Price-Watch’s most active coverage of Orthoxylene price assessment:

- Industrial Grade (>99%) FD Antwerp, Belgium

- Industrial Grade (>99%) Ex-Nanjing, China

- Industrial Grade (>99%) CIF Shanghai (Singapore), China

- Industrial Grade (>99%) CIF Shanghai (South Korea), China

- Industrial Grade (>99%) FD Hamburg, Germany

- Industrial Grade (>99%) Ex-Mumbai (Bulk), India

- Industrial Grade (>99%) Ex-Mumbai, India

- Industrial Grade (>99%) Ex-Ahemdabad, India

- Industrial Grade (>99%) CIF Manzanillo (USA), Mexico

- Industrial Grade (>99%) FD Rotterdam, Netherlands

- Industrial Grade (>99%) FOB Singapore, Singapore

- Industrial Grade (>99%) CIF Cape Town (Singapore), South Africa

- Industrial Grade (>99%) CIF Cape Town (Netherlands), South Africa

- Industrial Grade (>99%) FOB Busan, South Korea

- Industrial Grade (>99%) FOB Houston, USA

Orthoxylene Price Trend Q3 2025

In Q3 2025, the global Orthoxylene market witnessed a consistent downward pricing trend, primarily driven by subdued demand, stable feedstock costs, and cautious buying sentiment. Despite steady availability of upstream materials like Reformate and Toluene, oversupply in several regions and limited spot inquiries contributed to weakening market fundamentals. Sellers across the globe adjusted their offers in response to muted procurement activity and increased competition, particularly in the export segments.

Freight fluctuations also played a role in shaping landed costs, especially in import-reliant markets. Overall, the Ortho xylene price trend in global markets remained bearish throughout the quarter, with prices under pressure due to soft consumption patterns, balanced inventories, and conservative trade behaviour.

South Korea: Ortho xylene Export prices FOB Busan, South Korea, Industrial Grade (>99%).

According to Price-Watch, in Q3 2025, the Ortho xylene prices in South Korea under FOB Busan terms saw a significant decline, driven by limited regional buying interest and growing product availability. Domestic producers operated steadily, but weak offtake from export destinations added pressure on local inventories. Spot inquiries remained thin, with most buyers avoiding long-term commitments amid a bearish market outlook.

Feedstock supplies for Xylene remained stable; however, downstream demand was too subdued to support pricing. The Ortho xylene price trend in South Korea moved clearly downward, with prices assessed between USD 795–885 per metric ton, reflecting a 9.15% decline from the previous quarter. In September 2025 Ortho xylene prices down by 4.25% from previous month. The offered prices declined as Korean import demand softened, and exporters adjusted offers downward to stay competitive among alternative sources.

USA: Ortho xylene Export prices FOB Houston, USA, Industrial Grade (>99%).

