Price-Watch’s most active coverage of Propylene Glycol Monomethyl Ether (PGME) price assessment:

- IG min 99.5% Purity FOB Shanghai, China

- IG min 99.5% Purity CIF Manila (China), Philippines

- IG min 99.5% Purity CIF Mersin (China), Turkey

- IG min 99.5% Purity CIF Santos (China), Brazil

- IG min 99.5% Purity CIF Nhava Sheva (China), India

- IG min 99.5% Purity CIF Haiphong (China), Vietnam

Propylene Glycol Monomethyl Ether (PGME) Price Trend Q3 2025

The global market for Propylene Glycol Monomethyl Ether (PGME) experienced moderate stability with regional fluctuations during the July-September 2025 quarter, with price movement varying between 1-4%. This Propylene Glycol Monomethyl Ether (PGME) price trend remains both stable and fluctuating relative to feedstock prices, energy prices, and regional supply chain dynamics.

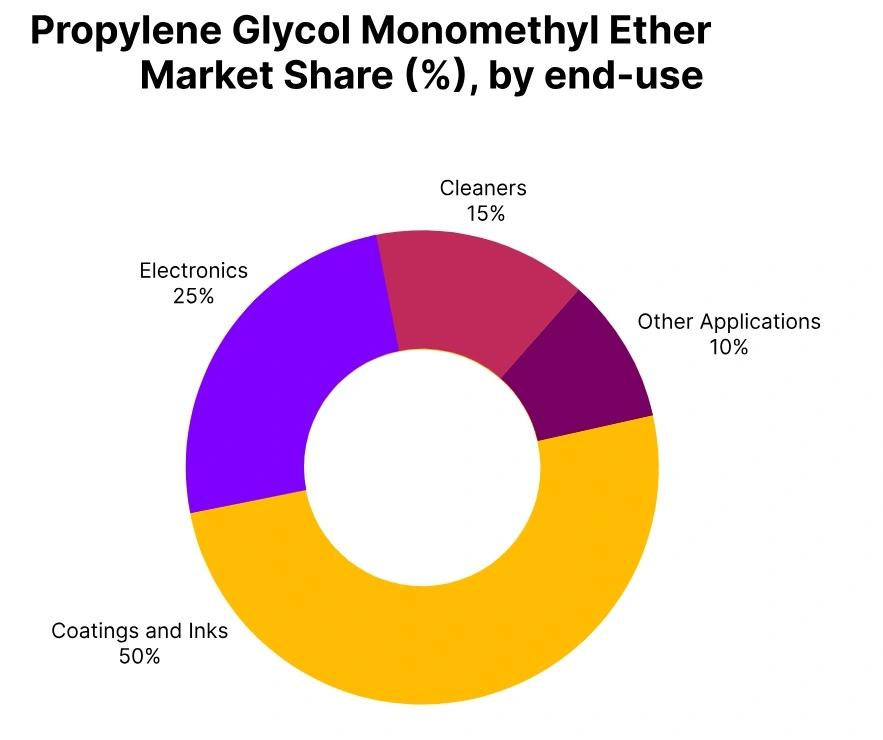

Any upstream price movements indicated generally strong demand in downstream sectors including electronics, coatings, and cleaning products, with regional supply chain dynamics supporting overall Propylene Glycol Monomethyl Ether (PGME) price stability. Additional production capacity expansion and supply chain adjustment are anticipated to maintain stability in the next quarter.

China: Propylene Glycol Monomethyl Ether price FOB Shanghai, China, Industrial Grade ≤ 99.5% purity.

In the third quarter of 2025, Propylene Glycol Monomethyl Ether (PGME) prices from China continue to decline. The rate of decline is slowing compared to Q2 with FOB China prices down 1.31%. The declination in the price trend of PGME in China was due to relatively stable feedstock conditions as both costs of propylene oxide and methanol (MeOH) remain unchanged between Q2 and Q3, providing neither upward support nor downward pressure on prices.

However, demand weakness continues as it is unlikely that there will be significant growth in global industrial activity. The caution of downstream buyers remains in place which prevents significant restocking. Southeast Asia, specifically Indonesia has softer imports as buyers reduce orders due to enough inventory held locally.

The overall export competition remains immense, and shipping conditions remain stable. Overall, Q3 has a persistent bearish price sentiment but at a decelerated pace suggesting cautious stabilization. In September 2025, PGME prices in China declined 2.89% to 1,109 USD/ton.

Philippines: Propylene Glycol Monomethyl Ether price in CIF Manila, Philippines, Industrial Grade ≤ 99.5% purity.

Propylene Glycol Monomethyl Ether (PGME) prices in the Philippines remain deterred in the third quarter 2025. Pricing pressure continues to mount now that CIF Philippines (China) is down 2.12%. The softness in the Propylene Glycol Monomethyl Ether (PGME) price trend was driven by weak upstream propylene values in major exporting countries like China which has decreased production costs leading suppliers to be able to offer more competitive pricing resulting in more competitive markets to face in all of Southeast Asia.

