Upstream feedstocks are essential to the petrochemical industry, supporting the production of chemicals, plastics, and synthetic materials which are vital to everyday life. Historically, the main sources of these feedstocks have been: Crude Oil, Natural Gas, and Natural Gas Liquids (NGLs). Now, the industry is altering its course towards renewable energy sources, chemical recycling, and evolving energy needs keeping sustainability in the forefront.

As the global economy advances toward greater sustainability and efficiency, feedstocks play a pivotal role in determining a company’s competitiveness, environmental impact, and the long-term stability of the petrochemical industry.

Traditional Feedstocks: The Foundation of the Industry

Key Conventional Feedstocks

- Naphtha – This is obtained through the refining of Crude Oil and continues to be a key material used to make Ethylene, Propylene, and Aromatics such as Benzene. It is useful both as a feedstock for chemical production and as a fuel.

- Ethane and Propane – These are obtained from Natural Gas. Ethane is mainly used to produce Ethylene, while Propane is turned into Propylene and Propylene Oxide.

- Methane – This is the main part of Natural Gas and is important for making Ammonia (used in fertilizers) and Methanol (used in chemicals and fuels).

Price Trends & Dynamics

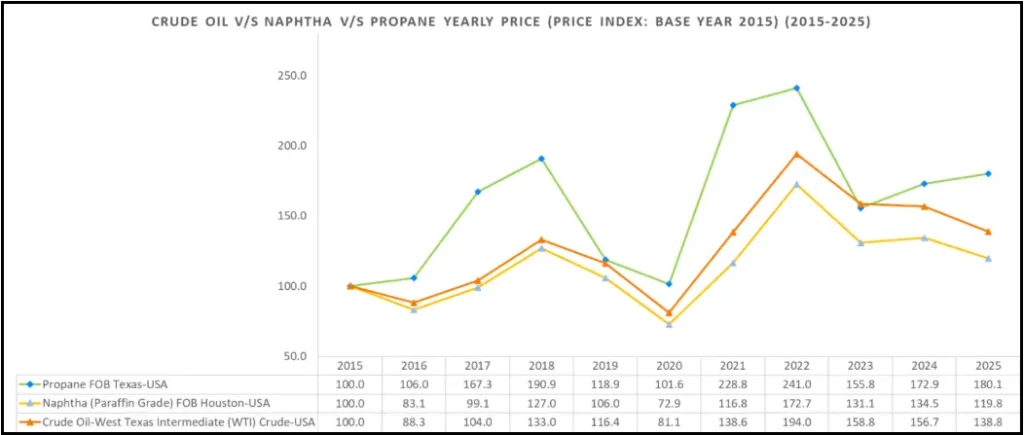

- Naphtha prices are closely linked to global Crude Oil movements. Their fluctuations are influenced by factors such as supply disruptions, political tensions, as well as changes in refining activities.

- Ethane and Propane have seen lower costs due to the U.S. shale revolution, making them more affordable in comparison to Naphtha in areas where Natural Gas is abundant.

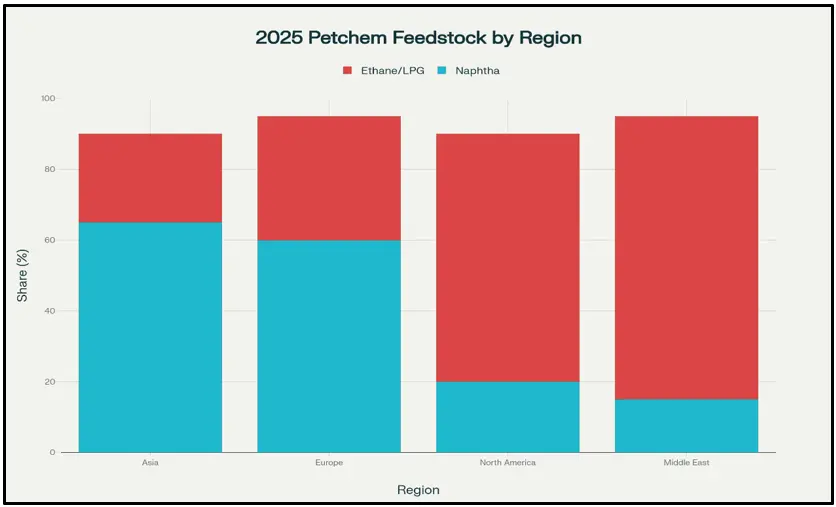

- Regional dependencies play a big role as Asia and Europe continue to rely heavily on Naphtha, while North America and the Middle East make greater use of Natural Gas.

The Shift Toward Alternative Feedstocks

The Rise of Shale Gas

The surge in shale gas production in the United States has significantly changed the global petrochemical industry. Ethane from shale gas has become the most cost-effective raw material for producing Ethylene. This gives North American manufacturers a strong advantage in international markets.