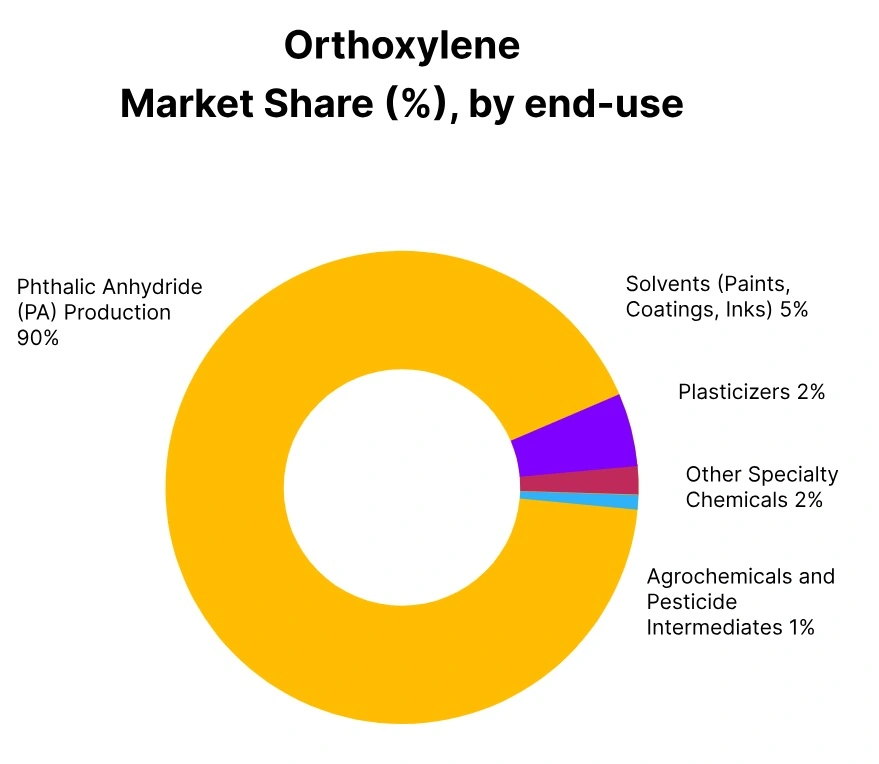

In Q3 2025, the Ortho xylene prices in the USA under FOB Houston terms edged down slightly, influenced by cautious purchasing behaviour and sufficient domestic supply. Producers reported stable operating rates, but downstream sectors such as plasticizers and phthalic anhydride showed little improvement in demand. Trading activity was muted, with most deals concluded at competitive levels to stimulate interest.

Despite steady costs for mixed xylene, the bearish sentiment prevailed. The Ortho xylene price trend in the USA remained under pressure, with prices ranging between USD 900–970 per metric ton, marking a 3.23% decline on a quarterly basis. In September 2025 Orthoxylene prices down by 4.57%. The offered prices dropped because US-origin exporters reduced margins under global export competition and balanced supply conditions.

Singapore: Ortho xylene Export prices FOB Singapore, Singapore, Industrial Grade (>99%).

In Q3 2025, the Ortho xylene prices in Singapore under FOB Singapore terms registered a notable drop, impacted by weak spot demand and healthy regional supply. Local suppliers faced pressure to reduce offers in the face of falling interest from regional buyers and oversupplied conditions. Export activity remained limited, and market sentiment turned bearish due to stagnant downstream activity.

Despite relatively stable feedstock input, price negotiations leaned towards lower levels. The Ortho xylene price trend in Singapore remained on a downward slope, with prices ranging between USD 810–888 per metric ton, reflecting a 6.71% decrease from Q2 2025. In September 2025 Orthoxylene prices down by 3.89%. The offered prices decreased because exporters from Singapore lowered offers amid softer regional export demand and available domestic inventory pressure.

Netherlands: Orthoxylene prices in Netherlands, Industrial Grade (>99%).

In Q3 2025, the Orthoxylene prices in the Netherlands under FD Rotterdam terms softened moderately amid balanced production and subdued end-user demand. European buyers remained hesitant to commit to large volumes, resulting in low spot market activity. Feedstock availability for reformate and toluene remained consistent, but this was insufficient to offset limited downstream pull. Market participants noted minimal change in contract discussions, contributing to stable yet slightly lower pricing.

The Ortho xylene price trend in the Netherlands was marginally negative, with prices assessed between USD 1085–1110 per metric ton, indicating a 2.06% fall from the previous quarter. In September 2025 Orthoxylene prices decreasing by 0.51% from previous month. The offered prices softened as European import corridor demand remained subdued and supply from alternative sources pressured seller offers.

India: Orthoxylene Domestic prices Ex-Mumbai, India, Industrial Grade (>99%).

In Q3 2025, the Orthoxylene prices in India under Ex-Mumbai terms saw a sharp correction due to weak domestic consumption and aggressive regional pricing. Local manufacturers continued operating at regular rates, but downstream procurement was minimal, leading to elevated inventory levels. Sellers were forced to offer discounts to stay competitive against lower-priced imports.

The feedstock situation for mixed xylene remained unchanged, offering limited cost support. The Orthoxylene price trend in India was clearly bearish, with prices reported between USD 920–990 per metric ton, showing a quarterly decrease of 8.83%. In September 2025 Orthoxylene prices down by 0.59% from previous month. The offered prices eased due to soft demand from domestic solvent and chemical users in Mumbai, while supply remained comfortable.

Belgium: Orthoxylene prices in Belgium, Industrial Grade (>99%).

