Price-Watch’s most active coverage of n-Hexane price assessment:

- 99% min Industrial Grade FOB Shanghai, China

- 99% min Industrial Grade CIF Haiphong_China, Vietnam

- 99% min Industrial Grade CIF Buenos Aires_China, Argentina

- 99% min Industrial Grade CIF Nhava Sheva_China, India

- FGH (BIS)3470 Ex-Mumbai, India

- FGH (BIS) 3470 Ex- South India, India

- FGH (BIS) 3470 Ex- North India, India

- FGH (BIS) 3470 Ex-West India, India

n-Hexane Price Trend Q3 2025

Hexane product prices in Q3 2025 showed regional divergence amid varying industrial demand and feedstock cost pressures. China and Vietnam recorded modest declines of around 2%, reflecting weaker export and import activity. India and its regional markets saw similar softness as domestic prices dipped between 2% and 3%. Conversely, Argentina stood out with a 6.9% increase driven by limited imports and firm industrial consumption.

China: n-Hexane Export Prices FOB Shanghai, China, Grade – 99% min Industrial Grade.

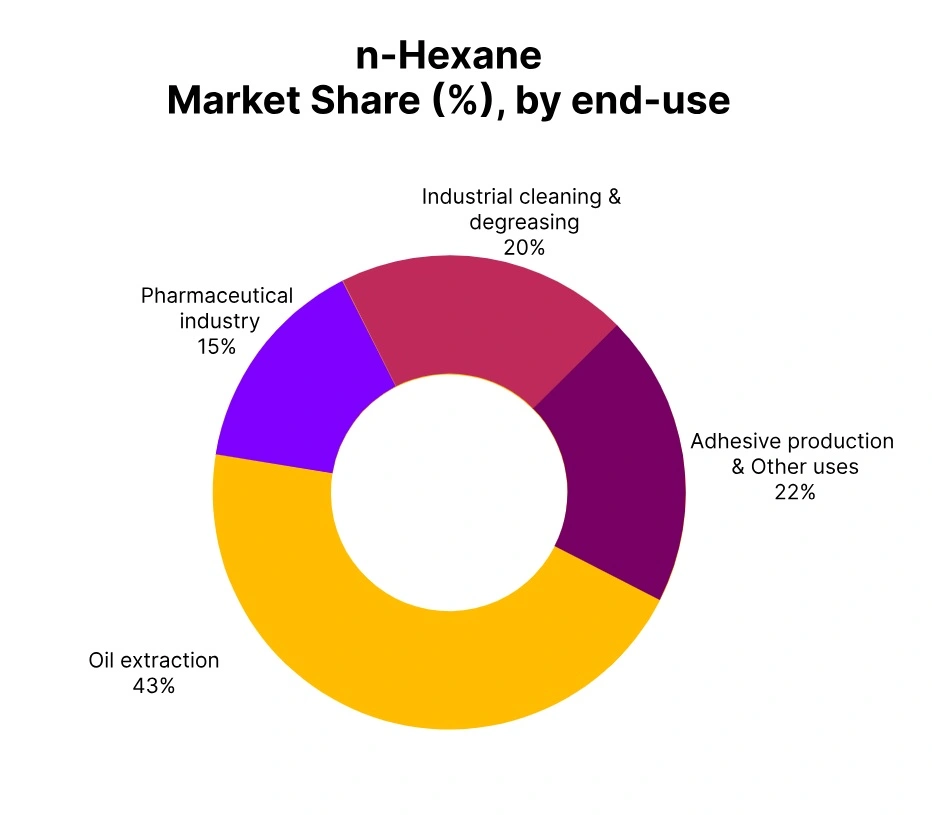

In Q3 2025, n-hexane prices in China experienced a minor downturn driven by weaker demand from downstream chemical and adhesive industries. n-hexane price trend in China reflected the impact of soft crude oil values and steady domestic production.

Supply levels remained adequate as refineries maintained high output rates during the quarter. Demand from the electronics cleaning and polymer sectors showed moderate stability. According to the Price-Watch, product prices in Q3 reported a decline of 2.02%, tracking slower export momentum.

The balance between export competitiveness and domestic consumption shaped pricing sentiment. Refinery margins narrowed slightly due to declining international benchmarks. n-hexane prices in September 2025 stayed low compared to Q2 levels, signaling a stable but cautious outlook for the next quarter.

Vietnam: n-Hexane Import Prices CIF Haiphong from China, Grade – 99% min Industrial Grade.

In Q3 2025, n-hexane prices in Vietnam recorded a slight decline amid steady import activities and limited downstream fluctuations. n-hexane price trend in Vietnam was largely influenced by weakening regional demand and competitive import quotes from Chinese producers.

