Price-Watch’s most active coverage of Polypropylene Glycol (PPG) price assessment:

- Molecular Weight 1000 _Viscosity 135-165 FOB Busan, South Korea

- Molecular Weight 1000 _Viscosity 135-165 FOB Laem Chabang, Thailand

- Molecular Weight 1000 _Viscosity 135-165 CIF Nhava Sheva (South Korea), India

- Molecular Weight 1000 _Viscosity 135-165 CIF Melbourne (South Korea), Australia

- Molecular Weight 1000 _Viscosity 135-165 CIF Hamburg (South Korea), Germany

- Molecular Weight 1000 _Viscosity 135-165 CIF Jeddah (South Korea), Saudi Arabia

- Molecular Weight 1000 _Viscosity 135-165 CIF Mersin (South Korea), Turkey

- Molecular Weight 1000 _Viscosity 135-165 CIF Houston (South Korea), USA

Polypropylene Glycol (PPG) Price Trend Q3 2025

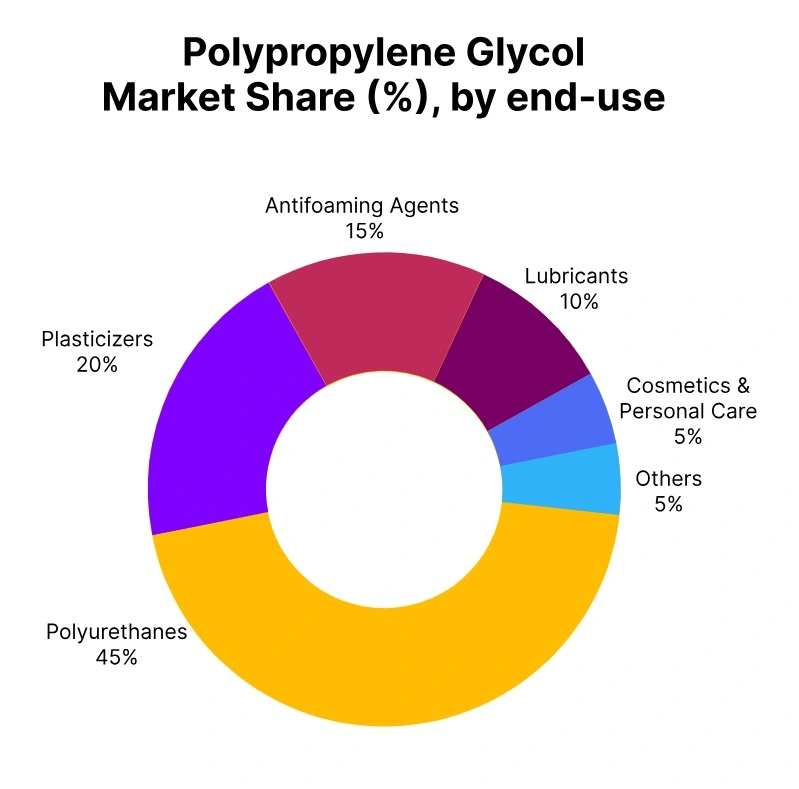

In Q3 2025, the global Polypropylene Glycol (PPG) market saw a price decline of 2-3% from Q2, driven by reduced demand from key sectors like polyurethane foams and coatings. Oversupply from major producers, particularly in Asia, and weaker consumption in end-use applications such as plasticizers and lubricants contributed to the drop.

Despite stable feedstock and energy prices, the market faced inventory destocking and lower industrial activity. A recovery is expected in Q4, depending on demand from industries like automotive and construction.

South Korea: Polypropylene Glycol (PPG) export prices FOB Busan, South Korea, Grade- Molecular Weight 1000 _Viscosity 135-165.

In Q3 2025, Polypropylene Glycol prices in South Korea dipped by 1.42% compared to Q2 2025. Polypropylene Glycol price trend in South Korea was influenced by less demand from key sectors like automotive and coatings, which faced slower production. Though production remained stable, oversupply conditions and rising freight costs contributed to the price decline.

The reduction in demand from downstream industries further pressured prices. Polypropylene Glycol prices in September 2025 in South Korea went on to show a downward trend. The outlook for Q4 2025 suggests that prices may remain volatile, based on recovery in downstream industries and global supply chain adjustments.

Thailand: Polypropylene Glycol (PPG) export prices FOB Laem Chabang, Thailand, Grade- Molecular Weight 1000 _Viscosity 135-165.

In Q3 2025, Polypropylene Glycol prices in Thailand decreased by 1.00% compared to Q2 2025. Polypropylene Glycol price trend in Thailand was influenced by reduced demand from industries such as automotive and chemical production, which faced slowdowns in activity. Freight costs also saw a slight increase, adding additional pressure to prices.

