The packaging industry stands at a pivotal moment where environmental responsibility meets business strategy. As the world grapples with mounting plastic waste concerns, global corporations are no longer viewing recycled plastics as merely an environmental initiative they’re embracing them as a core business strategy that delivers both sustainability credentials and competitive advantages.

The global plastics industry represents a massive economic engine, generating over USD 432 billion in shipments annually and supporting more than 1 million jobs across nearly 16,000 facilities in the United States alone. Yet this industry faces an unprecedented transformation as mounting environmental pressures and regulatory mandates drive a fundamental shift from linear to circular business models.

Recycling has evolved from a simple environmental practice into a catalyst for industrial transformation. The recycling sector itself contributes USD 6 billion to the U.S. economy and supports around 30,000 jobs, demonstrating the economic viability of circular approaches. As global corporations grapple with rising waste concerns and carbon footprint reduction targets, recycled plastics have emerged as both an environmental solution and a competitive advantage.

Global Leaders Driving Change: Corporate Pioneers in Recycled Plastics

This transformation is being led by industry giants who recognize that the future of packaging lies in circularity, not linear consumption models. From Coca-Cola’s ambitious World Without Waste vision to Nestlé’s comprehensive packaging innovation strategy, these companies are proving that recycled plastics can deliver both environmental impact and business value.

Coca-Cola: Engineering the Circular Economy

Coca-Cola has positioned itself as a frontrunner in adopting recycled plastics through its World Without Waste initiative. The company has set transformative targets: incorporating 35-40% recycled material into all primary packaging and reclaiming 70-75% of every bottle and can by 2035.

This isn’t just aspiration, it’s active implementation. In India, Coca-Cola launched 100% recycled PET (rPET) bottles in their Affordable Small Sparkling Package format, beginning with 250ml packs in Odisha. This shift delivers remarkable environmental benefits: 36% lower emissions compared to virgin PET bottles and a 66% reduced carbon footprint versus standard packaging.

The impact scales globally. In Canada, Coca-Cola transitioned all 500ml sparkling beverage bottles to 100% rPET, eliminating virgin PET entirely for this format. This single initiative saves 7.6 million pounds of new plastic annually and cuts 7,000 metric tons of CO₂ equivalent to removing nearly 1,500 cars from roads for a year.

