Price-Watch’s most active coverage of Methyl Ethyl Ketone price assessment:

- IG (99% min) FOB Shanghai, China

- IG (99% min) CIF Busan (China), South Korea

- IG (99% min) CIF Haiphong (China), Vietnam

- IG (99% min) CIF Jakarta (China), Indonesia

- IG (99% min) CIF Nhava Sheva(China), India

- IG (99% min) FOB Japan, Japan

- IG (99% min) CIF Haiphong (Japan), Vietnam

- IG (99% min) FOB Rotterdam, Netherlands

- IG (99% min) CIF Houston (Netherlands), USA

- IG (99% min) CIF Hamburg (Netherlands), Germany

- IG (99% min) FOB Durban, South Africa

- IG (99% min) Ex-Mumbai, India

Methyl Ethyl Ketone (MEK) Price Trend Q3 2025

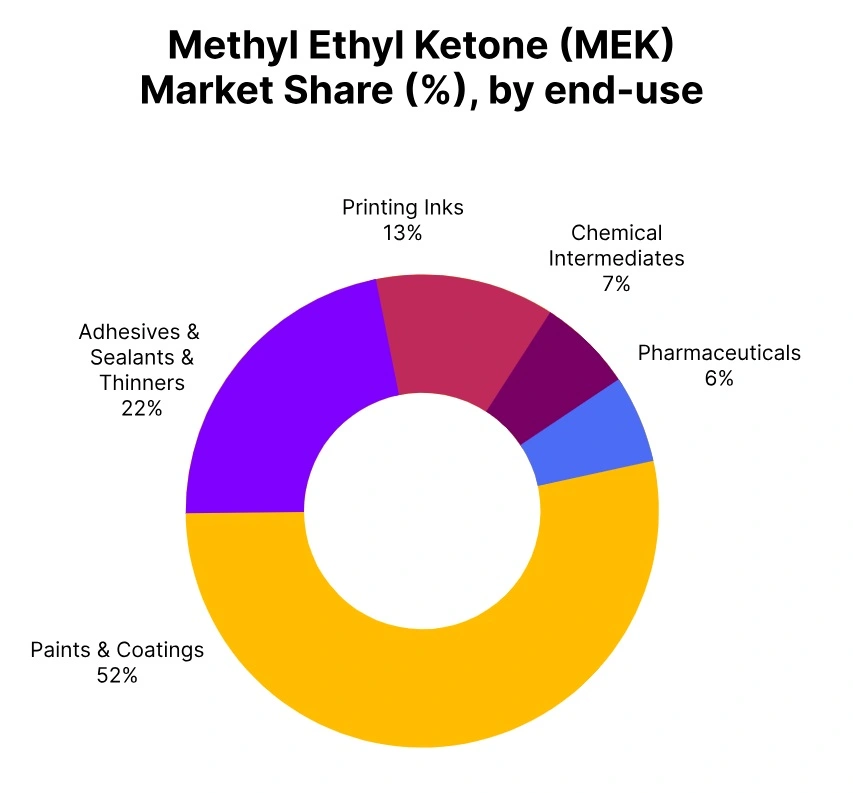

In Q3 2025, the overall Methyl Ethyl Ketone (MEK) price trend showed a clear decline across global markets, driven by weak downstream demand and sufficient supply levels. The price softened as industries such as paints, coatings, and adhesives continued to operate below capacity, reducing procurement volumes.

Additionally, stable production in key manufacturing hubs, coupled with easing feedstock prices like butylene, contributed to the bearish sentiment. By September, Methyl Ethyl Ketone (MEK) prices in most regions had adjusted downward, reflecting subdued buying interest and competitive export offers, with no immediate signs of recovery heading into Q4.

USA: Methyl Ethyl Ketone (MEK) Import prices CIF Houston, USA, Grade- Industrial Grade (99% min).

In the third quarter of 2025, prices for Methyl Ethyl Ketone (MEK) in the United States fell by 6.00% when compared to the second quarter of 2025. The Methyl Ethyl Ketone (MEK) price trend in the United States has been primarily driven by weaker demand from key sectors, particularly automotive and chemicals, which showed some slow deliveries. In a softer demand environment, rising freight costs facilitated downward pressure on Methyl Ethyl Ketone (MEK) prices.

As of September 2025, Methyl Ethyl Ketone (MEK) prices in the United States remained on a downward trend and exhibited a rather soft market. The outlook for the fourth quarter of 2025, as indicated, continues the focus on major sector demand as critical for MEK price direction and whether it remains downward or stabilizes, depending on sector improvement.

Germany: Methyl Ethyl Ketone (MEK) Import prices CIF Hamburg, Germany, Grade- Industrial Grade (99% min).

In Q3 2025, prices for Methyl Ethyl Ketone in Germany fell 5% compared to the previous quarter, Q2 2025. The Methyl Ethyl Ketone (MEK) price trend in Germany has been subject to tapering demand from the major consuming sectors of automotive and coatings, which also saw production slow. The decline in prices has occurred against an oversupply of Methyl Ethyl Ketone while freight costs rose.

In September 2025, Methyl Ethyl Ketone prices in Germany remained lower based on weaker downstream demand and oversupply. The outlook for Q4 2025 remains uncertain and could change as demand from downstream sectors varies.

Netherlands: Methyl Ethyl Ketone (MEK) Export prices FOB Rotterdam, Netherlands, Grade- Industrial Grade (99% min).

In Q3 2025, Methyl Ethyl Ketone prices in the Netherlands decreased by 5% compared to Q2 2025. Methyl Ethyl Ketone (MEK) price trend in the Netherlands has primarily been impacted by weaker demand from key sectors like coatings and automotive, which saw slower production. The oversupply of Methyl Ethyl Ketone, combined with rising freight costs, placed downward pressure on prices.

