Price-Watch’s most active coverage of Galvanized Sheet price assessment:

- DX51D+Z 2.0mm FOB Shanghai, China

- IS277 – 2mm EX-Mumbai, India

- DX51D+Z 1mm FD Sheffield, United Kingdom

- G90 2.0mm EX Illinois, USA

- DX51D+Z 2mm EX Ruhr, Germany

Galvanized Sheet Price Trend Q3 2025

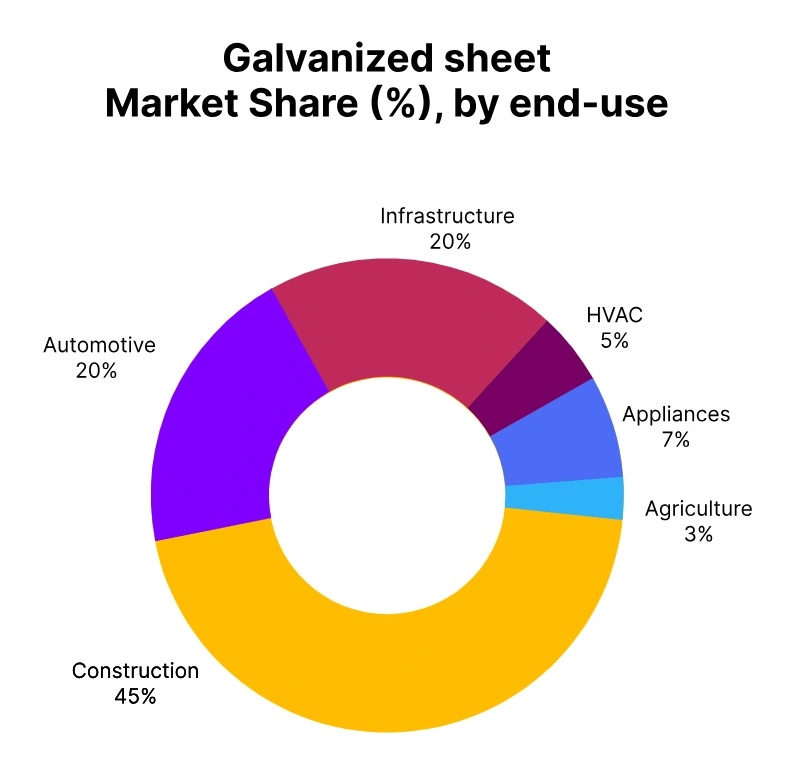

In Q3 2025, the global Galvanized Sheet market experienced a mild decline, with overall prices decreasing by approximately 1.57% versus the prior quarter. The drop has primarily been due to reduced demand from the construction and automotive industries, especially in China and the United States, which are among the top consumers in the world.

Additionally, oversupply conditions, along with diminished purchasing orders from the infrastructure and appliance manufacturing industries, pressured the market. In India and the United Kingdom, production volumes remained stable as limited downstream demand and a cautious approach to procurement limited trading activity.

Relatively stable input costs and limited activity on projects also continued to add to the bearish outlook. Though currently weak, participants in the marketplace remain cautiously optimistic regarding gradual demand recovery based on long-term “megatrends” in infrastructure development and the industrial space.

USA: Galvanized Sheet Domestically prices EX Illinois, USA, Grade- G90 2.0mm.

According to Price-Watch, in Q3 2025, the galvanized sheet price trend in the USA declined by 0.11% compared to the previous quarter, reflecting relatively stable market conditions with only slight softness in demand from the construction, automotive, and appliance sectors.

Steady zinc and steel feedstock costs helped limit the decline, while moderate import activity from Asia added mild competitive pressure. Producers maintained controlled output and inventory levels, resulting in a largely stable market with a minimal bearish tone throughout the quarter.

Galvanized sheet prices in the USA declined by 0.39% in September 2025, primarily driven by softened demand from the construction, automotive, and manufacturing sectors amid slower industrial activity. Steady domestic supply and sufficient inventory levels further contributed to the downward pressure on prices, while export demand remained moderate.

Germany: Galvanized Sheet Domestically traded prices EX Ruhr, Germany, Grade- DX51D+Z 2mm.

In Q3 2025, the galvanized sheet price trend in Germany declined by 1.94% compared to the previous quarter, driven by weaker demand from the automotive, construction, and industrial manufacturing sectors.

Soft downstream consumption, combined with competitive imports from China and other European producers, exerted downward pressure on prices. Although raw material costs for zinc and cold-rolled steel remained stable, domestic producers adjusted production and managed inventories cautiously to mitigate oversupply.

Overall, market sentiment remained bearish throughout the quarter. Galvanized sheet prices in Germany declined by 0.37% in September 2025, mainly due to subdued demand from the automotive, construction, and appliance manufacturing sectors amid slower industrial activity. Adequate domestic inventories and steady import supplies further exerted downward pressure on prices, limiting any significant recovery.

UK: Galvanized Sheet Domestically traded prices FD Sheffield, UK, Grade- DX51D+Z 1mm.

In Q3 2025, the galvanized sheet price trend in the United Kingdom declined by 1.64% compared to the previous quarter, reflecting subdued demand from the construction, automotive, and appliance manufacturing sectors. Competitive import offers from Europe and Asia, combined with stable zinc and steel feedstock costs, contributed to mild downward pressure on prices.

Domestic producers managed production and inventories carefully to prevent oversupply, resulting in a cautious and slightly bearish market sentiment throughout the quarter. Galvanized sheet prices in the United Kingdom declined by 0.32% in September 2025, primarily due to softening demand from the construction, automotive, and manufacturing sectors amid slower downstream activity.

Steady domestic supply and moderate imports from European markets further contributed to the mild downward pressure on prices. Overall, the galvanized sheet market in the UK during Q3 2025 reflected a slightly bearish trend, with expectations of gradual stabilization in Q4 as industrial and infrastructure demand picks up.

China: Galvanized Sheet Export prices FOB Shanghai, China, Grade- DX51D+Z 2.0mm.

According to Price-Watch, the galvanized sheet price trend in China decreased by 1.07% quarter on quarter in Q3 2025. A weakened demand from construction sector, automotive sector, and appliance sector have been the primary influences on price movement.

Prices moved down modestly given sluggish downstream consumption, stable prices for feedstocks of zinc and steel, and aggressive pricing by both domestic and regional import mills. Mill outputs and inventories held in check to prevent oversupply which contributed to a somewhat bearish attitude during Q3.

In September 2025, Galvanized sheet prices in China decreased by 1.47% due to subdued demand from construction, automotive, and appliance manufacturing, which have also seen slower downstream activity.

Domestic production levels remained steady with adequate inventory levels, which had a studied effect on price. Exports have not been strong amid slower global economic activity in September.

India: Galvanized Sheet Domestically traded prices EX-Mumbai, India, Grade- IS277 – 2mm.

According to Price-Watch, in Q3 2025, the galvanized sheet price trend in India decreased by 3.08% compared to the previous quarter, mostly because of weak demand from the construction, automotive, and appliance sectors. The fall-off in purchases by end-user manufacturers, in addition to competitive import offers from China and Southeast Asia, added further downward pressure.

Overall, despite stabilized raw material prices, such as zinc and cold rolled coil, domestic producers moderated production and inventory levels to keep pace with overall market conditions. There has been a resolutely cautious and bearish tone in the market in all quarters.

Galvanized sheet prices in India decreased by 0.11% in September 2025, primarily due to moderate demand from construction, automotive, and manufacturing sectors, and stable domestic production. The markets in India also bore adequate inventory levels and limited export activity, which added to the small downward pricing adjustment.