Price-Watch’s most active coverage of Sodium Tripolyphosphate (STPP) price assessment:

- IG (94% min) FOB Shanghai, China

- IG (94% min) CIF Jakarta, Indonesia

- IG (94% min) CIF (Laem Chabang), Thailand

- IG (94% min) CIF Santos, Brazil

- IG (94% min) CIF Nhava Sheva, India

- IG (94% min) Ex-Mumbai, India

Sodium Tripolyphosphate (STPP) Price Trend Q3 2025

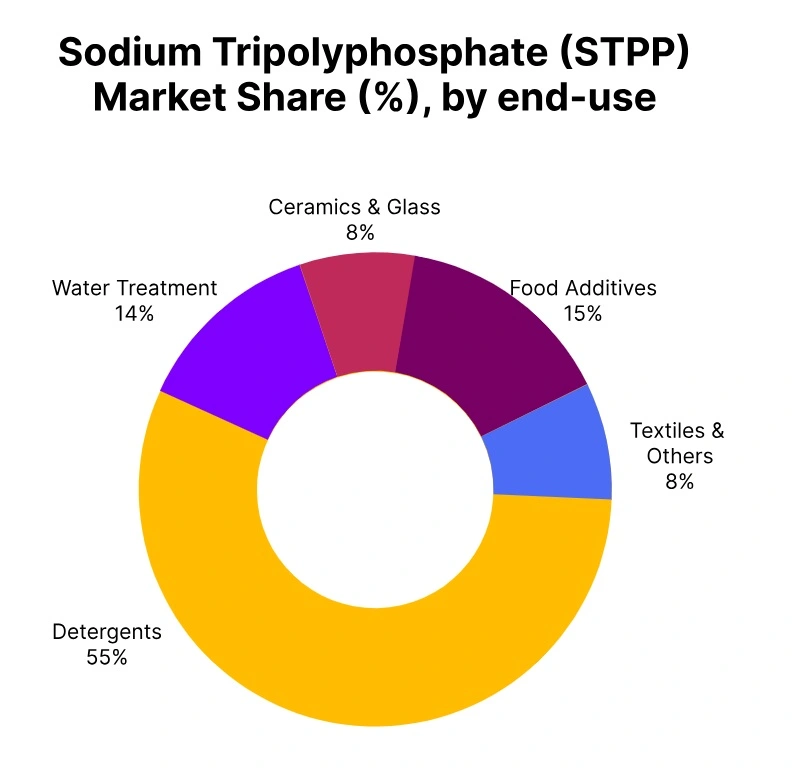

In Q3 2025, the global Sodium Tripolyphosphate (STPP) price trend continued an upward trajectory, driven by a combination of rising raw material costs, firm demand from the detergent and ceramics industries, and regional supply tightness. The Sodium Tripolyphosphate (STPP) price increased across key export hubs such as China and other Asian countries, supported by higher input costs for phosphorus-based chemicals and continued energy price volatility.

While environmental regulations and production curbs in China further constrained output, contributing to tighter availability in the international market. By September, the price in many importing regions, including Southeast Asia, Africa, and South America, had risen steadily, reflecting higher FOB values and, in some cases, increased shipping costs.

With no immediate relief in upstream pricing or significant capacity additions expected, the global Sodium Tripolyphosphate (STPP) price trend remains bullish heading into Q4, especially if demand holds firm in the cleaning and water treatment sectors.

China: Sodium Tripolyphosphate (STPP) Export prices FOB Shanghai, China, Grade- Industrial Grade (94% min).

In Q3 2025, the Sodium Tripolyphosphate (STPP) price trend for FOB China basis showed a 2.25% increase, supported by increased input costs and restricted supply. The Sodium Tripolyphosphate (STPP) price in China slowly firmed throughout the quarter, influenced by rising costs for phosphate rock and energy, as well as ongoing production constraints tied to environmental regulations.

By September, export offers from Chinese suppliers moved up as strong overseas demand particularly from Southeast Asia and parts of the Middle East met with tightening availability. While the price increase was moderate, it showed steady upward momentum, with the overall STPP price likely to remain elevated in the near term if supply limitations and cost pressures continue.

Indonesia: Sodium Tripolyphosphate (STPP) Import prices CIF Jakarta, Indonesia, Grade- Industrial Grade (94% min).

In Q3 2025, the Sodium Tripolyphosphate (STPP) price trend in Indonesia showed a modest 0.5% increase overall, despite a notable rise in STPP FOB prices from China. The Sodium Tripolyphosphate (STPP) price in Indonesia remained mostly steady due to a decline in ocean freight rates, which helped offset the upward pressure from higher export prices.

By September 2025, Sodium Tripolyphosphate (STPP) price in Indonesia had firmed due to costlier raw materials and tighter supply, but reduced shipping costs into Southeast Asia allowed importers in Indonesia to absorb most of the increase. As a result, the price movement in the local market was minimal, reflecting a stability between global supply-side inflation and improved logistics conditions.

Thailand: Sodium Tripolyphosphate (STPP) Export prices CIF Laem Chabang, Grade- Industrial Grade (94% min).

In Q3 2025, the Sodium Tripolyphosphate (STPP) price trend in Thailand basis saw a 2% increase, driven primarily by rising Sodium Tripolyphosphate (STPP) FOB prices from China and steady regional demand. The Sodium Tripolyphosphate (STPP) price in Thailand moved higher as Chinese suppliers raised export offers due to elevated raw material and energy costs, alongside tighter production conditions caused by ongoing environmental restrictions.

In September 2025, Sodium Tripolyphosphate (STPP) price in Thailand had impact on these cost increases became more visible in Thai import pricing, despite mostly stable freight rates. The overall price increase showed a combination of firm upstream pressure and resilient demand from the detergent and water treatment sectors, suggesting a cautiously bullish outlook heading into Q4.

Brazil: Sodium Tripolyphosphate (STPP) Import prices CIF Santos, Brazil, Grade- Industrial Grade (94% min).

In Q3 2025, the Sodium Tripolyphosphate (STPP) price trend in Brazil showed a 3.5% overall increase, primarily driven by a sudden rise in freight rates during the early part of the quarter. The Sodium Tripolyphosphate (STPP) price in Brazil moved higher as shipping costs from Asia surged unexpectedly due to tight vessel availability and logistical disruptions, pushing landed costs up despite relatively steady Sodium Tripolyphosphate (STPP) price in Brazil in September 2025.

However, as the quarter progressed, freight rates started to gradually decline, softly easing the pressure by September, though not enough to offset the earlier surge. As a result, importers in Brazil faced higher average costs for the quarter. The Sodium Tripolyphosphate (STPP) price outlook remains carefully firm, with freight volatility continuing to play a key role in shaping short-term market direction.

India: Sodium Tripolyphosphate (STPP) Import prices CIF Nhava Sheva, India, Grade- Industrial Grade (94% min).

According to Price-Watch, in Q3 2025, Sodium Tripolyphosphate (STPP) price trend in India experienced a 5% increase, primarily driven by rising STPP FOB prices from China and unfavorable movements in the USD/INR exchange rate. The Sodium Tripolyphosphate (STPP) price in India firmed significantly as Chinese exporters raised offers amid tighter supply and increased production costs, while the depreciation of the Indian Rupee against the U.S. Dollar further pushed up landed import costs.

In September 2025, Sodium Tripolyphosphate (STPP) price in India had the added factors resulted in higher prices for Indian importers, reflecting the strong influence of both upstream pricing dynamics and currency fluctuations. The overall price outlook stays firm, with continued upward pressure expected if raw material and currency trends persist.