Price-Watch’s most active coverage of Isopropyl Alcohol (IPA) price assessment:

- IG(99% min) FOB Shanghai, China

- IG(99% min) FOB Houston, USA

- IG(99% min) CIF Manzanilo (USA), Mexico

- IG(99% min) CIF Santos (USA), Brazil

- IG(99% min) CIF Montreal (USA), Canada

- IG(99% min) FOB Rotterdam, Netherlands

- IG(99% min) CIF JNPT (China), India

- IG(99% min) Ex-Dahej, India

- IG(99% min) CIF Bangkok (China), Thailand

- IG(99% min) CIF Jakarta (China), Indonesia

- IG(99% min) FD Southampton, United Kingdom

Isopropyl Alcohol (IPA) Price Trend Q3 2025

In Q3 2025, the global Isopropyl Alcohol (IPA) market demonstrated moderate stability with regional variations. The Isopropyl Alcohol (IPA) price trend fluctuated by 1-14% during the July-September 2025 quarter, driven by steady feedstock costs, energy prices, and regional supply chain dynamics.

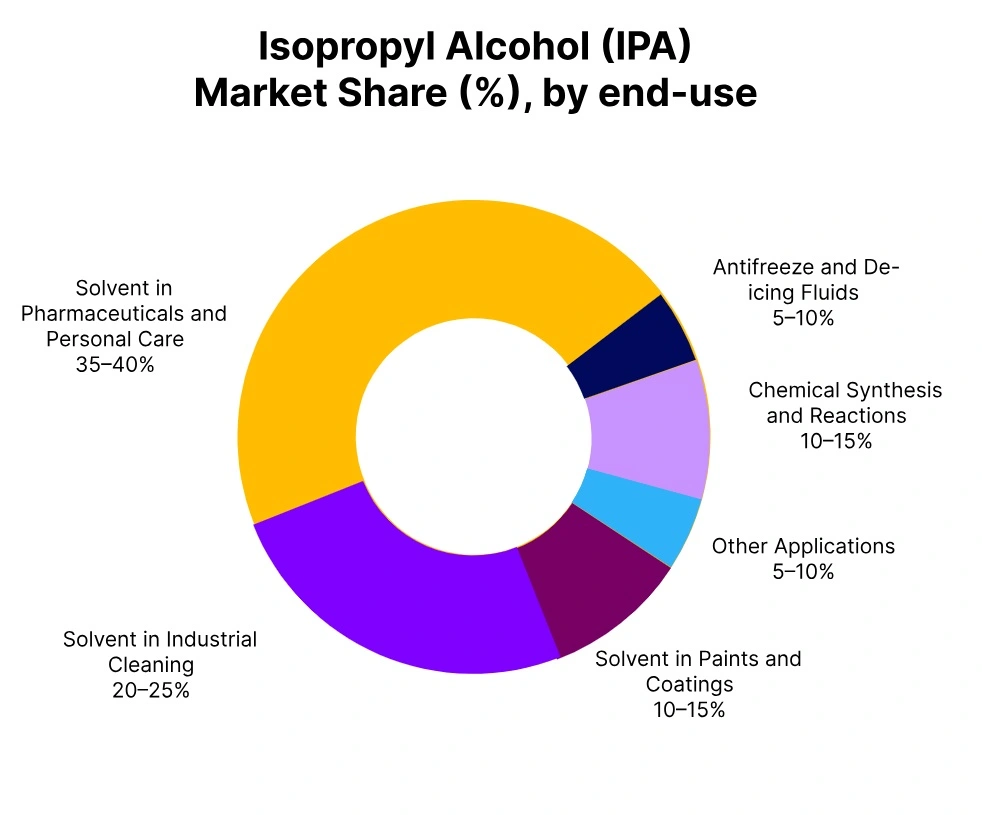

Despite fluctuations in upstream factors, robust demand from industries such as pharmaceuticals, personal care, and cleaning products helped maintain price stability. Ongoing production capacity expansions and supply chain adjustments are expected to support stable prices in the upcoming quarter.

China: Isopropyl Alcohol (IPA) Export price from China.

