Price-Watch’s most active coverage of Mineral Turpentine Oil price assessment:

- IG Density: 770-800 Ex- Mumbai, India

- IG Density: 770-800 FOB Nhava Sheva , India

- IG Density: 770-800 Ex-Delhi, India

- IG Density: 770-800 CIF Southampton (India), United Kingdom

- IG Density: 770-800 CIF Jebel Ali (India), United Arab Emirates

- IG Density: 770-800 CIF Durban (India), South Africa

- IG Density: 770-800 CIF Jakarta (India), Indonesia

Mineral Turpentine Oil (MTO) Price Trend Q3 2025

In Q3 2025, the global Mineral Turpentine Oil (MTO) market showed moderate stability, with prices fluctuating by around 3% due to steady feedstock and energy costs, as well as regional supply chain dynamics. Despite some volatility in upstream markets, strong demand from the automotive and tire industries helped sustain price resilience.

Additionally, ongoing expansions in production capacity and supply chain adjustments further supported market balance. These factors are expected to maintain stable pricing into the next quarter.

India: Mineral Turpentine Oil (MTO) Export prices FOB Nhava Sheva, India, Density: 770-800 kg/m³.

In Q3 2025, Mineral Turpentine Oil (MTO) prices in India rose by approximately 6 to 7%, particularly across key trade locations such as Ex-Mumbai, Ex-Delhi, and FOB Nhava Sheva, driven by a combination of domestic supply constraints, firm downstream demand, and rising logistics costs and disturbance in crude oil due to war conflicts in middle east. Local production faced disruptions due to scheduled maintenance at several refineries and blending facilities, leading to reduced availability in the domestic market.

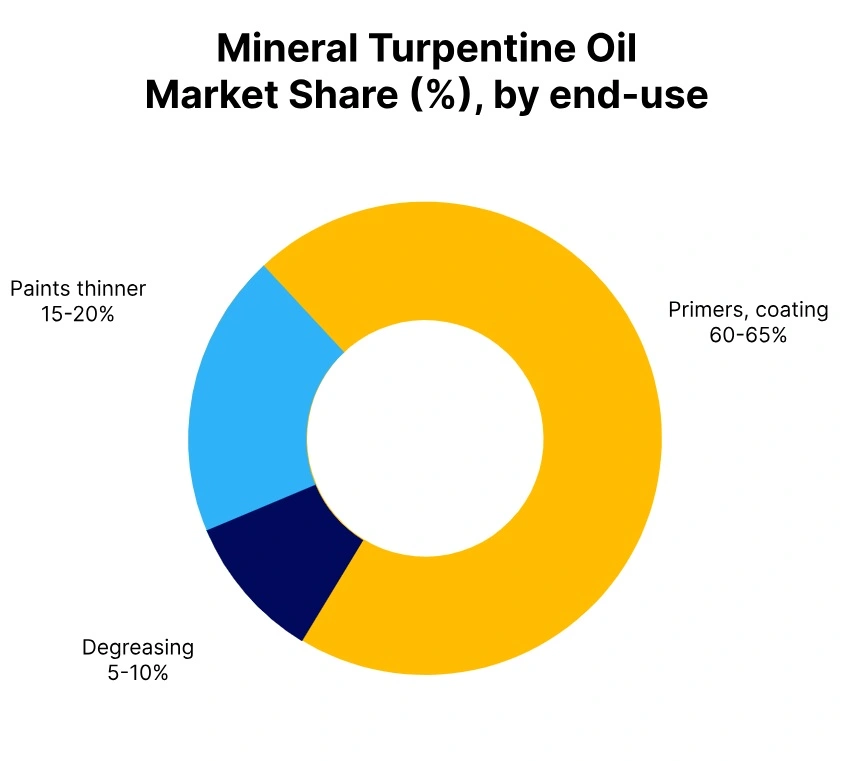

At the same time, demand from end use sectors like paints and coatings, automotive, and adhesives remained strong, bolstered by seasonal post-monsoon construction activity and consistent growth in manufacturing. Logistical bottlenecks including port congestion, increased inland freight rates, and transportation delays further compounded pricing pressures, especially for deliveries from western ports to northern regions.

On the export front, limited availability and higher domestic realizations pushed MTO prices trend in India upward. While global MTO markets remained relatively stable with flat feedstock and energy costs. In September 2025, Mineral Turpentine Oil (MTO) price in Indian market diverged due to regional imbalances and a marginally weaker rupee, which added to import costs.

