The styrene-butadiene rubber (SBR) market in 2025 presents a complex landscape shaped by structural transformations rather than cyclical fluctuations. While conventional synthetic rubber markets often move in tandem with crude oil prices, the current SBR price environment reflects deeper forces: accelerating demand for high-performance solution SBR grades driven by electric vehicle adoption, industry-wide migration toward certified sustainable feedstocks, and persistent regional cost differentials between Asia and Europe.

Technical Foundation and Market Significance of SBR

Styrene-butadiene rubber, a petroleum-derived copolymer combining styrene and butadiene monomers, occupies a central position in global elastomer markets. Originally developed as a natural rubber substitute during wartime material shortages, SBR has become the dominant synthetic rubber in tire manufacturing and maintains significant presence across industrial rubber goods, footwear, adhesives, and construction materials.

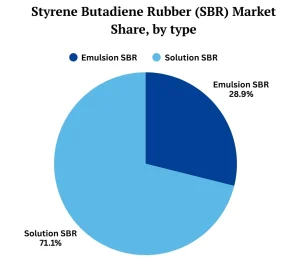

The SBR divides into two principal categories, each serving distinct technical requirements. Emulsion SBR (E-SBR), produced through cold emulsion polymerization, encompasses workhorse grades in the 1500 and 1700 series. These grades provide reliable performance in passenger and light truck tire treads, conveyor belts, footwear soles, industrial hoses, and flooring applications. Their established processing characteristics and competitive cost positioning ensure continued relevance in mainstream applications.

Solution SBR (S-SBR), manufactured via anionic polymerization in organic solvents, represents the premium segment. This production route enables precise molecular architecture control, yielding polymers with superior performance characteristics when compounded with silica reinforcement. The resulting materials deliver exceptional wet traction, reduced rolling resistance, and enhanced abrasion durability attributes increasingly essential in modern tire specifications. As automotive technology advances and regulatory pressures intensify, S-SBR’s market share continues expanding, fundamentally reshaping demand patterns and price structures.

Primary Drivers of 2025 SBR Pricing Dynamics

Two interconnected forces dominate current SBR market behaviour. First, demand composition is shifting decisively toward premium grades as electric vehicles gain traction, and tire performance requirements intensify. Second, supply-side transformation toward certified bio-based and circular feedstocks introduces structural cost increases that traditional commodity pricing models inadequately capture.

European producers exemplify this transformation. Synthos, a Poland based manufacturer, operating synthetic rubber facilities across Germany, Poland, and the Czech Republic with combined capacity approaching 760,000 metric tons annually, has positioned itself as a leading supplier of functionalized S-SBR grades. Critically, the company now offers ISCC PLUS certified materials incorporating bio-based or circular feedstocks. These certified grades command premium pricing reflecting both higher input costs and customer willingness to pay for supply chain transparency and sustainability credentials.

This certification trend creates a cascading effect on conventional SBR markets. As major tire manufacturers increasingly specify certified materials to meet corporate sustainability commitments, available supply of traditional grades tightens even when absolute production capacity appears adequate. The resulting grade mix shift elevates average realized prices across producer portfolios, supporting firm pricing despite moderate crude oil fluctuations. This phenomenon represents a structural rather than cyclical price support mechanism, distinguishing current market conditions from historical patterns.

Electric Vehicle Impact on SBR Demand Composition

Electric vehicle adoption introduces specific technical challenges that directly influence SBR consumption patterns. Higher vehicle curb weights, instant torque delivery, and extended service intervals place exceptional demands on tire performance. Tire manufacturers respond with advanced tread compounds balancing wet grip, rolling resistance, and durability formulations heavily dependent on S-SBR combined with silica reinforcement.

Beyond performance requirements, automotive manufacturers pursuing sustainability objectives increasingly demand traceable, low-carbon materials throughout their supply chains. This dual imperative technical performance and environmental compliance drive disproportionate S-SBR demand growth relative to conventional E-SBR grades. As electric vehicle market share expands from approximately 14% of global passenger vehicle sales in 2023 toward projected levels exceeding 30% by 2030, this premium grade preference exerts persistent upward pressure on average SBR pricing.