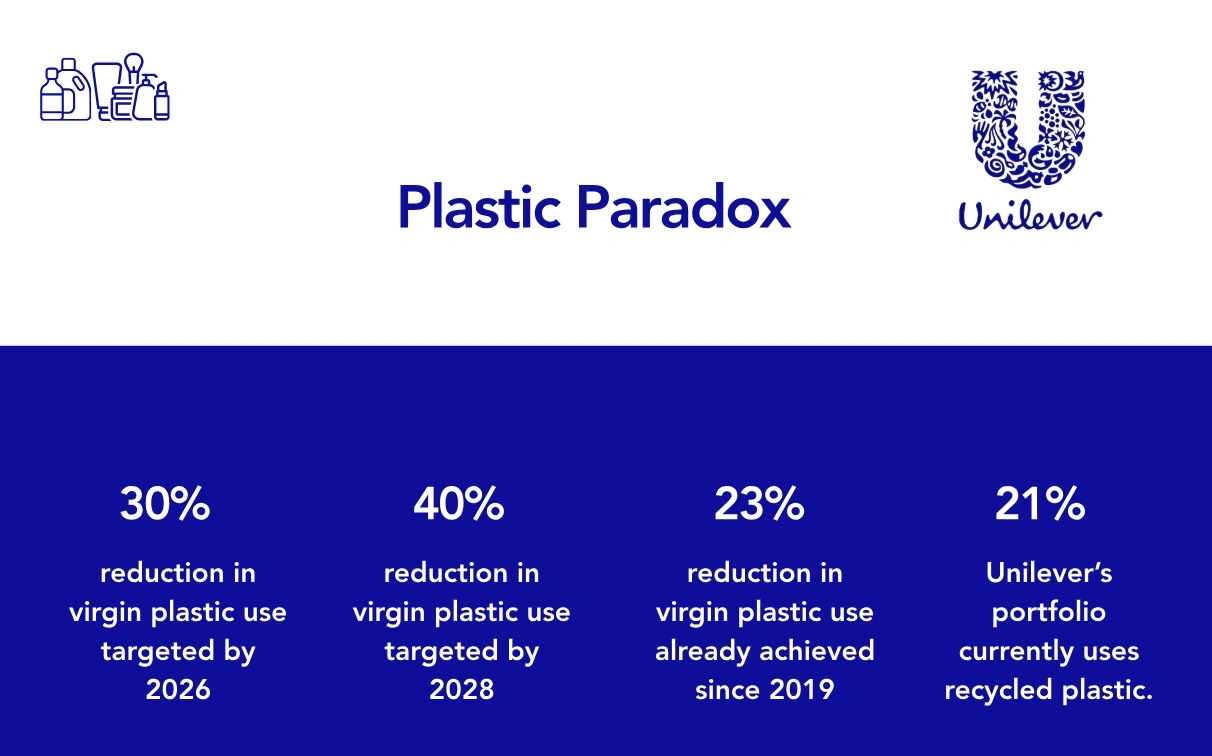

Hindustan Unilever: Solving the Plastic Paradox

Unilever addresses what it terms the “plastic paradox” the need for safe, effective packaging while minimizing environmental impact. The company has committed to reducing virgin plastic use by 30% by 2026 and 40% by 2028, having already achieved a 23% reduction since 2019.

Currently, 21% of Unilever’s global portfolio incorporates recycled plastic, targeting 25% by 2025. Their strategy rests on three pillars: reduction, circulation, and collaboration. This comprehensive approach focuses on minimizing virgin plastic usage, designing for recyclability and reusability, and strengthening recycling systems through strategic partnerships.

Today, 57% of Unilever’s packaging meets recyclable, reusable, or compostable standards. The company strategically addresses different packaging types: rigid plastics (69% of portfolio) focus on recyclability design, while flexible packaging (31%) shifts toward paper-based, compostable alternatives and refillable formats.

Nestlé: Innovation at Industrial Scale

Nestlé accelerates toward a waste-free future with ambitious 2025 targets: 100% recyclable or reusable packaging and one-third reduction in virgin plastic use. Current progress shows 87% of total packaging and 66% of plastic packaging meeting recyclable or reusable standards.

The company has invested USD 30 million in food-grade recycled plastics in the U.S. alone, demonstrating serious financial commitment to the transition. Innovation examples include refillable pet food systems in Chile, recyclable paper packaging for Maggi bouillon cubes in France, and Smarties in recyclable paper wrappers in the UK.

Nestlé’s approach extends beyond product innovation to systemic change. Through Project STOP in Indonesia and plastic neutrality initiatives in the Philippines, the company addresses waste management infrastructure. Their Institute of Packaging Sciences works with over 180 global experts and start-ups, developing alternative materials, refillable systems, and recyclable barrier papers.

The Economic Reality of Recycled Plastics in Packaging

The packaging sector represents the largest end-use market for plastics, accounting for 41% of U.S. plastic waste. This creates both challenge and opportunity. Recycled plastics now deliver tangible business benefits:

Cost Efficiency: Recycled resins typically cost less than virgin materials, reducing manufacturing expenses while meeting performance requirements.

Regulatory Compliance: Growing mandates for recycled content help companies avoid penalties while accessing potential incentives.

Consumer Appeal: Sustainability-conscious consumers increasingly prefer brands demonstrating environmental responsibility.

Supply Chain Resilience: Diversified material sources reduce dependence on volatile virgin resin markets.

