Price-Watch’s most active coverage of Dioctyl Phthalate (DOP) price assessment:

- Industrial grade(99.0% min purity) FOB Shanghai, China

- Industrial grade(99.5% min purity) FOB Busan, South Korea

- Industrial grade(99.6% min purity) FOB Klang, Malaysia

- Industrial grade(99.5% min purity) CIF Houston_South Korea, USA

- Industrial grade(99.6% min purity) CIF JNPT_Malaysia, India

- Industrial grade(99.0% min purity) CIF Alexandria_China, Egypt

- Industrial grade(99.6% min purity) CIF Laem Chabang_Malaysia, Thailand

- Industrial grade(99.5% min purity) Ex-Bharuch, India

Dioctyl Phthalate (DOP) Price Trend Q3 2025

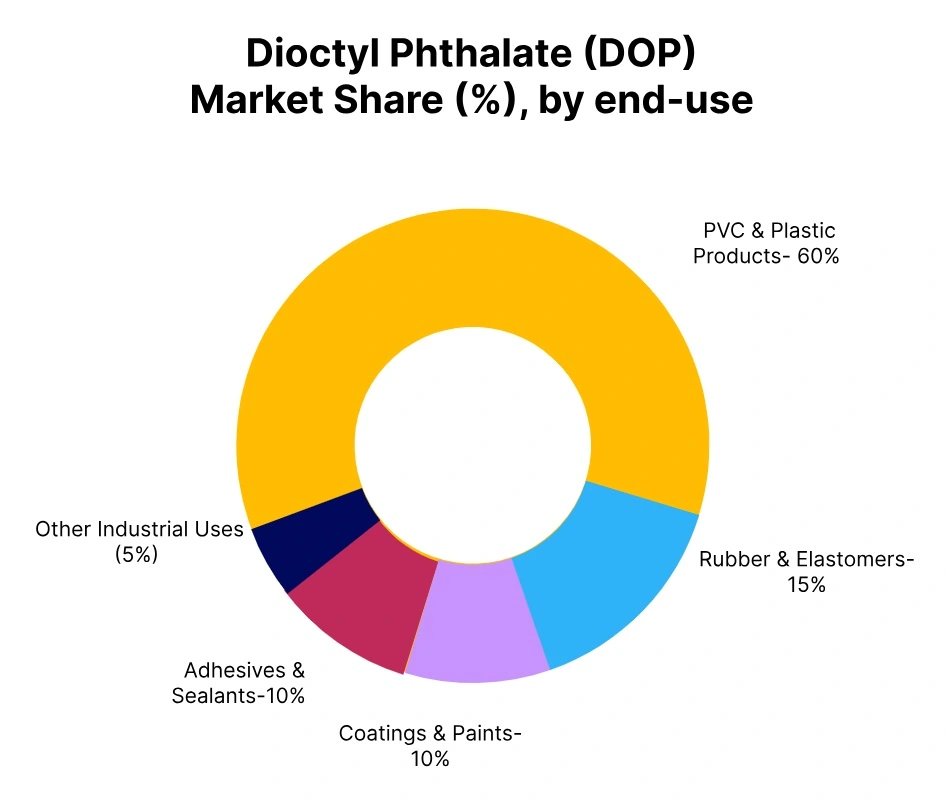

In the third quarter of 2025, the global Dioctyl Phthalate (DOP) market experienced a slight decrease in prices, down approximately 2-5% from the previous quarter. A decline in the costs of feedstock 2-ethylhexanol and phthalic anhydride, paired with weaker demand from key downstream sectors including PVC films, cables, and synthetic leather, led to prices moving softer.

Despite steady rates of production from key Asian and European facilities, continued high inventories and slow restocking by converters keep the general price sentiment softer. Looking to the upcoming quarter, steady prices for raw materials, alongside some gradual recovery in construction and packaging demand, will provide some moderate support to the Dioctyl Phthalate market in terms of prices.

China: Dioctyl Phthalate (DOP) Export prices FOB Shanghai, China, Grade- Industrial grade (99.0% min purity.

In the third quarter of 2025, Dioctyl Phthalate (DOP) price displayed a slight downward movement with DOP values in September 2025 between US$960-1050/MT based on FOB pricing. The Dioctyl Phthalate (DOP) price trend in China was influenced by lower feedstock values for both 2-ethylhexanol and phthalic anhydride, as well as steady operating rates at the major production plants. In addition, weak demand from downstream PVC sectors, especially cable manufacturers, synthetic leather, and flexible film production, also contributed to negative sentiment.