According to Price-Watch, in Q3 2025, Isopropyl Alcohol (IPA) price in China decreased by approximately 5.8%, as a result of a decline in export momentum despite industrial recovery and seasonal demand. The Isopropyl Alcohol (IPA) price trend in China was swayed by a rebound in the automotive and construction sectors, boosting IPA usage.

Freight costs climbed during global shipping demand and potential disruptions in key trade routes, while inventory levels increased slightly as suppliers prepared for higher consumption. A stronger Chinese Yuan enhanced export competitiveness, influencing pricing dynamics.

Despite geopolitical tensions, which remained manageable, demand for disinfectants and personal care products peaked, particularly in Western markets. Stable propylene feedstock supported consistent production, but the overall Isopropyl Alcohol export volume saw a slight decrease in this quarter.

USA: Isopropyl Alcohol (IPA) Export price from USA.

In Q3 2025, Isopropyl Alcohol (IPA) price in the USA decreased by approximately 13.42%, reflecting a decline in exports even though there was a rebound in industrial and commercial demand. The Isopropyl Alcohol (IPA) price trend in the USA was influenced by strengthened demand in cleaning and manufacturing applications, especially with the post-summer surge in preparation for colder months in North America and Europe.

Freight costs rose due to seasonal shipping pressures, but exporters adapted their logistics to maintain delivery efficiency. Propylene feedstock saw slight cost increases, yet production remained stable. Geopolitical factors and energy market shifts influenced trade dynamics, though disruptions were slight. Inventory levels tightened as demand intensified, contributing to strong export performance throughout the quarter, despite the decline in exports.

Netherlands: Isopropyl Alcohol (IPA) Export price from Netherlands.

In Q3 2025, Isopropyl Alcohol (IPA) price in the Netherlands dipped by approximately 3.42%, reflecting a decline in exports despite a strong rebound in demand. The Isopropyl Alcohol (IPA) price trend in the Netherlands was influenced by warmer weather and improved global economic conditions, which drove higher demand, especially from pharmaceuticals, personal care, and industrial cleaning sectors.

Elevated freight costs were mitigated by the Netherlands’ robust logistics infrastructure, ensuring efficient export operations. Inventory levels tightened as producers scaled up to meet rising global demand and stable propylene supply kept production unaffected by price fluctuations.

Easing trade barriers and geopolitical stability further supported export prospects, particularly to North America and Asia. Despite the strong market momentum, Isopropyl Alcohol (IPA) exports saw a slight decline this quarter.

United Kingdom: Isopropyl Alcohol (IPA) Free delivered price within the United Kingdoms.

In Q3 2025, Isopropyl Alcohol (IPA) price in the UK dipped by approximately 3.12%, reflecting a slight decline in exports despite a rebound in the market. The Isopropyl Alcohol (IPA) price trend in the UK was influenced by stabilizing global markets and summer-driven demand, boosting consumption across pharmaceuticals, personal care, and industrial cleaning sectors.

Freight rates stayed high due to peak-season pressures, but UK exporters managed logistics effectively. Inventory levels tightened as producers responded to rising export orders. Propylene feedstock remained readily available, keeping production costs in check.

Post-Brexit trade agreements continued to influence export dynamics, but improving conditions in Europe and North America supported growth. Despite the positive shift in export performance, IPA exports experienced a slight decline this quarter.

Mexico: Isopropyl Alcohol (IPA) import price in Mexico from USA.

In Q3 2025, Isopropyl Alcohol (IPA) price in Mexico went down by approximately 12.86%, reflecting a decline in imports despite a rise in demand. The Isopropyl Alcohol price trend in Mexico was influenced by peak summer demand, driven mainly by industrial cleaning and disinfecting applications. Strong industrial activity in both the USA and Mexico supported higher import volumes.

However, elevated freight rates due to seasonal shipping pressures caused delays and increased costs. Inventory levels in Mexico tightened as stocks were quickly drawn down. Propylene availability in the USA remained steady, ensuring sufficient IPA production. Geopolitical developments may influence trade flows, but stable USA-Mexico relations supported import growth, despite the decline in imports for the quarter.

Brazil: Isopropyl Alcohol (IPA) import price in Brazil from USA.