Regional SBR Price Divergence

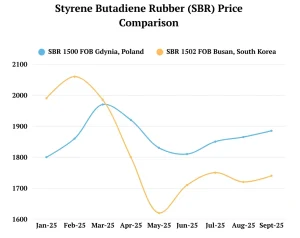

Price data from January through September 2025 reveals distinct regional trajectories reflecting underlying market structures. Asian markets have experienced significant volatility. SBR Prices reached USD 2000-2100 per metric ton in March before declining sharply to USD 1600-1700 in May, subsequently recovering towards in excess of USD 1700 per metric ton by September 2025. This pattern reflects inventory dynamics characteristic of Asian commodity markets: supply normalization following earlier tightness, subsequent buyer destocking, and eventual restocking as inventories reached comfortable levels.

European markets demonstrated markedly different behaviour. SBR prices climbed to approximately USD 1900-2000 per metric ton in March, then maintained a relatively narrow trading range between USD 1,810 -1,880 per metric ton through September. This price stability reflects Europe’s higher structural cost base, including elevated energy and logistics expenses, alongside capacity rationalization in recent years. Stable replacement tire demand and limited import competition provide additional price floor support.

The persistent premium of European prices over Asian quotations from April onward despite both representing non-oil extended E-SBR grades underscores fundamental regional differences rather than grade specifications. European producers operate in a tighter supply-demand balance with limited flexibility to absorb demand fluctuations, while Asian markets benefit from greater production capacity and more fluid trade flows.

Material Composition Insights and Consumption Trends

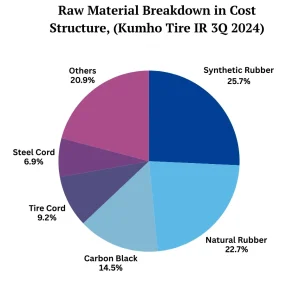

Recent tire material disclosures from major global manufacturers reveal remarkably stable formulation patterns. Natural and synthetic rubbers collectively comprise approximately 40% of tire weight, with carbon black accounting for slightly under 20%, and reinforcement materials (cord ply and bead wire) maintaining smaller, consistent shares. This compositional stability over recent years might suggest static raw material demand; however, absolute volumes tell a different story.

Global tire production growth, driven by vehicle parc expansion and replacement cycles, translates directly into increased SBR consumption even without formula modifications. Additionally, modest increases in reclaimed content incorporation pursued for both economic and environmental reasons complement rather than displace virgin SBR demand in current applications. The net effect supports firm SBR pricing through volume growth despite stable per-unit consumption ratios.

Producer Perspectives and Market Signals

Insights from integrated petrochemical producers provide valuable market context. Reliance Industries, operating substantial elastomer capacity within its oil-to-chemicals complex, reports global E-SBR demand growth of approximately 2% in calendar year 2024, with Indian domestic SBR demand expanding nearly 3% year-over-year in fiscal 2024-2025. Notably, polybutadiene rubber another critical tire elastomer demonstrated over 11% domestic demand growth, indicating robust Indian automotive and tire sector performance.

Reliance’s strategic emphasis on deep vertical integration across refining and petrochemical units positions the company to optimize feedstock utilization as market spreads fluctuate. For SBR production, which depends on benzene-derived styrene and C4-stream butadiene, such integration provides competitive advantage through feedstock flexibility and cost management. The company’s commitment to circular economy initiatives and a 2035 net carbon zero target aligns with broader industry sustainability trends influencing SBR specifications.

