Price-Watch’s most active coverage of Pyridine price assessment:

- IG (99.5% min) FOB JNPT, India

- IG (99.5% min) CIF Shanghai (India), China

- IG (99.5% min) CIF Jakarta (India), Indonesia

- IG (99.5% min) CIF Penang (India), Malaysia

- IG (99.5% min) CIF Hamburg (India), Germany

- IG (99.5% min) Ex West India, India

- IG (99.5% min) CIF Southampton (India), United Kingdom

Pyridine Price Trend Q3 2025

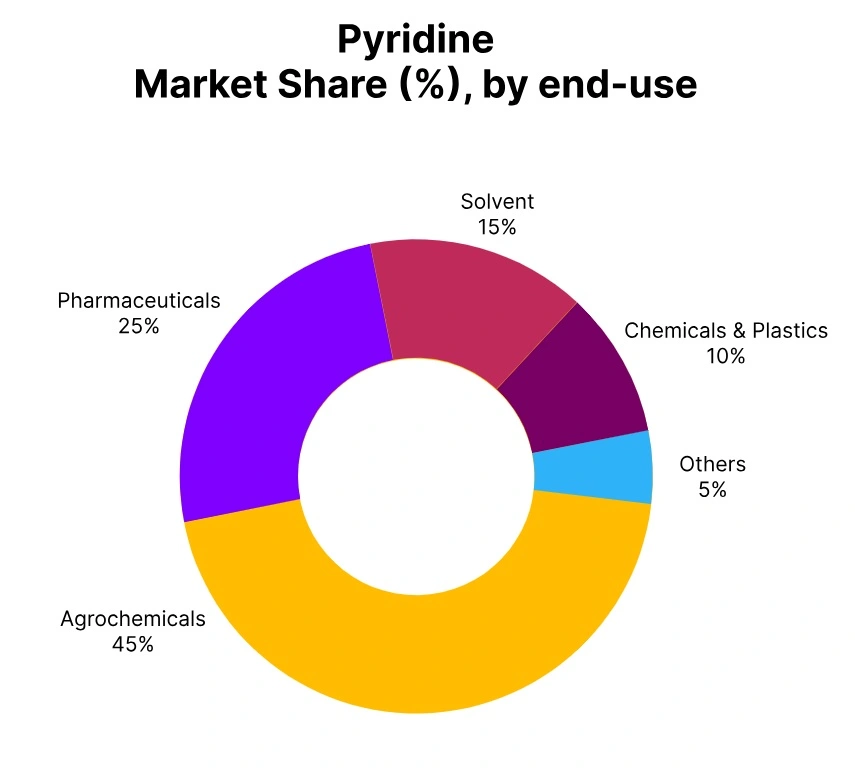

During the third quarter of 2025, the global Pyridine market demonstrated moderate growth, as prices rose approximately 2-5% from the previous quarter. This growth was primarily driven by stable demand from key Pyridine-consuming sectors, which included agrochemicals which use Pyridine to produce herbicides and insecticides. In addition, increased consumption of Pyridine in the pharmaceutical sector, where Pyridine is an important intermediate in drug synthesis, supported rising prices.

Other positive factors included stable raw materials required for production and some recovery in international supply chains. While some regional logistical transportation challenges continue to exist, the market was overall stable and responsive. As global production capacity continues to expand, and stable demand from key industries holds true, the Pyridine price trend is expected to maintain its growth trends in the next quarter.

India: Pyridine export prices FOB Nhava Sheva, India, Grade- Industrial Grade (99.5% min).

According to Price-Watch, in Q3 2025, Pyridine price in India saw an increase of 4.71%, in relation to Q2 2025. Pyridine price trend in India was based on stable demand shown in consistent production from the pharmaceutical and chemical sectors despite global uncertainties. Greater production costs of its feedstock and rising freight rates added pressure to higher prices.

