6Price-Watch’s most active coverage of Polymethyl Methacrylate (PMMA) price assessment:

- General Purpose Injection Moulding Natural (MFI: 2.3-5.7) FOB Busan, South Korea

- General Purpose Injection Moulding Natural (MFI: 2) FOB Jeddah, Saudi Arabia

- General Purpose Injection Moulding Natural (MFI: 2.3-5.7) CIF Nhava Sheva (South Korea), India

- General Purpose Injection Moulding Natural ( MFI: 2) CIF Nhava Sheva (Saudi Arabia), India

- General Purpose Injection Moulding Natural (MFI: 1.5-1.9) Ex-Shanghai, China

- General Purpose Injection Moulding Natural (MFI: 2) CIF Shanghai (Saudi Arabia), China

- General Purpose Injection Moulding Natural (MFI: 2.3-5.7) CIF Shanghai (South Korea), China

Polymethyl Methacrylate (PMMA) Price Trend Q3 2025

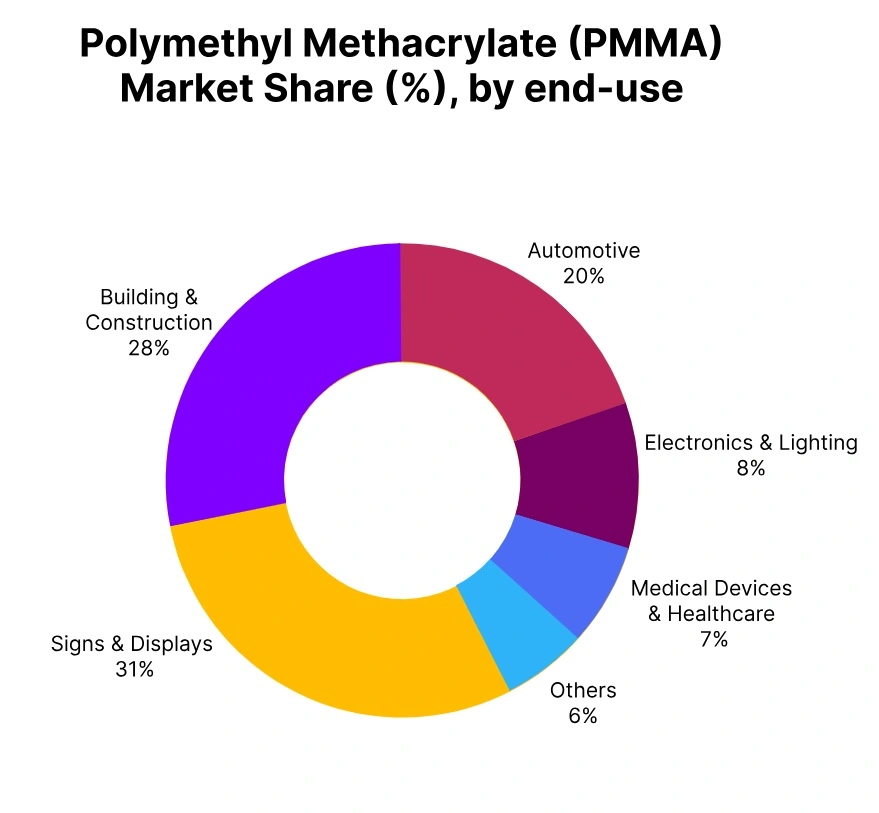

During Q3 of 2025, PMMA price trends have been reported to decline in most key regions as prices have fallen consistently due to lower demand in sectors including automotive, construction, and electronics. PMMA prices have been affected by economic slowdowns, which resulted in lower purchasing across regions.

Global supply has remained relatively consistent, but PMMA prices have shown that demand was not increasing as anticipated, resulting in downward pressure. PMMA price trends have been notably noticeable in China and Saudi Arabia, which have seen weak PMMA demand. Overall, PMMA price trends have indicated a market facing oversupply and low demand, contributing to the price reductions.

