Price-Watch’s most active coverage of Linear Alkyl Benzene (LAB) price assessment:

- 98%, FOB Al-Jubail, Saudi Arabia

- 98%, FOB Mesaieed, Qatar

- 98%, FOB Shanghai, China

- 98%, FOB Barcelona, Spain

- 98%, CIF Hamburg (Spain), Germany

- 98%, CIF Calcutta sea (Saudi Arabia), India

- 98%, CIF Mundra (Qatar), India

- 98%, Ex-Mumbai, India

- 98%, Ex-Chennai , India

- 98%, Ex-West India , India

- 98%, Ex-South India, India

Linear Alkyl Benzene (LAB) Price Trend Q3 2025

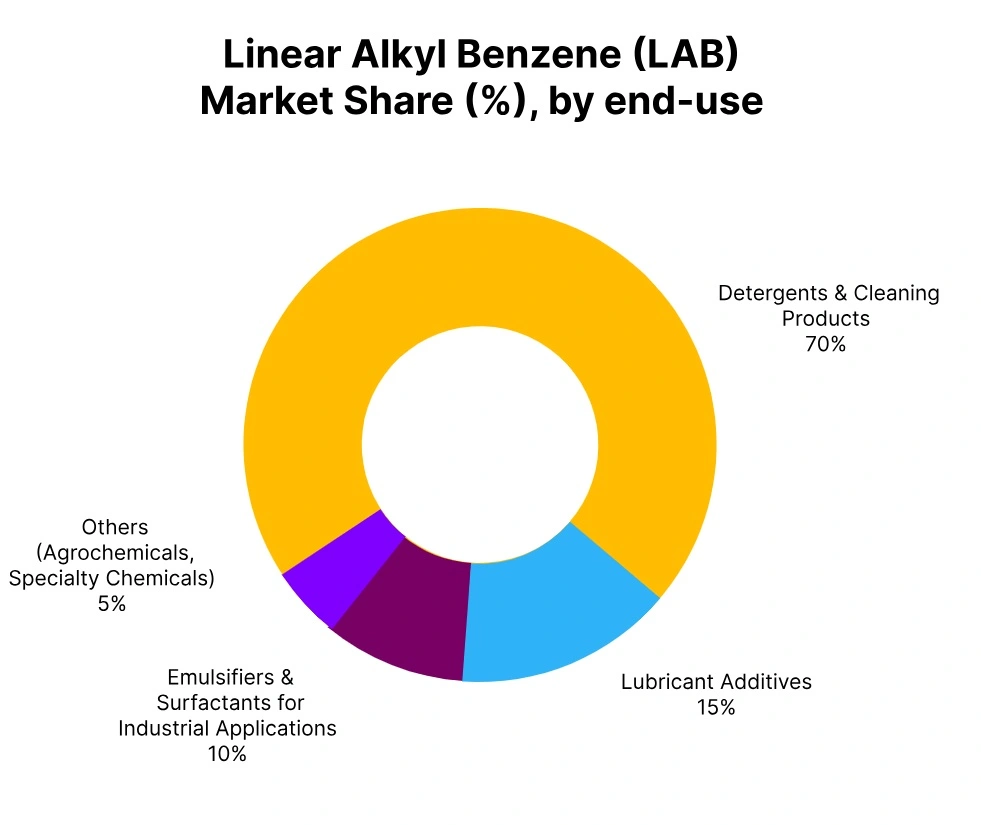

In Q3 2025, the global Linear Alkyl Benzene (LAB) market showed unstable performance across regions, with price fluctuations ranging from -6% to +4%. Western markets such as Southern Europe and Western Europe showed some price declines due to weak demand from detergent and industrial cleaning sectors amid economic uncertainties and ample supply.

European regions were comparatively stable with slight downward pressure, as cautious procurement and inventory management weighed on sentiment. Nevertheless, Asia-Pacific markets experienced mixed trends with prices rising in South Asia on strong domestic demand, while East Asia saw a decline due to oversupply and reduced export interest.

In general, the market remained reasonably balanced, underpinned by stable industrial activity, consistent feedstock supply, and moderate freight conditions. Regional supply chain fundamentals and disparate downstream consumption trends continued to drive pricing throughout the quarter.

Saudi Arabia: Linear Alkyl Benzene (LAB) Exported Price in Saudi Arabia, 98% Assay.

In Q3 2025, Linear Alkyl Benzene (LAB) price in Saudi Arabia has seen a slight increase amid steady downstream demand from detergent manufacturers. Stable Crude Oil prices and sufficient feedstock availability have supported production and shipment volumes.

