Price-Watch’s most active coverage of Chromium price assessment:

- (Cr-99%min, Fe-0.3%%max) FOB Shanghai, China

- (Cr-99%min, Fe-0.3%%max) CIF Nhava Sheva (China), India

- (Cr-99%min, Fe-0.3%%max) CIF Houston (China), USA

- (Cr-99%min, Fe-0.3%%max) CIF Rotterdam (China), Netherlands

Chromium Price Trend Q3 2025

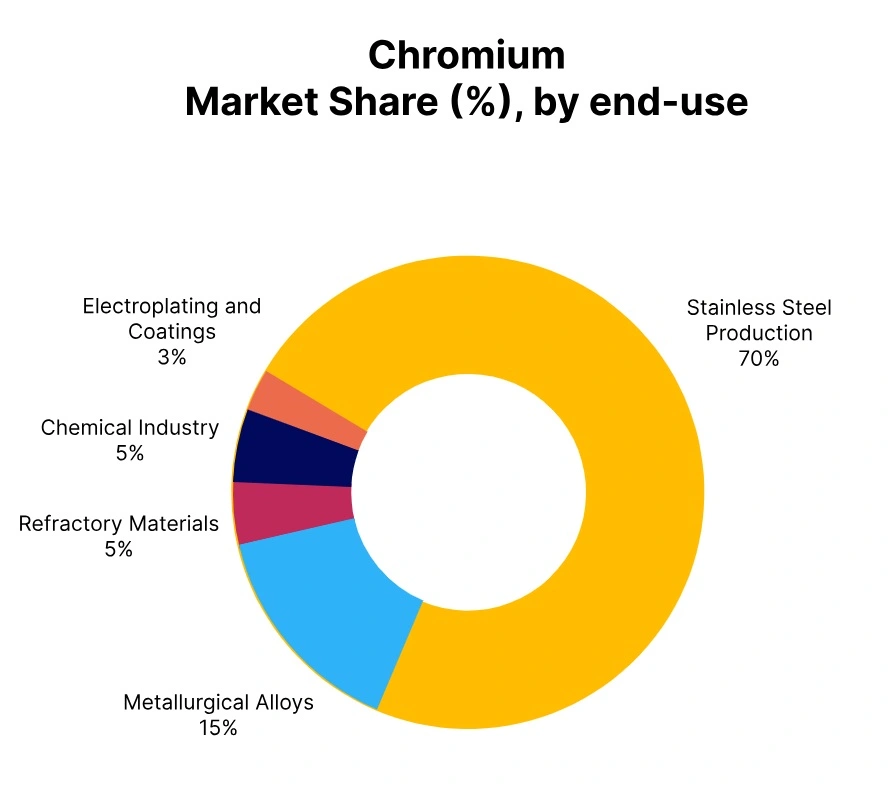

In Q3 2025, the global chromium market has been moving towards a negative price trend caused by reduced demand from key sectors such as stainless steel and construction, especially in developed markets. Prior to the negative price trend, some regional price spikes occurred due to supply chain disruptions and increased environmental compliance costs.

However, supply chain issues have been easing, and, as a result of weakening consumption, supply fundamentals have strengthened. Regulatory pressures and high production costs have been compressing margins, particularly for high-cost producers, while previous quarters of inventory build-up may see destocking. As a result, chromium prices should decrease further in the near-term.

Netherlands: Chromium Import prices CIF Rotterdam (China), Netherlands, Grade- (Cr-99%min, Fe-0.3%max).

According to PriceWatch, In Q3 2025, the chromium price trend market in Netherlands witnessed a slight decline of 0.84% compared to Q2, reflecting a mild softening in demand from key downstream industries such as stainless-steel production. The chromium price trend in the Netherlands showed a modest downward adjustment after earlier upward momentum driven by supply constraints.

This decrease has been influenced by cautious buying behaviour, inventory carryover, and potential easing of supply side pressures. The 0.76% decrease in chromium prices in the Netherlands in September 2025 can be attributed to reduced demand from the stainless-steel industry amid slowing manufacturing activity.

Additionally, increased global supply, particularly from key exporting countries, have contributed to downward pressure on prices. While the Chromium market remains relatively stable, stakeholders should monitor pricing closely as the trend may impact margins and sourcing strategies heading into Q4.

USA: Chromium Import prices CIF Houston (China), USA, Grade- (Cr-99%min, Fe-0.3%max).

In Q3 2025, the chromium price trend in the USA showed a slight decline of 0.7% compared to Q2, driven by moderate demand shifts in key industries like stainless steel production and stabilized supply levels. This small price decrease indicates a period of price consolidation amid improved mining outputs and cautious market sentiment influenced by global trade uncertainties.

The 0.75% decrease in chromium prices in the USA in September 2025 has been attributed to a slight oversupply in the market, reducing demand driven price support. Additionally, fluctuations in global trade dynamics and raw material availability have contributed to this moderate price adjustment. Overall, the Chromium market is expected to maintain a relatively stable outlook heading into the next quarter.

China: Chromium Export prices FOB Shanghai, China, Grade- (Cr-99%min, Fe-0.3%max).

In Q3 of 2025, the chromium price trend in China experienced a 4.01% quarter over quarter decrease from Q2 2025. The decline has largely been influenced by the tempered demand from the stainless steel and alloy markets, reduced supply concerns from higher ore imports, and lower input costs from tighter environmental restrictions in Q2.

Although inventories built and speculative interest weakened, the market had maintained sensitivity to supply risk and have limited rebound from infrastructure activity. Overall, the quarter represented a change in chromium price momentum in China, from the stability seen in Q2 to a moderate decline.

The 1.84% decline in chromium prices in China during September 2025 has been attributed to weaker demand from the stainless steel and alloy producing markets which have been major consumers of chromium. Additionally, increased supply from laundered producers and slower export demand placed additional downward pressure on prices.

India: Chromium Import prices CIF Nhava Sheva (China), India, Grade- (Cr-99%min, Fe-0.3%max).

In the third quarter of 2025, the chromium price trend in India experienced a modest drop of 0.85% from the second quarter, signalling a mild cooling in market momentum after a strong first half of the year. This has been due to softened demand from the stainless-steel sector, seasonal slowdowns, and a stable supply of chrome ore in the market. Demand has been sufficient, yet there have been signs of softness, alongside an easing of cost pressures related to softer export demand.

The modest price drop indicates that the market has been stabilizing, rather than falling sharply, and prices are balancing out due to supply demand attributes. In September 2025, chromium prices in India fell by 0.77% due to softness in demand from the stainless steel and alloy industries, which have been the primary consumers of chromium.