Synthetic rubber has become one of the most important materials in modern industries, particularly in automotive, manufacturing, and consumer products. Originally developed as a wartime substitute, it now plays a vital role in the global economy, supporting natural rubber, often surpassing it in function and flexibility. As markets expand and demand grow, understanding the path, status, and future of synthetic rubber is essential for policymakers, entrepreneurs, and researchers.

This article explores the history of synthetic rubber, its technological growth, and the factors that made it a key material. It also outlines the diverse types of synthetic rubbers, their makeup, and their role as substitutes for natural rubber in multiple uses. Additionally, the article examines the changing market dynamics of natural and synthetic rubber, using production and consumption data from reliable sources including the Rubber Board of India. Besides production numbers, the discussion highlights the challenges facing the synthetic rubber industry, including uncertainty in raw materials, dependence on crude oil, environmental regulations, and international trade policies.

These issues are analyzed per their impact on downstream industries, particularly in automotive and tire sectors. At the same time, this article emphasizes the opportunities arising from capacity growth, technological advancements, and sustainable developments, such as bio-based rubbers and improved polymer chemistry. It discusses the future of the synthetic rubber market in 2025, addressing policy expectations, trade shifts, and demand trends in major consuming industries such as tires and vehicles. Together, these perspectives illustrate how synthetic rubber has transitioned from a strategic alternative to a key driver of industrial growth while continuing to adapt to the evolving challenges of technology, sustainability, and global trade.

Wartime Necessity to Global Essential

The history of synthetic rubber is closely tied to the industrial and geopolitical events of the 20th century. Its development was mainly a response to the wartime shortages of natural rubber and the rising demand for rubber products. During World War I (1914-1918), supplies of natural rubber from Southeast Asia were disrupted. This prompted scientists to seek alternatives that could be produced locally. As a result, early studies of polymerization emerged. Polymerization is a chemical reaction in which small molecules, or monomers, link together to form long, elastic chains with rubber-like properties.

By the 1930s, Germany produced one of the first successful synthetic rubbers called “Buna.” Buna (a name derived from Butadiene + Natrium, sodium catalyst) was created by polymerizing butadiene, a byproduct of petroleum refining. This rubber had performance characteristics suitable for industrial uses, especially in tires for the growing automobile market.

The turning point came during World War II when natural rubber supplies significantly dropped. Recognizing the importance of rubber for military vehicles, aircraft, and equipment, countries like the United States, Japan, and Germany expanded their synthetic rubber programs. In 1941, the U.S. government launched the Synthetic Rubber Program. This initiative greatly increased production and introduced major innovations, such as Styrene Butadiene Rubber (SBR). This product became, and still is, one of the most important rubbers used in tire manufacturing.

After the war, the synthetic rubber industry advanced quickly. New elastomers including Neoprene, Nitrile Butadiene Rubber (NBR), and Ethylene Propylene Diene Monomer (EPDM) were developed. These rubbers boasted unique features like oil resistance, hardness, and weather resistance. This expansion allowed synthetic rubber to be used in various industrial products, household items, and infrastructure. Over time, synthetic rubbers became more affordable, versatile, and often better than natural rubber.

In recent decades, the focus has shifted to improving performance and increasing sustainability. Developments in polymer chemistry have resulted in rubbers with greater strength, heat resistance, and flexibility. Efforts to create bio-based synthetic rubbers aim to reduce dependence on petroleum and minimize environmental impact. Today, synthetic rubber is a technological achievement and a strategic material, continuously adapting to meet industrial and environmental needs.

Production, Performance, and a Sustainable Future

Synthetic rubber is a broad term for any man-made elastomer that imitates the main properties of natural rubber. Like natural rubber, synthetic rubber is elastic, resilient, and flexible, making it a valuable material for many industrial and consumer applications. The key difference is its source. Natural rubber comes from the latex sap of rubber trees, while synthetic rubber is produced on a large scale through chemical processes. By relying on controlled production methods, synthetic rubbers can be manufactured to meet specific requirements, offering advantages in situations where natural rubber falls short.