In September 2025, LAB prices in Saudi Arabia have risen by 2.35% compared to the previous month. FOB Al-Jubail prices have ranged between USD 1300–1500 per metric ton, resulting in a modest quarterly gain of 0.79%.

Exporters have reported consistent activity toward Asian and Middle Eastern buyers, while new capacity additions in the region have maintained pressure on long-term pricing. Overall, the market has been characterized by careful optimism as supply-demand dynamics have shown a slight improvement, consistent with the overall LAB price trend in Saudi Arabia.

Qatar: Linear Alkyl Benzene (LAB) Exported Price in Qatar, 98% Assay.

In Q3 2025, Linear Alkyl Benzene (LAB) price in Qatar has increased moderately, reflecting firm demand from detergent and industrial cleaning product sectors. In September 2025, LAB prices in Qatar have grown by 1.50%, compared to the previous month.

FOB Mesaieed prices have ranged between USD 1300–1500 per metric ton, recording a quarterly gain of 1.69%. Production facilities have operated near full capacity as tighter supply in some global markets has supported export volumes.

Market participants have seen stable feedstock costs and favourable freight conditions, which have underpinned price resilience during the quarter. Buyer interest has remained steady across major Asian markets, aligning with the overall Linear Alkyl Benzene (LAB) price trend in Qatar.

China: Linear Alkyl Benzene (LAB) Exported Price in China, 98% Assay.

According to Price-Watch, in Q3 2025, Linear Alkyl Benzene (LAB) price in China has declined modestly due to quieter demand from textile auxiliaries and detergent manufacturers. In September 2025, Linear Alkyl Benzene (LAB) prices in China have dropped by 2.03% compared to the previous month. FOB Shanghai prices have traded between USD 1400–1600 per metric ton, marking a quarterly dip of 2.43%.

Regional supply has been abundant, while new capacities have contributed to increased competition. Buyers have adopted cautious purchasing strategies, resulting in pressure on spot prices. Feedstock costs have remained stable, but the market sentiment has been subdued due to softened downstream consumption, consistent with the Linear Alkyl Benzene (LAB) price trend in China.

Spain: Linear Alkyl Benzene (LAB) Exported Price in Spain, 98% Assay.

In Q3 2025, LAB price in Spain has slipped slightly amid reduced activity from European detergent and chemical formulation industries. In September 2025, Linear Alkyl Benzene (LAB) prices in Spain have dipped by 2.93% compared to the previous month. FOB Barcelona values have ranged between USD 1300–1600 per metric ton, showing a quarterly decrease of 1.71%.

Market participants have highlighted ample supply levels and cautious buying amid economic uncertainties. Producers have moderated output to manage inventories, but competitive pressures have persisted as European consumers have tightened procurement ahead of peak demand seasons, reflecting the overall LAB price trend in Spain.

Germany: Linear Alkyl Benzene (LAB) Imported Price in Germany from Spain, 98% Assay.

In Q3 2025, LAB price in Germany has fallen under pressure due to weak demand from cleaning product and industrial detergent sectors. In September 2025, LAB prices in Germany have dipped by 1.47% compared to the previous month. CIF Hamburg prices have ranged between USD 1400–1600 per metric ton, reflecting a quarterly drop of 5.52%.

Stable import flows and steady inventories have weighed on spot pricing. Buyers have remained cautious, curtailing purchases amid ongoing economic challenges in the European market. Supplier competition has intensified, maintaining a downward bias on pricing across an array of contract terms, consistent with the Linear Alkyl Benzene (LAB) price trend in Germany.

India: Linear Alkyl Benzene (LAB) Imported Price in India from Saudi Arabia and Qatar, 98% Assay.

According to Price-Watch, in Q3 2025, LAB price in India has recorded robust gains supported by steady imports from Saudi Arabia and Qatar. In September 2025, Linear Alkyl Benzene prices in India have gone up by 0.39% compared to the previous month. CIF Calcutta Sea and CIF Mundra prices have ranged between USD 1400–1600 and USD 1400–1500 per metric ton respectively, registering quarterly gains of 3.29% and 3.87%.

Significant demand from domestic detergent manufacturers amid improving economic activity has provided price support. Importers have reported improved buying sentiment and steady freight conditions, which have underpinned overall market strength during the quarter. Domestic Linear Alkyl Benzene (LAB) price trend in India has advanced moderately as demand from detergent and chemical formulation industries has increased.

Ex-Mumbai, Ex-Chennai, Ex-West India, and Ex-South India prices have ranged between USD 1700–1900 per metric ton, reflecting quarterly gains of 2.87% to 4.03%. Market participants have cited tightening supply and steady downstream consumption as key drivers. Improved economic indicators have continued to bolster procurement activity, while regional producers have maintained stable capacity utilization rates to meet growing order volumes.