In spite of stable production levels, the market faced oversupply conditions, contributing to the price reduction. Polypropylene Glycol prices in September 2025 in Thailand remained on a downward trend, influenced by continued softness in demand. Moving forward, prices are anticipated to stay under pressure unless there is a pickup in industrial demand.

India (CIF from South Korea): Polypropylene Glycol (PPG) Import prices CIF Nhava Sheva, India, Grade- Molecular Weight 1000 _Viscosity 135-165.

According to Price-Watch, in Q3 2025, Polypropylene Glycol prices in India reduced by 0.39% compared to Q2 2025. Polypropylene Glycol price trend in India was impacted by less demand from key sectors such as pharmaceuticals and coatings, which faced slowdowns due to global supply chain disruptions.

Despite stable feedstock costs, rising freight charges and oversupply conditions contributed to the price decline. Polypropylene Glycol prices in September 2025 in India stayed lower, reflecting the weaker demand and ongoing logistical challenges. The outlook for Q4 2025 suggests a continued downward trend, with demand pressure from key industries and possible inventory destocking.

Australia (CIF from South Korea): Polypropylene Glycol (PPG) Import prices CIF Melbourne, Australia, Grade- Molecular Weight 1000 _Viscosity 135-165.

In Q3 2025, Polypropylene Glycol prices in Australia decreased by 0.13% compared to Q2 2025. Polypropylene Glycol price trend in Australia was impacted by stable demand from the coatings and chemical sectors, though market softness and rising freight costs led to a minimal price reduction.

The slower production in significant downstream industries, coupled with supply chain disruptions, kept price movement subdued. Polypropylene Glycol prices in September 2025 in Australia stayed stable with a slight decline. The outlook for Q4 2025 indicates that prices will likely remain stable unless there is a significant shift in demand from key sectors.

Germany (CIF from South Korea): Polypropylene Glycol (PPG) Import prices CIF Hamburg, Germany, Grade- Molecular Weight 1000 _Viscosity 135-165.

In Q3 2025, Polypropylene Glycol prices in Germany went up by 0.97% compared to Q2 2025. Polypropylene Glycol price trend in Germany was driven by consistent demand from the pharmaceutical and coatings sectors, which helped maintain production levels. The price increase was influenced by rising feedstock costs, particularly propylene, and higher transportation costs.

Polypropylene Glycol prices in September 2025 in Germany stayed on an upward trajectory, reflecting strong demand and limited supply. The market outlook for the next quarter suggests moderate price increases, supported by demand in key industries and feedstock cost pressures.

Saudi Arabia (CIF from South Korea): Polypropylene Glycol (PPG) Import prices CIF Jeddah, Saudi Arabia, Grade- Molecular Weight 1000 _Viscosity 135-165.

In Q3 2025, Polypropylene Glycol prices in Saudi Arabia decreased by 1.85% compared to Q2 2025. Polypropylene Glycol price trend in Saudi Arabia was impacted by less demand from key industrial sectors, including automotive and coatings, which faced production slowdowns. Rising freight costs and supply chain disruptions added to the downward pressure on prices.

Polypropylene Glycol prices in September 2025 in Saudi Arabia remained lower, following the overall trend of weaker demand. The outlook for Q4 2025 remains cautious, with prices expected to remain under pressure unless there is a comeback in demand from key downstream industries.

Turkey (CIF from South Korea): Polypropylene Glycol (PPG) Import prices CIF Mersin, Turkey, Grade- Molecular Weight 1000 _Viscosity 135-165.

In Q3 2025, Polypropylene Glycol prices in Turkey dipped by 2.04% compared to Q2 2025. Polypropylene Glycol price trend in Turkey was driven by reduced demand from the automotive and coatings sectors, which saw slowdowns in production. Freight costs, although rising slightly, added additional pressure on the market, adding to the price decrease.

Polypropylene Glycol prices in September 2025 in Turkey stayed on a downward trend, reflecting the ongoing market softness. The outlook for Q4 2025 suggests potential continued price pressure unless demand from key sectors improves and supply chain issues ease.

USA (CIF from South Korea): Polypropylene Glycol (PPG) Import prices CIF Houston, USA, Grade- Molecular Weight 1000 _Viscosity 135-165).

In Q3 2025, Polypropylene Glycol prices in the USA went down by 3.00% compared to Q2 2025. Polypropylene Glycol price trend in the USA was influenced by slower demand from the automotive and chemical sectors, which slowed production. The rising freight costs and continued supply chain disruptions further added to the price reduction.

Polypropylene Glycol prices in September 2025 in USA were lower, following the market’s overall downward trend. The outlook for Q4 2025 remains uncertain, with prices likely to stay under pressure unless demand picks up in key downstream industries.