Price-Watch’s most active coverage of Propylene Carbonate price assessment:

- TG(99% min) FOB Shanghai, China

- TG(99% min) CIF Haiphong (China), Turkey

- TG(99% min) CIF Mersin (China), Vietnam

- TG(99% min) CIF Nhava Sheva (China), India

- TG(99% min) Ex-Mumbai, India

Propylene Carbonate Price Trend Q3 2025

The global propylene carbonate market demonstrated moderate stability in Q3 2025, with some regional variation. The Propylene Carbonate price trend fluctuated by 0.1-1.0% during the July-September 2025 quarter, driven by consistent feedstocks, energy prices, and supply chain costs at the regional level.

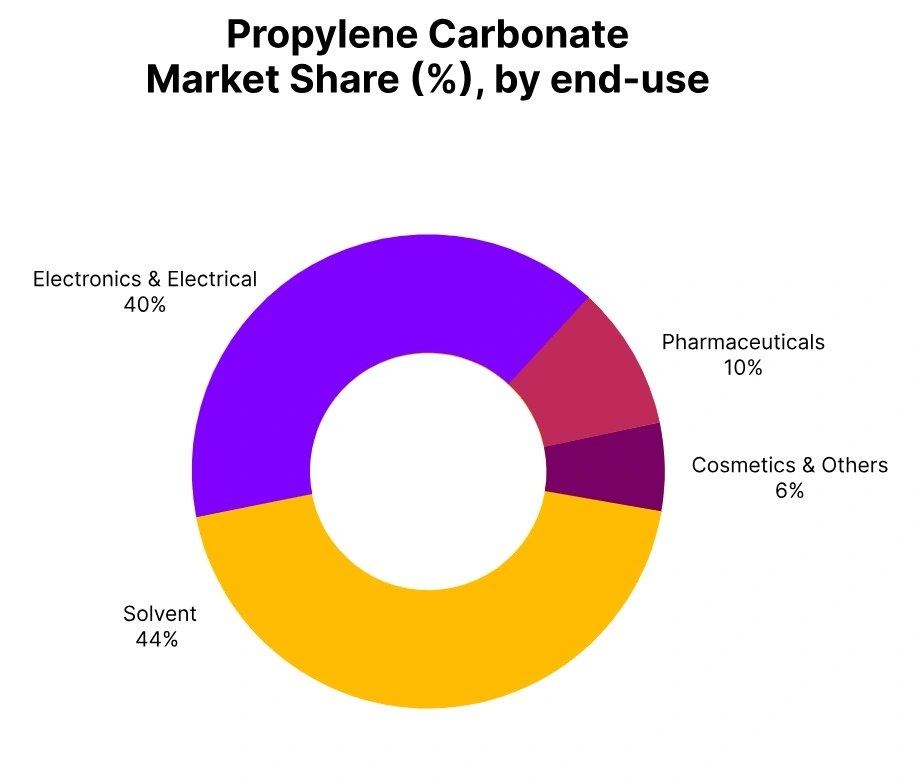

Although some upstream price fluctuations took place, solid demand from lithium-ion batteries, coatings, and pharmaceuticals held prices relatively steady. Continued expansion of production capacity and supply chain normalization should also help maintain pricing stability for propylene carbonate in the upcoming quarter.

China: Propylene Carbonate price FOB Shanghai, China, Purity: ~99%.

During the third quarter of 2025, the price of Propylene Carbonate in China experienced a modest decrease of 0.3%. Propylene Carbonate Price trend in China remained weak, with the market experiencing tentative stability after months of declining prices. Seasonal restocking enabled moderate buying, particularly from downstream customers in electronics and energy storage, as supply chains adapted for post-summer activity.

Exports to Southeast Asia improved slightly due to improvement in shipping conditions and steady trade lanes, which gave Chinese producers some support. Feedstock costs for propylene oxide remained stable, while crude oil benchmarks experienced price variability, but did not materially impact costs.

Overall demand in both domestic and export markets remained limited, as the trend of cautious buying practices continued during the summer months. Buyers were focused on short-term purchases without committing to long-term contracts, while general market sentiment appeared weak. In September 2025, propylene carbonate prices in China decreased 2.37% to 740 USD/ton.