In September 2025, Methyl Ethyl Ketone prices in the Netherlands remained lower, reflecting weaker market conditions. The outlook for Q4 2025 remains cautious, with prices expected to stay subdued unless there is a rebound in demand from downstream industries.

South Africa: Methyl Ethyl Ketone (MEK) Export prices FOB Durban, South Africa, Grade- Industrial Grade (99% min).

In Q3 2025, Methyl Ethyl Ketone prices in South Africa decreased by 3.0% compared to Q2 2025. Methyl Ethyl Ketone (MEK) price trend in South Africa was influenced by slower demand from the automotive and chemicals sectors, which faced production slowdowns. Despite stable feedstock costs, the reduction in demand from key downstream industries and rising freight costs contributed to the price decline.

In September 2025, Methyl Ethyl Ketone prices in South Africa continued to show a downward trend, reflecting the weaker market environment. Moving forward, the outlook for Q4 2025 suggests continued price pressure unless demand from major sectors recovers.

China: Methyl Ethyl Ketone (MEK) Export prices FOB Shanghai, China, Grade- Industrial Grade (99% min).

According to Price-Watch, the price of Methyl Ethyl Ketone (MEK) in China experienced a drop of about 8% in Q3 2025 compared to Q2 2025. The downward Methyl Ethyl Ketone (MEK) price trend in China has largely stemmed from reduced demand from both the coatings and chemical sector as some downstream producers reduced operation rates due to the slower influx of orders.

In addition, lower feedstock prices (particularly for propylene and butadiene) and declining freight costs, added downward pressure for MEK prices in China. In September 2025, the price of Methyl Ethyl Ketone in China continued to decrease, due to adequate supply levels and weak activity in the market.

Japan: Methyl Ethyl Ketone (MEK) Export prices FOB Tokyo, Japan, Grade- Industrial Grade (99% min).

According to Price-Watch, in the third quarter of 2025, the price of Methyl Ethyl Ketone (MEK) in Japan decreased by almost 8% when compared to the preceding quarter. Decreased demand from the coatings and adhesive classifications drove the Methyl Ethyl Ketone (MEK) price trend in Japan as end-users reduced production and downstream consumption remained weak in general.

Since domestic consumption has mostly been stagnant with low export activity, cheap feedstocks availability and supply have been steady, further reinforcing price declines in Methyl Ethyl Ketone (MEK). Price for Methyl Ethyl Ketone in Japan continued to fall in September of 2025, consistent with the market’s stronger supply and hesitancy to purchase.

South Korea: Methyl Ethyl Ketone (MEK) Import prices CIF Busan, South Korea, Grade- Industrial Grade (99% min).

The price of Methyl Ethyl Ketone (MEK) in South Korea has decreased by a margin of 8 to 10% in Q3 2025 compared with Q2 2025. The Methyl Ethyl Ketone (MEK) price trend in South Korea has reflected a drop in the FOB prices of major exporting countries which impacted valuations in the domestic market.

Demand from the coatings and chemicals markets has decreased, with a stable supply also contributing to the downward pressure on prices. The price of Methyl Ethyl Ketone in South Korea continued to fall in September 2025 as a result of lower import prices and moderate consumption from downstream users.

Vietnam: Methyl Ethyl Ketone (MEK) Import prices CIF Haiphong, Vietnam, Grade- Industrial Grade (99% min).

The price of Methyl Ethyl Ketone (MEK) in Vietnam fell by approximately 8-10% in the third quarter of 2025 compared to the second quarter of 2025. The Methyl Ethyl Ketone (MEK) price trend in Vietnam has been impacted by a decline in the free-on-board (FOB) price of MEK in major exporting countries, causing lower entry costs to the Vietnamese marketplace for importers.

Coupled with modest demand in the coatings and adhesive markets, and adequate supply across the market contributed to the decrease in price. For September 2025, the price of Methyl Ethyl Ketone in Vietnam continued to decline following the slow procurement and poor end-user consumption in August 2025.

Indonesia: Methyl Ethyl Ketone (MEK) Import prices CIF Jakarta, Indonesia, Grade- Industrial Grade (99% min).

Methyl Ethyl Ketone (MEK) price in Indonesia dropped around 8-10% during the third quarter of 2025 compared to the second quarter of 2025. The Methyl Ethyl Ketone (MEK) price trend in Indonesia has been affected predominantly by a downward trend in the FOB price offered by the major exporting countries that tampered with the local buyer’s costs for imports to the region.

Softer demand from the coatings and adhesive industries along with overall supply levels in the domestic market being adequate, have contributed to a decline in the Methyl Ethyl Ketone (MEK) price. In September 2025, Methyl Ethyl Ketone prices in Indonesia continued to decrease, signalling buyers’ cautiousness in following through with purchases and overall downstream purchases have not strong for MEK.

India: Methyl Ethyl Ketone (MEK) Domestic traded price Ex-Mumbai, India, Grade- Industrial Grade (99% min).

According to Price-Watch, Methyl Ethyl Ketone (MEK) prices in India (Ex-Mumbai) declined by 5–6% in Q3 2025 compared to Q2, reflecting a broad correction in the regional solvent market. The Methyl Ethyl Ketone (MEK) price trend in India weakened as lower import prices from China, driven by reduced FOB offers and high inventories, eased landed costs for Indian importers. Downstream demand from coatings, adhesives, and resins remained sluggish, prompting manufacturers to limit procurement and maintain lean inventories amid volatile feedstock values.

Though propylene and butadiene prices fluctuated moderately, regional supply softness shaped overall sentiment. By September 2025, MEK prices in India extended their downward trajectory, pressured by weak Chinese export offers, muted domestic consumption, and cautious buyer behavior ahead of the festive and construction demand cycle.