Price-Watch’s most active coverage of Nonyl Phenol price assessment:

- IG (98% min) FOB Kaohsiung, Taiwan

- IG (98% min) CIF Nhava Sheva (Taiwan), India

- IG (98% min) CIF Singapore (Taiwan), Singapore

- IG (98% min) Ex-Mumbai, India

Nonyl Phenol Price Trend Q3 2025

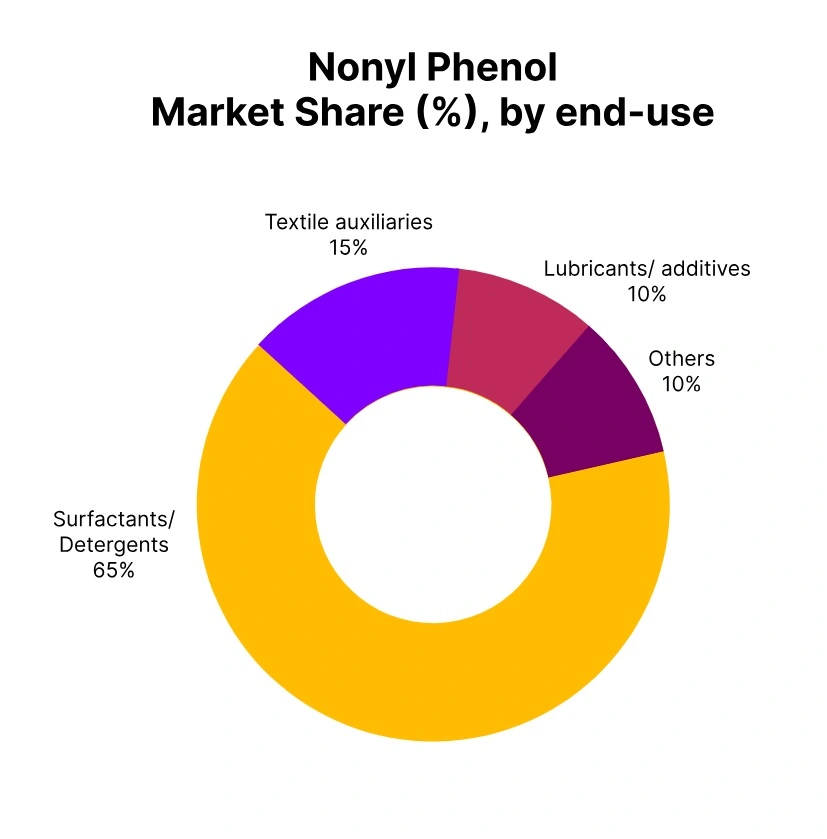

The global Nonyl Phenol price trend in Q3 2025 was fairly steady with minor increases in key regions. September 2025 Nonyl Phenol prices showed a slight uptick that followed a prolonged period of stable prices and were supported by steady demand from downstream sectors such as surfactants, resins, and industrial cleaners, especially in Asia and parts of Europe.

Pricing remained steady as upstream feedstock prices (propylene and phenol), fluctuated in a long-term range, meaning limited spot availability, and some account of pricing from producers, played a role in the firmness of the cost.

The increase was less than drastic, typically between 1-2% depending on the area, driven primarily by balanced-to-tight supply and logistical trends rather than significant movement in raw material trends. Supply-demand conditions allowed for firm prices, and expectations for a continued firm priced structure into Q4 2025 are likely given steady demand and continued constrained supply.

Taiwan: Nonyl Phenol Export prices FOB Kaohsiung, Taiwan, Grade- Industrial Grade (98% min).

In the third quarter of 2025, the price of nonylphenol in Taiwan was relatively stable, with a slight increase of around 1.5% overall during the quarter. The Nonyl Phenol price trend in Taiwan saw an abrupt increase driven primarily by a tighter supply due to plant turnarounds, healthy demand for surfactants and resins in Taiwan, and robust upstream costs, particularly phenol.

By September 2025, the price of nonylphenol in Taiwan market reached its highest levels of the quarter, buoyed by limited available spot supply and higher costs of production. In stark contrast, other regional markets globally saw only modest increases in prices, indicative of more balanced fundamentals.

The lack of similar price drivers in other global regions highlighted the price impacts of Taiwan supply side constraints and firm local consumption heading into the fourth quarter as a major consideration impacting the overall market tone.

Singapore: Nonyl Phenol Import prices CIF Singapore, Singapore, Grade- Industrial Grade (98% min).

In the third quarter of 2025, the Nonyl Phenol price trend in Singapore exhibited a mild upward trajectory of approximately 2.5%, primarily attributable to higher Nonyl Phenol prices from FOB China and marginally higher shipping costs. Nonyl Phenol price in Singapore continued to climb as Chinese export offers increased with domestic supply tightening alongside solid local demand, particularly in the second half of the quarter.

Prices for Nonyl Phenol in September 2025 indicated that these factors resulted in higher landed costs for importers across Southeast Asia, including Singapore, despite overall demand being steady but not particularly bullish.

The limited availability of competitive alternatives to Nonyl Phenol outside of China and in a low-volume market provided justification for the increase. Overall, the market remained stable but slightly firm while cost pressures from logistics and upstream suppliers continued to shape near-term pricing.

India: Nonyl Phenol Import prices CIF Nhava Sheva, India, Grade- Industrial Grade (98% min).

According to Price-Watch, in Q3 2025, the Nonyl Phenol price trend for CIF Nhava Sheva (India) recorded a rise of 3.5%, mainly driven by rising Nonyl Phenol prices in India from FOB China and unfavorable variation in the USD/INR exchange rate. The Nonyl Phenol price in India moved higher throughout the quarter as Chinese suppliers moved up offers in line with constrained domestic supply and increased local demand forcing export prices higher.

Further, the depreciation of the Indian Rupee versus the U.S. Dollar increased the effective landed cost for Indian importers increasing the impact of producer’s upstream price gain. By September 2025 priced had risen substantially due to the move in the factors mentioned above despite underlying demand fundamentals from both surfactants and resins remaining flat. The overall price movement signifies both external market pressures and currency led dependencies, should these dynamics persist well into Q4 expect further firmness in pricing.