Price-Watch’s most active coverage of Palm Stearin price assessment:

- Grade: RBD Palm Stearin FOB Port Kelang, Malaysia

- Grade: RBD Palm Stearin CIF Houston (Malaysia), USA

- Grade: RBD Palm Stearin CIF Shanghai (Malaysia), China

- Grade: RBD Palm Stearin CIF Tokyo (Malaysia), Japan

- Grade: RBD Palm Stearin CIF Sharjah (Malaysia), United Arab Emirates

- Grade: RBD Palm Stearin CIF Nhava Sheva (Malaysia), India

Palm Stearin Price Trend Q3 2025

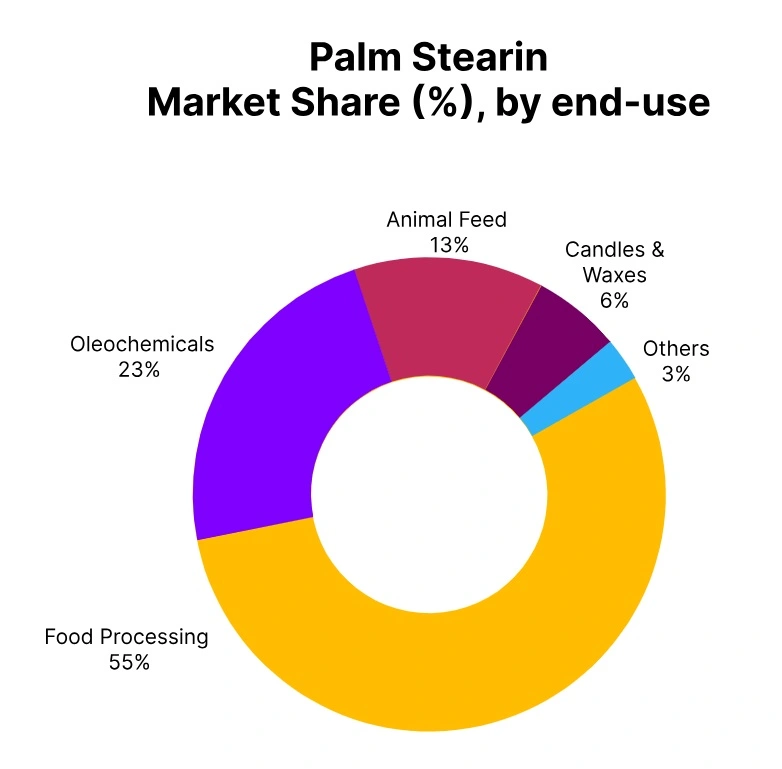

In Q3 2025, the worldwide RBD Palm Stearin market witnessed strong Palm Stearin price trend increase in major importing nations, varying from about 7-11%. Malaysia remained the pacesetter for the prices on the back of strong Crude Palm Oil prices, firm local demand, and consistent export supplies. Regional imports like the USA, China, Japan, UAE, and India experienced high demand from food, oleochemical, and industrial markets, leading to further price increase.

Though supplier competition existed, buyers emphasized reliability and standard product quality sourced from Malaysia. Generally, Palm Stearin’s relevance in food, personal care, and industries guaranteed robust demand even in the face of changing supply and logistics situations. The forecast is for continued steady demand and persistent price resilience looking into the next quarter.

Malaysia: Palm Stearin Export prices FOB Port Kelang, Malaysia, Grade- RBD Palm Stearin.

In Q3 2025, RBD Palm Stearin prices in Malaysia increased by 7.81% compared to the last quarter, ranging between 975–1080 USD per metric ton. Palm Stearin Price trend in Malaysia was fueled by stronger Crude Palm Oil prices and steady domestic consumption, with tight export volumes in regional markets. Malaysia remained the world reference price for Palm Stearin because of consistent supply and robust industrial demand from food and oleochemical makers.

Production discipline and efficiency ensured quality was sustained, and the country’s proven logistics network ensured timely shipment and consistency. In September 2025, prices rose by 2.68%, with pricing stability expected to remain fragile soon. Despite modest rivalry, Malaysia’s position as a top supplier did not waver during the period, supported by its commitment to sustainable sourcing and strong downstream refining capability.

