Price-Watch’s most active coverage of Polypropylene (PP) price assessment:

- Impact Copolymer Injection Moulding Grade (MFR: 12) FOB Houston, USA

- Impact Copolymer Injection Moulding Grade (MFR: 12) CIF Manzanillo (USA), Mexico

- Impact Copolymer Injection Moulding Grade (MFR: 12) CIF Montreal (USA), Canada

- Impact Copolymer Injection Moulding Grade (MFR: 12-30) FD Hamburg, Germany

- Homo-polymer Injection Moulding Grade (MFR: 12-30) FD Hamburg, Germany

- Impact Copolymer Injection Moulding Grade (MFR: 12-30) FD Antwerp, Belgium

- Homo-polymer Injection Moulding Grade (MFR: 12-30) FD Antwerp, Belgium

- Impact Copolymer Injection Moulding Grade (MFR: 12-30) FD Le Havre, France

- Homo-polymer Injection Moulding Grade (MFR: 12-30) FD Le Havre, France

- Impact Copolymer Injection Moulding Grade (MFR: 12) FOB Jeddah, Saudi Arabia

- Impact Copolymer Injection Moulding Grade (MFR: 12) CIF Shanghai (Saudi Arabia), China

- Impact Copolymer Injection Moulding Grade (MFR: 12) CIF Nhava Sheva (Saudi Arabia), India

- Homo-polymer Injection Moulding Grade (MFR: 11) Ex-Ahmedabad, India

- Impact Copolymer Injection Moulding Grade (MFR: 12) Ex-Ahmedabad, India

- Homo-polymer Injection Moulding Grade (MFR: 12) FOB Houston, USA

- Impact Copolymer Injection Moulding Grade (MFR: 12) CIF Santos (USA), Brazil

- Homo-polymer Injection Moulding Grade (MFR: 12) CIF Santos (USA), Brazil

- Raffia Grade (MFR: 3±0.5) Ex-Fujian, China

- Homo-polymer Injection Moulding Grade (MFR: 11) FOB Jeddah, Saudi Arabia

- Raffia Grade (MFR: 3) FOB Jeddah, Saudi Arabia

- Homo-polymer Injection Moulding Grade (MFR: 11) CIF Shanghai (Saudi Arabia), China

- Raffia Grade (MFR: 3) CIF Shanghai (Saudi Arabia), China

- Homo-polymer Injection Moulding Grade (MFR: 11) CIF Nhava Sheva (Saudi Arabia), India

