Price-Watch’s most active coverage of C10 Solvent price assessment:

- IG (Aromatic Wt. 99% min) FOB Busan, South Korea

- IG (Aromatic Wt. 99% min) CIF Nhava Sheva(South Korea), India

- IG (Aromatic Wt. 99% min) CIF Jakarta(South Korea), Indonesia

- IG (Aromatic Wt. 99% min) Ex-Mumbai, India

C10 Solvent Price Trend Q3 2025

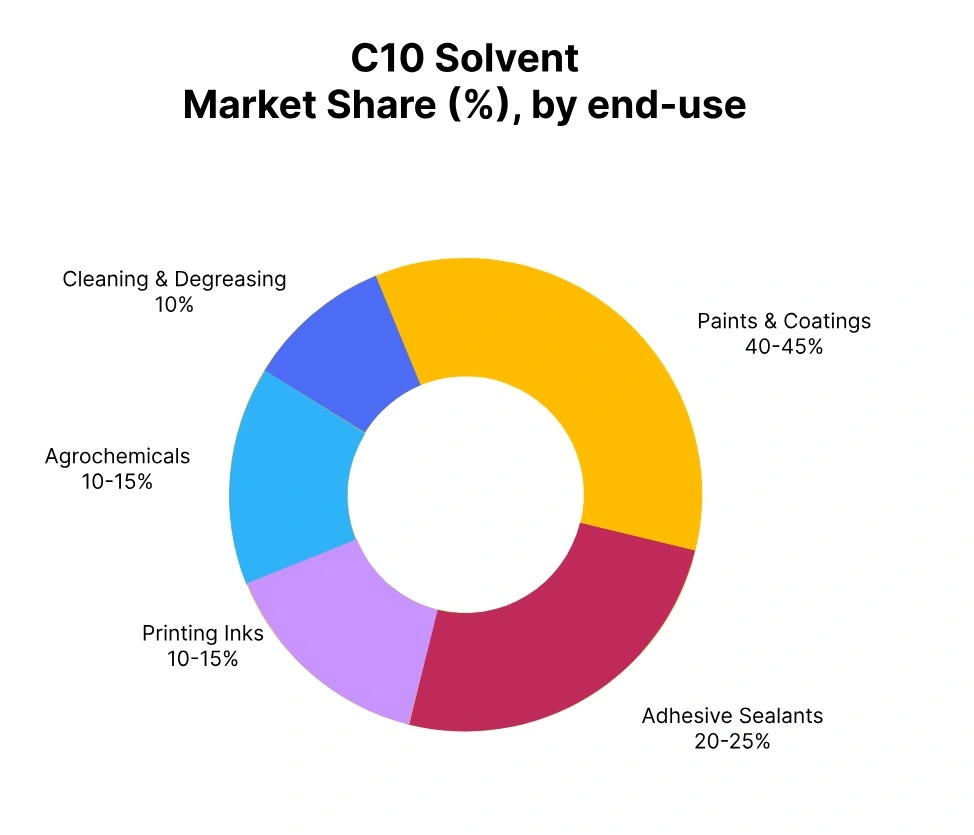

In Q3 2025, the global C10 solvent price trend in market remained relatively stable, with C10 Solvent prices showing a slight downward correction across most regions. The marginal decline was largely influenced by moderate demand from downstream sectors such as coatings, inks, and industrial cleaners, coupled with adequate supply availability and steady production levels in key manufacturing hubs.

While upstream feedstock prices, including aromatic streams and reformate, remained largely unchanged. However, the overall price movement was limited, as sellers maintained stable offer levels amid balanced inventories and steady export flows. Barring any significant shifts in crude oil or feedstock costs, C10 solvent prices are expected to remain broadly stable, with only minor fluctuations in the near term.

South Korea: C10 Solvent Export prices FOB Busan, South Korea, Grade Industrial Grade (Aromatic Wt. 99% min).

In Q3 2025, the C10 solvent price trend in South Korea reflected a period of relative stability, with only a slight decline observed as the quarter progressed. The C10 Solvent price trend in South Korea remained largely steady through July and August, supported by consistent production levels, balanced inventory positions, and stable upstream costs from reformate and other aromatic feedstocks.

However, C10 Solvent prices in South Korea in September 2025 showed modest downward movement, primarily driven by softer export demand, particularly from Southeast Asia and the Middle East, where buyers adopted a cautious, need-based procurement strategy due to weaker consumption in coatings, ink, and industrial sectors. The slight drop in price was further influenced by reduced freight rates and increased availability of competitively priced alternatives in the regional market.

Despite these pressures, the decline was limited as South Korean producers maintained controlled output levels and refrained from aggressive discounting. Throughout the quarter, market sentiment remained neutral, with participants closely watching global crude and naphtha trends for direction. Looking ahead, unless there is a significant shift in feedstock costs or a rebound in regional demand, C10 solvent prices in South Korea are expected to continue following a stable to slightly soft trend, with minimal volatility in the near term.

Indonesia: C10 Solvent Import prices CIF Jakarta, Indonesia, Grade Industrial Grade (Aromatic Wt. 99% min).

In Q3 2025, the C10 solvent price trend in Indonesisa cargoes sourced from South Korea remained relatively stable, with a slight downward adjustment emerging toward the end of the quarter. The C10 Solvent price in South Korea on an FOB basis saw limited movement through July and August, supported by steady operating rates and moderate feedstock costs thus carried the same momentum to the imported price for Indonesia.

However, C10 Solvent price in Indonesia in September 2025 shows a combination of softer downstream demand in Indonesia particularly from the paints, coatings, and industrial cleaning sectors and increased regional supply availability placed mild pressure on import prices. As a result, CIF Jakarta C10 Solvent prices dipped slightly, reflecting buyer resistance to elevated offers and preference for smaller, need-based volumes amid cautious inventory management.

Despite this, the decline was modest, as sellers in South Korea remained disciplined with export allocations, avoiding sharp price cuts in order to preserve margins. Freight rates between South Korea and Indonesia also remained stable, contributing to minimal volatility in landed costs. Overall, the C10 solvent price trend in Indonesia imports reflected a balanced market with slight softness, and unless there is a rebound in local demand or a shift in upstream aromatics pricing, this pattern of stable-to-soft pricing is expected to persist in the near term.

India: C10 Solvent Import prices CIF Jakarta, Indonesia, Grade- Industrial Grade (Aromatic Wt. 99% min).

According to PriceWatch, in Q3 2025, the C10 solvent price trend in India for CIF India and Ex-Mumbai remained relatively stable, with a slight upward movement observed toward the end of the quarter. Interestingly, this modest increase occurred despite a decline in C10 Solvent price for FOB South Korea, which serves as a key export origin for Indian imports. The primary factor supporting higher landed costs in India was the fluctuation in USD/INR exchange rates, which pushed up import costs in local currency terms.

While the price in South Korea continued its softening trend through July and August due to stable supply and easing regional demand, the effect was largely neutralized for Indian buyers by the currency-driven cost escalation. C10 Solvent price in September 2025 Indian market reflected a cautious but firm pricing tone, with importers accepting slightly higher prices to maintain inventory levels ahead of seasonal demand.

Despite the softer global sentiment, Indian C10 solvent prices in India held steady to slightly firmer, driven by macroeconomic factors rather than core supply-demand fundamentals, suggesting that the market could remain sensitive to forex movements even if FOB values remain under pressure in the near term.