Price-Watch’s most active coverage of N-Heptane price assessment:

- (99% min) High Purity n-heptane Pure Grade FOB Shanghai, China

- (99% min) High Purity n-heptane Pure Grade FOB Busan, South Korea

- (99% min) High Purity n-heptane Pure Grade CIF Nhava Sheva (China), India

- (99% min) High Purity n-heptane Pure Grade CIF Nhava Sheva (South Korea), India

- (99% min) High Purity n-heptane Pure Grade Ex-Mumbai, India

n-Heptane Price Trend Q3 2025

In Q3 2025, n-Heptane markets across Asia showed mixed performance driven by varied industrial dynamics. China observed slight growth due to firm feedstock values and steady petrochemical output. South Korea registered a mild decline amid weaker domestic and export demand.

India showed overall stability with minor growth in imports from China and domestic markets, while imports from South Korea slightly softened. According to the PriceWatch, regional product prices reflected balanced supply-demand across the quarter.

China: n-Heptane Export prices FOB Shanghai, China, Grade (99% min) High Purity n-Heptane Pure Grade.

In Q3 2025, n-heptane prices in China exhibited mild increases driven by consistent industrial demand and firm feedstock naphtha costs. The n-heptane price trend in China reflected a balanced market supported by steady petrochemical production and limited regional exports. Moderate refinery throughput ensured stable supply levels despite logistical constraints in East Asia.

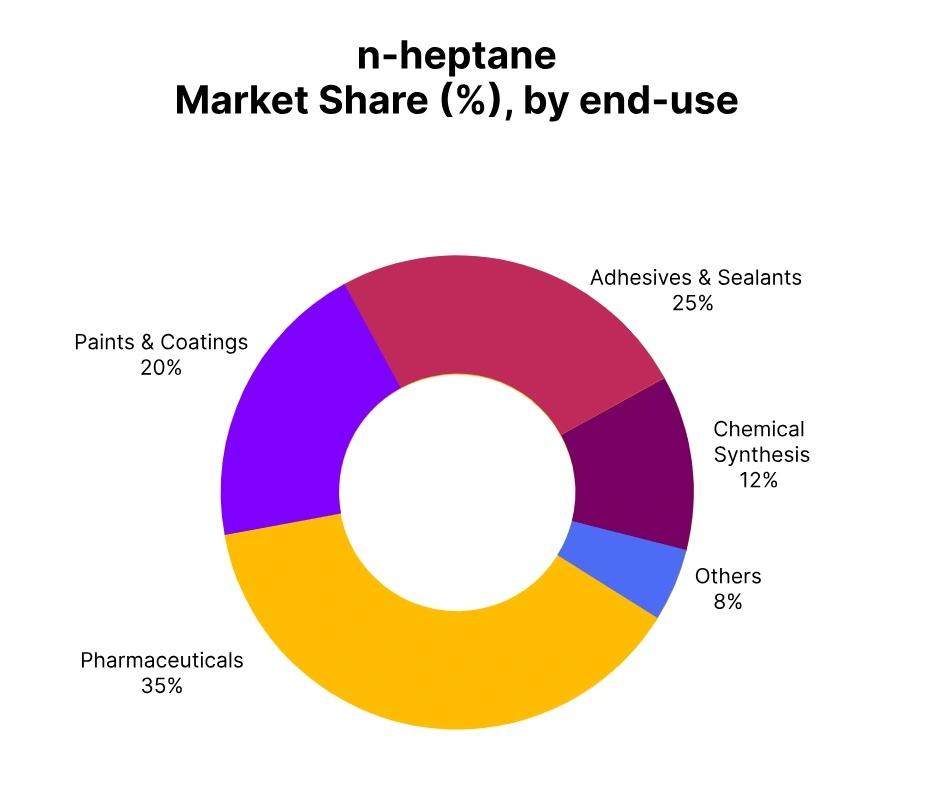

According to the PriceWatch, product prices rose by 1.11% compared to the previous quarter. Sustained demand from pharmaceuticals, coatings, and lab reagent sectors supported price stability. Export demand from Southeast Asian markets also contributed to price resilience.

The n-heptane price in China improved slightly by September 2025, suggesting moderate growth. Product prices in Q3 remained influenced by sustained operating rates and balanced regional supply chains. The product price trend in China is expected to maintain stability in the next quarter.

South Korea: n-Heptane Export prices FOB Busan, South Korea, Grade (99% min) High Purity n-Heptane Pure Grade.

In Q3 2025, n-heptane prices in South Korea declined marginally due to weakened domestic demand and slower solvent sector consumption. The n-heptane price trend in South Korea faced downward pressure amid soft export activities and reduced refinery run-rates. According to the PriceWatch, product prices dropped by 2.95% versus the previous quarter. Lower buying interest from foreign markets affected price movements during this period.

Limited restocking activities and stable crude oil values kept the overall market subdued. Product prices in Q3 continued to reflect moderate volatility in feedstock availability and end-use demand. The n-heptane price in South Korea eased slightly by September 2025, showing market correction. The product price trend in South Korea indicates short-term bearish sentiment but may recover with improving export orders.

India: n-Heptane Import prices CIF Nhava Sheva (China), India, Grade (99% min) High Purity n-Heptane Pure Grade.

In Q3 2025, n-heptane imports into India from China recorded mild price appreciation driven by steady downstream manufacturing activity. The n-heptane price trend in India was supported by stable solvent demand and sustained industrial consumption. According to the PriceWatch, product prices increased by 3.89% compared to the last quarter. Domestic manufacturers in coatings, adhesives, and pharmaceuticals contributed to the continued demand momentum.

This uplift was moderated by currency volatility and freight adjustments. Product prices in Q3 displayed steady growth with limited supply disruptions. The n-heptane price in India from China remained strong in September 2025, supported by end-user uptake. Overall, the product price trend in India suggested a positive trajectory across solvent-linked markets.

India: n-Heptane Import prices CIF Nhava Sheva (South Korea), India, Grade (99% min) High Purity n-Heptane Pure Grade.

In Q3 2025, India’s n-heptane imports from South Korea faced restricted growth due to steady demand and balanced local production. The n-heptane price trend in India remained largely unchanged amid consistent transaction volumes and moderate petrochemical activity. According to the PriceWatch, product prices dropped slightly by 0.47% compared to Q2 2025.

Import costs stayed stable as freight rates normalized and refinery operation levels steadied. Product prices in Q3 reflected cautious procurement by buyers amid soft international offers. The n-heptane price in India from South Korea softened in September 2025, tracking limited downstream momentum. Nevertheless, the product price trend in India is expected to hold firm supported by seasonal industrial uptick.

India: n-Heptane Domestic prices Ex-Mumbai, India, Grade (99% min) High Purity n-Heptane Pure Grade.

In Q3 2025, domestic n-heptane prices in India saw steady patterns driven by resilient local consumption and balanced production. The n-heptane price trend in India reflected consistent feedstock availability and moderate crude value oscillations. According to the PriceWatch, product prices improved by 0.47% compared to the earlier quarter. Sustained consumption from paints, adhesives, and specialty chemicals helped maintain price support.

Product prices in Q3 held firm, with manufacturers optimizing refinery utilizations. The n-heptane price in India during September 2025 displayed minor upward movement, indicating demand stability. Import parity levels and transportation costs remained decisive for market sentiment. The product price trend in India suggests stable movement through late 2025 amid growing solvent industry requirements.