Vietnam: Propylene Carbonate price FOB Haiphong, Vietnam, Purity: ~99%.

In the third quarter of 2025, Propylene Carbonate price in Vietnam decreased slightly by 0.2%. Propylene Carbonate price trend in Vietnam indicates a tentative phase of stabilization, as the market is dependent on imports from China. Some seasonal improvement in industrial activity took place after the monsoon season, which allowed for some marginal restocking, particularly in the electronics and lithium-ion battery sectors.

There was also some modest recovery in demand from the coatings sector, although overall demand for coatings continued to be dampened by widespread caution on industrial activity. Exports from China remained stable with FOB levels holding steady, backed by stable feedstock propylene oxide values. Shipping conditions across Southeast Asia were also better, resulting in fewer logistical bottlenecks and smoother trade flows into Vietnam.

Despite the positive factors in Vietnam, procurement continued to be tentative as buyers avoided pursuing aggressive forward purchasing strategies given the uncertainties globally. Buyers had a comfortable amount of supply available, which limited any significant upward momentum, keeping the propylene carbonate market either in equilibrium or controlled balance.

In general, the third quarter was a period of stability, and demand improved, leading to a cautiously optimistic outlook, balanced by the fragile sentiment and pace that ultimately dampened recovery. In Vietnam, the price of Propylene Carbonate in September 2025 decreased by 4.66% to 778USD/ton.

Turkey: Propylene Carbonate price FOB Mersin, Turkey, Purity: ~99%.

During the third quarter of 2025, Propylene Carbonate prices in Turkey were down by 0.74%. The Propylene Carbonate price trend in Turkey captures tentative stabilization, but the momentum remains weak. The resumption of industrial activity post-summer has featured some mild restocking, as downstream buyers have moved some volumes, particularly in coatings and electronics, that provided support, but only briefly.

We have observed steady imports from China, with firm import values reflected in FOB prices that were modestly firm, largely reflective of feedstock propylene oxide price stability. However, the lack of demand has limited any significant recovery in purchasing activity, and cautious buying patterns have remained a consistent feature of the marketplace.

Global economic uncertainty, and Turkey’s domestic inflationary environment, kept buyers selective and limiting them to committing to short-term volumes in the marketplace rather than entering new forward contracts.

Freight conditions have remained in reasonable balance ensuring supply security, but with little influence on price dynamics. As a result, Q3 reflected a period of relative stability, improved restocking offsetting previous declines, but being unable to gain much on the demand side creating significant upward pressure. Propylene Carbonate prices in Turkey were reported down in December 2025 at 5.49% at 861 USD/ton.

India: Propylene Carbonate price CIF Nhava Sheva, Mumbai, India, Purity: ~99%z.

According to Price-Watch, in the third quarter of 2025, Propylene Carbonate prices in India dropped by 0.39%, with this slight reduction being reported at CIF Nhava Sheva. Propylene Carbonate Price trend from India reflected some stabilization, driven by Chinese imports, and modest restocking from post-monsoon activity in the industry due to consistent demand in electronics and lithium-ion batteries.

The coatings and adhesives sector experienced slight normalization or recovery but still remained somewhat constrained. FOB China prices also remained steady, with feedstock prices for propylene oxide holding static and fluctuations in crude oil being intermittent. On the Indian buying side, the pattern of short-term sourcing from Chinese suppliers was preferred to keep from being overly committed in an uncertain global situation.

For Ex-Mumbai, the Propylene Carbonate price also fell a little larger at 0.51%. This market also experienced some moderate degree of stabilization led by seasonal restocking with industrial and chemical players returning to the market post-monsoon.

Feedstock prices for propylene oxide were flat, with little influence or distraction from crude oil pricing benchmarks. Domestic producers did a very good job of controlling production levels to align with market demand to avoid any over-supply situation. In September 2025, Propylene Carbonate prices in India fell by 0.11% (CIF) to 72,335 INR/ton and 1.82% (Ex-Mumbai) to 80,250 INR/ton.