Refinery infrastructure in neighboring Asian economies helped sustain steady supply chains. According to the Price-Watch, product prices in Q3 showed a marginal decrease of 1.88% as buyers adopted cautious procurement.

Aromatic solvent demand in coatings and rubber processing sectors remained consistent, softening the price decline. Import costs adjusted moderately due to logistical stability. n-hexane prices in September 2025 reflected relative steadiness, supported by balanced inventories and modest industrial recovery in Vietnam’s manufacturing sector.

Argentina: n-Hexane Import Prices CIF Buenos Aires from China, Grade – 99% min Industrial Grade.

In Q3 2025, n-hexane prices in Argentina demonstrated a strong upward shift supported by tight availability and rising procurement costs. n-hexane price trend in Argentina was impacted by limited imports and currency-related fluctuations. Demand from the edible oil extraction and chemical blending segments increased steadily.

According to the Price-Watch, product prices in Q3 expanded by 6.90%, indicating notable recovery after earlier softness. Refinery supply bottlenecks and import delays heightened local market sentiments.

The strengthening of industrial consumption kept most distributors active through the quarter. n-hexane prices in September 2025 continued to firm up, reflecting bullish energy spreads and renewed buying interest within Argentina’s refining and industrial base.

India: n-Hexane Import Prices CIF Nhava Sheva from China, Grade – 99% min Industrial Grade.

According to Price-Watch, in Q3 2025, n-hexane prices in India under CIF Nhava Sheva condition registered a marginal decline amid steady demand and controlled import activity. n-hexane price trend in India was influenced by consistent naphtha feedstock values and limited fluctuations in crude oil benchmarks.

Importers maintained balanced inventories due to manageable freight and stable currency performance. According to the Price-Watch, product prices in Q3 witnessed a contraction of 0.44%, aligning with global industrial solvent trends. Domestic demand from pharmaceuticals and adhesives remained firmly stable.

Competitive offers from Chinese exporters contributed to restrained pricing at Nhava Sheva port. n-hexane prices in September 2025 recorded minor downward adjustments, reflecting cautious procurement and controlled import

India (Ex-Mumbai): n-Hexane Domestic Prices Ex-Mumbai, Grade – 98.5% min Food Grade.

In Q3 2025, n-hexane prices in Mumbai demonstrated mild weakness amid steady refinery operations and moderate downstream consumption. n-hexane price trend in Mumbai showed pressure from sustained regional supply and limited procurement by edible oil processors. According to the Price-Watch, product prices in Q3 declined by 2.52%, affected by soft market fundamentals and ample inventories.

Local manufacturers ensured continuous availability, balancing production economics. Packaging and pharmaceutical sectors maintained consistent but cautious demand. n-hexane prices in September 2025 were slightly below Q2 averages, supporting overall market stability across western trade routes.

India (Ex-South India): n-Hexane Domestic Prices Ex-South India, Grade – 98.5% min Food Grade.

In Q3 2025, n-hexane prices in South India recorded a mild decline amid limited consumption from chemical and extraction industries. n-hexane price trend in South India followed subdued regional buying and stable raw material costs. According to the Price-Watch, product prices in Q3 decreased by -2.33%, tracking sufficient refinery stock levels. Market sentiment remained neutral as regional production sustained market continuity.

Buyers continued moderate procurement aligned with quarterly requirements. n-hexane prices in September 2025 stood slightly lower than Q2, emphasizing steady supply and restrained demand growth.

India (Ex-North India): n-Hexane Domestic Prices Ex-North India, Grade – 98.5% min Food Grade.

In Q3 2025, n-hexane prices in North India showed a soft trend influenced by oversupplied conditions and moderate consumption across edible oil refineries. n-hexane price trend in North India reflected balanced refinery output and organized stock management. According to the Price-Watch, product prices in Q3 declined by 2.36%, consistent with weaker regional offtake.

Domestic producers maintained operational stability to adjust margins. Procurement slowed slightly amid high availability and controlled demand cycles. n-hexane prices in September 2025 were below Q2 levels, reflecting continued equilibrium in regional price movement and inventory control.

India (Ex-West India): n-Hexane Domestic Prices Ex-West India, Grade – 98.5% min Food Grade.

According to Price-Watch, in Q3 2025, n-hexane prices in West India experienced moderate softness driven by balanced refinery output and subdued industrial activity. n-hexane price trend in West India indicated lower procurement rates from extraction units and steady stock accumulation. According to the Price-Watch, product prices in Q3 fell by 2.42%, reflecting slow trading momentum.

Regional refiners prioritized consistent supply to maintain pricing parity. Competitive offers among local distributors ensured limited volatility. n-hexane prices in September 2025 remained slightly weaker, highlighting stable yet cautious regional demand across food processing sectors.