Price-Watch’s most active coverage of Graphite price assessment:

- Flakes 94-95%,-100mesh FOB Shanghai, China

- Flakes 94-95%,-100mesh CIF Busan_China, South Korea

- Flakes 94-95%,-100mesh CIF Nagoya_China, Japan

- Flakes 94-95%,-100mesh CIF Houston_China, USA

Graphite Price Trend Q3 2025

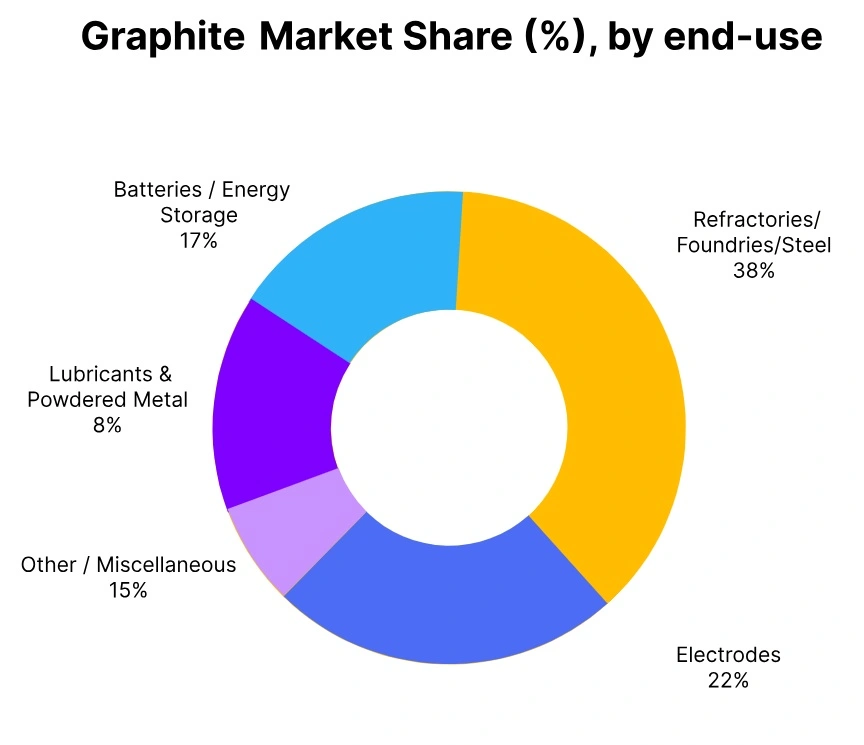

In the third quarter of 2025, the global Graphite market saw a mild downward shift, with average prices decreasing by roughly 0.95% since the last quarter. Demand from clients in the battery and refractories sectors has generally soften, particularly in China and the U. S., which are two of the largest consuming markets.

Electric vehicle (EV) and steel orders have been softer than expected this quarter which also contributed to lower overall demand. Production levels in India and Germany remained stable, however, weaker downstream activity, combined with more cautious purchasing behaviour from end-users, has lowered demand in the market.

Higher inventory levels and consistent pricing for raw materials have also contributed to the current market conditions. Despite this slight setback, the fundamental growth remained intact, as the long-term growth remained supported by increased demand for energy storage technologies and industrial applications.

China: Graphite Export prices FOB Shanghai, China, Grade- Flakes 94-95%, 100mesh.

According to PriceWatch, during the third quarter of 2025, China saw a decline of 1.88% in the graphite price trend from the previous quarter due to softer demand from the battery, refractory and lubricant industries. Weaker downstream manufacturer purchasing and lower export orders had an impact on prices as well.

Meanwhile, raw material and energy prices were stable, though an oversupply of some grades and more competition from domestic suppliers resulted in downward pricing pressure. The graphite market has been mildly bearish overall.

Producers have been responsive to softer conditions, and adjusted output and inventories to correct for market conditions. In September 2025, graphite prices in China fell 0.08%, mainly due to moderate buying activity from the battery, refractories and steel sectors amid stable industrial activity.

Additionally, there has been sufficient domestic supply and steady levels of production, enabling a slight price adjustment lower. The overall graphite market in China during Q3 of 2025 essentially reflected a stable price trend with a minor price softening, with expectations for stabilization to gradually occur in Q4 as key downstream demand stabilizes.

South Korea: Graphite Import prices CIF Busan, South Korea, Grade- Flakes 94-95%,100mesh.

In the third quarter of 2025, Graphite price trend in South Korea has witnessed decline as prices decreased by 1.01% over the previous quarter, reflecting marginally reduced demand from battery, refractory, and lubricant applications. A decline in downstream procurement and stable supply through China countervailing demand exerted some downward pressure on Graphite prices.

Although raw material costs and energy pricing have stable, there has been increased competition among sellers and some risk aversion in the inventory management approach of manufacturers resulting in some overall bearish sentiment during the period. In September 2025, the price of Graphite in South Korea decreased by 0.08% mainly exasperated by diminishing demand from battery, steel, and refractory applications even with stable industrial activity.

The stable domestic supply and stable availability of imported Graphite maintained slight downward pressure on prices. Overall, pricing of Graphite in South Korea has generally been stable during Q3 2025 with slight softening and is expected to become increasingly stable in Q4 2025 with downstream consumable use remaining approximately stable.

Japan: Graphite Import prices CIF Nagoya, Japan, Grade- Flakes 94-95%, 100mesh.

According to PriceWatch, in Q3 2025, the graphite price trend in Japan declined as prices dropped by 0.59% compared to the previous quarter, reflecting modestly weaker demand from the battery, refractory, and industrial lubricant sectors. Downstream manufacturers adopted a cautious procurement approach, slowing their purchases amid steady inventory levels and stable raw material costs.

Although supply from domestic producers and imports from China remained sufficient, competitive pricing and moderate oversupply in certain grades contributed to mild downward pressure. Energy and processing costs remained stable, providing some support to producers, who maintained controlled production and inventory strategies.

Overall, market sentiment in Japan remained slightly bearish, with price adjustments reflecting both subdued consumption and careful supply management across the quarter. However, Graphite prices in Japan inclined by 0.02% in September 2025, primarily supported by steady demand from the battery, steel, and refractories sectors amid moderate industrial activity.

Limited changes in domestic supply and consistent import availability contributed to the marginal upward adjustment. Overall, the graphite market in Japan during Q3 2025 reflected a stable trend with slight positive momentum, with expectations of continued steadiness in Q4 as downstream demand remains consistent.

USA: Graphite Import prices CIF Houston, USA, Grade- Flakes 94-95%, 100mesh.

In Q3 2025, Graphite prices in the USA decreased by 0.95% from the previous quarter. Demand remained slightly weaker from the battery, refractory, and lubricant industries. Downstream manufacturers adjusted their purchasing plans following steady inventory levels and raw material prices.

Domestic supply remained sufficient, however, mild import availability from China and other regions added competition, which contributed to price softness. Producers moderated production schedules and inventories in a controlled manner to mitigate risk of oversupply. Overall, market sentiment has been slightly bearish in Q3 with prices adjusting modestly to reduced consumption and cautious market activity.

In September 2025, Graphite prices in the USA decreased by 0.05%, primarily due to moderate demand from the battery, steel, and refractories industries following stable industrial activity. Adequate supply in the USA market and stable imports maintained a slight pricing adjustment. Overall, the US graphite market in Q3 2025 has been largely stable with minimal softening, and a gradual return to stability was expected in Q4 as downstream consumption remained steady.