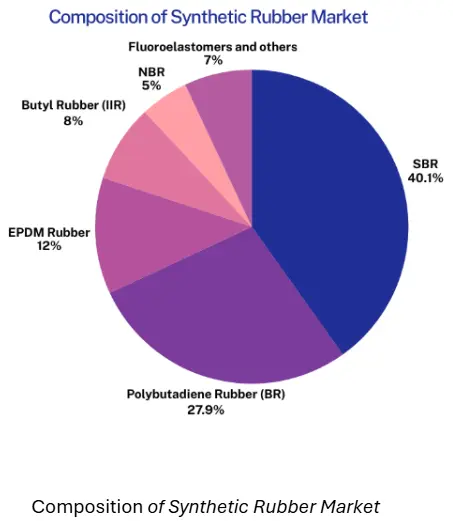

The production of synthetic rubber typically involves the polymerization of butadiene and styrene monomers derived from petroleum refining feedstocks. This connection to petrochemical feedstocks links the industry closely to global energy markets, meaning that fluctuations in crude oil prices directly affect production costs. Even so, synthetic rubber remains essential due to its durability and versatility. Other types, such as Styrene Butadiene Rubber (SBR), Nitrile Butadiene Rubber (NBR), and Ethylene Propylene Diene Monomer (EPDM), serve specialized needs, including automobile tires, industrial hoses, seals, gaskets, shoes, and medical devices.

In addition to its performance benefits, synthetic rubber plays a role in the global effort toward sustainability and environmental responsibility. Manufacturers are increasingly exploring innovations like bio-based feedstocks, new polymer blending techniques, and recycling technologies to reduce dependence on fossil fuels and minimize the environmental impact of manufacturing. These efforts align with global decarbonization policies and consumer demand for more sustainable products. Synthetic rubber is not merely a substitute for natural rubber but a flexible and evolving group of materials that reflects the intersection of industrial needs, technological progress, and environmental awareness. Its production also highlights human creativity in finding alternatives to natural resources while continually striving for improved performance, efficiency, and sustainability.

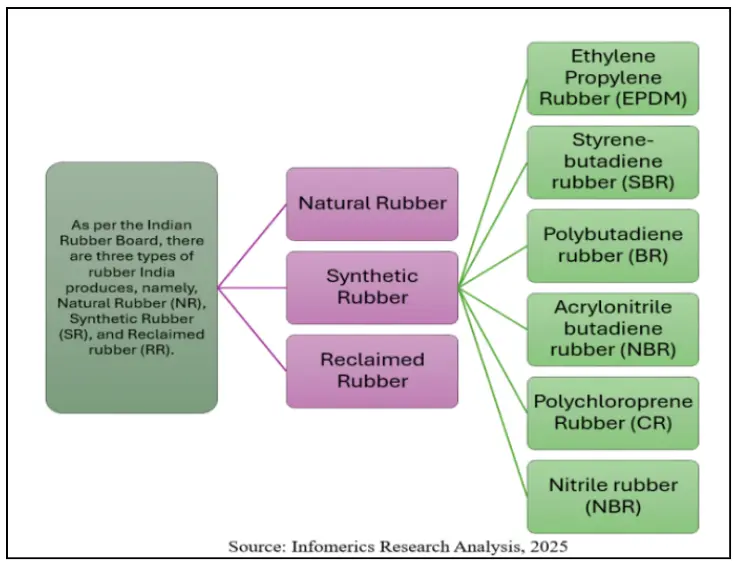

Types of Synthetic Rubber

Market Dynamics Shaping Global Synthetic Rubber

1. Economic & Market Factors

Synthetic rubber prices depend on feedstocks like butadiene and styrene, whose prices track crude oil. When feedstock costs rise, synthetic rubber becomes costlier; when they fall, production costs drop.

Drivers of crude oil volatility: global demand patterns, OPEC output levels, along with changing geopolitical factors.

Rupee dollar exchange rate also impacts costs (Crude oil priced in USD).

2. Raw Materials & Input Costs

Reliance on Butadiene and Styrene (directly crude oil-linked).

Volatility in crude spillovers into production cost.

Tire manufacturers experienced narrowed margins.

3. Downstream Industry Impact

Automotive industry = biggest synthetic rubber user.

Increased raw material and input cost eats into profitability.

4. Logistics & Supply Chain

High shipping rates and delay throughout Asia.

