Price-Watch’s most active coverage of Ortho Nitro Chloro Benzene (ONCB) price assessment:

- Industrial Grade (>99%) FOB Nhava Sheva, India

- Industrial Grade (>99%) CIF Shanghai (India), China

- Industrial Grade (>99%) CIF Santos (India), Brazil

Ortho Nitro Chloro Benzene (ONCB) Price Trend Q3 2025

In Q3 2025, the global Ortho Nitro Chloro Benzene (ONCB) market showed a firm upward trajectory across key regions, supported by steady international inquiries, consistent export flows from India, and resilient downstream demand. Freight conditions remained generally stable, although regional variations, particularly in Latin America, led to localized logistical challenges.

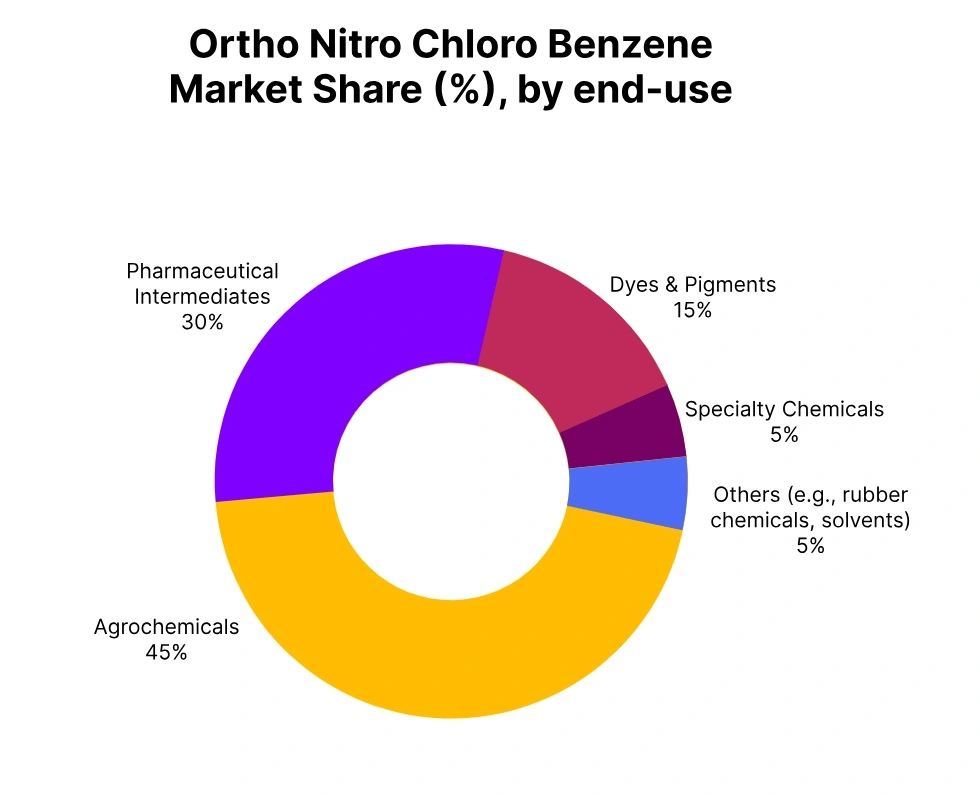

India maintained FOB dispatches with regular availability, driving strong performance in both domestic and export markets. In China, increased freight charges were offset by robust demand from the agrochemical and pharmaceutical sectors, keeping import interest intact.

Meanwhile, Brazil saw growing interest in Indian-origin cargoes, backed by clear pricing and punctual shipments. As a whole, the Ortho Nitro Chloro Benzene (ONCB) price trend remained positive globally, driven by steady consumption and firm procurement sentiment.

India: Ortho Nitro Chloro Benzene (ONCB) Export prices FOB Nhava Sheva, India, Industrial Grade (>99%).

According to Price-Watch, in Q3 2025, the Ortho Nitro Chloro Benzene (ONCB) prices in India saw a stable uptrend. Despite minor fluctuations in upstream costs of key feedstocks like Chlorine, Nitric Acid, and Aniline, the domestic market displayed steady procurement activity. Manufacturers reported improved availability and regular dispatches under FOB Nhava Sheva terms.

The Ortho Nitro Chloro Benzene (ONCB) price trend in India remained firm as inquiries picked up towards the latter half of the quarter. Moreover, steady demand from dye intermediate producers supported market stability. The ONCB price in India under FOB terms ranged between USD 715-775 per metric ton, mirroring a 3.76% increase over the previous quarter, driven by strong buying sentiment and improved export bookings.

In September 2025 Ortho Nitro Chloro Benzene (ONCB) prices marking an increase of 1.32% compared to the previous month. The upward movement was supported by steady procurement from key downstream industries such as dyes, pesticides, and pharmaceuticals.

China: Ortho Nitro Chloro Benzene (ONCB) Import prices CIF Shanghai, China, Industrial Grade (>99%).

According to Price-Watch, In Q3 2025, the Ortho Nitro Chloro Benzene (ONCB) prices in China under CIF Shanghai terms saw upward momentum, supported by rising import costs and a significant surge in regional freight charges. Despite increased freight costs from India, demand in the Chinese market stayed firm, driven by a hike in inquiries from the agrochemical and pharmaceutical sectors.

Stable feedstock availability in India allowed for uninterrupted exports, while the FOB India offers remained competitive in global tenders. The Ortho Nitro Chloro Benzene (ONCB) price trend in China displayed strength as buyers accepted higher price levels amidst limited regional availability.

The Ortho Nitro Chloro Benzene (ONCB) price in China stood within the range of USD 720-805 per metric ton, showing a 6.13% increase compared to the previous quarter. In September 2025 Ortho Nitro Chloro Benzene (ONCB) prices showing a moderate increase of 1.07% from August. The price rise was linked to constrained export volumes from India, driven by consistent domestic demand that reduced availability for overseas shipments.

Brazil: Ortho Nitro Chloro Benzene (ONCB) Import prices CIF Santos, Brazil, Industrial Grade (>99%).

In Q3 2025, the Ortho Nitro Chloro Benzene (ONCB) prices in Brazil under CIF Santos terms observed a steady upward trend, bolstered by stable freight conditions and sustained interest in Indian-origin cargoes. In spite of logistical bottlenecks in some Latin American ports, shipments from India remained punctual.

The number of inquiries from Brazilian importers went up, especially toward the quarter-end, indicating firm downstream interest. FOB offers from Indian manufacturers were reported to be consistent, giving buyers clarity in contract negotiations. The Ortho Nitro Chloro Benzene (ONCB) price trend in Brazil mirrored moderate appreciation, as the local market adjusted to higher procurement costs and freight components.

The Ortho Nitro Chloro Benzene (ONCB) price in Brazil ranged between USD 785-865 per metric ton, registering a 4.81% increase over Q2 2025. In September 2025 Ortho Nitro Chloro Benzene (ONCB) prices rising by 0.16% compared to the previous month. The market remained broadly stable, with Brazilian suppliers maintaining consistent offer levels due to balanced inventory and average overseas demand from Indian buyers.