pricing likely to remain rangebound into Q4 2025.

Malaysia: Butyl Acrylate Export Prices, FOB Klang, Malaysia, Purity >99%.

According to PriceWatch, In Q3 2025, Butyl Acrylate prices in Malaysia showed a slight downward movement, driven by minor declines in export demand from neighbouring Southeast Asian markets and steady domestic production. Feedstock costs remained relatively stable, but buyers adopted cautious procurement strategies amid sufficient inventories.

The Butyl Acrylate price trend in Malaysia reflected balanced supply and steady logistics, while limited offtake from coatings and adhesive manufacturers created mild pricing pressure. Smooth freight and shipping supported continuous trade flows. In September 2025, Butyl Acrylate prices in Malaysia under FOB Klang fell by 0.40%, reflecting a mildly soft market tone with potential stabilization as industrial activity gradually improves in Q4 2025.

Saudi Arabia: Butyl Acrylate Export Prices, FOB Jeddah, Saudi Arabia, Purity >99%.

In Q3 2025, Butyl Acrylate prices in Saudi Arabia showed a moderate downward trend due to limited export demand and controlled domestic consumption. Producers stayed stable operating rates while buyers checked inventory levels carefully, slowing spot purchases. The Butyl Acrylate price trend in Saudi Arabia reflected balanced supply conditions, supported by sufficient feedstock availability and smooth logistics operations.

Measured procurement from coatings and adhesive sectors helped maintain balance in the market. In September 2025, Butyl Acrylate prices in Saudi Arabia under FOB Jeddah decreased by 0.27%, indicating a balanced-to-soft tone with pricing expected to remain largely steady going into Q4 2025 and limited volatility anticipated.

Brazil: Butyl Acrylate Import Prices, CIF Santos (China), Purity >99%.

In Q3 2025, Butyl Acrylate prices in Brazil showed a small downward trend, driven by moderate import demand and stable domestic consumption in the coatings and adhesives sectors. Competitive offers from Chinese suppliers, along with cautious procurement patterns, added mild downward pressure. The Butyl Acrylate price trend in Brazil mirrored balanced supply and controlled inventory levels, with steady industrial activity maintaining market stability.

Import volumes under CIF Santos fell moderately, while logistics stayed efficient. In September 2025, Butyl Acrylate prices in Brazil under CIF Santos decreased by 0.33%, indicating a soft market tone, with pricing likely to remain consistent as supply and demand balance out in Q4 2025.

India: Butyl Acrylate Import Prices, CIF Nhava Sheva (China), Purity >99%.

In Q3 2025, Butyl Acrylate prices in India showed a slight downward trend, influenced by stable eady domestic supply and moderate downstream demand from adhesives, paints, and coating industries. Importers used cautious procurement strategies amid sufficient inventories, while minor fluctuations in feedstock acrylic acid limited price movement.

The Butyl Acrylate price trend in India reflected stable market fundamentals, supported by consistent industrial consumption and balanced supply-demand conditions. Buyers stayed conservative, keeping trading volumes calculated. In September 2025, Butyl Acrylate prices in India under CIF Nhava Sheva (China origin) fell by 0.13%, signalling a steady-to-soft market tone with limited volatility expected into Q4 2025.

Turkey: Butyl Acrylate Import Prices, CIF Mersin (Saudi Arabia), Purity >99%.

In Q3 2025, Butyl Acrylate prices in Turkey showed a slight downward trend, influenced by steady feedstock costs and average demand from coatings and adhesive industries. Import offers from Saudi Arabia remained competitive, while buyers maintained cautious inventory management amid manageable stock levels. The Butyl Acrylate price trend in Turkey reflected controlled price adjustments, supported by consistent supply and steady import volumes.

Regional demand stayed consistent but restrained, preventing significant upward movement. In September 2025, Butyl Acrylate prices in Turkey under CIF Mersin decreased by 0.26%, highlighting a soft market tone, with near-term stabilization expected as downstream industrial activity and trading volumes normalize in Q4 2025.