High energy prices.

Stability of supply interrupted, increasing risk exposure.

5. Regulatory & Environmental Pressures

Synthetic rubber is exempt from the EU’s Deforestation Regulation, unlike natural rubber, but faces growing pressure from global decarbonization and emission mandates.

Increasing pressure for: Cleaner production technologies, Renewable feedstocks, Sustainable technologies, Compliance for producers.

6. Trade & Protectionist Measures

Global trade in synthetic rubber is being reshaped by protectionist measures, as major economies tighten their grip on imports to safeguard domestic industries. India has maintained anti-dumping tariffs on Styrene-Butadiene Rubber (SBR) from the EU, South Korea, and Thailand, while China continues its prolonged duties on halogenated butyl rubber from the U.S., EU, and Singapore. In a notable move in August 2025, China imposed hefty provisional anti-dumping duties ranging from 13.8% to 40.5% on imports from Canada and Japan.

While these measures aim to shield local producers from unfair pricing and market distortions, they add layers of complexity to global supply chains, raising costs for downstream industries and potentially accelerating regionalization of trade.

Market Developments and Expansion Trends

1. Capacity Expansion

Cariflex (DL Chemical): Commissioned a USD 355 million polyisoprene latex facility in Singapore. Enhances supply for industrial and medical latex uses.

Arlanxeo (China): Developing a 5,000 Tonnes per Annum (TPA) Hydrogenated Nitrile Butadiene Rubber (HNBR) plant in Changzhou which is projected to start production by Q3 2025. Another NBR capacity expansion in Nantong (with TSRC JV) to 40,000 TPA.

Tosoh Corporation (Japan): Increasing production of SKYPRENE chloroprene rubber.

Reliance Industries (India): Establishing a 6.5 TPA styrene-butadiene rubber (SBR) facility in Jamnagar in a bid to make India as a world SBR hub.

2. Sustainability & Innovation

Synthos: State-of-the-art bio-butadiene production from renewable ethanol and facilitates greener tire production.

Fraunhofer NaMoKau Project: Created process to synthesize dimethyl butadiene from bio-alcohols and facilitates high-performance bio-based rubbers with customized properties

Industry trends: The synthetic rubber industry is evolving toward sustainability through bio-based monomers to cut fossil fuel reliance, advanced polymer blending for tailored performance, and microbial synthesis for low-carbon, circular production. Key goals include greater biodegradability and improved recyclability, aligning with global decarbonization and sustainable material demands.

3. Trade Realignment

China (2024): Extended up to 75% duties on Halogenated Butyl Rubber imports (US, EU, Singapore).

India: Initiated probes into NBR imports and suggested interim duties on Isobutylene Isoprene Rubber (IIR) imports. Steps shield local producers but shed light on disjointed global trade regulations.

4. Strategic Outlook

Despite challenges, the sector is evolving, expanding global capacity, advancing sustainability-driven innovation, and adapting to shifting trade frameworks. It is emerging as a more innovative, diversified, and strategically vital pillar of global mobility and manufacturing.

