Price-Watch’s most active coverage of Cold Rolled Sheet price assessment:

- SPCC 2.0mm FOB Shanghai, China

- SAE 1008 2.0mm EX Alabama, USA

- DC01 2.00mm FD Sheffield, United Kingdom

- IS513 – 2.0mm EX-Mumbai, India

- DC01 2.00mm EX Ruhr, Germany

Cold Rolled Sheet Price Trend Q3 2025

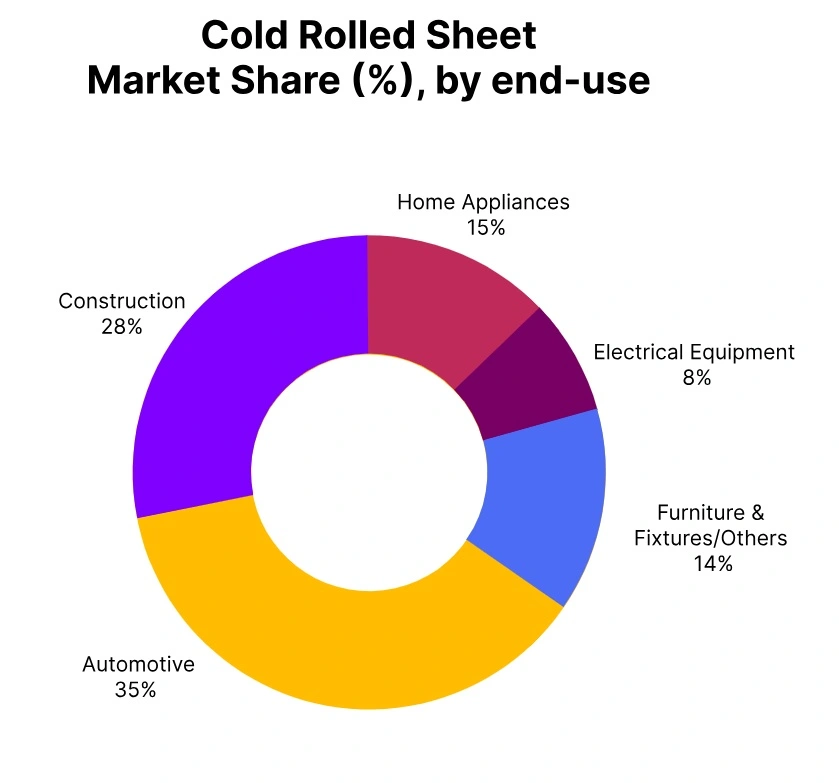

During Q3 2025, the Cold Rolled Sheet market worldwide saw a downward trend as prices overall fell by about 1.77% across the major regions. This weakness has been consistent at the same time across all key producing nations, such as China, India, the U.S. and the U.K. Weak market performance has primarily been driven by weak demand from the automotive and appliance sector, sufficient inventories and mild export performance.

The persistent macroeconomic uncertainty and cautious buying from downstream manufacturers exerted additional price pressure. While raw material costs remained stable, limited recovery in consumption levels and competitive, lower export offers continued to drive bearish sentiments in the global market throughout the quarter.

UK: Cold Rolled Sheet Domestically traded prices FD Sheffield, UK, Grade- DC01 2.00mm.

In Q3 2025, the cold rolled sheet price trend in the United Kingdom declined by 2.04% compared to the previous quarter, as weak demand from the construction and automotive industries continued to pressure the market. Sluggish economic activity, high energy costs, and reduced manufacturing output dampened overall consumption. Additionally, increased import competition from European and Asian suppliers contributed to the downward movement in prices.

Producers focused on controlling production and managing inventories to mitigate the impact of declining margins, resulting in a cautious and subdued market sentiment throughout the quarter. Cold Rolled Sheet prices in the United Kingdom declined by 0.25% in September 2025, primarily due to subdued demand from the construction and manufacturing sectors amid slow economic recovery.

Adequate supply levels and competitive imports from European markets further weighed on domestic prices, limiting any potential rebound. Overall, the Cold Rolled Sheet market in the UK during Q3 2025 exhibited a mildly bearish trend, with expectations of stabilization in Q4 as downstream activity gradually improves.