- Raffia Grade (MFR: 3) CIF Nhava Sheva (Saudi Arabia), India

- Raffia Grade (MFI: 3.3) Ex-Ahmedabad, India

- Raffia Grade (MFI: 3.3) Ex-West India, India

- Homo-polymer Injection Moulding Grade (MFR: 11) Ex-West India, India

- Impact Copolymer Injection Moulding Grade (MFR: 12) Ex-West India, India

Polypropylene (PP) Price Trend Q3 2025

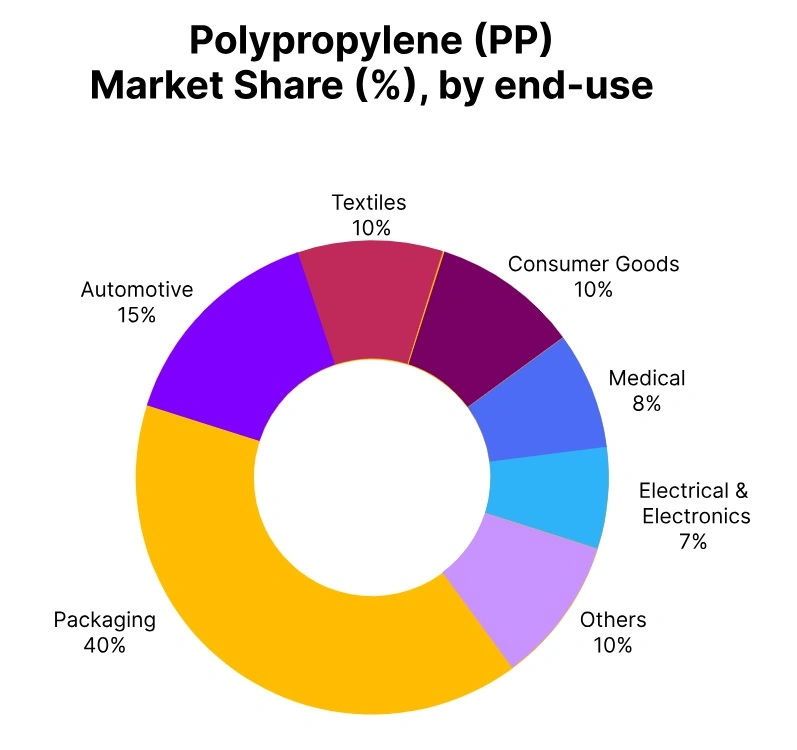

Global Polypropylene pricing has exhibited a broad-based decline across regions in Q3 2025 with softer demand and economic uncertainty driving prices lower. Weak demand from key industries like automotive and packaging has weighed on the US pricing trend in Houston, resulting in a relatively small decrease of 4.7%. Similarly, the pricing trend in Mexico and Canada has shown a downward shift driven by oversupply and reduced procurement activity.

The trend in Europe shows a decline across the pricing in Germany, Belgium, and France, reflecting reductions in the key licensing sectors and increased competition from imports. Saudi Arabia experienced a relatively brief, initial increase in polypropylene pricing trend related to strong demand across the region, while by September polypropylene prices have begun showing mixed results with a decline of 2.5%.

In both India and Brazil, the pricing trend continues to be weak due to cautious buying and limited restocking behaviours. In addition, the trend in China has declined with reduced demand from construction and packaging, adding pressure to the continued global bearishness in the overall markets.

United States: Polypropylene (PP) Export prices FOB Houston, USA, Impact Copolymer Injection Moulding Grade (MFR: 12).

According to PriceWatch, in the third quarter of 2025, the price of polypropylene in the USA, saw a decrease of 4.7%, with prices ranging between USD 1,050 and USD 1,100 per metric ton. Polypropylene prices in the US have declined following diminished demand from key end-user industries (automotive, packaging), which are scaling back consumption across the region.

As there have been uncertainties in the economy, buyers have postponed purchases and acted with extreme caution in their procurement of polypropylene. The influx of imports into the market have been contributing to the weakened price trend in polypropylene. Polypropylene price in the US continued its decline throughout September 2025, falling a further 3.6% due in part to feedstock propylene dropping more than 5% and less cost support.

Together with pervasive weak demand globally, and reduced downstream consumption, the polypropylene price trend slid lower as demand continued to soften. Overall, the polypropylene price trend has been considerably weaker, as buyers remain passive and the overall sentiment is bearish in the market due to oversupply and sluggish demand conditions.

Mexico: Polypropylene (PP) Import prices CIF Manzanillo, Mexico from USA, Impact Copolymer Injection Moulding Grade (MFR: 12).

In the third quarter of 2025, the polypropylene price trend in Mexico reduced by 4.4%, impacted by lower demand from automotive and packaging industries. The polypropylene price trend has been pressured downward by relatively large supply from suppliers based in the USA, whose supply levels have induced buyers to delay purchases.

Global oversupply levels have also had an effect on polypropylene pricing trends, with an overall weaker downstream demand contributing to lighter market conditions. Economic uncertainty and cautious purchasing behaviour have also contributed to supporting downward pressure on the polypropylene price trend.

In September 2025, the prevailing prices of polypropylene in Mexico fell further 3.5%, with responses to lower pricing from imports from the United States and weak demand in downstream domestic industries. Decreased consumption and no appreciable restocking have also contributed to the broader weak polypropylene price trend.

More generally, the polypropylene pricing trend remains softer in Mexico overall, with buyers not taking significant action, and with decreased market activity contributing to the bearish sentiment experienced to close the quarter.