South Korea: Dioctyl Phthalate (DOP) Export prices FOB Busan, South Korea, Grade- Industrial grade (99.5% min purity).

In Q3 2025, Dioctyl Phthalate (DOP) price in South Korea were steady to slightly firm, with September DOP prices quoted within a USD 1050–1150/MT range on a FOB South Korea basis. Dioctyl Phthalate price trend in South Korea were impacted by slightly increasing feedstock prices for 2-ethylhexanol and phthalic anhydride, coupled with stable domestic producer plant operating rates. Export demand from Southeast Asia remained stable during the quarter; however, limited activity in PVC and flexible plasticizers markets restrained significant upward momentum.

Malaysia: Dioctyl Phthalate (DOP) Export prices FOB Klang, Malaysia, Grade- Industrial grade (99.6% min purity).

Dioctyl Phthalate (DOP) prices in Malaysia experienced a minor decline in Q3 of 2025, with DOP prices in September 2025 seen hovering around USD 1000–1050/MT on an FOB Klang basis. The Dioctyl Phthalate (DOP) price trend in Malaysia was influenced by minor shifts in feedstock 2-ethylhexanol and phthalic anhydride prices and stable run rates among regional producers. Demand from the downstream PVC and flexible plastic manufacturing sectors was soft, exerting slight downward pressure on overall market sentiment.

USA: Dioctyl Phthalate (DOP) import prices CIF Houston, USA, Grade- Industrial grade (99.5% min purity).

In Q3 of 2025, Dioctyl Phthalate (DOP) prices declined slightly in the USA, with Dioctyl Phthalate prices in September 2025 reported ranging from USD 1200–1350/MT, CIF USA. The DOP price trend in the USA was mainly impacted by varying feedstock costs for 2-ethylhexanol and phthalic anhydride, along with steady production rates not adjusting in large domestic capacity facilities.

Demand from downstream PVC compounding and flexible plastics remained relatively weak as procurement activity was still taking place cautiously. Somewhat stable export flows and relative inventory ratios helped support the Dioctyl Phthalate market from continued declines.

India: Dioctyl Phthalate import prices CIF JNPT, India, Grade- Industrial grade (99.6% min purity).

According to Price-Watch, in Q3 2025, Dioctyl Phthalate (DOP) price trend in India showed a minor downward trend, with Dioctyl Phthalate prices noted between USD 1050–1150/MT CIF India in September 2025. The Dioctyl Phthalate price trend in India is attributed to soft import offers from key suppliers in Asia, notably Malaysia, in addition to modest changes in freight rates.

Demand from downstream PVC and plasticizer producers was stable yet conservative, as converters processed production based on existing inventory levels. On the domestic front, DOP prices declined modestly around 1–2% during Q3 in the context of muted consumption and steady inventory levels.

Egypt: Dioctyl Phthalate (DOP) import prices CIF Alexandria, Grade- Industrial grade (99.0% min purity).

In the third quarter of 2025, Dioctyl Phthalate (DOP) prices in Egypt exhibited a slight decrease, with DOP prices in September 2025 assessed between USD 1050–1150/MT on a CIF Egypt basis. The price behavior of DOP in Egypt was primarily influenced by the softening FOB China market characterized by lower phthalic anhydride feedstock values paired with steady production rates for plasticizers resulting in a moderate export offer. Import demand in Egypt continued to be lackadaisical, as the demand for PVC and cable manufacturers was steady yet subdued in downstream manufacturing capacity.

Thailand: Dioctyl Phthalate (DOP) import prices CIF Laem Chabang, Grade- Industrial grade (99.6% min purity).

In the third quarter of 2025, Dioctyl Phthalate (DOP) prices experienced a slight decline in Thailand, with prices in September 2025 quoted in the range of USD 1000–1100/MT on a CIF Thailand price basis. The Dioctyl Phthalate (DOP) price trend in Thailand closely mimicked the price trend in the FOB Malaysia market, given consistent feedstock phthalic anhydride prices and slow production rates somewhat influenced export offers. The import market in Thailand was relatively stable, but downstream demand from PVC compounding and flexible plastic markets was weaker.