Looking ahead, with production capacity expected to ramp up and logistical issues potentially easing, prices may stabilize in Q4, although sustained demand and any further disruptions could continue to exert upward pressure.

United Kingdom: Mineral Turpentine Oil (MTO) import prices CIF Southampton, United Kingdom, Grade- Density: 770-800 kg/m³.

In Q3 2025, Mineral Turpentine Oil (MTO) prices in United Kingdom increased by approximately 3%, largely influenced by rising import costs from India, one of its key supply sources. The Mineral Turpentine Oil (MTO) price trend in Indian market saw a hike during the same period, driven by supply constraints, strong downstream demand from sectors like automotive and paints, and elevated logistics costs, particularly from major export hubs such as FOB Nhava Sheva.

Momentum in Mineral Turpentine Oil (MTO) price trend in United Kingdom was transmitted to the UK market, where buyers faced higher landed costs due to both the elevated Indian export prices and increased freight charges. Additionally, a relatively stable yet firm demand in the UK, combined with limited availability from alternative sources, supported the price increase.

The Indian rupee’s marginal depreciation also played a role in raising the effective import cost when priced in local currencies. Going forward, if Indian supply conditions stabilize and freight rates ease. In September 2025, Mineral Turpentine Oil prices in the UK may see a correction, though strong seasonal demand in both regions could keep prices elevated in the short term.

UAE: Mineral Turpentine Oil (MTO) import prices CIF Jebel Ali, UAE: Grade – Density: 770-800 kg/m³.

In Q3 2025, Mineral Turpentine Oil (MTO) prices in UAE, particularly at the Jebel Ali port, rose by approximately 2.25%, primarily due to higher import costs from India, a major supplier to the region. The Mineral Turpentine Oil (MTO) price trend in UK was settled as India market saw a price increase driven by domestic supply constraints, strong demand from the automotive, coatings, and industrial sectors, and elevated logistics costs from key export points such as FOB Nhava Sheva. These factors directly impacted export prices, leading to increased landed costs for UAE importers.

According to Price-Watch, in September 2025, Mineral Turpentine Oil (MTO) price in UAE market felt the ripple effects of India’s pricing dynamics, compounded by higher freight rates and currency-related cost adjustments. Although the price increase in Jebel Ali was more moderate compared to other markets

Indonesia: Mineral Turpentine Oil (MTO) import prices CIF Jakarta, Indonesia: Grade – Density: 770-800 kg/m³.

In Q3 2025, Mineral Turpentine Oil (MTO) prices in Indonesia, saw a 3% increase, primarily driven by higher import costs from India, which remains a key source of supply for the Indonesian market. The Mineral Turpentine Oil (MTO) price trend in Indonesia hike during the quarter was fuelled by supply limitations, strong downstream demand from sectors like automotive and coatings, and increased logistics and export charges from ports such as FOB Nhava Sheva.

These elevated export prices translated into higher landed costs for Indonesian buyers, despite relatively stable domestic consumption. The impact was further amplified by increased regional freight rates and currency exchange effects.

Although MTO price increase in Indonesia was more moderate compared to India. In September 2025, MTO price in Indonesia underscores the sensitivity of regional markets to upstream cost fluctuations.

South Africa: Mineral Turpentine Oil (MTO) import prices CIF Durban, South Africa: Grade – Density: 770-800 kg/m³.

In Q3 2025, Mineral Turpentine Oil (MTO) prices in South Africa, rose by approximately 3%, mainly due to increased import costs from India, a major supplier to the South African market. The Mineral Turpentine Oil (MTO) price trend in South Africa rose as Indian market saw rise during the quarter, driven by tight domestic supply, strong demand from key sectors like automotive and paints, and higher export and logistics costs from ports such as FOB Nhava Sheva.

These upstream cost pressures translated into higher landed MTO prices in South Africa, despite relatively steady local demand. Additional factors, including elevated shipping rates along the India Africa trade route and currency exchange movements, further contributed to the price increase.

While the impact in Mineral Turpentine Oil (MTO) price in South Africa in September 2025 was milder compared to India, the market remains closely tied to external supply dynamics, making it susceptible to fluctuations in global and regional sourcing costs.