Price-Watch’s most active coverage of Epichlorohydrin price assessment:

- IG (99.9%) FOB Shanghai, China

- IG (99.9%) FOB Laem Chabang, Thailand

- IG (99.9%) CIF Nhava Sheva_Thailand, India

- IG (99.9%) CIF Busan_China, South Korea

- IG (99.9%) CIF Busan_Thailand, South Korea

- IG (99.9%) FOB Hamburg, Germany

- IG (99.9%) FD Rotterdam, Netherlands

- IG (99.9%) Ex Kandla, India

Epichlorohydrin (ECH) Price Trend Q3 2025

In the third quarter of 2025, the global Epichlorohydrin (ECH) market saw moderate growth, with pricing reaching an increase of 2-5% higher from the prior quarter. Several crucial factors supported a positive outlook, including stable supply for key feedstocks, propylene and chlorine, along with an uptick in demand from downstream applications.

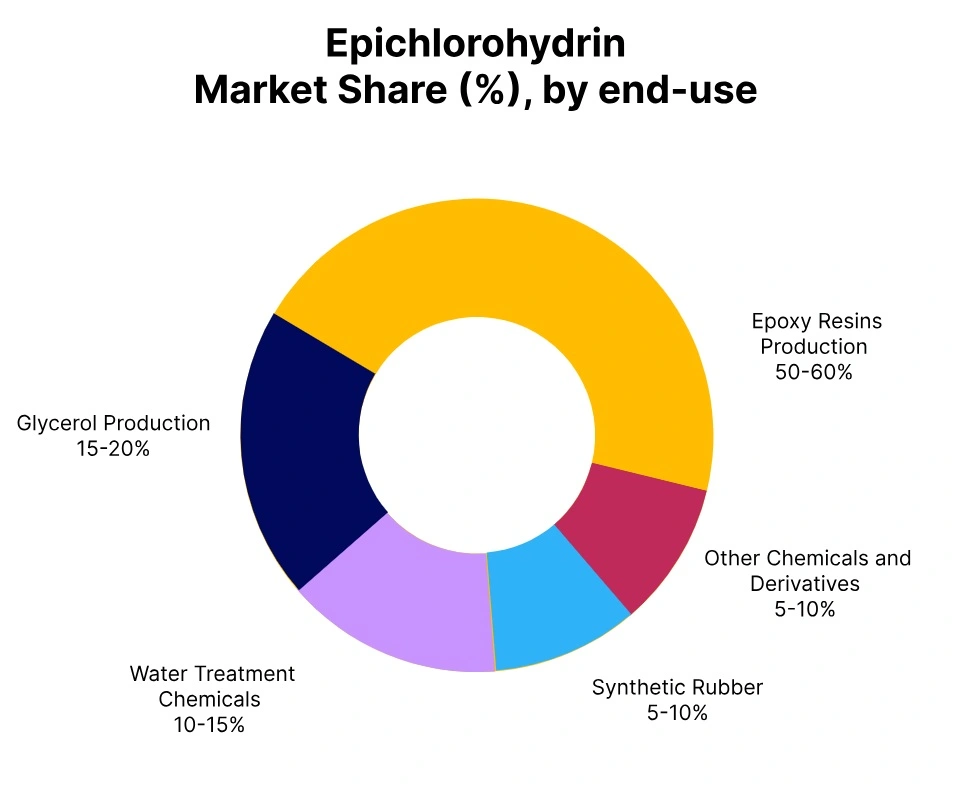

The major application of ECH and epoxy resins epoxy grew steadily with demand in downstream industries such as automotive, construction, and electronics remained present due to the durability and adhesive properties of epoxy resins. Additionally, the demand for glycerol, a by-product of Epichlorohydrin (ECH) that is used in food, pharmaceutical, and cosmetic applications, supported demand and market performance.

Although there have been sporadic supply chain disruptions in some regions, the overall market experienced positive performance, and producers adapted to changes in raw material costs. As supply chains continue to adapt and production capacity grows, the Epichlorohydrin market projects that outlook will continue in the upcoming quarter.

Germany: Epichlorohydrin (ECH) export prices FOB Hamburg, Germany, Grade- Industrial Grade (99.9%).

