Price-Watch’s most active coverage of MS Angle price assessment:

- Primary(50*50*6mm) EX-Delhi NCR, India

- Primary(50*50*6mm) EX-Mumbai, India

Mild Steel (MS) Angle Price Trend Q3 2025

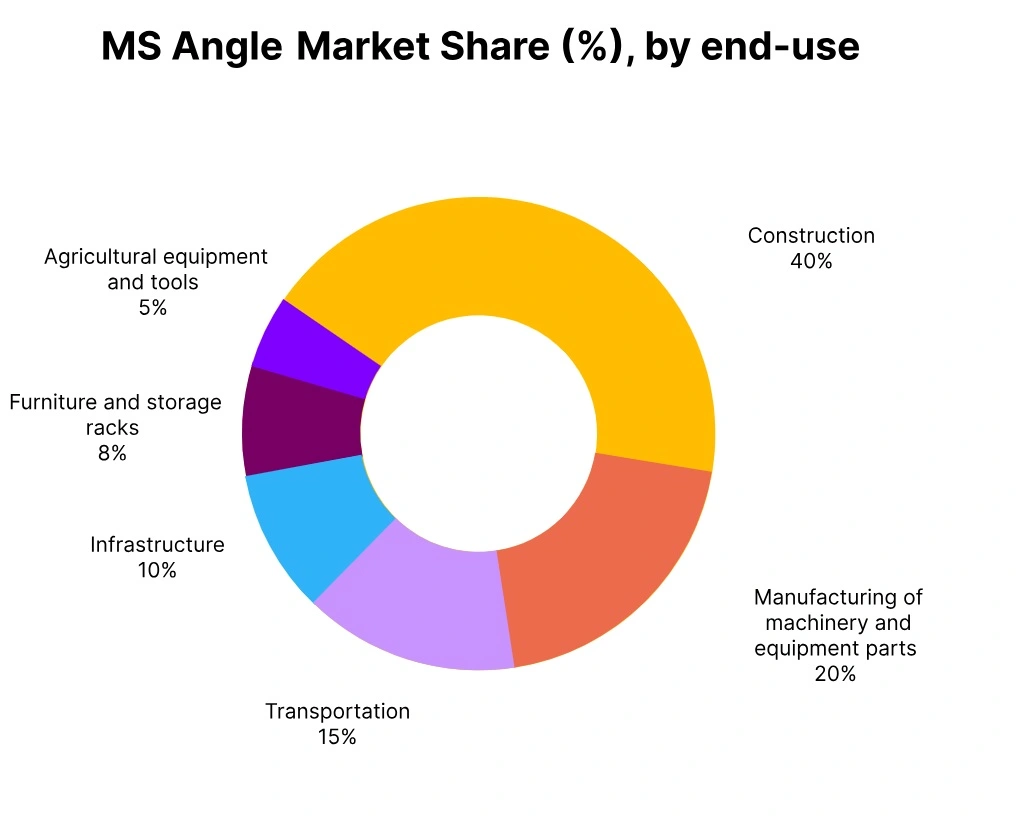

In Q3 2025, mild steel (MS) angle prices have decreased across the world. The price decline has been driven by weaker demand in construction and automotive, plus oversupply primarily from increased exports from China.

Although regional pricing variations have been minimal, prevailing market sentiment has been bearish and compounded by trade tariffs, higher inventories, and general subdued activity levels in many industries. As a result, many producers have cut production to remain profitable, but there has been no substantial indication of increased demand and prices are expected to remain low till 2025.

India: MS Angle Domestically traded prices Ex-Delhi-NCR, India, Grade- 50*50*6mm.

According to Price-Watch, in Q3 2025, the mild steel (MS) angle price trend in India has recorded a 2.21% decrease compared to Q2 2025, primarily driven by reduced demand from the construction sector and increased domestic steel production exerting downward pressure on prices.

While Q2 had witnessed a slight price rise, the Q3 correction reflects cautious market sentiment amid ongoing global steel price fluctuations and regional economic factors. This decline has underscored the need for stakeholders to closely monitor supply-demand dynamics as the market navigates through slower infrastructure activity and input cost challenges.

The 0.24% increase in mild steel (MS) angle prices in India during September 2025 has been attributed to rising raw material costs and heightened demand from the construction sector. Additionally, supply chain disruptions and inflationary pressures have further contributed to this price adjustment.