Canada: Polypropylene (PP) Import prices CIF Montreal, Canada from USA, Impact Copolymer Injection Moulding Grade (MFR: 12).

In Q3 2025, the polypropylene price trend in Montreal, Canada, has declined by 3.7%, with weaker demand from automotive and packaging sectors driving the trend downward. The PP price trend has been pressured by competitively priced imports from the USA, which have increased market competition and limited domestic price growth. Canadian buyers have been remaining cautious, delaying large orders, and thereby affecting the polypropylene price trend.

In September 2025, the polypropylene prices in Canada has continued its decline by 3.2%, as imports from the USA and other overseas regions have entered the market at lower costs. Reduced downstream consumption and weak global demand have further influenced the polypropylene price trend, creating a bearish market environment. Overall, the PP prices in Canada has reflected softness, constrained by cautious procurement, limited restocking, and oversupply conditions, resulting in sustained downward pressure on prices.

Germany: Polypropylene (PP) Domestically Traded prices FD Hamburg, Germany, Impact Copolymer Injection Moulding Grade (MFR: 12-30).

In Q3 2025, the PP price trend in Hamburg, Germany, has declined by 5.0%, driven by soft demand from key sectors such as automotive and packaging. The polypropylene price trend has been under pressure due to persistent oversupply in the European market, with buyers hesitating to place large procurement orders. Global economic uncertainty and cautious purchasing behavior have further influenced the polypropylene price trend, keeping the market subdued.

In September 2025, the PP prices in Germany has continued to decline by 2.0%, as weak demand has failed to trigger typical seasonal restocking, and oversupply has remained a key factor. Despite stable upstream feedstock availability, the PP price trend has been affected by limited downstream consumption and subdued market sentiment. Overall, the polypropylene price trend in Germany has shown ongoing softness, with the market facing persistent bearish pressure and restrained buyer activity throughout Q3 2025.

Belgium: Polypropylene (PP) Domestically Traded prices FD Antwerp, Belgium, Impact Copolymer Injection Moulding Grade (MFR: 12-30).

In Q3 2025, the PP price trend in Antwerp, Belgium, has declined by 5.1%, as demand from automotive and packaging industries has weakened. The polypropylene price trend has been influenced by imports from the USA and Asia, which have increased competition and limiting local price growth. Buyers have been remaining cautious, deferring procurement, which has further put downward pressure on the polypropylene price trend.

In September 2025, the polypropylene prices in Belgium has continued its decline by 2.0%, with weak demand preventing seasonal restocking and persistent oversupply pressuring prices. Subdued buying activity and uncertainty regarding future demand have further affected the PP price trend. Overall, the PP price trend in Belgium has shown sustained softness, with the market sentiment remaining bearish and procurement activity limited, reinforcing the downward trajectory observed throughout Q3 2025.

France: Polypropylene (PP) Domestically Traded prices FD Le Havre, France, Impact Copolymer Injection Moulding Grade (MFR: 12-30).

In Q3 2025, the polypropylene price trend in France, particularly in Le Havre, has declined by 4.9%, as demand from major industries such as packaging and automotive has softened. The PP price trend has been pressured by competitive international pricing, with buyers adopting a more conservative approach and deferring procurement.

The availability of imported polypropylene from other regions has been increasing market competition, which has further constrained the PP price trend. In September 2025, the PP prices in France have continued its downward movement by 1.9%, as weak demand has failed to trigger usual seasonal restocking, and oversupply has remained a persistent factor.

Subdued buying interest and cautious procurement behaviour have also influenced the PP price trend. Overall, the PP price trend in France has shown consistent softness, with bearish sentiment dominating the market and limited recovery observed throughout Q3 2025, as market participants have remained hesitant to commit to large purchases.

Saudi Arabia: Polypropylene (PP) Export prices FOB Jeddah, Saudi Arabia, Impact Copolymer Injection Moulding Grade (MFR: 12).