Germany: Cold Rolled Sheet Domestically traded prices EX Ruhr, Germany, Grade- DC01 2.00mm.

In Q3 2025, the cold rolled sheet price trend in Germany declined by 2.13% compared to the previous quarter, primarily due to weak demand from the automotive and industrial manufacturing sectors. Persistent economic headwinds, including high energy costs and lower export orders, led to reduced production activity. Meanwhile, an oversupply situation across the European market and competitive import offers further pressured domestic prices.

Steelmakers focused on output optimization and inventory management to stabilize operations, but overall market sentiment remained bearish throughout the quarter. Cold Rolled Sheet prices in Germany declined by 0.26% in September 2025, mainly due to weak demand from the automotive and machinery sectors as industrial production slowed.

Persistent supply availability and competitive pricing across the European market further pressured domestic offers, preventing any significant recovery. Overall, the Cold Rolled Sheet market in Germany during Q3 2025 reflected a softening trend, with expectations of gradual stabilization in Q4 as manufacturing activity begins to pick up.

USA: Cold Rolled Sheet Domestically traded prices EX Alabama, USA, Grade- SAE 1008 2.0mm.

In Q3 2025, the cold rolled sheet price trend in the USA declined by 0.74% compared to the previous quarter, reflecting slightly softer demand from the automotive, appliance, and construction sectors. Stable raw material costs, including hot rolled coil and scrap steel, helped limit the decline, but moderate inventory buildup and cautious downstream procurement applied mild downward pressure.

Producers maintained controlled production schedules to avoid oversupply, resulting in a modest bearish trend while the overall market remained relatively stable. Cold Rolled Sheet prices in the USA declined by 1.06% in September 2025, primarily driven by softer demand from the automotive, appliance, and construction sectors amid slowing industrial activity.

Steady domestic production and sufficient inventory levels, coupled with cautious import and export dynamics, contributed to the downward pressure on prices.

China: Cold Rolled Sheet Export prices FOB Shanghai, China, Grade- SPCC 2.0mm.

In the third quarter of 2025, the cold rolled sheet price trend in China fell by 1.50% over the previous quarter, as demand cooled from the automotive, appliance, and construction sectors. There has been a drop in the activity across manufacturing and end-users bought cautiously, which helped contribute to easing market sentiment.

Unchanged raw material costs for hot rolled coil and iron ore, combined with an oversupply from domestic mills and relatively weak export orders, put downward pressure on prices. Overall, the market sentiment was bearish, as producers were focused on destocking in order to support their margins.

The price of Cold Rolled Sheet in China has been down 1.51% in September 2025, primarily due to soft demand from the automotive and appliance sectors and continued weakness in manufacturing output.

Moreover, high inventory levels and steady production rates from leading mills added to the supply pressure and made it hard for prices to recover. Export activity remained modest and many overseas buyers were cautious, especially amid uncertainty in the global economy.

India: Cold Rolled Sheet Domestically traded prices EX-Mumbai, India, Grade- IS513 – 2.0mm.

According to Price-Watch, The cold rolled sheet price trend in India decreased in Q3 2025 by 2.44% compared to the previous quarter, primarily due to sluggish demand in the automobile, construction and appliances sectors.

A slowdown in consumption in downstream markets, as well as competitive import offers from East Asian countries, impacted domestic prices. While a fixity of raw material costs, high inventories and sluggish project activity limited pricing upside potential and became an impediment.

Mills were discounting products to entice sales, resulting in a bearish disposition towards general market sentiment for the duration of Q3 2025. Cold Rolled Sheet prices in India declined by 0.09% in September 2025 dominantly due to steady, albeit cautious, demand and usage from the automobile, appliance and construction sectors.

Even though domestic consumption has marginally been stable, competitive offers from domestic mills and moderate export orders of Cold Rolled Sheet in the spot market maintained pricing under slight pressure.

Overall, the Cold Rolled Sheet market in India showed a marginally declining trend in pricing behaviour during Q3 2025, with an expectation for modest upside recovery in Q4 2025 through growth in infrastructure spending and demand around the festive season.