USA: Palm Stearin Import prices CIF Houston, Malaysia, Grade- RBD Palm Stearin.

During Q3 2025, RBD Palm Stearin prices in the USA posted a healthy 7.73% increase, with prices quoted between 1120–1220 USD per metric ton. Sharply escalating freight costs provided upward momentum, and competitive global market forces contained larger price jumps but maintained palm stearin price trends in the USA firmly. Palm Stearin prices were also supported largely by robust US export demand and material scarcity from Malaysia that drove supply-side tightness across the board.

In September 2025, Palm Stearin prices rose sharply by 3.19%, with buying interest likely to remain limited in the near term. US purchasers still preferred Malaysian Palm Stearin due to quality and reliability. Strategic inquiry and import planning remained key, with market players watching shifting consumption patterns and vegetable oil competition in the wider food and chemical sectors.

China: Palm Stearin Import prices CIF Shanghai, Malaysia, Grade- RBD Palm Stearin.

According to Price-Watch, in Q3 2025, RBD Palm Stearin prices in China increased 7.69% from Q2 and fell in the range of 990–1095 USD per metric ton. Freight charges slightly increased this quarter, adding to the cost of imports but the positive Palm Stearin price trend in China was driven by sustained strong demand from China’s food processing and industrial sectors, backed by strong upstream Crude Palm Oil prices.

However, a competitive import environment and deep market discipline among purchasers constrained further price increase. In September 2025, Palm Stearin prices rose by 2.76%, with market momentum expected to remain positive. Flexible supply deals and strategic sourcing enabled Chinese importers to adapt to market developments while sustaining positive buying momentum during the quarter.

Japan: Palm Stearin Import prices CIF Tokyo, Malaysia, Grade- RBD Palm Stearin.

In Q3 2025, RBD Palm Stearin prices in Japan increased by 8.50% compared to the last quarter, with prices at 1020–1125 USD per metric ton. Higher freight rates, along with supply shortages from Malaysia and high levels of demand from Japanese food and industrial processors, drove the upward Palm Stearin price trend in Japan. Malaysia remained the most favored among Japanese buyers due to consistent product quality and reliable shipments.

In September 2025, Palm Stearin prices rose by 2.59%, with overall market sentiment likely to remain guarded in the near term. Japanese buyers revised procurement plans to purchase inventories considering continued market dynamics, validating Malaysia’s continued status as a supplier partner for Palm Stearin to Japan’s variegated industrial and consumer base.

United Arab Emirates: Palm Stearin Import prices CIF Sharjah, Malaysia, Grade- RBD Palm Stearin.

During Q3 2025, RBD Palm Stearin prices in the UAE market saw a quarterly rise of 8.10%, with CIF Sharjah prices between 1075–1175 USD per metric ton. The increase on the Palm Stearin price trend in the UAE was aided by modestly higher freight charges, consistent supply from Malaysia, and steady demand from regional food and chemical users. Malaysian Palm Stearin continued its reliable position with stable procurement backed by consistency and timely deliveries.

In September 2025, Palm Stearin prices increased slightly by 0.80%, with pricing stability expected to remain fragile in the near term. UAE buyers reacted to changing market pressures by diversifying procurement strategies, enabling cost stability while maximizing supply security amid moderate competition in the regional edible oil market.

India: Palm Stearin Import prices CIF Nhava Sheva, Malaysia, Grade- RBD Palm Stearin.

According to Price-Watch, in Q3 2025, RBD Palm Stearin prices in India recorded the steepest quarterly increase among importers, increasing by 10.56%, with CIF Nhava Sheva prices at 1040–1145 USD per metric ton. Palm Stearin Price trend in India was driven by higher freight costs, mounting demand from food and oleochemical producers and strong supply alliances with Malaysia. Indian customers ranked assured product quality and versatile procurement at the top, backing Malaysia’s continued leadership position in India’s Palm Stearin value chain.

In September 2025, prices rose by 2.85%, with buying interest likely to remain limited in the near term. Competitive forces and changing Palm Stearin price trends necessitated smart sourcing tactics and solidified Malaysia’s position as a key source for both industrial and food industry requirements within the nation.