As of September 2025, Pyridine prices in India still expressed a positive growth trajectory which reflected steady demand and underlying constraints in supply. Q4 2025 and into Q1 2026 would expect this price growth to continue as long as that demand remained strong and feedstock costs continued to increase.

United Kingdom (CIF from India): Pyridine Import prices CIF Southampton, United Kingdom, Grade- Industrial Grade (99.5% min).

During Q3 2025, Pyridine prices witness a price hike of 5.74% from Q2 2025 levels in the United Kingdom. Pyridine price trend in the UK is supported by solid demand levels from the chemical and pharmaceutical industries, which continue to support consistent production levels. There was also upward price momentum due to increasing feedstock costs and increasing freight costs from India.

In September 2025, Pyridine prices continued to trend upward in the United Kingdom due to tight supply and healthy demand levels for Pyridine. The forward-looking landscape for the upcoming quarter is likely to see continued increases in pricing due to steady demand levels and upward pressure from feedstock and transportation costs.

China (CIF from India): Pyridine Import prices CIF Shanghai, China, Grade- Industrial Grade (99.5% min).

According to Price-Watch, in the third quarter of 2025, Pyridine prices in China rose by 5.02% compared to the second quarter of 2025. The Pyridine price trend in China was sustained from its previous Q2 quarter, by firm offtake in agricultural and chemical applications, which have continued to operate, despite the persistent challenges of supply chain disruptions.

The rise in price has also been driven by rising feedstock prices and increasing freight prices from India. By September 2025, the Pyridine price in China remained at elevated levels due to solid downstream demand. Looking ahead, the price will likely remain robust due the continuation of strong demand from key consumer industries and the global nature of feedstock and shipping price increases.

Indonesia (CIF from India): Pyridine Import prices CIF Jakarta, Indonesia, Grade- Industrial Grade (99.5% min).

In the third quarter of 2025, Pyridine prices in Indonesia increased by 5.02% compared to the second quarter of 2025. Pyridine price trend in Indonesia experienced in Indonesia since the first quarter of 2025 were driven by continued end-user demand from the chemical and pharmaceutical sectors, which experienced continued production volumes. Price increases were attributed to rising costs of feedstocks while applying upward pressure on the supply curve. Additionally, freight rates from India added upward pressure on prices.

In September 2025, Pyridine prices in Indonesia continued a trend upward, and prices were based on strong demand while the supply was constrained. The expectations for Pyridine prices in the fourth quarter of 2025 are for prices to remain stable, but prices will continue to respond to increased costs for feedstock and freight.

Malaysia (CIF from India): Pyridine Import prices CIF Penang, Malaysia, Grade- Industrial Grade (99.5% min).

In the third quarter of 2025, Pyridine prices in Malaysia went up by 5.00% from the previous quarter. Pyridine price trend in Malaysia was mainly driven by strong demand from pharmaceutical and agricultural markets, which helped to maintain consistent production levels. Further price increases were also supported by higher feedstock costs, particularly propylene and increasing freight to Malaysia from India.

September 2025 Pyridine prices in Malaysia continued to rise amidst stable demand and tight supply conditions. Price projections for the next quarter indicate higher prices are likely to remain even if demand from key sectors remain strong, as feedstock costs are anticipated to continue to increase.

Germany (CIF from India): Pyridine Import prices CIF Hamburg, Germany, Grade- Industrial Grade (99.5% min).

During the third quarter of 2025, Pyridine prices in Germany rose 5.51% compared with the prior quarter, continuing an upward trajectory. Pyridine price trend in Germany was supported by stable demand from the pharmaceutical and chemical industries, which continued production amid a rigid supply chain fundamentals. In addition to stable demand, improved pricing related to rising feedstock prices, namely propylene, alongside increased freight rates from India also drove sales prices up.

September 2025 saw prices for Pyridine continue on their upward trend, reflecting strong demand amidst tightening supply. The outlook for the market in the next quarter witnesses prices will continue to rise, and that prices will remain high unless there is a significant change in the availability of feedstock or freight.