China: PMMA Export prices Ex-Shanghai, China, Grade, General Purpose Injection Moulding Natural (MFI: 1.5-1.9).

According to the PriceWatch, in China, it has been observed that PMMA export prices fell by 7.4% in Q3 2025, one of the most dramatic decreases during the quarter. PMMA price trends in China have been shaped by weakening demand from sectors, including automotive, electronics, and packaging, which all were slow to procure.

As the global economic environment continued to strain local demand in the region, the PMMA price trend subsequently moved downward keeping prices pressured downward as well. And while supply has remained steady, the PMMA price trend reflected a market experiencing difficulty with insufficient demand and excess supply, causing significant price reductions.

In September 2025, PMMA price in China had decreased 0.4% as the domestic market remained soft with muted downstream activity. Continued lack of strength in both construction and electronics limited buying interest; major producers’ inventories had increased slightly.

India: PMMA Imported prices CIF Nhava Sheva, India from South Korea, Grade, General Purpose Injection Moulding Natural (MFI: 2.3-5.7).

According to the PriceWatch, in India, PMMA imported prices have fallen by -1.7% in Q3 2025. The PMMA price trend in India has been slightly more stable compared to other regions, with a modest decline in prices. The PMMA price trend in India has been influenced by weaker demand from key sectors such as packaging and construction.

While the market has remained somewhat resilient, the PMMA price trend has shown that procurement has not been as strong as expected. The PMMA price trend in India has reflected a global slowdown, with local demand showing only minimal growth.

However, in September 2025, PMMA prices in India have increased by 0.7% as limited export volumes and steady Indian demand supported the price uptrend. Indian converters and distributors have engaged in restocking ahead of seasonal demand, leading to higher offtake rates.

The slight increase in prices was supported by continued FOB offers from producers in South Korea and moderate domestic demand from the automotive and appliance sectors in India. Indian buyers have continued to demonstrate interest in replenishing inventories ahead of the holidays, which has contributed to a balanced trade activity.

Saudi Arabia: PMMA Export prices FOB Jeddah, Saudi Arabia, Grade General Purpose Injection Moulding Natural (MFI: 2).

According to the PriceWatch, in Saudi Arabia, PMMA export prices have dropped by 4.1% in Q3 2025. The PMMA price trend in Saudi Arabia has been mainly driven by weaker demand from sectors like construction and automotive. The PMMA price trend has continued to decline as industrial activity in the region has remained slower than anticipated, leading to reduced procurement.

Despite stable supply, the PMMA price trend in Saudi Arabia has shown the impact of reduced purchasing activity, particularly from key buyers in the Middle East. In September 2025, PMMA prices in Saudi Arabia have decreased by 0.3% as regional market fundamentals softened slightly. The decline has been attributed to subdued export demand from Asia and consistently strong domestic demand that has not led to tight supply conditions.

The feedstock MMA prices have remained broadly stable and have not provided much support to producers on the cost side. Weaknesses in downstream demand from the construction and automotive sectors, and light manufacturing, has also occurred as job completion for projects has started to slow.

South Korea: PMMA Export prices FOB Busan, South Korea, Grade General Purpose Injection Moulding Natural (MFI: 2.3-5.7).

In the South Korean market, PMMA (Polymethyl Methacrylate) export prices have been down by 4.0% in Q3 2025. The PMMA price trend in South Korea has weakened significantly as demand from key industries, such as automotive and electronics, has slowed in procurement activity. As a result of stagnating industrial output levels, PMMA price trend continued its declines through Q3 2025.

In consideration of month-on-month outcomes, PMMA price trend notably reflects the impacts of the prevailing global economic uncertainty and subdued demand even with stable industrial production. In the Chinese PMMA prices have decreased by 0.8% in September 2025, also reflecting weak downstream demand against lethargic export activity. Key consuming segments (automotive, electronics, construction) have all slowed impacting market sentiment advertising additional inventories furthering pressure on producers.