Price-Watch’s most active coverage of Cerium price assessment:

- Purity:-99% CIF Nhava Sheva (China), India

- Purity:-99% CIF Rotterdam (China), Netherlands

- Purity:-99% CIF Houston (China), USA

- Purity:-99% FOB Shanghai, China

Cerium Price Trend Q3 2025

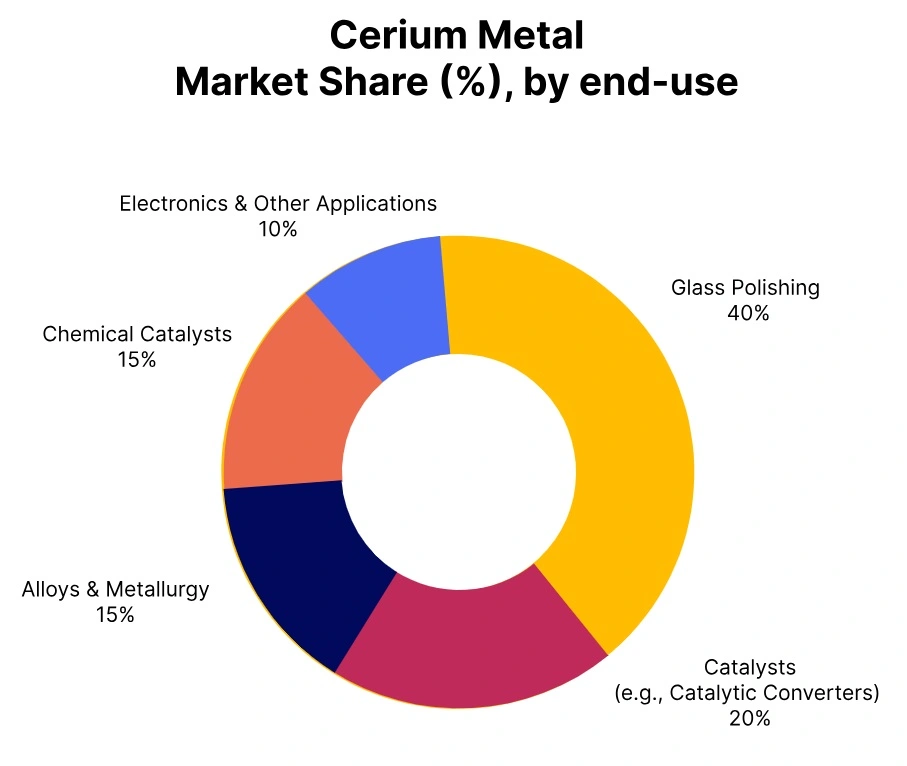

The global Cerium market showed a positive tendency in Q3 2025, with prices increasing 8.82% over the July-September 2025 time frame. This trend has been supported by strong demand from principal end-use industries, such as automotive catalysts, glass polishing, and electronics manufacturing.

Supply limitations from main producer countries, compounded by rising raw material and energy costs, provided additional support to higher prices. Although some regions saw mild price moderation due to localized destocking, market sentiment remained strong, helping to create a noticeable uptick in Cerium prices during the quarter.

USA: Cerium Import prices CIF Houston, USA, Grade- Purity: -99%.

In Q3 2025, the cerium price trend in the USA inclined by 6.28% compared to the previous quarter, driven by steady demand from the glass polishing, catalytic, and specialty alloy industries in the first half of the quarter. Limited imports from China and constrained domestic supply supported the upward movement, while downstream manufacturers increased procurement to secure inventories amid expectations of continued tight global availability.

Rising energy and raw material costs also contributed to firmer pricing. Overall, market sentiment remained positive, with producers cautiously managing output to maintain a balanced supply-demand scenario. However, Cerium prices in the USA declined by 2.36% in September 2025, primarily driven by softening demand from the automotive, glass polishing, and electronics sectors amid slower industrial activity.

Steady import supplies and comfortable inventory levels further weighed on market sentiment, resulting in a notable downward adjustment in prices. Overall, the cerium market in the USA during Q3 2025 reflected a declining trend, with expectations of moderate stabilization in Q4 as downstream demand shows gradual improvement.

Netherlands: Cerium Import prices CIF Rotterdam, Netherlands, Grade- Purity: -99%.

In the third quarter of 2025, the price of Cerium Metal in the Netherlands rose by 8.59% compared to the previous quarter, supported by strong demand from the glass polishing, chemical catalyst, and specialty alloy industries in the first half of the quarter. Global suppliers had limited availability, particularly from China, and energy and transportation costs rose, all contributing to increases in local prices in July-August 2025.

However, the prices of cerium in the Netherlands fell by 2.09% in September 2025, as demand from the glass, automotive, and polishing markets moderated due to slower downstream activity. Adequate domestic inventories and stable imports from global sources contributed to downward price pressure. Overall, the cerium price trend in the Netherlands softened in later Q3 2025, but expectations for moderate growth will stabilize in Q4, as we expect industrial consumption and downstream orders will improve.

China: Cerium Export prices FOB Shanghai, China, Grade- Purity: -99%.

In China, Cerium price trend in China witnessed significant rise as the prices increased by 6.08% in the third quarter of 2025 on quarterly basis, sharply higher than the previous quarter due to healthy demand from glass polishing, catalytic converters, and electronic applications n H1 of the third quarter. Strongly positive downstream consumption and tighter conditions in domestic supply caused the price increase in July-August 2025.

There has been positive market sentiment as manufacturers will remain sensitive to volumes while balancing demand and rising industrial requirements to support a firm, bullish trend in cerium prices throughout the quarterly period. However, Cerium prices in China fell by 2.98% in September of 2025, largely attributed to slowdown in demand for automotive and glass polishing and slower downstream developments in industrial activity.

Steady domestic production and sufficient inventory levels, along with limited priced export inquiry, contributed to this pricing pressure. The cerium market in China continues to develop; while prices did appear to soften in laterQ3, there has been increased expectation of moderate stabilization in Q4 as downstream demand for cerium begins to normalize. Additionally, mild increases in the cost of production energy and raw rare-earth feedstock likely to support prices going forward.

India: Cerium Import prices CIF Nhava Sheva, India, Grade- Purity: -99%.

According to PriceWatch, In the third quarter of 2025, cerium price trend in India rose sharply, as the prices increased substantially by 14.32% quarter-on-quarter on the back of robust demand from polishing, catalyst, and specialty alloy applications in the first half of Q3. Domestic supply was limited and imports from China remained stable, helping to put upwards pressure on pricing in July and August 2025.

Rising costs for raw materials and energy provided additional support for the increase in prices. Industrial buyers were also actively replenishing stocks in anticipation of continued tight supply. Market sentiments remained positive, and producers were exercising caution by balancing production with sales in order to maintain the uptick.

However, in September 2025, Cerium prices in India fell by 1.98% amid weakening demand from glass, polishing, and automotive sectors as end-users demonstrated cautious procurement activity. Domestic supply has been aptly supported by imports from China, adding further pressure to the downward pressure on downstream market demand.

Overall, the cerium market in India softened towards the later stages of third quarter of 2025, with the expectation of gradual stabilization in the fourth quarter as downstream industrial activity improved.