Domestic demand in the Philippines remains mediocre, while coatings, construction, and adhesive sectors have slow demand because of the wet season. As demand slows, it has led importers to focus on reducing purchases while waiting for better procurement opportunities.

Tramp freight conditions remain stable for now, but stable conditions in the shipping of PGME have led to constant availability and additional oversupply pressure. As September concludes, we still find ourselves continuing the downward pressure, as we need soft feedstocks, muted demand, and additional regional competitors. Propylene Glycol Monomethyl Ether (PGME) prices in the Philippines dropped by 1.50% in September 2025 closing at 1,183 USD/ton.

Turkey: Propylene Glycol Monomethyl Ether price in CIF Mersin, Turkey, Industrial Grade ≤ 99.5% purity.

In the third quarter of 2025, PGME price trend in Turkey come under greater downward market pressure. This is observed with CIF Turkey (China) declining by 3.08% due to weakening feedstock economics. Additionally, falling propylene cost in various major exporting countries, for instance, China, result in more favorable economics for PGME producers to be able to offer competitive prices using feedstocks at this lower price. Demand in Turkey during the summer is also weak, with notable seasonality in the coatings and construction market delays.

Importers begin to follow the trend as they negotiate prices more aggressively and intentionally display less haste in the buying phase of inventory build-up in the anticipation of more price decreases to come. While freight remains stable, hence the stability in delivery of cargo, good amounts of PGME available to be delivered to market only add more downward pressure to lower pricing.

The third quarter occurs during the year’s lowest market pricing time when weaker feedstock, aggressive suppliers, and mild demand have the most impact on accelerating prices. September 2025 saw Propylene Glycol Monomethyl Ether (PGME) prices fall by -2.35% overall to 1,246 USD/ton in Turkey.

Brazil: Propylene Glycol Monomethyl Ether price in CIF Santos, Brazil, Industrial Grade ≤ 99.5% purity.

In the third quarter of 2025, Brazil’s PGME market faces the steepest correction of the year. CIF Brazil (China) PGME prices drop by 3.42%, driven by softening feedstock economics. Easing propylene prices in key exporting nations like China lower Propylene Glycol Monomethyl Ether (PGME) production costs, prompting more competitive offers from Chinese exporters. Domestic demand in Brazil remains weak, with solvent consumption in coatings and adhesives sectors constrained by slow industrial activity. Freight flows remain steady, but consistent imports amplify oversupply conditions.

Q3 sees sharper corrections in the Propylene Glycol Monomethyl Ether (PGME) price trend, with buyers negotiating aggressively, and suppliers conceding ground. The quarter underscores how weak feedstocks and fragile demand accelerate downward momentum. In September 2025, the Propylene Glycol Monomethyl Ether (PGME) prices in Brazil decreased by -6.11%, reaching 1,261 USD/ton.

India: Propylene Glycol Monomethyl Ether price in CIF Nhava Sheva, India, Industrial Grade ≤ 99.5% purity.

According to Price-Watch, In the third quarter of 2025, India’s PGME import market faces sharper downward pressure. CIF India (China) prices drop by 3.42%, with seasonal and structural drivers contributing to the decline. The onset of the monsoon season dampens demand in key segments like coatings, adhesives, and construction, leading to lower solvent consumption. On the supply side, Chinese exporters lower offer due to building inventories amid subdued regional demand.

The decline in the Propylene Glycol Monomethyl Ether (PGME) price trend in India was amplified by easing feedstock dynamics, with propylene oxide (PO) values expected to soften as propylene balances improve. Freight flows remain steady, but abundant availability limits exporters’ ability to hold firm pricing. Buyers in India take advantage of the bearish tone, negotiating more aggressively and delaying restocking in anticipation of further concessions.

Q3 represents the most bearish period of the year, where weak domestic demand, softer feedstocks, and competitive suppliers accelerate the decline. In September 2025, the Propylene Glycol Monomethyl Ether (PGME) prices in India decreased by 1.08%, reaching 104,867 INR/ton.

Vietnam: Propylene Glycol Monomethyl Ether price in CIF Haiphong, Vietnam, Industrial Grade ≤ 99.5% purity.

In the third quarter of 2025, Vietnam’s Propylene Glycol Monomethyl Ether (PGME) prices witnessed a downward trend. Prices in Vietnam, with CIF Vietnam (China) down by -2.00%, reflect stable feedstock prices, particularly for propylene in China, which helps maintain consistency in export offers. However, domestic demand remains lackluster, especially as the wet season dampens construction activity and slows consumption of coatings and adhesives.

Buyers limit purchases, opting for smaller lots to meet immediate needs, rather than committing to large restocking, resulting in weak price trend of PGME in Vietnam. Exporters in China continue to ensure steady flows but have limited leverage for stronger prices.

Freight rates remain steady, maintaining accessibility but doing little to offset bearish fundamentals. The third quarter represents a phase of gradual easing, where steady feedstocks cushion the decline, but soft demand continues to weigh on sentiment. In September 2025, the Propylene Glycol Monomethyl Ether (PGME) prices in Vietnam decreased by 1.53%, reaching 1,162 USD/ton.