The global propylene oxide (PO) market has been experiencing a transformative phase, driven by surging demand from key end-use industries including polyurethane manufacturing, construction, automotive, and furniture sectors. As of 2024, Asia-Pacific has emerged as the epicentre of production and consumption, with China commanding a dominant position while India grapples with limited domestic capacity, a bottleneck constraining the growth of its downstream industries.

Amid this evolving landscape, sustainability has become a central theme, exemplified by strategic collaborations such as the Sumitomo Chemical-KBR partnership aimed at developing eco-friendly production technologies.

Global Propylene Oxide Market Overview

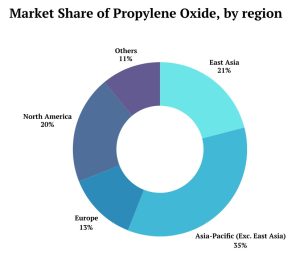

According to PriceWatch, The propylene oxide market share distribution by region shows that Asia-Pacific dominates, holding between 46.2% and 56% of the global market, with China leading the way. East Asia, a subset of this region, contributes 21.9% of revenue. North America follows with around 20%, driven by strong demand from automotive, construction, and packaging sectors. Europe accounts for about 15%, with a focus on regulations and sustainability in industries like chemicals and textiles. The Middle East & Africa, with smaller but rapidly growing markets, and Latin America, with a limited share, are emerging regions for Propylene Oxide.

Propylene oxide finds its major application in the manufacture of polyether polyols (PPG), which account for approximately 75% of world demand. Secondary major applications are propylene glycol (13.8%) and 1,4-butanediol. The market for propylene oxide continues on an upward trend because of the expanding demand for polyurethane products, especially in end-use markets such as automotive, construction, and insulation.

In October 2025, the Propylene Oxide prices in China recorded steady growth, mainly driven by rising feedstock propylene prices and increased buying activity from downstream consumers. By the end of first week, Propylene Oxide prices have risen to USD 1005/MT FOB Qingdao. The increase in propylene prices, supported by high production costs, provided strong cost support and pushed the overall market price upward.

Domestic Propylene Oxide Supply and Demand in China

China remains the leading player in the world propylene oxide market, with its use in 2020 totalling 2.99 million tons or nearly 70% of domestic consumption being utilized for the manufacturing of polyether polyols. Even though China has a huge manufacturing capacity, there is still a shortage-supply gap with a shortage of around 467,000 tons in 2020 primarily caused by interference from the COVID-19 pandemic.

To close this gap, China is heavily investing in novel production technologies. As of 2025, China has been closing-in on the goal of self-sufficiency in the production of propylene oxide, with an estimated 9.43 million tons per annum capacity, fuelled by the advancement of HP propylene oxide and propylene oxide/SM technologies. These developments have also been catering to China’s increasing demand for polyols and propylene glycol, which are crucial to a number of industries.

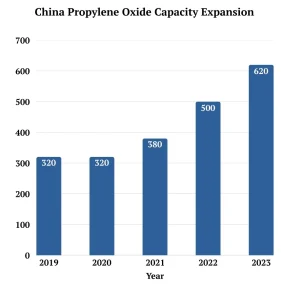

China’s propylene oxide production capacity has almost doubled from 2019 to 2023, reflecting major industry expansion and surging market demand.

The Indian Propylene Oxide Market

In India, local production of polyols and propylene glycol is restricted due to the local availability of propylene oxide. Being a significant intermediate for polyether polyols (73% of PO demand) and propylene glycol (14% of PO demand), insufficient domestic propylene oxide restricts India from catering to increased demand from industries such as automotive, construction, and furniture production.

India’s dependence on propylene oxide imports increases the cost of production and leads to inefficiencies in the supply chain. To meet this challenge, India must improve its domestic propylene oxide production capacity, as global demand for derivatives such as polyurethane-based products continues to expand.

Technological Advancements: The KBR and Sumitomo Chemical Alliance

In a major news for the world propylene oxide market, Sumitomo Chemical and KBR have disclosed an exclusive license agreement for Sumitomo’s ground-breaking propylene oxide by cumene (POC) technology. This new technology is a cutting-edge, eco-friendly process with lower carbon emissions and wastewater creation, offering a cleaner, greener alternative to conventional processes.

Sumitomo’s POC technology aims to improve the energy efficiency of propylene oxide manufacturing, with more effective yields and safer, more efficient plant operation. Through this alliance, KBR will manage global licensing and leverage its vast engineering experience to introduce this technology to a wider market.

This partnership is a major milestone in the effort of the industry to move toward greener chemical production. Its lower carbon footprint and more efficient system of energy recovery, Sumitomo Chemical’s process reflects the worldwide drive toward sustainability, making it a central actor in the coming years of propylene oxide manufacturing.

With this agreement, manufacturers will gain a co-product-free solution to produce propylene oxide, which will enable them to achieve their sustainability goals while extracting the full value from their propylene derivatives. This partnership places increased focus on green chemistry in chemical production and reflects the transformation towards sustainable processes within the global chemical industry.

Challenges in the Propylene Oxide Market

Despite significant growth in production and consumption, several challenges persist in the global propylene oxide market:

Feedstock Dependency: Propylene oxide relies on propylene, which is derived from crude oil-based feedstocks, making the industry vulnerable to price volatility and supply disruptions.

Environmental Impact: Traditional production methods, such as the chlorohydrin process, generate significant environmental pollution, including hazardous waste and carbon emissions. As a result, there is a growing need for cleaner, more sustainable production methods.

Supply-Demand Imbalance: In countries like India and China, while production capacity is expanding, demand is also rising rapidly, leading to potential imbalances and reliance on imports.

Innovation and Expansion in Propylene Oxide Production

The future of the propylene oxide market looks promising, driven by innovations such as the KBR-Sumitomo Chemical partnership and the rising adoption of energy-efficient POC technology. As manufacturers prioritize improving operational efficiency and reducing environmental impact, the market is poised for sustainable growth aligned with evolving industry demands.

In China, the commissioning of multiple new projects will make the country self-sufficient in propylene oxide production by 2025. Likewise, India will have to increase its domestic manufacturing capacity to cater to increasing demand for polyether polyols and propylene glycol.

With an emphasis on sustainability, technology, and capacity growth, the world propylene oxide market can serve the growing demand while relieving the test of environmental sustainability and supply chain reliability.

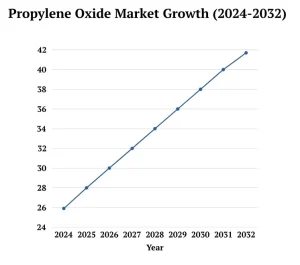

The graph below highlights the projected growth of the Propylene Oxide market from 2024 to 2032. It illustrates a significant rise in market size, increasing from USD 25.96 billion in 2024 to USD 41.23 billion by 2032, with an estimated compound annual growth rate (CAGR) of 5.95%.

Sustainable Production Fuels a Promising Future

The propylene oxide market worldwide is transforming at a rapid pace, with major changes in production capacity and the implementation of green technologies. Major production hubs like China and India are expanding capacity, with innovations in green and energy-efficient technologies playing a critical role. The partnership between KBR and Sumitomo exemplifies this shift toward sustainable manufacturing, underscoring a future where economic growth and environmental responsibility go hand in hand. As the industry adopts eco-friendly processes, the outlook for propylene oxide remains highly promising, blending profitability with sustainability.