Price-Watch’s most active coverage of Mild Steel (MS) Pipe price assessment:

- 100 NB EX-Delhi NCR, India

- 100 NB EX-Mumbai, India

Mild Steel (MS) Pipe Price Trend Q3 2025

In the third quarter of 2025, global pricing for mild steel (MS) pipe has been on the decline, due to decreasing demand in important sectors such as construction and automotive, and with increased Chinese exports contributing to oversupply.

Other than minor variations in price among regions, overall market sentiment has held steady and continued to be bearish, pressured by tariffs, accumulating inventories, and lack lustre industrial activity.

Major producers have reduced their capacity to remain sustainably profitable. However, barring any demonstrable increase in demand, pricing is expected to remain weak through 2025.

India: Mild Steel (MS) Pipe Domestically traded prices Ex-Delhi-NCR, India, Grade- 100NB.

According to Price-Watch, in Q3 2025, the mild steel (MS) pipes price trend in India has recorded a modest decline of 1.84% compared to Q2 2025, influenced by seasonal demand slowdowns during the monsoon season, easing raw material costs particularly hot rolled coil prices and intensified competition from cheaper imports.

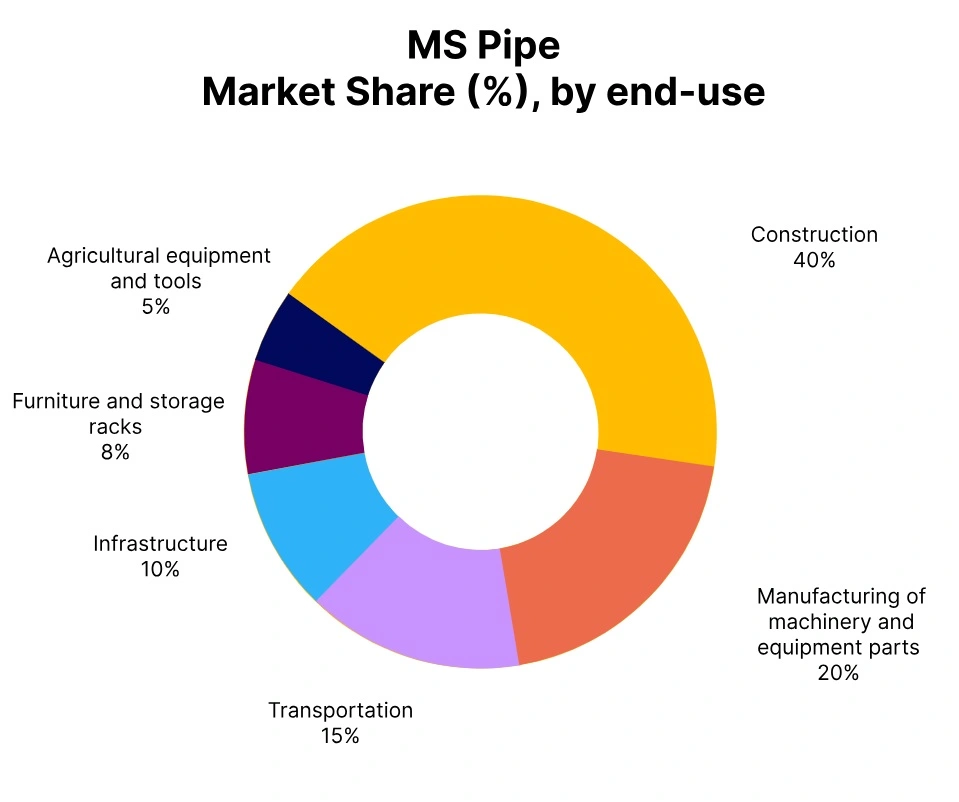

Procurement delays in the construction and infrastructure sectors, primary consumers of mild steel pipes, alongside inventory build-up from preceding quarters, have compelled suppliers to offer discounts to clear stock. Although premium brands have maintained relatively stable pricing, overall market sentiment has remained cautious, reflecting margin pressures and muted downstream demand.

In September 2025, Mild steel (MS) pipes prices have increased marginally by 0.25%, driven by a slight uptick in raw material costs and rising domestic demand from the infrastructure and construction sectors. Additionally, global supply chain adjustments and fluctuating input costs have contributed to this modest price revision.