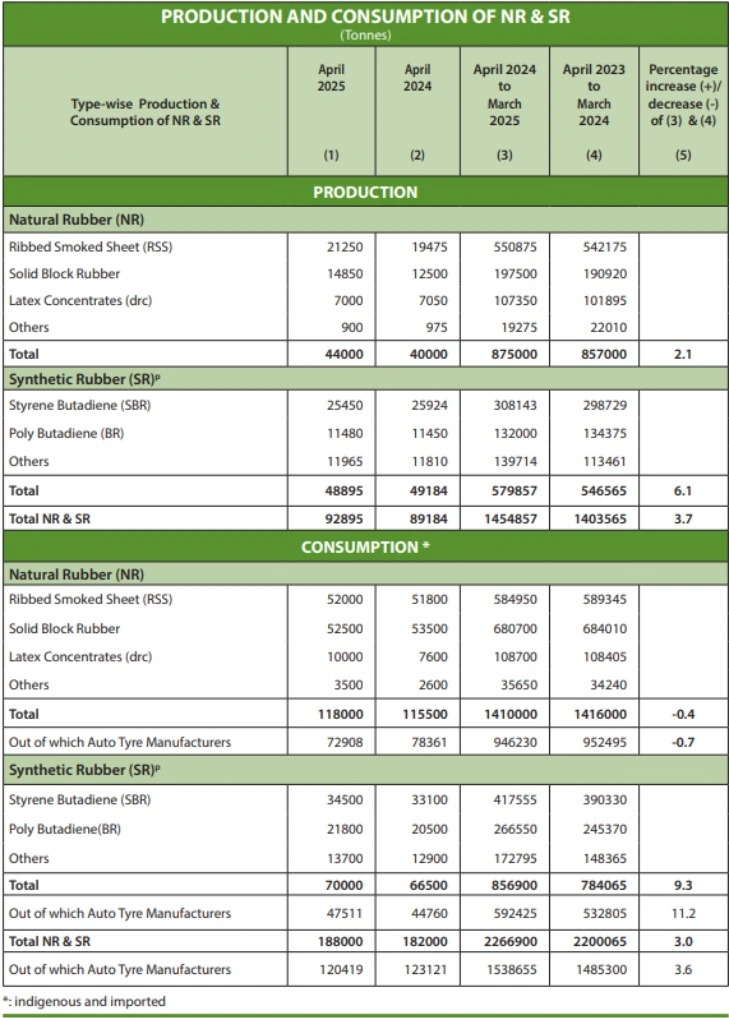

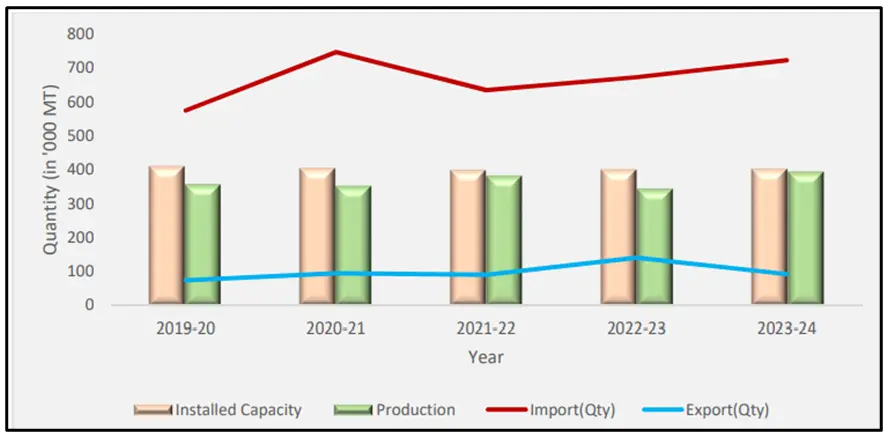

India’s Rubber Revolution: Synthetic on the Rise

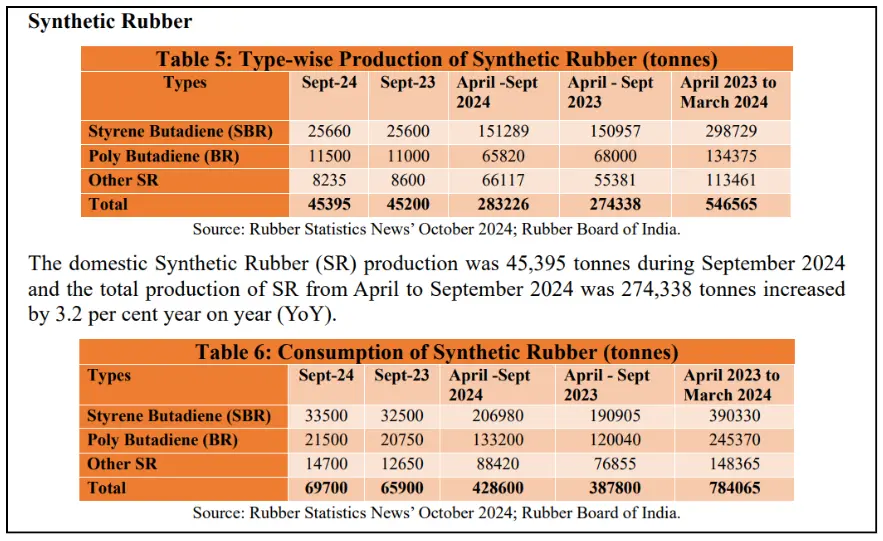

India’s domestic Synthetic Rubber (SR) production showed strong growth in the 2023-2024 period as per Statistics & Planning Department of the Rubber Board data. In January 2024, SR production reached 47,460 tonnes. This brought the total production from April 2023 to January 2024 to 454,054 tonnes. This represents an 18.1% increase from the 384,447 tonnes produced during the same time last year. This growth shows the increasing importance of synthetic rubber in India’s rubber economy.