- The lower cost of Ethane compared to Naphtha has led to increased global investment in Ethane-based cracking facilities.

- The availability of shale gas reserves ensures a reliable supply of this feedstock for the coming decades.

Renewable & Bio-Based Feedstocks

Growing focus on sustainability is increasing the adoption of renewable feedstocks:

- Bioethanol, derived from Sugarcane, Corn, or Cassava, can be converted into Bio-Ethylene providing an environmentally friendly method for making plastics.

- Biomass sources such as Agricultural Waste, Algae, and Wood Chips are becoming more prominent, although their commercial use is still limited due to higher costs.

Chemical Recycling Closes the Loop

Advanced recycling technologies can transform plastic waste into materials that can be reused, helping to create a circular system for petrochemicals.

This approach helps reduce the waste going to landfills and oceans, while offering an alternative for materials derived from fossil fuels.

Economic & Environmental Impacts

Cost Competitiveness

The main factor affecting the profitability of petrochemicals are Feedstock costs.

- Shale Gas reduced production costs, which helps U.S. Ethylene compete globally.

- Bio-Based Feedstocks remain relatively more costly, yet they continue to appeal to consumers and regulators prioritizing sustainability. However, as production scales and technological advancements progress, the cost differential is expected to diminish over time.

Sustainability & Emissions

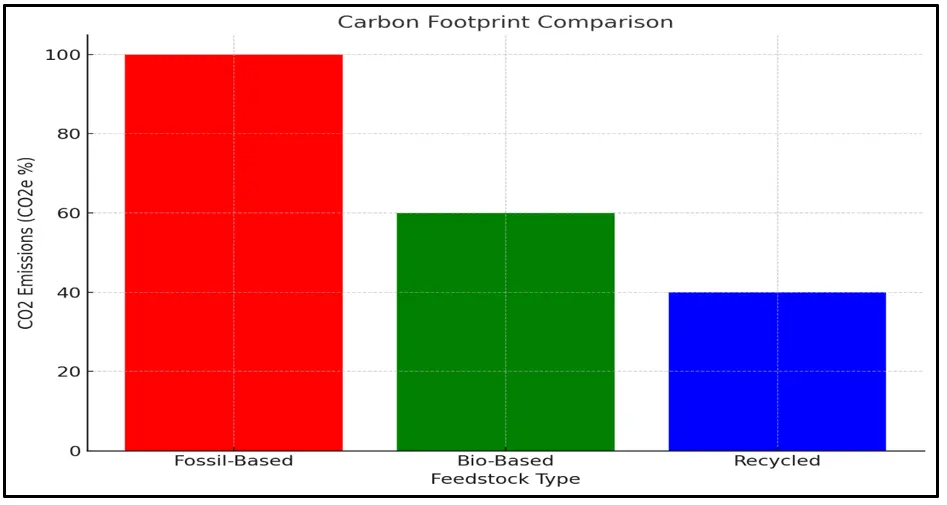

Fossil-based feedstocks are high in carbon, leading to significant emissions.

Renewable and Recycled Feedstocks lowers the carbon footprint and supports goals for net-zero emissions.

By 2050, fossil fuels may be utilized predominantly for product manufacturing rather than energy generation, making sustainable sourcing a critical component of corporate environmental strategy.

Feedstock Shifts & Petrochemical Production

Product Implications

- Ethylene & Propylene: The availability of abundant shale gas Ethane has boosted global Ethylene supply, leading to lower prices in North America.

- Plastics & Bioplastics: The use of renewable feedstocks has made bioplastics such as PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates) more viable. This has led to growing use in packaging and consumer products.

- Aromatics: The continued use of Naphtha ensures a steady production of Benzene and Toluene in Asia and Europe.

Market Volatility

- Prices for feedstocks and petrochemicals are highly influenced by:

- Fluctuations in Crude Oil prices

- Disruptions in regional supply chains

- Changes in the balance between gas-based and liquid-based feedstock usage.