In Q3 2025, the Orthoxylene prices in Belgium under FD Antwerp terms eased slightly amid sluggish market sentiment and consistent availability. Domestic consumption stayed flat, and spot buying was restrained, leading to slow turnover for most sellers. Production continued at steady rates, but without any significant pull from end-users, sellers faced mounting pressure to keep offers competitive.

Feedstock dynamics remained neutral, offering little pricing leverage. The Orthoxylene price trend in Belgium declined modestly, with prices assessed in the range of USD 1110–1140 per metric ton, reflecting a 1.95% fall from the previous quarter. In September 2025 Orthoxylene prices declining by 0.61% from previous month. The offered prices softened because demand in the European spot market had weakened and inventories across regional terminals remained ample.

China: Orthoxylene Domestic prices Ex-Nanjing, China, Industrial Grade (>99%).

In Q3 2025, the Orthoxylene prices in China under Ex-Nanjing terms posted the steepest quarterly decline, driven by oversupply and subdued domestic demand. Increased operating rates across local units coincided with weak downstream interest, leading to surplus product and a highly competitive market. Export offers were aggressively adjusted downward to clear inventory, but demand from overseas markets also remained limited. Feedstock inputs were stable, yet the overall sentiment remained strongly bearish.

The Orthoxylene price trend in China dropped significantly, with prices assessed between USD 885–975 per metric ton, marking a steep 14.17% decrease quarter-on-quarter. In September 2025 Orthoxylene prices down by 1.53% from previous month. The offered prices dropped as local demand in eastern China eased and sellers responded by cutting margins to stimulate trade.

Germany: Orthoxylene prices in Germany, Industrial Grade (>99%).

In Q3 2025, the Orthoxylene prices in Germany under FD Hamburg terms recorded a slight decline, impacted by stable supply and low-volume purchases from end-users. Market discussions were subdued, with most buyers showing minimal interest in forward buying. Local producers maintained regular output, but a lack of fresh inquiries weighed on negotiations. Feedstock costs for reformate and xylene remained flat, offering limited support to prices.

The Orthoxylene price trend in Germany remained negative, with prices reported between USD 1120–1150 per metric ton, reflecting a 2.04% drop compared to the previous quarter. In September 2025 Orthoxylene prices declining by 0.07% from previous month. The minimal offered price change resulted from balanced supply and demand in the German market, with sellers maintaining steady offers amid neutral transactional activity.

Mexico: Orthoxylene Import prices CIF Manzanillo, Mexico, Industrial Grade (>99%).

In Q3 2025, Orthoxylene prices in Mexico under CIF Manzanillo terms declined slightly, impacted by moderate freight fluctuations and limited import interest. Despite steady availability from Asian exporters, the number of inquiries in Mexico remained subdued due to sufficient inventory and cautious downstream procurement.

Market participants noted that feedstock costs for Reformate and Toluene remained largely unchanged during the quarter, contributing to stable production costs. However, oversupply in the regional market and minimal spot demand kept prices from rebounding. The Orthoxylene price trend in Mexico registered a 3.67% decrease quarter-on-quarter, with Orthoxylene price in Mexico assessed in the range of USD 955–1025 per metric ton.

In September 2025 Orthoxylene prices down by 4.70% from previous month. The offered prices dropped because Mexican exporters lowered margins to compete in the US import market amid surplus exportable volumes and moderate local demand.

South Africa: Orthoxylene Import prices CIF Cape Town, South Africa, Industrial Grade (>99%).

In Q3 2025, Orthoxylene prices in South Africa under CIF Cape Town terms weakened due to ample cargo arrivals from Asian exporters and rising freight rates, which affected cost dynamics. Despite increased shipping costs, the number of inquiries remained low as downstream buyers held back purchases amid a bearish demand outlook. Local traders reported sufficient stock availability, leading to limited price support.

Feedstock costs, particularly for Mixed Xylene and Reformate, remained steady, but oversupply conditions weighed heavily on market sentiment. The Orthoxylene price trend in South Africa showed a clear decline of 4.44%, with o xylene price in South Africa ranging between USD 950–1040 per metric ton. In September 2025 Orthoxylene prices down by 3.88% from previous month. The offered prices from Singapore exporters were trimmed under competitive pressure in the African import market and sufficiently available export volume.