Price-Watch’s most active coverage of Linear Alkyl Benzene Sulphonic Acid (LABSA) price assessment:

- Grade: LABSA 90%, Ex-Gandhidham, India

- Grade: LABSA 90%, Ex-Kolkata, India

- Grade: LABSA 96%, Ex-Kolkata, India

- Grade: LABSA 90%, Ex-West India, India

- Grade: LABSA 90%, Ex-East India, India

- Grade: LABSA 96%, Ex-East India, India

- Grade: LABSA 90%, FOB Mundra, India

- Grade: LABSA 90%, CIF Santos (India), Brazil

- Grade: LABSA 90%, CIF Manila (India), Philippines

- Grade: LABSA 90%, CIF Colombo (India), Sri Lanka

Linear Alkyl Benzene Sulphonic Acid (LABSA) Price Trend Q3 2025

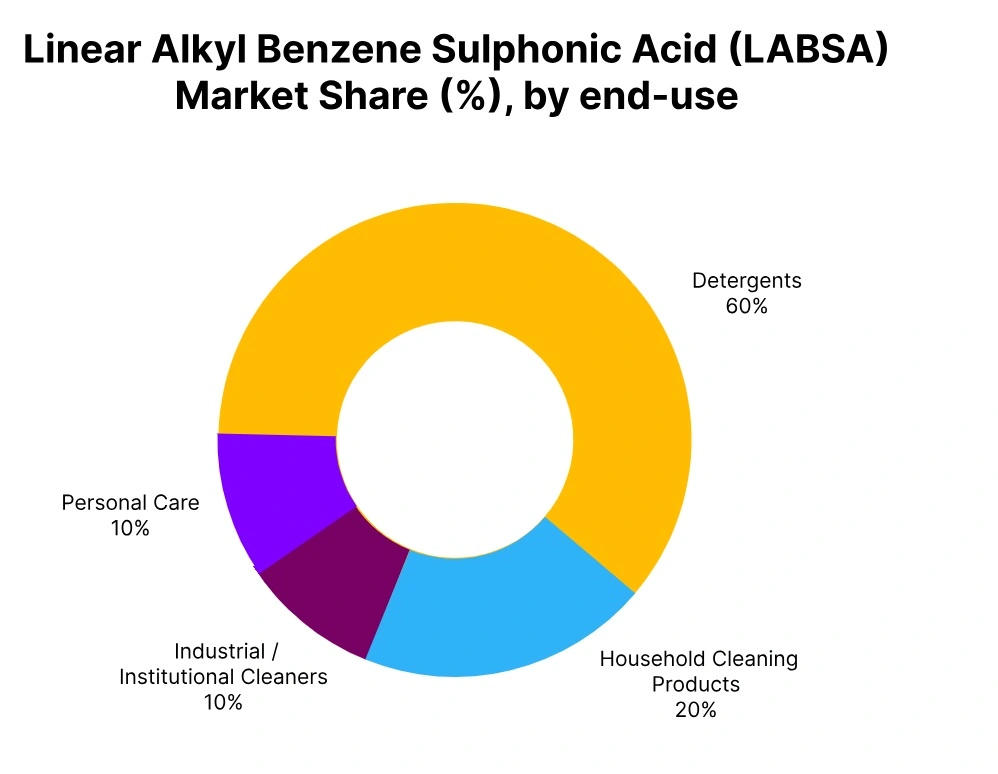

In Q3 2025, the global Linear Alkyl Benzene Sulphonic Acid (LABSA) market showed a generally firm trend, supported by strong demand from detergent and cleaning product manufacturers. In South Asia, domestic prices surged across key hubs amid tight supply and high consumption levels, reflecting robust performance in downstream sectors. South American import prices also strengthened as buyers sourced cargoes from South Asia to offset limited local production and maintain steady supply.

In Southeast Asia, the region saw a mild upward adjustment supported by stable industrial and cleaning sector demand, while markets in South Asia remained steady with balanced supply-demand conditions and consistent trade flows within the region. Overall, the LABSA market maintained positive momentum during the quarter, underpinned by resilient end-use demand and stable logistics across major trade regions.

India: Linear Alkyl Benzene Sulphonic Acid (LABSA) Domestically Traded Price in India, Grades: LABSA 90%, LABSA 96%.

According to Price-Watch, in Q3 2025, LABSA price in India has increased significantly across domestic hubs, driven by robust demand from detergent and cleaning product manufacturers. In September 2025, LABSA prices in India have gone up by 0.81% compared to the previous month. Ex-Gandhidham, Ex-Kolkata, Ex-West India, and Ex-East India prices for LABSA have ranged between USD 1300–1600 per metric ton, with quarterly increase of 5.62% to 11%.

Market participants have cited supply constraints and strong downstream consumption as reasons for the firming prices. Producers have maintained high utilization rates, while buyers have competed for available cargoes to ensure steady supply lines. The strong upward momentum has reflected resilient end-use sector activity, consistent with the overall LABSA price trend in India.

Brazil: Linear Alkyl Benzene Sulphonic Acid (LABSA) Imported Price in Brazil from India, Grade: LABSA 90%.

In Q3 2025, LABSA price in Brazil has posted a gain, fuelled by ongoing demand from detergent and industrial cleaning sectors. In September 2025, LABSA prices in Brazil have declined slightly by 0.37% compared to the previous month. CIF Santos prices have ranged from USD 1300–1500 per metric ton, up by 2.41% quarter on quarter.

Brazilian buyers have opted for Indian cargoes to secure supply as regional production has remained constrained. Logistic flows have been stable, and buyers have maintained steady procurement to meet end-use requirements, reflecting positive market dynamics and the prevailing LABSA price trend in Brazil.

Philippines: Linear Alkyl Benzene Sulphonic Acid (LABSA) Imported Price in Philippines from India, Grade: LABSA 90%.

LABSA price in the Philippines has recorded an increase in Q3 2025, driven by stable demand from cleaning and industrial sectors. In September 2025, LABSA prices in the Philippines have edged down by 0.23%, compared to the previous month. CIF Manila prices for LABSA 90% have risen 1.20% from the previous quarter, trading between USD 1200–1400 per metric ton.

Consistent flows from Indian suppliers have ensure secure supply, while buyers’ inventories have remained adequate to meet ongoing consumption. Overall, trading activity has remained stable, aligning with the LABSA price trend in the Philippines.

Sri Lanka: Linear Alkyl Benzene Sulphonic Acid (LABSA) Imported Price in Sri Lanka from India, Grade: LABSA 90%.

In Q3 2025, LABSA price in Sri Lanka has shown slight change amid balanced supply and demand dynamics. In September 2025, LABSA prices in Sri Lanka have fallen slightly by 0.31% compared to the previous month. CIF Colombo prices have held stable between USD 1200–1400 per metric ton, reflecting a marginal quarterly gain of 0.14%.

End-use sectors have continued to source regular volumes from Indian producers, ensuring uninterrupted production across the country’s detergent industry. Overall, the market has remained steady with buyers and sellers maintaining steady trading relationships, reflecting the LABSA price trend in Sri Lanka.