In Q3 2025, Isopropyl Alcohol (IPA) price in Brazil decreased by approximately 12.51%, mirroring a decline in imports despite a surge in demand. The Isopropyl Alcohol (IPA) price trend in Brazil was influenced by significant summer-driven demand across cleaning, disinfecting, and personal care industries.

Elevated freight costs remained high due to peak shipping volumes, though Brazil’s port infrastructure helped decrease delays. Inventory levels tightened as suppliers responded to increased consumption. Propylene availability in the USA remained stable, allowing production costs to stay in check.

While trade agreements and import regulations influenced flows, strong bilateral ties supported steady imports. Despite the strong industrial demand, IPA imports faced a slight decline in the quarter.

Canada: Isopropyl Alcohol (IPA) import price in Canada from USA.

In Q3 2025, Isopropyl Alcohol (IPA) price in Canada decreased by approximately 11.74%, reflecting a decline in imports despite seasonal demand. The Isopropyl Alcohol (IPA) price trend in Canada was driven by a significant rise in summer-driven demand across cleaning, disinfecting, and personal care industries.

Freight movement was strained by peak-season pressures, with elevated costs and possible delays, although Canada’s supply chain infrastructure helped mitigate disruptions. Inventory levels tightened as suppliers responded to increased consumption. Steady propylene supply in the USA supported production. While trade relations and policy shifts may influence import dynamics, their impact remained limited. Despite robust demand, IPA imports experienced a decline this quarter.

Thailand: Isopropyl Alcohol (IPA) import price in Thailand from China.

In Q3 2025, Isopropyl Alcohol (IPA) price in Thailand decreased by approximately 5.20%, reflecting a slight decline in imports despite relatively stable demand. The Isopropyl Alcohol (IPA) price trend in Thailand was influenced by reduced demand in the construction and automotive sectors due to summer conditions, leading to a dip in consumption.

Elevated freight costs, driven by peak-season pressures, and potential delays at ports increased transportation expenses. Inventory levels tightened slightly, but suppliers adjusted shipments to meet demand. Propylene availability in China remained steady, supporting Isopropyl Alcohol production.

Geopolitical factors may have influenced trade flows, but their overall impact remained controlled. Despite these factors, IPA imports remained consistent, supported by stable production and cautious inventory management.

Indonesia: Isopropyl Alcohol (IPA) import price in Indonesia from China.

In Q3 2025, Isopropyl Alcohol (IPA) price in Indonesia decreased by approximately 6.73%, reflecting a slight decline in imports despite recovery in demand. The Isopropyl Alcohol (IPA) price trend in Indonesia showed a moderate uptick in consumption, driven by increased demand from the pharmaceuticals and cleaning sectors.

Freight rates remained high due to peak-season pressures, although improvements in logistics helped reduce delays. Inventory levels tightened as demand increased, prompting increased shipments. Propylene availability in China remained steady, supporting stable IPA production.

Geopolitical factors might have influenced trade flows, but their impact remained minimal. This quarter marked a modest increase in IPA imports, supported by seasonal demand and more efficient supply chain operations, despite the decline in overall import volume.

India: Isopropyl Alcohol (IPA) import price in JNPT from China, Domestically Traded IPA price in Mumbai.

According to Price-Watch, in Q3 2025, Isopropyl Alcohol (IPA) price in India decreased by approximately 1.36% on a CIF basis and 7.66% on an Ex Dahej basis, even though there was a notable rebound in imports. The Isopropyl Alcohol (IPA) price trend in India was driven by the onset of the monsoon season and increased industrial activity, which elevated consumption in the pharmaceuticals, cleaning, and personal care sectors.

Freight rates stayed high due to the peak shipping season, though improved logistics and trade routes helped mitigate delays. As demand rose, inventory levels in India tightened, prompting increased shipments from China. Stable propylene availability ensures uninterrupted IPA production.

Geopolitical factors may have influenced trade flows, but strong bilateral ties supported import stability. Despite robust industrial expansion and stronger consumer spending, IPA imports saw a decline due to tightening inventory levels and higher demand pressures at Ex Dahej.