According to PriceWatch, in Q3 2025, the PP price trend in Saudi Arabia, particularly in Jeddah, has increased by 4.2%, as regional and export demand from Middle Eastern and African markets has supported prices. The PP price trend has been strengthened by limited competition in the local market, allowing producers to secure higher prices.

Strong demand from key sectors and consistent regional procurement have kept the PP price trend on a positive trajectory. In September 2025, however, the PP prices in Saudi Arabia have decreased by 2.5%, as weaker global demand and slower procurement activity have been putting downward pressure on prices.

Increased import competition and limited domestic buying interest have been influencing the PP price trend, partially reversing gains observed earlier in the quarter. Overall, the PP price trend in Saudi Arabia has shown mixed behaviour, with rising trends during early Q3 being offset by weaker market activity and cautious buying in September, reflecting temporary softness.

India: Polypropylene (PP) Domestically Traded prices Ex-Ahmedabad, India, Impact Copolymer Injection Moulding Grade (MFR: 12).

According to PriceWatch, in Q3 2025, the PP price trend in India, particularly in Ahmedabad, has declined by 1.2%, as weak demand from automotive and consumer goods sectors has been limiting procurement activity. The price trend of polypropylene (PP) in India has been shaped by stable domestic supply and competition from imported PP, which has limited any upside price potential.

Demand has continued to keep buyers cautious with their orders and further affected PP price trends. PP prices in India have fallen 4.1% in September 2025, aligned to poorly performing domestic demand and competitive pricing from US-origin PP which further pressured prices lower too.

The PP price trend has been affected by reduced restocking and a steady level of lower demand continuing into August 2025 contributing to its bearish factors in the trends of last few months. All in all, PP price trends are illustrative of a continued soft state throughout Q3, with buyer caution shown by demand, a stable domestic supply and imported PP maintaining a competitive presence to base floor values.

Brazil: Polypropylene (PP) Import prices CIF Santos, Brazil from USA, Impact Copolymer Injection Moulding Grade (MFR: 12).

The price trend of polypropylene (PP) in the Q3 2025 Brazil market, particularly in Santos, decreased by 3.9% since weakening domestic demand from the packaging and automotive sectors curtailed procurement, which contributed to lower polypropylene price trends. Competitive imports from the USA have also weighed on the PP price trend in Brazil, as weak domestic demand limited the ability to push the local PP price trend higher.

Due to this weak domestic demand for PP, buyers continued to be cautious and focused on smaller volumes of procurement in Q3 2025, which also contributed to lower PP price trends. For September 2025, Brazilian polypropylene prices continued to decline at a rate of 3.7% due to weaker global demand and oversupply conditions that have limited buyers’ willingness to purchase PP.

These PP price trends have also led the price for Polypropylene Impact Copolymer Injection Moulding Grade in Brazil to reflect more of a downward price movement, while also exhibiting reduced restocking and weakened buying interest due to less procurement from consumer end-users.

Overall, the PP price trend in Brazil has displayed of solid softness and has limited pricing momentum, throughout Q3 – 2025. This was due to market participants remaining cautious, and even though there may have been limited procurement, the competition from imports always looms.

China: Polypropylene (PP) Domestically Traded prices Ex-Fujian, China, Impact Copolymer Injection Moulding Grade (MFR: 12).

In Q3 2025, the PP prices in China, particularly in Fujian, has declined by 1.1%, as demand from packaging and construction sectors has been weakening. The PP price trend in China has been pressured by limited domestic consumption and the availability of imported material, which has increased competition and constrained local pricing.

Despite stable production levels, the polypropylene price trend has been remaining soft due to subdued downstream demand. In September 2025, PP prices in China have declined by 1.6%, as weak global demand has outweighed short-term supply disruptions caused by plant shutdowns across producers like Sinopec Henan Refining and Chemical.

Reduced procurement from downstream industries has also been influencing the PP price trend, creating a bearish environment. Overall, the PP price trend in China has shown consistent softness throughout Q3 2025, with cautious buying, oversupply, and competitive imports contributing to sustained downward pressure on prices.