On the demand side, India consumed about 64,800 tonnes of SR in January 2024. Total SR consumption from April 2023 to January 2024 was 647,565 tonnes and consumption has increased by 1.9% from 635,540 tonnes compared to the same period last year. The difference between rising consumption and higher output points to an improvement in local supply. However, demand has remained flat, mainly driven by the motor and tire sectors.

Natural Rubber (NR) production also saw moderate growth. January 2024 production was 105,000 tonnes, a 4.0% increase from 101,000 tonnes in January 2023. The cumulative production for April 2023 to January 2024 was 739,000 tonnes, which is a 1.9% increase from 725,000 tonnes during the same period last year. Importantly, preliminary estimates for February 2024 are at 71,000 tonnes. Overall, the statistics show India’s steady efforts to balance natural and synthetic rubber production, with synthetic rubber experiencing more growth in recent months.

India’s Growing Demand for Rubber

Major industries like automobile, rubber, and textiles expressed hopes for growth and solutions to ongoing problems in the latest Union Budget of 2025. The automobile industry, a key part of India’s manufacturing economy, wanted action to support the move toward electric vehicles (EVs). Industry leaders requested targeted help for EV adoption, a GST adjustment on cars, as well as increased spending on infrastructure development.

These measures aimed to boost domestic demand and improve India’s competitiveness in the global automobile market. The rubber industry focused on reforms to lower costs and increase domestic supply. Industry leaders called for a reduction in import duties on raw materials and policies to promote local rubber farming. Alongside those, there were also requests for incentives to encourage technical innovation in rubber production, helping the industry modernize and become more efficient. Strengthening Rubber Producers Societies (RPS) and cluster farmers was highlighted as a strategy to improve market access, ensure better prices for growers, and enhance supply chain integration.

Similarly, the textile industry, a significant export-driven sector, looked forward to increased budget provisions to strengthen its international presence. The industry continued export incentives, lower import tariffs on essential raw materials, and policies aimed at boosting international competitiveness. In all three sectors, there was a common hope for active engagement with policymakers and the timely implementation of budget measures. Meeting these needs would sustain growth momentum, create fair market opportunities, and support India’s broader economic goals of industrial growth, job creation, and competitiveness in global trade.

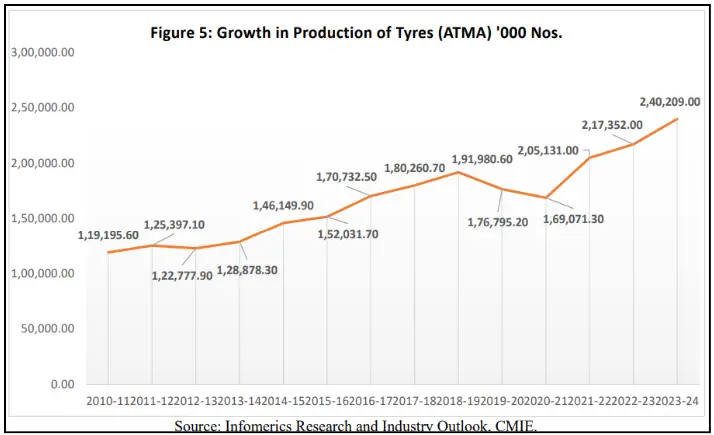

The tire market is likely to see consistent growth in 2024–25 on account of increasing demand in both the original equipment manufacturer (OEM) and replacement markets. The forthcoming festive season is anticipated to serve as a robust driver, fueling automobile sales in all segments, thereby propelling OEM tire demand. Concurrently, the replacement market is also expected to remain strong, driven by higher vehicle usage around the festival season as well as increased construction activity, both of which put more pressure on tires across industries.

