The global benzene market in 2025 stands at a critical juncture, where price stability amid crude oil volatility reveals deeper structural shifts within the petrochemical industry. As one of the most fundamental building blocks in chemical manufacturing, benzene’s pricing trajectory carries implications far beyond its immediate derivatives, influencing strategic decisions across entire value chains. The current market environment, characterized by regional divergence and evolving demand patterns, demands a nuanced understanding of the forces shaping production costs, competitive positioning, and long-term industry sustainability.

The Paradox of Stability in Volatile Times

Perhaps the most striking feature of the 2025 benzene market is its relative price stability despite significant crude oil fluctuations. This resilience stems from deliberate supply-side management by producers who have learned from previous cycles that oversupply can devastate margins more severely than temporary supply constraints. The cautious approach to capacity expansion reflects a maturing industry that prioritizes sustainable profitability over volume growth.

This stability, however, masks underlying tensions. Benzene production through catalytic reforming and steam cracking inherently ties its economics to both gasoline and ethylene markets. As the automotive industry accelerates its transition toward electrification, gasoline demand projections continue their downward trajectory, potentially reducing benzene yields from refineries. Simultaneously, robust demand for ethylene-based products maintains steam cracker operations, but optimization toward lighter products could shift benzene availability. These countervailing forces create a delicate balance that producers must navigate with increasing sophistication.

The fact that styrene and phenol derivatives consume approximately two-thirds of global benzene production provides a stabilizing anchor. These downstream applications span critical sectors including packaging, construction, automotive components, and pharmaceuticals industries with relatively inelastic demand patterns. This structural support has prevented the price volatility that might otherwise emerge from crude oil swings, but it also means that any significant demand shock in these sectors would reverberate powerfully through benzene markets.

Regional Dynamics

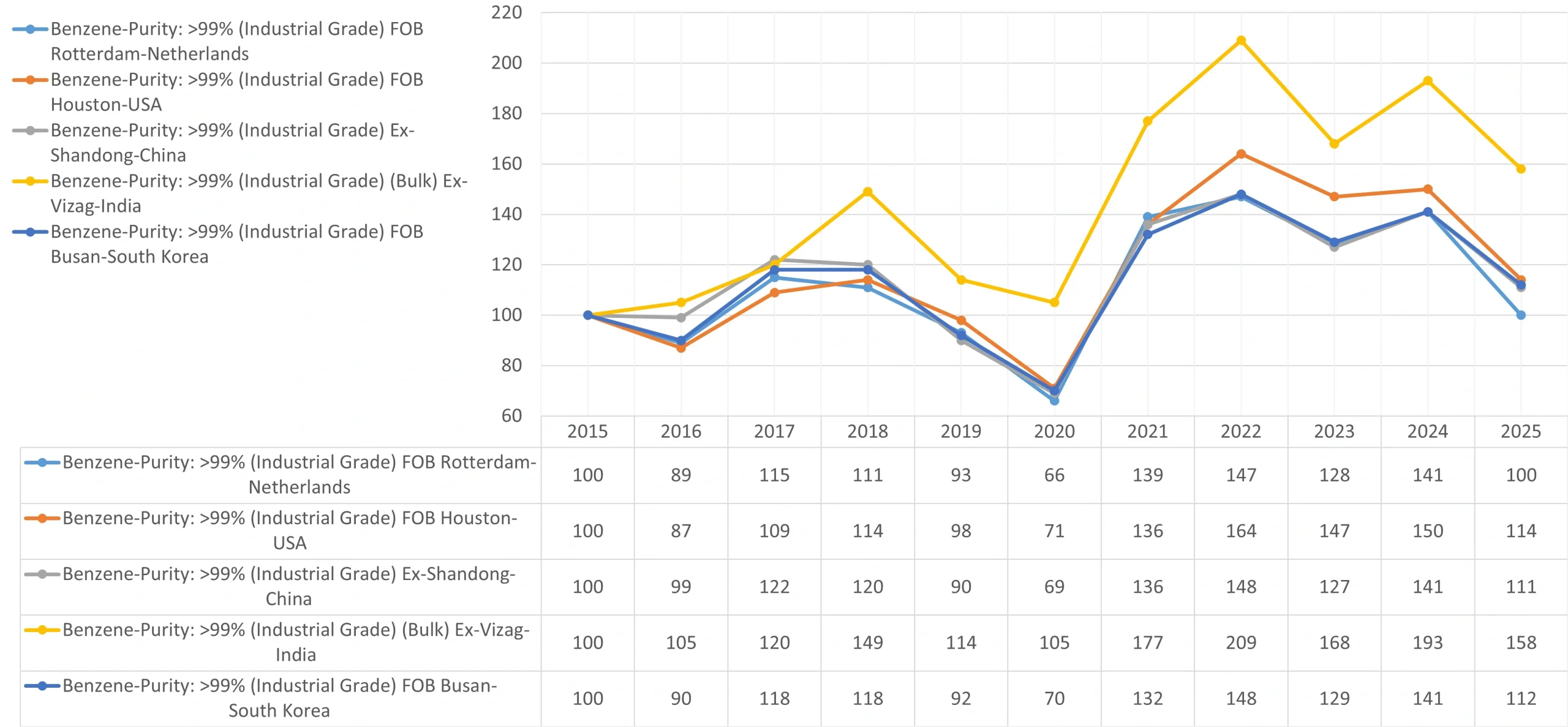

The benzene market’s regional fragmentation reveals distinct strategic challenges and opportunities. Asia Pacific, particularly China and India, dominates global consumption but faces divergent pressures. China’s benzene sector grapples with naphtha price volatility and inconsistent downstream demand, reflecting broader economic uncertainty and the ongoing transition away from infrastructure-led growth. The maturation of Chinese plastics and chemicals demand, while still substantial in absolute terms, no longer offers the explosive growth rates that previously characterized the market.