In Q3 2025, Epichlorohydrin prices in Germany increased by 4.33% compared to Q2 2025. Epichlorohydrin (ECH) price trend in Germany has been influenced by steady demand from the automotive and chemicals sectors, which maintained consistent production despite broader market challenges. The price rise has been supported by higher feedstock costs, particularly propylene, as well as rising freight costs for imports.

Epichlorohydrin prices in September 2025 in Germany have been higher, reflecting strong domestic demand and tight supply chains. Moving forward, the outlook for the market remains stable, with moderate price increases expected, driven by feedstock cost fluctuations and steady demand from key industries.

Netherlands (FD): Epichlorohydrin (ECH) FD prices Rotterdam, Netherlands, Grade- Industrial Grade (99.9%).

In Q3 2025, Epichlorohydrin prices in the Netherlands increased by 5.82% compared to Q2 2025. Epichlorohydrin (ECH) price trend in the Netherlands has largely been influenced by stable demand from the automotive and coatings industries, which helped maintain strong market conditions. The increase in prices has further supported by rising feedstock costs and logistical challenges that led to higher transportation expenses.

Epichlorohydrin (ECH) prices in September 2025 in the Netherlands continued to rise, reflecting tight supply and robust downstream demand. The market outlook for the next quarter suggests continued price increases, with further pressure from global feedstock and freight conditions.

China: Epichlorohydrin (ECH) export prices FOB Shanghai, China, Grade- Industrial Grade (99.9%).

According to Price-Watch, during Q3 2025, Epichlorohydrin (ECH) prices in China increased 19.44% from Q2 2025 levels. Epichlorohydrin pricing trends in China have been driven by continued demand from the automotive and chemical industries along with limited industry supply chains.

The increase in Epichlorohydrin (ECH) prices have taken place as feedstock prices have been raising upward pressure, especially price increases associated with propylene, compounded by rising freight costs increasing import and export prices.

Epichlorohydrin prices in China, in September 2025, continued an upward path due to continued demand and tight supply conditions. The outlook for the upcoming quarter suggests prices in the market will stay elevated, assistance from demand and the cost of feedstock materials, along with adjustments in the regional supply chains.

Thailand: Epichlorohydrin (ECH) export prices FOB Laem Chabang, Thailand, Grade- Industrial Grade (99.9%).

In Q3 2025, the Epichlorohydrin price in Thailand rose 3.92% compared to Q2 2025, a price trend supported by stable consumption from key domestic downstream user sectors (including automotive and coatings). The price increase has also been supported by higher priced feedstocks and limited supply. The cost of freight has remained about the same as the previous quarter but presented some upward pressure on pricing.

In September 2025, Epichlorohydrin (ECH) price trend in Thailand remained elevated based on continued strong demand and limited supplies. The price outlook for Q4 2025 suggests continued but moderate price increases based on demand from key end use user sectors and the availability of feedstock.

South Korea: Epichlorohydrin (ECH) Import prices CIF Busan, South Korea, Grade- Industrial Grade (99.9%).

In Q3 of 2025, South Korea Epichlorohydrin (ECH) prices were up 3.40% compared with Q2 of 2025. Epichlorohydrin price increases in South Korea have primarily been the result of continued steady demand from key end-use markets, namely the automotive and chemicals sectors. Increased propylene feedstock costs as well as increased freight rate from Thailand also contributed to rising prices.

In September of 2025, Epichlorohydrin prices still increased in South Korea because of steady domestic consumption and ongoing regional demand. The outlook for Q4 of 2025 is for moderate price increases due to continuing steady demand and increased feedstock and freight costs.

India: Epichlorohydrin (ECH) Ex-prices Ex-Bhiwandi, India, Grade- Industrial Grade (99.9%).

According to Price-Watch, in the third quarter of 2025, the Epichlorohydrin (ECH) price trend in India increased by 3.66% compared to the second quarter of the year. The Epichlorohydrin (ECH) price trend in India has been impacted in the third quarter by strong demand from the pharmaceutical sector and the automotive sectors, which did show resilience even during times of global demand concerns.

The prices advanced because of higher feedstock costs, particularly propylene, and increases in the logistics industry during that quarter. By September 2025, Epichlorohydrin prices at Ex-Bhiwandi (India) remained higher, suggesting sustained demand and continued supply issues within the supply chain. Overall, prices are expected to stabilize, while still on a moderate trend up the structure, increasingly dependent on overall downstream demand, as well as worldwide conditions in supply chains.