Price-Watch’s most active coverage of n-Propyl Acetate price assessment:

- IG (99.7%) FOB Shanghai, China

- IG (99.7%) CIF Mersin (China), Turkey

- IG (99.7%) CIF Haiphong (China), Vietnam

- IG (99.7%) CIF Nhava Sheva (China), India

- IG (99.5%) FOB Houston, USA

- IG (99.5%) CIF Callao (USA), Peru

- IG (99.5%) CIF Mersin (USA), Turkey

- IG (99%) Ex Kandla, India

n-Propyl Acetate Price Trend Q3 2025

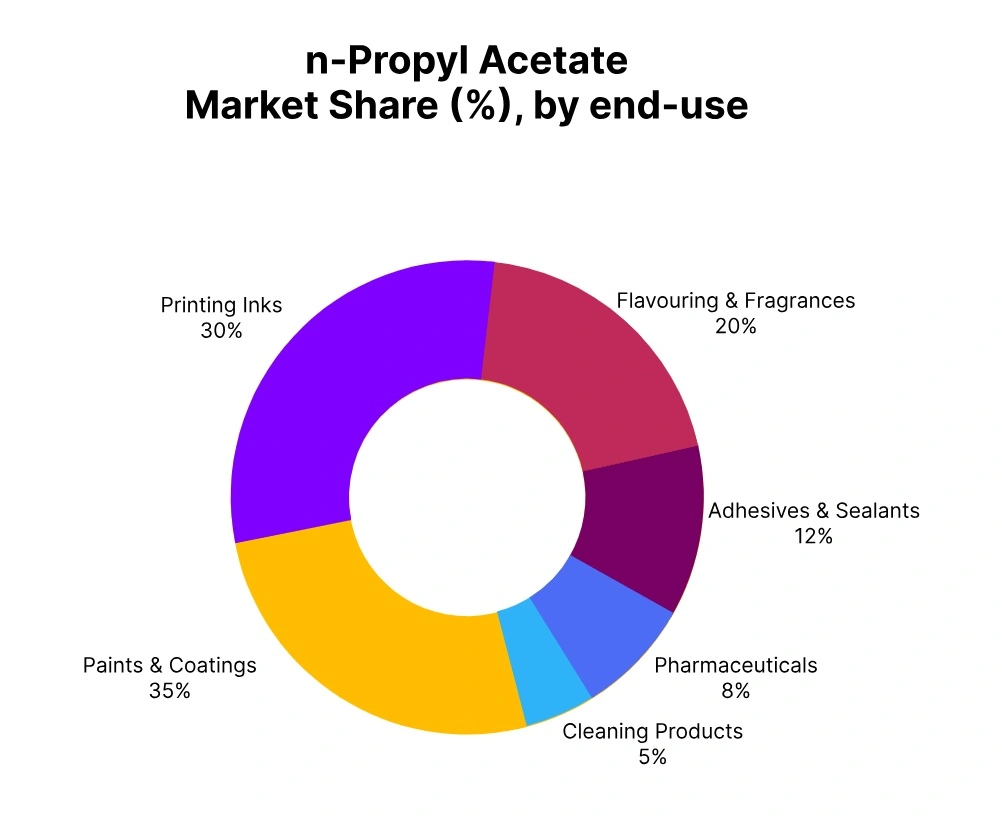

In Q3 2025, the global n-propyl acetate market recorded a steady upward trajectory, with prices rising by 3–5% across major regions between July and September. The n-propyl acetate price trend was primarily driven by firm demand from the paints, coatings, and adhesive sectors, which benefited from a seasonal uptick in industrial and construction activities.

Feedstock n-propanol and acetic acid costs increased moderately due to stable crude oil prices and constrained regional availability, further supporting price gains. Additionally, improved export orders from Asian markets, coupled with steady operating rates at production facilities, maintained supply-demand balance.

Consequently, n-propyl acetate prices demonstrated resilience throughout the quarter. In September 2025, n-propyl acetate prices continued to strengthen, supported by ongoing restocking activities and stable downstream consumption.

China: N-propyl acetate export prices FOB Shanghai, China, Grade- Industrial Grade (99.7% min).

