Price-Watch’s most active coverage of C9 Solvent price assessment:

- IG Water White (Aromatic Wt. 99% min) FOB Busan, South Korea

- IG Water White (Aromatic Wt. 99% min) CIF Nhava Sheva (South Korea), India

- IG Water White (Aromatic Wt. 99% min) Ex-Mumbai , India

C9 Solvent Price Trend Q3 2025

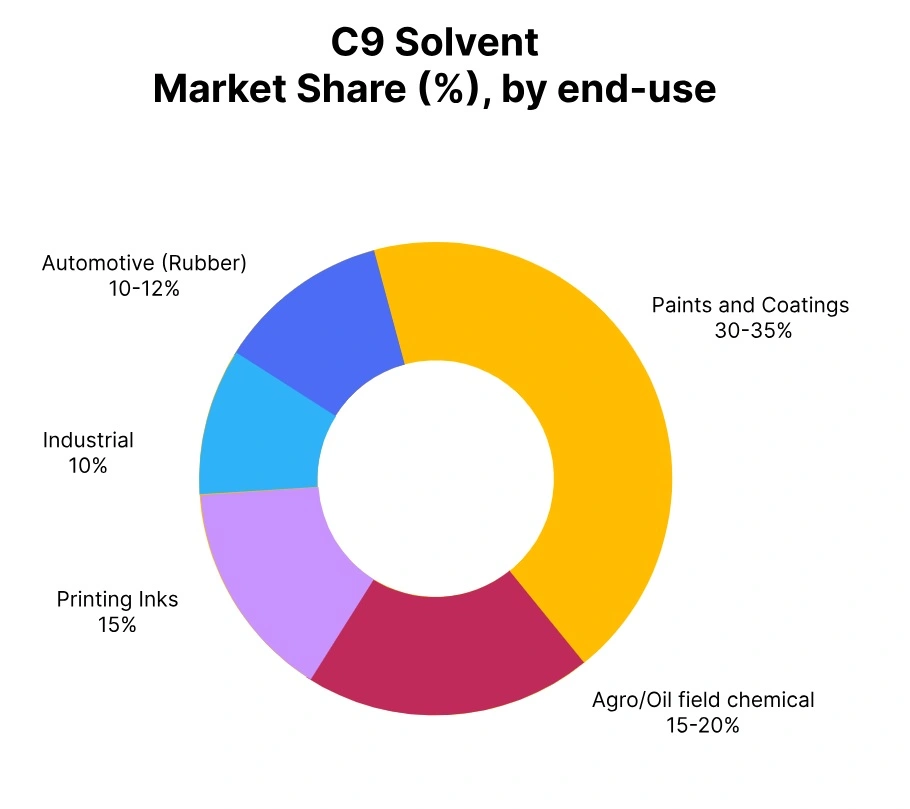

In Q3 2025, the global C9 solvent market exhibited a mixed pricing pattern, with some regions showing minor upward adjustments while others experienced more pronounced declines, resulting in an overall downward trend. Weaker demand from key downstream sectors particularly paints, coatings, adhesives, and rubber processing across several regions including East Asia and Europe contributed to the softening prices. Additionally, ample supply availability, reduced feedstock costs from pyrolysis gasoline (Pygas), and subdued buying sentiment in export markets like Southeast Asia and Africa further weighed on prices.

South Korea: C9 Solvent Export prices FOB Busan, South Korea, Grade- Industrial Grade Water White (Aromatic Wt. 99% min).

In Q3 2025, C9 solvent prices in South Korea declined by approximately 3%, reflecting a softening in regional demand and improved supply availability. C9 solvent price trend in South Korea decrease was primarily driven by ample inventory levels, coupled with reduced procurement activity from downstream industries such as coatings, adhesives, and rubber processing.

Additionally, stable to slightly lower feedstock prices, particularly from reformate and pyrolysis gasoline (Pygas), contributed to easing production costs for C9 solvent price in South Korea in September 2025. Competitive pricing from other Northeast Asian suppliers also pressured domestic producers to adjust prices downward.

Despite the price dip, overall market fundamentals remained balanced, with no major supply disruptions. However, if demand picks up in the coming quarter particularly from the export or construction sectors C9 solvent prices may recover moderately, depending on upstream cost trends and refinery output levels.

India: C9 Solvent import prices CIF Nhava Sheva, India, Grade- Industrial Grade Water White (Aromatic Wt. 99% min).

According to PriceWatch, in Q3 2025, C9 solvent price trend in India, particularly on a CIF Nhava Sheva and Ex-Mumbai basis remained relatively stable, despite fluctuations in global solvent markets. A key factor supporting this C9 Solvent price in India stability was the moderation in FOB prices from key exporting countries in Asia, including South Korea and China, which helped offset cost pressures. Simultaneously, the recent stabilization of the USD/INR exchange rate reduced volatility in import costs, creating a more predictable pricing environment for Indian buyers.

While demand from downstream sectors such as paints, coatings, and resins remained steady, abundant supply and competitive offers in the regional market kept price movements limited. As a result, despite broader market softening in parts of Asia. In September 2025 C9 solvent price trend in India held firm, supported by currency stability and easing upstream FOB values.