Overall, tire manufacturing is expected to grow by 3.4%, reflecting steady momentum notwithstanding sectoral challenges. Segment-wise, two-wheeler tires, passenger vehicle tires, and tractor tires are projected to expand greatly, with production anticipated to expand in the range of 7% to 19%. This growth reflects the expanding customer demand for mobility and the growing mechanization of the agriculture sector. Conversely, however, commercial vehicle tire manufacturing is projected to have a marginal decrease of about 1%, primarily because of damped demand in the heavy transport category. This mixed pattern underlines the dynamic character of India’s tire sector, which keeps changing in accordance with more general trends in automobile demand, infrastructure expansion, and customer tastes.

Shaping the future of Synthetic Rubber

In conclusion, synthetic rubber has come a long way from being a strategic wartime requirement to becoming an essential material that fuels today’s industries around the world. It has been influenced by technological breakthroughs, geopolitical happenings, and the relentlessly escalating demand from industries such as automotive and manufacturing. Looking ahead, the synthetic rubber industry is both confronted with challenges and presented with opportunities. Challenges like dependence on raw material, price instability, and green regulations continue to influence the industry, while developments in sustainability and bio-based rubbers promise to take it in more sustainable directions.

As the demand for synthetic rubber continues to be strong on an international scale, particularly in the automobile and tire industries, its status as an important sector in the international economy becomes more evident. It will be crucial for policymakers, companies, and researchers to comprehend the evolving nature of synthetic rubber manufacturing and consumption to make sense of the industry’s intricacies and harvest newly emerging opportunities. The future of synthetic rubber is full of hope, based on technological progress, strategic innovation, and sustainability.

FAQs

1.How is sustainability shaping the future of synthetic rubber?

Producers are increasingly investing in bio-based feedstocks, recyclable polymers, and energy-efficient processes. These innovations aim to reduce the industry’s carbon footprint and align with global sustainability goals.

2.What are the key challenges faced by the synthetic rubber industry?

The industry struggles with rising input costs, crude oil price volatility, logistics disruptions, and stringent environmental regulations. Trade protectionist measures have also resulted in complexed global supply chains.

3.What trade measures impact the synthetic rubber industry?

Countries like India and China have imposed anti-dumping duties on imports of various rubbers to protect domestic industries. While this shields local producers, it often complicates global supply chains.

4.What role does synthetic rubber play in electric vehicles (EVs)?

EVs require specialized tires and rubber components that withstand higher torque and weight. Demand for advanced synthetic rubbers with improved durability and efficiency is rising alongside EV adoption.

PriceWatch helps businesses decode the synthetic rubber market by providing real-time insights on production trends, pricing shifts, and trade dynamics. With in-depth analysis of crude-linked cost fluctuations, regulatory impacts, and demand forecasts, PriceWatch equips stakeholders with actionable intelligence to navigate challenges and seize growth opportunities.

Sources:

https://rubberboard.gov.in/rbfilereader?fileid=994

https://rubberboard.gov.in/rbfilereader?fileid=1183

CHEMICAL AND PETROCHEMICAL STATISTICS AT A GLANCE-2024

https://www.tyrepress.com/2024/08/china-continues-anti-dumping-duties-on-synthetic-rubber-for-tyre-liners-tubes/

Bio-Based Synthetic Rubbers: A Sustainable Shift in Plastics

https://www.umsicht.fraunhofer.de/en/press-media/press-releases/2024/bio-based-synthetic-rubber.html

http://globaldata.com/media/oil-gas/india-lead-styrene-butadiene-rubber-capacity-additions-asia-2026-forecasts-globaldata/

https://www.tyre-trends.com/materials/anrpc-forecasts-marginal-growth-in-nr-output-for-2025

https://www.chemengonline.com/plant-watch-june-2025-business-news/

https://www.lawcode.eu/en/blog/eudr-rubber-classification/

https://www.infomerics.com/publication-detail/indian-rubber-industry-report-resilience-innovation-and-expansion

Halogenated butyl rubber: China imposes anti-dumping duties on Canada & Japan

Alternative biomanufacturing routes for natural and synthetic rubber