According to Price-Watch, in Q3 2025, n-Propyl Acetate prices in China rose by 2.23% compared to Q2 2025. n-Propyl Acetate price trend in China was primarily supported by steady demand from the coatings, automotive, and chemical sectors, which maintained moderate production despite global market volatility. Rising feedstock costs, particularly for propylene and acetic acid, contributed to upward pressure on prices.

Additionally, freight costs for domestic and export shipments went up, which further supported the market. n-Propyl Acetate prices in September 2025 in China remained on an upward trajectory, mirroring a stable demand environment. Looking forward, the market is expected to maintain moderate upward momentum, dependent on downstream industry recovery and feedstock availability.

USA: N-propyl acetate export prices FOB Houston, USA, Grade- Industrial Grade (99.5% min).

In Q3 2025, n-Propyl Acetate prices in the USA increased by 1.12% compared to Q2 2025. n-Propyl Acetate price trend in the USA was influenced by stable demand from the pharmaceutical, coatings, and adhesive sectors, which maintained consistent consumption. The upward movement was supported by increased feedstock costs and slight tightening in regional supply.

Freight costs, though moderately rising, added additional upward pressure on prices. n-Propyl Acetate prices in September 2025 in the USA continued an upward trend, reflecting stable demand and limited supply growth. Moving forward, prices are expected to remain moderately upward, contingent on downstream demand recovery and worldwide feedstock cost dynamics.

Vietnam (CIF from China): N-propyl acetate Import prices CIF Haiphong, Vietnam, Grade- Industrial Grade (99.7% min).

In Q3 2025, n-Propyl Acetate prices in Vietnam hiked by 2.22% compared to Q2 2025. n-Propyl Acetate price trend in Vietnam was influenced by improved demand from coatings, automotive, and adhesives sectors, which supported moderate consumption levels. Rising freight costs for imports from China and increased feedstock prices contributed to the upward price movement.

n-Propyl Acetate prices in September 2025 in Vietnam continued to rise, reflecting a tightening market and stable downstream demand. The outlook for the next quarter suggests continued upward momentum, with price direction dependent on the balance between Chinese exports, regional demand, and feedstock cost fluctuations.

Turkey (CIF from China): N-propyl acetate Import prices CIF Mersin, Turkey, Grade- Industrial Grade (99.7% min).

In Q3 2025, n-Propyl Acetate prices in Turkey increased by 1.14% compared to Q2 2025. n-Propyl Acetate price trend in Turkey was supported by steady demand from industrial sectors including coatings and chemicals, alongside stable import volumes from China. Rising freight charges and higher feedstock costs, particularly acetic acid and propylene, contributed to upward pressure.

n-Propyl Acetate prices in September 2025 in Turkey remained on an upward trajectory, reflecting a mix of regional demand stability and supply chain tightness. Looking ahead, the market is likely to maintain a moderate upward trend, influenced by import flows from China and the recovery of domestic downstream consumption.

Peru (CIF from USA): N-propyl acetate Import prices CIF Callao, Peru, Grade- Industrial Grade (99.5% min).

In Q3 2025, n-Propyl Acetate prices in Peru increased by 1.19% compared to Q2 2025. n-Propyl Acetate price trend in Peru was supported by stable demand from the coatings and chemical processing industries, alongside consistent import volumes from the USA. Rising freight costs and feedstock price went up added additional upward pressure.

n-Propyl Acetate prices in September 2025 in Peru remained on an upward trajectory, reflecting strong downstream consumption and supply constraints. Going forward, the market is expected to maintain a moderately upward trend, with prices influenced by import dynamics, freight adjustments, and regional industrial activity levels.

Ex-Kandla: N-propyl acetate Ex-prices Ex-Kandla, India, Grade- Industrial Grade (99.0% min).

According to Price-Watch, In Q3 2025, n-Propyl Acetate prices at Ex-Kandla dipped by 6.37% compared to Q2 2025. n-Propyl Acetate price trend in India was influenced by slowed demand from key sectors such as pharmaceuticals, adhesives, and coatings, which experienced slow production and subdued consumption. Oversupply conditions in the domestic market, coupled with rising freight costs for imports, further added to the downward trend.

n-Propyl Acetate prices in September 2025 at Ex-Kandla remained on a downward trajectory, reflecting soft demand and market weakness. The outlook for Q4 2025 remains cautious, with further price adjustments possible unless demand from major downstream industries recovers and supply balances tighten.