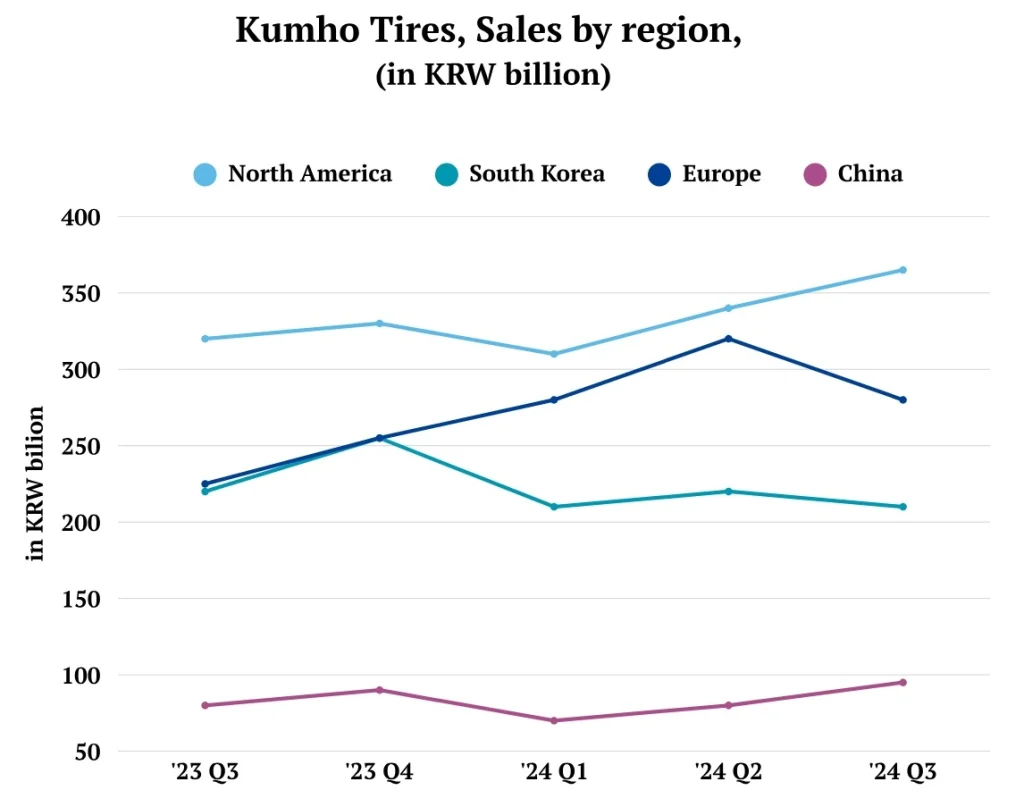

Tire manufacturer perspectives reinforce these observations. Kumho Tire’s investor communications highlight resilient replacement demand across North America and Europe alongside increasing sales of larger rim diameter tires and electric vehicle fitments. These commercial dynamics pull additional S-SBR volume through supply chains while maintaining premium price points. Strategic initiatives such as Kumho Petrochemical’s memorandum of understanding with SK Geocentric and Tongsuh Petrochemical to develop sustainable bio-based raw material chains further illustrate industry commitment to feedstock transformation despite associated cost implications.

Strategic Implications for Procurement

The evolving SBR market landscape demands sophisticated procurement approaches accounting for grade differentiation, regional dynamics, and sustainability requirements. Several strategic considerations emerge for buyers navigating 2025 market conditions.

First, grade selection increasingly carries strategic implications beyond immediate technical requirements. While E-SBR grades remain cost-effective for mainstream applications, S-SBR specifications for high-performance requirements should be secured through longer-term arrangements given tightening premium grade availability. Early engagement with suppliers regarding certified sustainable grades positions buyers to meet emerging customer and regulatory requirements without supply disruption.

Second, regional price differentials create arbitrage opportunities for buyers with flexible sourcing capabilities and logistics infrastructure. The persistent Asia-Europe spread suggests potential value in Asian sourcing for buyers capable of managing longer lead times and quality assurance protocols. However, regional sourcing decisions must account for total landed cost including freight, duties, and working capital implications rather than solely FOB price comparisons.

Third, feedstock cost monitoring provides leading indicators for SBR price direction. Styrene and butadiene monomer prices, themselves influenced by crude oil, naphtha, and refining economics, drive variable production costs. Tracking benzene and C4 stream pricing alongside refinery utilization rates offers insight into near-term SBR cost pressures before they appear in finished polymer quotations.

Conclusion

The SBR market in 2025 reflects an industry in transition rather than cyclical equilibrium. Demand migration toward solution SBR grades driven by electric vehicle requirements and performance standards combines with supply-side transformation toward certified sustainable feedstocks to create upward price pressure independent of crude oil movements. Regional market structures characterized by Asian volatility and European stability present both challenges and opportunities for strategic procurement.

Looking forward, these structural trends appear likely to intensify rather than moderate. Electric vehicle adoption continues accelerating, regulatory sustainability requirements tighten globally, and tire performance specifications evolve toward lower rolling resistance and enhanced safety characteristics. Each of these developments favours premium S-SBR grades and certified materials, supporting firm pricing for differentiated products even as commodity E-SBR grades face more competitive pressure.

For procurement organizations, success requires moving beyond traditional commodity purchasing approaches toward strategic category management incorporating grade optimization, supplier relationship development, regional sourcing strategies, and proactive sustainability planning. Organizations achieving this transformation will navigate market volatility more effectively while securing supply continuity and cost competitiveness in an increasingly complex elastomer landscape.

Sources and Acknowledgements:

All figures cited for Kumho Tire have been sourced from official quarterly reports, annual reports, and other company materials available on the Kumho Tire website. These references are provided for further review and verification and available on https://www.kumhotire.com/en/index.do