India presents a contrasting narrative. Anticipated tax reforms targeting appliances and vehicles signal government efforts to stimulate domestic consumption, which should indirectly bolster demand for benzene-adjacent chemicals like polypropylene and polyethylene. For benzene producers and traders, India represents a growth frontier where demographic dividends and urbanization trends support long-term demand expansion. However, India’s benzene market infrastructure remains less developed than China’s, creating both opportunities and execution risks for market entrants.

Europe’s benzene market contraction reflects deeper industrial malaise. Energy cost pressures, stemming from structural gas market changes and ambitious decarbonization targets, have eroded the competitiveness of European chemical production. The softening benzene prices in this region indicate oversupply relative to weakened industrial activity. Nevertheless, tariff adjustments with the United States on chemical precursors could provide some relief by improving export competitiveness. European producers must consider whether their long-term strategy emphasizes volume retention through improved cost positions or gradual capacity rationalization favoring higher-margin specialty derivatives.

North America, particularly the United States, exhibits mixed signals that reflect the region’s unique market structure. Strong export demand positions US producers to capture opportunities in global markets, but elevated crude prices and production costs compress margins. The shale revolution provided the US chemical industry with a feedstock advantage, but benzene production from steam crackers running on ethane yields less benzene than naphtha-based operations, creating periodic supply constraints that support prices. These dynamic benefits existing producers but complicates expansion decisions.

Downstream Cost Transmission and Strategic Positioning

The transmission of benzene price movements through downstream value chains illustrates the interconnected nature of petrochemical economics. Styrene producers, serving plastics and rubber applications, maintain relatively stable margins when benzene prices stabilize, but they remain vulnerable to demand fluctuations in end-use sectors like packaging and consumer durables. The moderate impact of benzene pricing on styrene production economics in 2025 has preserved industry profitability, but producers must remain vigilant about demand-side risks, particularly in consumer discretionary categories sensitive to economic cycles.

Cumene production for phenol and acetone, representing approximately twenty percent of benzene demand, benefits from steady cost bases when benzene prices remain range-bound. The criticality of phenol in adhesives and coatings applications with relatively stable industrial demand provides downstream buffer against volatility. However, cumene producers face strategic questions about capacity additions given the moderate growth outlook for traditional phenol applications and emerging competition from alternative production routes.

The aromatics complex, encompassing benzene, toluene, and xylenes, experiences shifting competitive dynamics as relative prices change. Paraxylene, the dominant xylene isomer used in polyester production, competes indirectly with benzene through feedstock allocation decisions at petrochemical complexes. As benzene prices stabilize, operators may adjust production slates to optimize margins across the aromatics pool, affecting relative supply positions and price spreads. This flexibility provides operational advantages but requires sophisticated market intelligence and nimble decision-making.

Strategic Imperatives for Industry Stakeholders

Looking forward, several strategic imperatives emerge for benzene market participants. First, geographic diversification of supply sources and customer bases can mitigate regional volatility and capture growth where it emerges. Companies with presences across Asia Pacific, Europe, and North America can optimize production allocations and trade flows in response to regional price differentials and demand patterns.

Second, investment in production flexibility and efficiency improvements will prove increasingly valuable. Technologies that allow rapid adjustments to production slates, minimize energy consumption, and reduce carbon intensity will provide competitive advantages as regulatory pressures intensify, and energy costs remain elevated in many regions. The document’s reference to cleaner production technologies and alternative feedstocks acknowledges this imperative, though implementation timelines and capital requirements remain substantial barriers.

Third, vertical integration strategies merit reassessment. Companies with positions across multiple stages of the benzene value chain can internalize margin volatility and optimize total system economics rather than focusing on individual transaction profitability. However, integration also reduces flexibility and can trap capital in lower-return assets, requiring careful evaluation of specific business contexts.

Fourth, risk management capabilities must evolve beyond traditional price hedging to encompass supply chain resilience, regulatory compliance, and sustainability positioning. As stakeholders across the value chain face increasing pressure to demonstrate environmental responsibility, benzene producers must articulate credible decarbonization pathways or risk customer and investor attrition.

Conclusion

The benzene market in 2025 presents a study in cautious stability amid transformative pressures. While prices have remained relatively steady, the forces shaping long-term supply and demand trajectories energy transition, regional economic divergence, feedstock evolution, and sustainability imperatives continue gathering momentum. Industry participants who recognize that current stability provides a window for strategic repositioning rather than a return to historical norms will be best positioned for success in the evolving petrochemical landscape. The ability to navigate complexity, maintain operational excellence, and anticipate structural change will increasingly differentiate market leaders from those left behind by industry transformation.