Future Direction: Innovation and Transition

Emerging Technologies

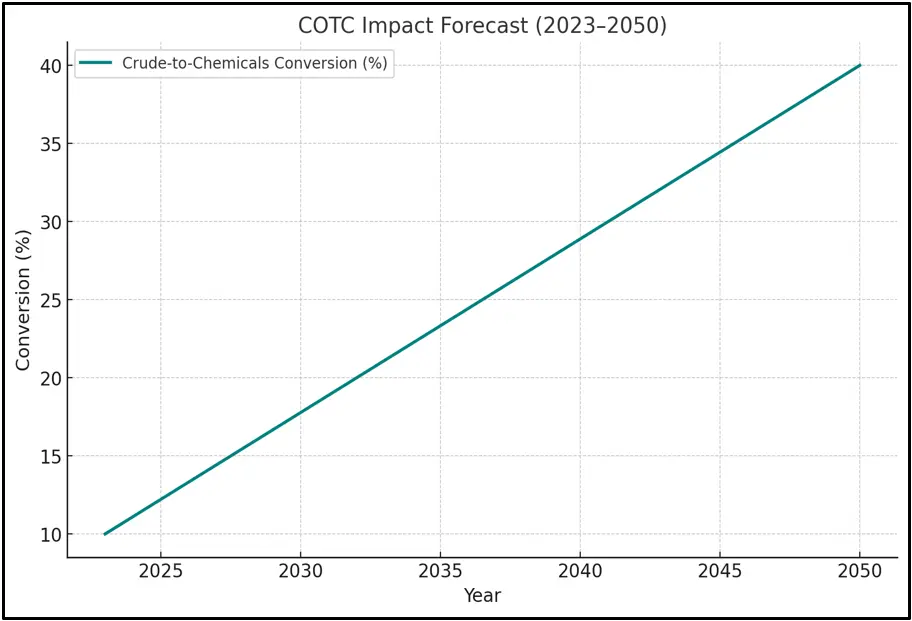

Crude Oil-To-Chemicals (COTC): New large-scale integrated facilities have the capability to convert up to 40% of Crude Oil directly into chemicals. This is significantly higher than the 10–15% conversion rate noted in conventional refineries. This approach is expected to address potential shortages of feedstock in the future.

Biomass Conversion and Chemical Recycling are to broaden the range of available feedstock sources while helping to reduce the environmental impact of the industry.

Long-Term Price Trends

- Shale Gas Feedstocks: Prices for Ethane and Propane are likely to stay low in the near future, although growth in production is expected to slow down after the year 2030.

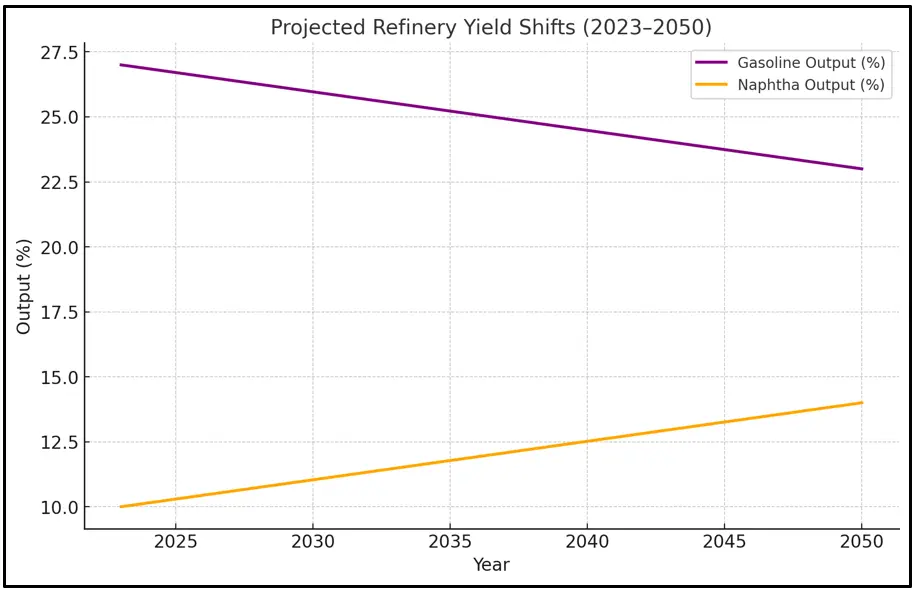

- Naphtha: As demand for fuels decreases, supply of Naphtha may be limited further. However, refineries are expected to change their operations to increase Naphtha output, which should aid in closing the supply gap.

- Bio-Based Feedstocks: With the continued scaling up of production and improvements in technology, the costs of producing bio-based feedstocks are expected to decrease, making them more competitive by the year 2040.

Navigating The Future of Feedstocks

The petrochemical industry stands at a pivotal juncture. While traditional feedstocks like naphtha and natural gas continue to underpin production, the growing adoption of shale gas, renewable alternatives, and chemical recycling is reshaping the sector’s dynamics. Future competitiveness will hinge on strategic access to feedstock sources, the integration of sustainability through bio-based and recycled materials, and technological innovations such as Crude Oil-to-Chemicals, advanced recycling, and biomass conversion.

In this era of transformation, upstream feedstocks are not merely inputs, they are central to achieving cost efficiency, environmental stewardship, and long-term sustainable growth.

![Chart: Ethylene v/s Propylene v/s Benzene [Price Index: Base Year 2015] (2015-2025)](https://www.price-watch.ai/wp-content/uploads/2025/08/ethylene-vs-propylene-vs-benzene-price-index-2015-2025-1024x430.webp)