Market Dynamics and Material Flows

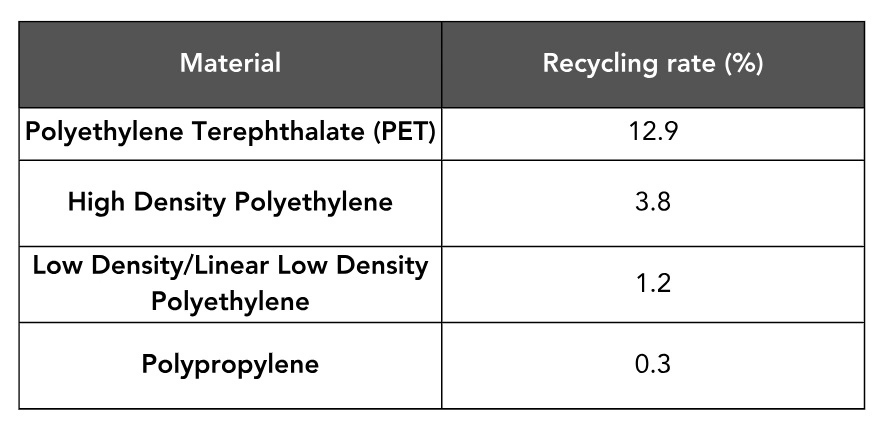

U.S. data reveals the scale of opportunity and challenge. In 2019, polyolefins dominated virgin resin production at 87%, led by LDPE/LLDPE (36%), HDPE (29%), and PP (22%). PET contributed 13% but showed higher recycling rates. However, recycling rates remain suboptimal.

Despite generating 32.4 MMT of plastic waste, only 7% was collected for recycling. The remainder went to landfills (77%) and incineration (16%). This gap represents enormous potential for companies that can capture and process this waste stream effectively.

Emerging Trends Reshaping the Market

Corporate Sustainability Commitments: Major corporations including Coca-Cola, Nestlé, Unilever, and Procter & Gamble are actively integrating PCR plastics into packaging to meet ESG standards, reduce environmental impact, and cater to eco-conscious consumers. These corporate initiatives create strong, predictable demand for recycled materials.

AI-Powered Sorting and Recycling: Technologies like AMP Robotics revolutionize recycling by using machine learning to improve sorting efficiency, particularly for challenging materials like flexible films. This technological advancement increases recovery rates while improving material quality.

Polypropylene and Rigid Plastics Focus: These materials gain popularity in PCRP markets due to improved recovery methods and expanding applications in packaging, automotive parts, and consumer goods.

Construction Sector Integration: PCR plastics are increasingly integrated into non-residential construction projects, including structural components and paving applications, creating new demand streams beyond traditional packaging applications.

Refillable and Reusable Models: Companies such as Kiehl’s introduce refillable packaging options that minimize plastic waste, cutting plastic usage by up to 81% compared to traditional packaging approaches.

Plastic Credit Systems: Verified plastic credit frameworks are being developed to track and offset PCR contributions, improving transparency and accountability in sustainability claims.

The Packaging Transformation

Corporate leaders represent a fundamental shift in how global brands handle materials, waste, and value creation. Their investments in recycled plastics, innovative packaging, and circular partnerships are driving industry-wide transformation.

As these initiatives scale and mature, they’re proving that recycled plastics can meet the most demanding packaging requirements while delivering environmental benefits and business value. The question for other companies isn’t whether to embrace recycled plastics, but how quickly they can adapt their strategies to compete in this new reality.

The packaging industry’s recycled plastic revolution is accelerating, driven by corporate leadership, regulatory momentum, and economic opportunity. Companies that understand and act on this transformation will define the future of sustainable packaging.

Reference/Source:

The Coca‑Cola Company Launches 100% Recycled Plastic Bottles* Across Canada

Nestlé intensifies its sustainable packaging transformation journey

https://yourstory.com/2025/03/indias-plastic-policy-pushes-coca-cola-pepsi

https://www.unilever.com/sustainability/plastics/