Price-Watch’s most active coverage of Cobalt Oxide price assessment:

- Cobalt Oxide (Green Purity: min 72%) FD Rotterdam, Netherlands

- Cobalt Oxide (Purity: min 72%) FOB Antwerp, Belgium

- Cobalt Oxide (Purity: min 72%) CIF (Nhava Sheva_Belgium), India

Cobalt Oxide (Co₃O₄) Price Trend Q3 2025

In Q3 2025, the Cobalt Oxide (min 72% purity) market demonstrated a slightly positive trend across major regions. European hubs like Rotterdam and Antwerp recorded modest upward Cobalt Oxide (Co₃O₄) price trends movement of 0.18%, reflecting steady industrial demand in battery, ceramics, and chemical applications. Indian imports via CIF Nhava Sheva saw slightly stronger growth of 0.36%, driven by consistent procurement from cathode manufacturers and downstream chemical industries.

Stable cobalt feedstock availability and controlled shipping logistics contributed to limited volatility. Overall, the global market remains balanced-to-firm, with marginal price improvements anticipated into Q4 2025 as downstream demand continues at a measured pace.

Netherlands: Domestically Traded Cobalt Oxide (Co₃O₄) price in Netherlands, FD Rotterdam, Grade: (72%) Industrial.

In Q3 2025, Cobalt Oxide prices in the Netherlands showed a modest increase, supported by stable demand from European battery manufacturers and specialty chemical sectors. Steady supply from African and Asian origins, coupled with well-managed inventory levels, prevented sharp price swings. The Cobalt Oxide price trend in the Netherlands reflected controlled market growth, aided by limited volatility in freight and feedstock costs, while European buyers maintained measured procurement aligned with production requirements.

In September 2025, Cobalt Oxide prices in the Netherlands at FD Rotterdam rose by 0.18%, indicating a balanced-to-slightly firm market tone, with incremental improvements expected if downstream demand remains consistent into Q4 2025.

Belgium: Cobalt Oxide (Co₃O₄) Export price from Belgium, FOB Antwerp, Grade: (72%) Industrial.

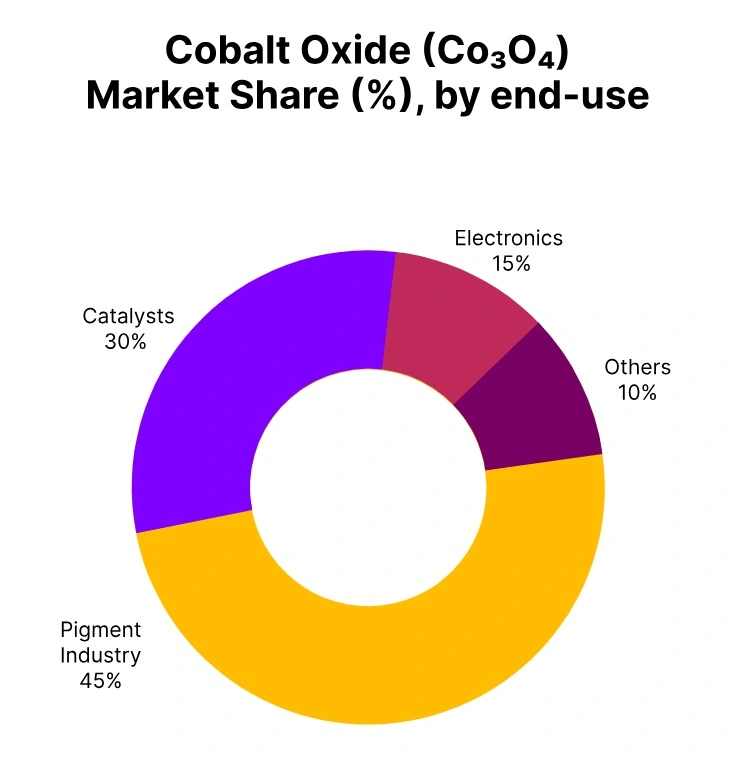

The price of Cobalt Oxide in Belgium saw modest increases in Q3 2025, which corresponds to more stable offtake from European battery, pigment, and chemical end-users. Export flows from African and Asian sources remained stable, with no additional volatility to the market as supply continued to come through reliably.

The Cobalt Oxide (Co₃O₄) price trend in Belgium followed Dutch price trend. Logistics and freight conditions continued to be stable and helpful to support a well-controlled market. As of September 2025, Cobalt Oxide prices in Belgium at FOB Antwerp reported an increase of 0.18%, which indicates a stable-to-mildly bullish market tone.

India: Cobalt Oxide (Co₃O₄) import price in India from Belgium CIF Nhava Sheva (Belgium), Grade: (72%) Industrial.

According to Price-Watch, In Q3 of 2025, Cobalt Oxide pricing in India experienced a moderate increase as demand remained firm from the pigment, paint, electronics, and specialty chemical sectors. Indian buyers have been active in maintaining steady levels of purchasing in line with production schedules and inventory management. The Cobalt Oxide (Co₃O₄) price trend in India, at regional level, appeared stable with balanced supply from European and African sourcing channels, with favourable freight and logistics supply keeping pricing in check.

Downstream industries continued to provide domestic demand, supporting positive market sentiment. In September 2025, Cobalt oxide pricing in India rose by 0.36%, indicating mildly bullish market tone, and prices remained expected to move in a slightly positive market sentiment through 2025 Q4, as industrial demand remains steady.